Superior Court, State of California

advertisement

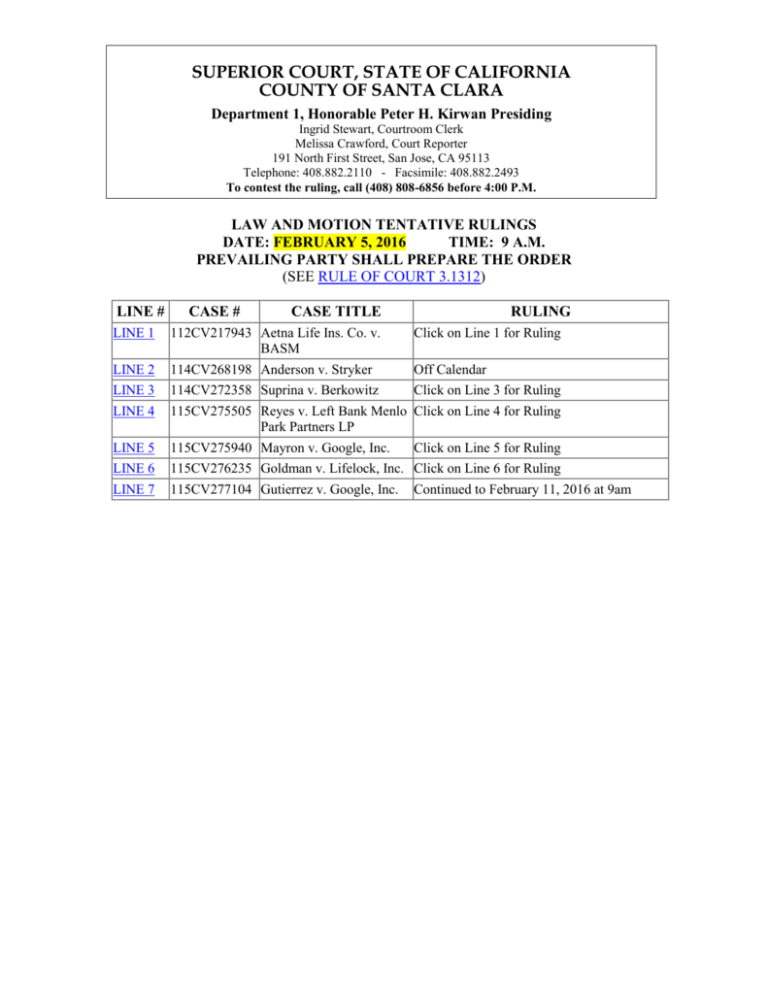

SUPERIOR COURT, STATE OF CALIFORNIA COUNTY OF SANTA CLARA Department 1, Honorable Peter H. Kirwan Presiding Ingrid Stewart, Courtroom Clerk Melissa Crawford, Court Reporter 191 North First Street, San Jose, CA 95113 Telephone: 408.882.2110 - Facsimile: 408.882.2493 To contest the ruling, call (408) 808-6856 before 4:00 P.M. LAW AND MOTION TENTATIVE RULINGS DATE: FEBRUARY 5, 2016 TIME: 9 A.M. PREVAILING PARTY SHALL PREPARE THE ORDER (SEE RULE OF COURT 3.1312) LINE # LINE 1 LINE 2 LINE 3 LINE 4 LINE 5 LINE 6 LINE 7 CASE # CASE TITLE 112CV217943 Aetna Life Ins. Co. v. BASM 114CV268198 Anderson v. Stryker 114CV272358 Suprina v. Berkowitz 115CV275505 Reyes v. Left Bank Menlo Park Partners LP 115CV275940 Mayron v. Google, Inc. 115CV276235 Goldman v. Lifelock, Inc. 115CV277104 Gutierrez v. Google, Inc. RULING Click on Line 1 for Ruling Off Calendar Click on Line 3 for Ruling Click on Line 4 for Ruling Click on Line 5 for Ruling Click on Line 6 for Ruling Continued to February 11, 2016 at 9am Calendar Line 1 Case Name: Aetna Life Insurance Company, Inc. v. Bay Area Surgical Management, LLC, et al. Case No.: 2012-1-CV-217943 There are several motions before the Court: [1] Defendant Julia Hashemieh’s (“Hashemieh”) Objection to [Proposed] Discovery Order No. 35; [2] Hashemieh’s Application to File Under Seal Exhibits to Julia Hashemieh’s Objections to [Proposed] Discovery Order Number 35; and [3] Non-Party Sports Orthopedic & Rehabilitation Medicine Associates (“SOAR Group”) Objection to Discovery Referee’s [Proposed] Discovery Order No. 39. Bay Area Surgical Management, LLC, Bay Area Surgical Group, Inc., Forest Ambulatory Surgical Associates, L.P., SOAR Surgery Center, LLC, Knowles Surgery Center, LLC, National Ambulatory Surgery Center, LLC, Los Altos Surgery Center, LP (collectively, “BASM”) have joined in SOAR Group’s objection. I. Hashemieh’s Objection to [Proposed] Discovery Order No. 35 [Proposed] Discovery Order No. 35 concerns Hashemieh’s Motion to Access Attorney’s Eyes Only Documents. Although Hashemieh was previously represented by counsel, she is now self-represented. Hashemieh contends she should now have access to attorney’s eyes only documents (“AEO documents”). In Discovery Order No. 35, the discovery referee (Hon. Trembath) found that Hashemieh admitted that her primary reason for deciding to represent herself was to obtain access to the AEO documents. Additionally, the referee found that Hashemieh is still effectively represented by counsel and has not established she will be prejudiced unless she has access to AEO documents. The referee therefore denied Hashemieh’s motion. Precluding Hashemieh completely from seeing AEO documents raises due process concerns. While the referee found that Hashemieh is still “effectively represented by counsel,” the fact is that she is not actually represented. As a self-represented litigant, she must have access to relevant documents in this litigation so that she can defend herself. Nevertheless, the Court is cognizant of the possibility that Hashemieh may have decided to represent herself for the improper purpose of gaining access to AEO documents with confidential information that she would not normally be permitted to see. Therefore, the Court will not authorize Hashemieh to view AEO documents absent an appropriate protective order. Accordingly, the Court will not sign [Proposed] Discovery Order No. 35. The parties are ordered to appear at the hearing on 2/5 at which point they will be given the opportunity to meet and confer regarding the terms of a protective order. II. Hashemieh’s Application to File Under Seal Exhibits to Julia Hashemieh’s Objection to [Proposed] Discovery Order Number 35 A party moving to seal a record must file a memorandum and a declaration containing facts sufficient to justify the sealing. (Cal. Rules of Court, rule 2.551(b)(1).) A declaration supporting a motion to seal should be specific, not conclusory, as to the facts supporting