IOWA DEPARTMENT OF CULURAL AFFAIRS

advertisement

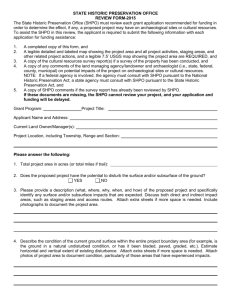

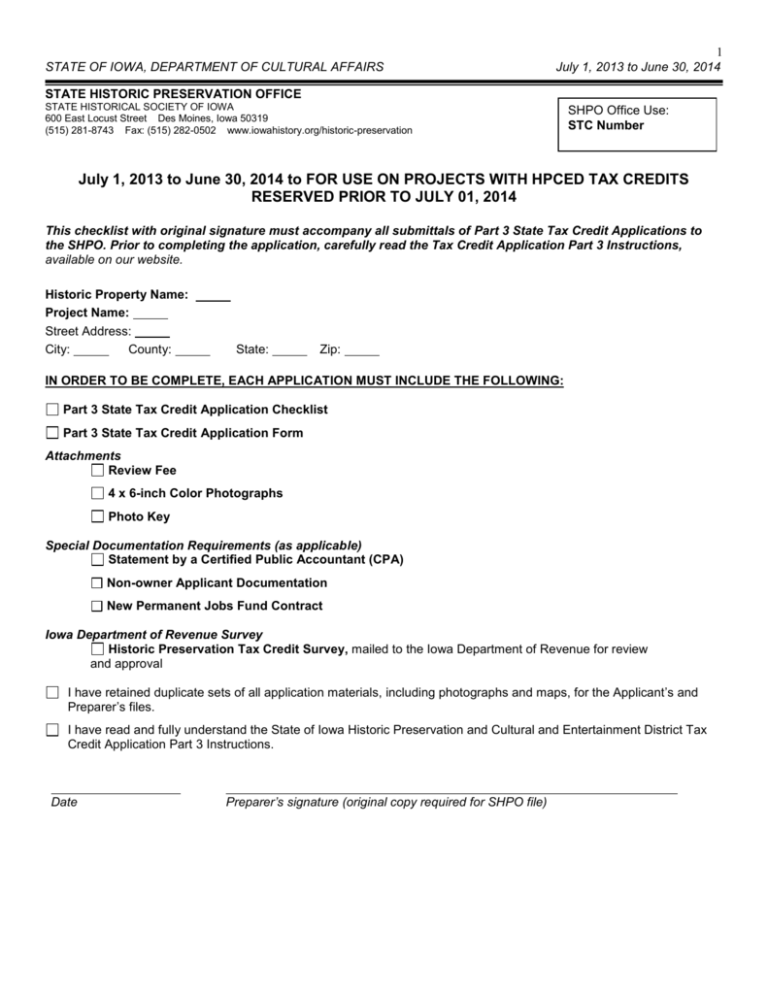

STATE OF IOWA, DEPARTMENT OF CULTURAL AFFAIRS 1 July 1, 2013 to June 30, 2014 STATE HISTORIC PRESERVATION OFFICE STATE HISTORICAL SOCIETY OF IOWA 600 East Locust Street Des Moines, Iowa 50319 (515) 281-8743 Fax: (515) 282-0502 www.iowahistory.org/historic-preservation SHPO Office Use: STC Number July 1, 2013 to June 30, 2014 to FOR USE ON PROJECTS WITH HPCED TAX CREDITS RESERVED PRIOR TO JULY 01, 2014 This checklist with original signature must accompany all submittals of Part 3 State Tax Credit Applications to the SHPO. Prior to completing the application, carefully read the Tax Credit Application Part 3 Instructions, available on our website. Historic Property Name: Project Name: Street Address: City: County: State: Zip: IN ORDER TO BE COMPLETE, EACH APPLICATION MUST INCLUDE THE FOLLOWING: Part 3 State Tax Credit Application Checklist Part 3 State Tax Credit Application Form Attachments Review Fee 4 x 6-inch Color Photographs Photo Key Special Documentation Requirements (as applicable) Statement by a Certified Public Accountant (CPA) Non-owner Applicant Documentation New Permanent Jobs Fund Contract Iowa Department of Revenue Survey Historic Preservation Tax Credit Survey, mailed to the Iowa Department of Revenue for review and approval I have retained duplicate sets of all application materials, including photographs and maps, for the Applicant’s and Preparer’s files. I have read and fully understand the State of Iowa Historic Preservation and Cultural and Entertainment District Tax Credit Application Part 3 Instructions. Date Preparer’s signature (original copy required for SHPO file) STATE OF IOWA, DEPARTMENT OF CULTURAL AFFAIRS 2 July 1, 2013 to June 30, 2014 STATE HISTORIC PRESERVATION OFFICE STATE HISTORICAL SOCIETY OF IOWA 600 East Locust Street Des Moines, Iowa 50319 (515) 281-8743 Fax: (515) 282-0502 www.iowahistory.org/historic-preservation SHPO Office Use: STC Number HISTORIC PRESERVATION AND CULTURAL AND ENTERTAINMENT DISTRICT TAX CREDIT APPLICATION PART 3 – REQUEST FOR CERTIFICATION OF COMPLETED WORK Read carefully the Tax Credit Application Part 3 Instructions before completing this form; instructions are available on our website. Prior to submitting an application, applicants should read the administrative rules for the tax credit program: www.iowahistory.org/historic-preservation/tax-incentives-for-rehabilitation/state-tax-credits/index.html. No certifications will be made unless a completed application form has been received. The decision by the SHPO with respect to certification is made on the basis of descriptions in this application form. In the event of any discrepancy between the application form and other supplementary material submitted with it (such as architectural plans, drawings, and specifications), the application form shall take precedence. Computerized application forms