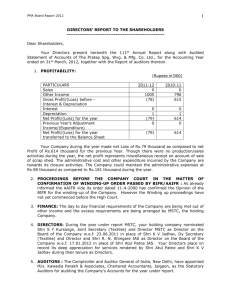

Word Format

advertisement