the overriding interest. If the court finds that the supporting declarations are conclusory or otherwise unpersuasive, it may conclude that the moving party has failed to demonstrate an overriding interest that overcomes the right of public access. (See In re Providian Credit Card Cases (2002) 96 Cal.App.4th 292, 305.) Further, where some material within a document warrants sealing but other material does not, the document should be edited or redacted if possible, to accommodate the moving party’s overriding interest and the strong presumption in favor of public access. (See Cal. Rules of Court, rule 2.550(e)(1)(B); see also In re Providian Credit Card Cases, supra, 96 Cal.App.4th at p. 309.) In such a case, the moving party should take a line-by-line approach to the information in the document, rather than framing the issue to the court on an all-or-nothing basis. (Ibid.) Hashemieh seeks to have the Court seal the exhibits submitted with her objection to [Proposed] Discovery Order No. 35. Hashemieh makes the conclusory statement in her supporting declaration that the materials filed under seal are commercially sensitive and private. (Declaration of Julia Hashemieh in Support of Application to Seal Documents, ¶ 6.) As stated above, a declaration supporting a motion to seal should be specific, not conclusory, as to the facts supporting the overriding interest. A review of the exhibits submitted for sealing shows that most, if not all, of the documents are not confidential. For example, Exhibit 2 is almost entirely redacted; the only information in that exhibit consists of column headings for a chart. Exhibit 1 is similar, but contains some small amount of information regarding an individual. Exhibit 4 is a newspaper article from the San Jose Mercury News and Exhibit 8 appears to be an advertisement from a magazine. It is not apparent how these exhibits, or any of the other exhibits, are confidential and should be sealed. Accordingly, Hashemieh’s motion to seal is CONTINUED to 3/2. Hashemieh may file and serve a supplemental declaration justifying the application for sealing by 2/19. III. SOAR Group’s Objection to Discovery Referee’s [Proposed] Discovery Order No. 39 The parties have reached an agreement regarding [Proposed] Discovery Order No. 39. Accordingly, Soar Group’s objection is MOOT. - oo0oo - Calendar line 2 - oo0oo - Calendar line 3 Case Name: Suprina v. Berkowitz Case Number: 1-14-CV-272358 This is a putative class action related to the acquisition of Move, Inc. by News Corporation and related entities through an all cash tender offer of Move’s outstanding shares of common stock at $21 per share followed by a merger. Move announced on September 30, 2014, that it had entered into the merger agreement to be acquired by News Corp. On October 15, 2014, Move filed a Solicitation/Recommendation Statement on Schedule 14D-9 (the “Recommendation Statement”) with the SEC, which contained disclosures concerning the transaction and commenced the cash tender offer to acquire all of the outstanding shares of Move common stock for $21 per share. The tender offer was set to expire on November 13, 2014. On October 18, 2014, plaintiff Jamie Suprina (“Plaintiff”), a stockholder of Move, sent a pre-suit demand challenging the transaction and the recommendation statement. On October 24, 2014, Plaintiff filed the Complaint in this action, which set forth a single cause of action for breach of fiduciary duty and sought injunctive relief preventing consummation of the proposed transaction, a directive to the members of the Board that they exercise their fiduciary duties to obtain a transaction that maximizes value for Move stockholders, and rescission of the merger agreement. On November 1, 2014, Plaintiff’s counsel sent a settlement demand letter to counsel for the defendants requesting a reduced termination fee for the transaction and additional disclosure to be made to Move’s stockholders about the financial analysis of Morgan Stanley, Move’s financial advisor in connection with the transaction. Following