are available at www.iowahistory.org/historic-preservation/index.html or by e-mailing your request to Beth.Foster@iowa.gov. Use a computer or typewriter to complete all items. If additional space is needed, use Continuation Sheets, available at www.iowahistory.org/historic-preservation/assets/stc_continuationamendment_2012_NEW.doc 1. Historic Property Name: SHPO-Assigned State Tax Credit (STC) Project Number (listed in the Part 2 letter): STC number: Is this Part 3 application being submitted simultaneously with a Part 2 application? Yes No 2. Project Name (if applicable): Street Address: City: County: State: Zip: 3. Applicant: I hereby apply for certification of rehabilitation work in this application for purposes of the state tax credit program. I hereby attest that the information provided is, to the best of my knowledge, correct and is consistent with the work described in Part 2 of the Description of Rehabilitation. I am authorized to receive state tax credits for rehabilitation of the property described above. I understand that falsification of factual representations in this application is subject to legal sanctions or punishment under Iowa law. Has this information changed since the Part 1 or 2 applications were submitted? Name: Organization: Street Address (no P.O. Box): City: State: Zip: Daytime Telephone Number: E-mail Address: Social Security Number or Taxpayer Identification Number: Date Yes Applicant’s signature (original copy required for SHPO file) No 3 4. Project Manager (This person will be the primary point of SHPO contact and correspondence): Has this information changed since the Part 1 and Part 2 applications were submitted? Name (if different from the Applicant): Organization: Street Address (no P.O. Box): City: State: Zip: Daytime Telephone Number: E-mail Address: 5. Preparer (The person who prepared this application): Name (if different from the Applicant): Organization: Street Address (no P.O. Box): City: State: Zip: Daytime Telephone Number: E-mail Address: 6. Data on the Rehabilitation Project: Project start date (MM/DD/YYYY): Project completion/placed-into-service date (MM/DD/YYYY): Costs attributed solely to building rehabilitation, incurred within the allowable timeframe: $ Costs attributed solely to new construction associated with the rehabilitation: $ Yes No SHPO Office Use Only The SHPO has reviewed the Part 3 Certification of Completed Work Application for the above-listed building abovenamed property and has determined: The completed rehabilitation meets the Secretary of the Interior’s Standards for Rehabilitation and is consistent with the historic character of the property or the district in which it is located. The rehabilitation is not consistent with the historic character of the property or the district in which it is located, and the project does not meet the Secretary of the Interior’s Standards for Rehabilitation. Date DCA Office Use Only State Historic Preservation Office Authorized Signature