arm’s length negotiations between November 4 and 7, 2014, the parties reached an agreement in principle to settle the action on November 7, 2014. Move filed an amendment to the recommendation statement with the SEC containing supplemental disclosures on November 7, 2014. On November 13, 2014, with 83.1% of outstanding shares of Move validly tendered, the transaction was completed. On August 7, 2015, this Court heard plaintiffs’ Motion for Preliminary Approval of Class Action Settlement. At that time, this Court granted Plaintiffs’ request for provisional certification of the class and preliminarily found the settlement to be fair and reasonable, but continued the motion to more fully assess the request for attorney’s fees and recommended some minor changes to the Notice to Class Members. Thereafter, on October 2, 2015, this Court found the changes to the Proposed Notice allowing class members to appear, object and speak at the final fairness hearing to have been properly added and reduced the fees requested from $475,000 to $250,950.00 plus expenses of $14,581.13. Plaintiffs now move for Final Approval of the Class Action Settlement. As noted in the Preliminary Approval Order, “questions whether a settlement was fair and reasonable, whether notice to the class was adequate, whether certification of the class was proper, and whether the attorney fee award was proper are matters addressed to the trial court’s broad discretion.” (Wershba v. Apple Computer, Inc. (2001) 91 Cal.App.4th 224, 234-235, citing Dunk v. Ford Motor Co. (1996) 48 Cal.App.4th 1794.) In determining whether a class settlement is fair, adequate and reasonable, the trial court should consider relevant factors, such as “the strength of plaintiffs’ case, the risk, expense, complexity and likely duration of further litigation, the risk of maintaining class action status through trial, the amount offered in settlement, the extent of discovery completed and the stage of the proceedings, the experience and views of counsel, the presence of a governmental participant, and the reaction of the class members to the proposed settlement.” (Wershba v. Apple Computer, Inc., supra, 91 Cal.App.4th at pp. 244-245, citing Dunk, supra, 48 Cal.App.4th at p. 1801 and Officers for Justice v. Civil Service Com’n, etc. (9th Cir. 1982) 688 F.2d 615, 624.) “The list of factors is not exclusive and the court is free to engage in a balancing and weighing of factors depending on the circumstances of each case.” (Wershba v. Apple Computer, Inc., supra, 91 Cal.App.4th at p. 245.) The court must examine the “proposed settlement agreement to the extent necessary to reach a reasoned judgment that the agreement is not the product of fraud or overreaching by, or collusion between, the negotiating parties, and that the settlement, taken as a whole, is fair, reasonable and adequate to all concerned.” (Ibid., quoting Dunk, supra, 48 Cal.App.4th at p. 1801 and Officers for Justice v. Civil Service Com’n, etc., supra, 688 F.2d at p. 625, internal quotation marks omitted.) The burden is on the proponent of the settlement to show that it is fair and reasonable. However “a presumption of fairness exists where: (1) the settlement is reached through arm’s-length bargaining; (2) investigation and discovery are sufficient to allow counsel and the court to act intelligently; (3) counsel is experienced in similar litigation; and (4) the percentage of objectors is small.” (Wershba v. Apple Computer, Inc., supra, 91 Cal.App.4th at p. 245, citing Dunk, supra, 48 Cal.App.4th at p. 1802.) In consideration for the settlement, Move made supplemental disclosures in the form 14D-9/A filed with the SEC on November 7, 2014, ahead of expiration of the close of the transaction, which took place on November 13, 2014. Plaintiff contends that the settlement confers a substantial benefit on the class. The disclosures made as a result of this action includes material information about the work performed by Morgan Stanley in rendering its fairness opinion, such as the identity of the analysts, the specific price targets observed, observed multiples for each company observed in its comparable companies analyses, the projected net operating losses for projections Cases 1, 2, and 3 as well as projected revenues, adjusted EBITDA and free cash flows for 2017-2024 for projection Cases 1, 2, and 3, and dates for each of the transactions analyzed by Morgan Stanley for its precedent transaction analysis. The supplemental disclosures also contained information surrounding the sales process, including about potential other bidders, and the rationales underlying the transaction. As set forth in the final moving papers, the supplemental disclosures provided Move stockholders with additional information regarding the work performed by Move’s investment banker and concerning the historical facts and circumstances precipitating the Board’s decision to enter into the transaction. Plaintiffs argue that the Supplemental Disclosures provided Move stockholders with significant material information, including important internal data that Move needed to evaluate an all cash tender offer. The Supplemental Disclosures also contained information surrounding the sales process, including about potential other bidders, and the rationales underlying the Transaction including material information about News Corp, Company A and Company B which provided additional information about the events leading up to the Transaction. Plaintiffs argue that by providing the stockholders with significant and material information about the Acquisition, the Settlement significantly benefited the Class. Moreover, obtaining an early settlement provided a benefit by avoiding the risk and expense of further litigation. Plaintiff’s counsel states that the settlement was reached only after conducting discovery and engaging in multiple arm’s length negotiations with opposing counsel. Finally, the final moving papers indicate that although the January 26, 2016 deadline had not expired, there were no objections as of the filing date of January 15, 2016. The Court also recognizes the experience and expertise of counsel who negotiated this Settlement. Consequently, the Court finds that the settlement is fair and reasonable. As noted in the Preliminary Approval Order and at the time of the hearing, the Court also has an independent right and responsibility to review the requested attorney’s fees and only award so much as it determines reasonable. (See Garabedian v. Los Angeles Cellular Telephone Co. (2004) 118 Cal.App.4th 123, 127-128.) At the preliminary approval hearing, the Court noted the high hourly rates of counsel (which it approved) and the duration of the litigation (two weeks) and denied the requested multiplier of 1.83, but did approve attorney’s fees in the amount of $250,950.00. The final moving papers request that this Court reconsider the original requested figure of $475,000. Both the moving papers and the Declaration of David Bower outline the activity taken by counsel prior to the litigation as well as the hourly rates of counsel and their staff. Counsel further points out that there were no objections to the request for fees. After further consideration, this Court will agree to a multiplier of 1.2 and approve reasonable attorney’s fees in the sum of $301,140.00. Expenses of $14,581.13 are also awarded. This Court has also reviewed the Declaration of Markham Sherwood regarding the mailing of Notices to Class Members. According to the Sherwood Declaration, Computershare Shareholder Services provided KCC Class Action Services with 2338 names and addresses of record holders during the class period. As of Jan. 20, 2016, KCC had received 5208 names and addresses of potential class members and Notices were sent out to those members as well as other brokers, banks, dealers, and other nominees. A total of 9679 Notices were sent out and according to counsel, there have been no objections. As the Court granted approval to the request for conditional class certification, the Court will not go through its analysis again in this Order. For the reasons set forth above, the Motion for Final Approval of Class Action Settlement is GRANTED subject to the conditions referenced above. - oo0oo - Calendar line 4 Case Name: Reyes v. Left Bank Menlo Park Partners LP Case Number: 1-15-CV-275505 Plaintiffs Motion for Preliminary Approval of Class Action Settlement was heard before this Court on January 8, 2016. At that time, the Court issued its Order requesting further briefing regarding two specific issues: (1) provisional certification of the proposed class; and (2) certain amendments to the Class Notice as discussed in the Court’s tentative. The preliminary approval hearing was continued to Feb. 5th, 2016 to allow supplemental briefing and declarations regarding those specific issues. The Court has now had an opportunity to review Plaintiff’s Supplemental Brief re: Certification of Settlement Class as well as the Declaration of Eric B. Kingsley in Support of the Supplemental Brief. After a full review of the supplemental papers, this Court is satisfied that the named representative, Juan Reyes, meets the adequacy standards for class certification and the requisite standards for provisional certification of the proposed class have been adequately addressed in the Supplemental Brief and Declaration. Accordingly, this Court finds that the proposed class be conditionally certified for settlement purposes. The Court has also reviewed the Stipulation to Amend Portions of the Settlement Agreement and the Class Notice and finds that the requisite changes have been made as requested in the Court’s earlier Order. For the reasons set forth in the Court’s Order following the original hearing on the Motion for Preliminary Approval on January 8th, 2016 and the reasons set forth above, the Plaintiff’s Motion for Preliminary Approval of Class Action Settlement is GRANTED. The Final Fairness Hearing Date is currently set for July 1, 2016. - oo0oo - Calendar Line 5 Case Name: Mayron v. Google, Inc. Case No.: 2015-1-CV-275940 This is a putative class action brought by plaintiff Eric Mayron (“Plaintiff”). (Complaint, ¶ 1.) Plaintiff alleges that defendant Google, Inc. (“Google”) offers free and paid storage plans for Google Drive, which gives subscribers the ability to reach stored-data files from any smartphone, tablet, or computer. (Complaint, ¶ 17.) Defendant offers subscribers 15 gigabytes of storage for free. (Ibid.) Defendant also offers the ability to upgrade membership to its paid service by purchasing a storage plan. (Ibid.) In connection with the subscriptions, Plaintiff alleges: Defendant made automatic renewal or continuous service offers to consumers in California and (a) at the time of making the automatic renewal or continuous service offers, failed to present the automatic renewal offer terms, or continuous service offer terms, in a clear and conspicuous manner and in visual proximity to the request for consent to the offer before the subscription or purchasing agreement was fulfilled in violation of Cal. Bus. & Prof. Code § 17602(a)(1); (b) charged Plaintiff’s and Class Members’ credit or debit cards, or third-party account [sic] . . . without first obtaining Plaintiff’s and Class Members’ affirmative consent to the agreement containing the automatic renewal offer terms or continuous service offer terms in violation of Cal. Bus. & Prof. Code § 17602(a)(2); and (c) failed to provide an acknowledgment that includes the automatic renewal or continuous service offer terms, cancellation policy, and information regarding how to cancel in a manner that is capable of being retained by the consumer in violation of Cal. Bus. & Prof. Code § 17602(a)(3). (Complaint, ¶ 2.) The Complaint, filed on January 23, 2015, sets forth the following causes of action: [1] Failure to Present the Automatic Renewal Offer Terms or Continuous Service Offer Terms Clearly and Conspicuously and in Visual Proximity to the Request for Consent Offer (Cal. Bus. & Prof. Code § 17602(a)(1)); [2] Failure to Obtain the Consumer’s Affirmative Consent Before the Subscription is Fulfilled (Cal. Bus. & Prof. Code §§ 17602(a)(2) and 17603); [3] Failure to Provide Acknowledgment with Automatic Renewal Terms and Information Regarding Cancellation Policy (Cal. Bus. & Prof. Code § 17602(a)(3); [4] Unfair Competition Law Violations (Cal. Bus. & Prof. Code § 17200, et seq.); and [5] Injunctive Relief (Cal. Bus. & Prof. Code § 17535). Defendant now demurs to each cause of action on the grounds that they fail to state facts sufficient to constitute a cause of action against Defendant. I. Plaintiff’s Request for Judicial Notice In opposition to Defendant’s demurrer, Plaintiff requests judicial notice of Legis. Counsel’s Digest, Sen. Bill 340 (2009-2010 Reg. Session), 2009 Cal. Legis. Serv. Ch. 340 (West). Plaintiff’s request for judicial notice is GRANTED. (See Kaufman & Broad Communities, Inc. v. Performance Plastering, Inc. (2005) 133 Cal.App.4th 26, 31-37 [discussing categories of documents that constitute cognizable legislative history for purposes of judicial notice].) II. Substantive Analysis a. First, Second, and Third Causes of Action The first, second, and third causes of action are all brought pursuant to the Automatic Renewal Law. Defendant argues that the Automatic Renewal Law does not create a private right of action and therefore Plaintiff cannot maintain these causes of action. “Adoption of a regulatory statute does not automatically create a private right to sue for damages resulting from violations of the statute. Such a private right of action exists only if the language of the statute or its legislative history clearly indicates the Legislature intended to create such a right to sue for damages.” (Vikco Ins. Services, Inc. v. Ohio Indem. Co. (1999) 70 Cal.App.4th 55, 62, emphasis in original.) That intent need not necessarily be expressed explicitly, but if not it must be strongly implied. (Farmers Ins. Exchange v. Superior Court (2006) 137 Cal.App.4th 842, 850.) The Automatic Renewal law provides, generally: (a) It shall be unlawful for any business making an automatic renewal or continuous service offer to a consumer in this state to do any of the following: (1) Fail to present the automatic renewal offer terms or continuous service offer terms in a clear and conspicuous manner before the subscription or purchasing agreement is fulfilled and in visual proximity, or in the case of an offer conveyed by voice, in temporal proximity, to the request for consent to the offer. (2) Charge the consumer’s credit or debit card or the consumer’s account with a third party for an automatic renewal or continuous service without first obtaining the consumer’s affirmative consent to the agreement containing the automatic renewal offer terms or continuous service offer terms. (3) Fail to provide an acknowledgment that includes the automatic renewal or continuous service offer terms, cancellation policy, and information regarding how to cancel in a manner that is capable of being retained by the consumer. If the offer includes a free trial, the business shall also disclose in the acknowledgment how to cancel and allow the consumer to cancel before the consumer pays for the goods or services. (b) A business making automatic renewal or continuous service offers shall provide a toll-free telephone number, electronic mail address, a postal address only when the seller directly bills the consumer, or another cost-effective, timely, and easy-to-use mechanism for cancellation that shall be described in the acknowledgment specified in paragraph (3) of subdivision (a). (c) In the case of a material change in the terms of the automatic renewal or continuous service offer that has been accepted by a consumer in this state, the business shall provide the consumer with a clear and conspicuous notice of the material change and provide information regarding how to cancel in a manner that is capable of being retained by the consumer. (d) The requirements of this article shall apply only prior to the completion of the initial order for the automatic renewal or continuous service, except as follows: (1) The requirement in paragraph (3) of subdivision (a) may be fulfilled after completion of the initial order. (2) The requirement in subdivision (c) shall be fulfilled prior to implementation of the material change. (Bus. & Prof. Code, § 17602.) There is no express provision in the Automatic Renewal Law authorizing a private right of action. Section 17604 of the Business and Professions Code states that “all available civil remedies that apply to a violation of this article may be employed.” However, the use of the language “all available” indicates that no new private right of action has been created; rather, a party can rely on civil remedies that already exist. For example, a party could bring an action under the UCL. Plaintiff cites to two cases that Plaintiff contends have held that Section 17602 creates a private right of action - Noll v. eBay Inc. (N.D. Cal. 2013) 2013 WL 2384250 and In re Trilegiant Corp., Inc. (D. Conn. 2014) 11 F.Supp.3d 82. In Noll, however, the court did not find that Section 17600, et seq. creates a private right of action; the Court only found that recovery under Section 17600, et seq. is limited to California consumers. (Noll v. eBay Inc., supra, 2013 WL 2384250 at *6.) The In re Trilegiant Corp., Inc. court also found that Section 17600, et seq. could not be relied on by non-California customers. (In re Trilegiant Corp., Inc., supra, 11 F.Supp.3d at p. 126.) While that court stated that the Automatic Renewal law created a private right of action for California residents, that statement was dicta and also incorrectly interpreted the holding of Noll. Therefore, the case law does not support Plaintiff’s position. Plaintiff also relies on Business and Professions Code section 17603, which states: In any case in which a business sends any goods, wares, merchandise, or products to a consumer, under a continuous service agreement or automatic renewal of a purchase, without first obtaining the consumer’s affirmative consent as described in Section 17602, the goods, wares, merchandise, or products shall for all purposes be deemed an unconditional gift to the consumer, who may use or dispose of the same in any manner he or she sees fit without any obligation whatsoever on the consumer’s part to the business, including, but not limited to, bearing the cost of, or responsibility for, shipping any goods, wares, merchandise, or products to the business. Plaintiff contends that the plain language of this statute shows the Legislature’s intent to allow individual consumers to bring actions against businesses violating the statute. It is telling that, while the Section 17600 refers to “ongoing shipments of a product or ongoing deliveries of service,” thereby distinguishing between “products” and “services,” Section 17603 refers to “goods, wares, merchandise, or products” and does not include “services.” In other words, this section only applies to tangible goods or products. Defendant argues that Section 17603 is only intended as a shield against a seller seeking payment for a good sent in violation of the Automatic Renewal Law; it is not intended to authorize a consumer to bring an action. This interpretation makes sense in light of the fact that Section 17603 only applies to tangible goods. In other words, a consumer could keep a good or product that is sent in violation of the Automatic Renewal Law, but there is nothing to keep when it is only a service that is provided. In sum, Plaintiff has not established that Section 17600, et seq. provides for a private right of action. Accordingly, Defendant’s demurrer to the first, second, and third causes of action is SUSTAINED WITHOUT LEAVE TO AMEND. b. Fourth and Fifth Causes of Action The fourth and fifth causes of action are UCL claims. Defendant first argues that Plaintiff lacks standing to sue under the UCL. “Proposition 64 amended section 17204 to provide that no private party has standing to prosecute a UCL action unless he or she ‘has suffered injury in fact and has lost money or property as a result of the unfair competition.’” (Law Offices of Mathew Higbee v. Expungement Assistance Services (2013) 214 Cal.App.4th 544, 555.) Defendant contends Plaintiff has not alleged he was injured in any way, let alone that any injury could be traced to any allegedly unlawful conduct by Defendant. Specifically, Defendant asserts that Plaintiff has not alleged, for example, (1) that he was not aware at the time he upgraded that his paid Google Drive account would renew automatically unless he cancelled it; (2) that he would not have upgraded or would not have maintained his subscription had Defendant provided more conspicuous notice; (3) that he was billed for a service he did not want or did not use; or (4) that he ever cancelled the subscription or asked Defendant for a refund. Plaintiff responds that he suffered economic injury in the form of Defendant automatically charging his credit card without complying with the provisions of the Automatic Renewal Law. Plaintiff argues that his state of mind is irrelevant and he does not need to show reliance on any representation by Defendant. Defendant is correct that “a plaintiff must allege that the defendant’s misrepresentations were an immediate cause of the injury-causing conduct.” (In re Tobacco II Cases (2009) 46 Cal.4th 298, 328.) Plaintiff here has not alleged that any representation by Defendant caused Plaintiff economic injury. Moreover, even if Defendant’s conduct is looked at as simply a violation of statute, Plaintiff has not alleged that he lost money as a result of that statutory violation. Plaintiff alleges that he was charged for a subscription to Google Drive. (Complaint, ¶¶ 64, 72.) Plaintiff does not allege that he did not receive and use Google Drive. In other words, the allegations show that Plaintiff received the service for which he paid. There are no allegations that Plaintiff tried to cancel the service, or even that he did not want the service. If Plaintiff used the service for which he was charged, then it is not apparent how he has lost money or property as a result of any allegedly unlawful conduct by Defendant; Defendant simply charged Plaintiff for a service provided to Plaintiff that Plaintiff used. Consequently, Plaintiff has not established standing to bring a UCL claim. This defect is fatal to the fourth and fifth causes of action. Accordingly, Defendant’s demurrer to the fourth and fifth causes of action is SUSTAINED WITH 10 DAYS’ LEAVE TO AMEND. - oo0oo - Calendar line 6 Case Name: Goldman v. Lifelock, Inc. Case Number: 1-15-CV-276235 Plaintiff Etan Goldman (“Plaintiff”) brings this putative class action on behalf of himself and others similarly situated in California that, since December 1, 2010, purchased subscriptions to identity theft protection services from defendant LifeLock, Inc. (“Defendant”). (Complaint, ¶ 1.) Defendant made automatic renewal or continuous service offers to consumers in and throughout California and (a) at the time of making the automatic renewal offers, failed to present the terms in a clear and conspicuous manner; (b) charged Plaintiff’s and class members’ credit or debit cards without first obtaining affirmative consent to the agreement containing the automatic renewal offer terms; and (c) failed to provide an acknowledgment that includes the renewal offer terms, cancellation policy, and information regarding how to cancel. (Complaint, ¶ 2.) The Complaint, filed on January 29, 2015, sets forth the following causes of action: [1] Failure to Present the Automatic Renewal Offer Terms or Continuous Service Offer Terms Clearly and Conspicuously and in Visual Proximity to the Request for Consent Offer (Bus. & Prof. Code, § 17602, subd. (a)(1)); [2] Failure to Obtain the Consumer’s Affirmative Consent Before the Subscription is Fulfilled (Bus. & Prof. Code, §§ 17602, subd. (a)(2) and 17603); [3] Failure to Provide Acknowledgment with Automatic Renewal Terms and Information Regarding Cancellation Policy (Bus. & Prof. Code, § 17602, subd. (a)(3)); [4] Unfair Competition Law Violations (Bus. & Prof. Code, § 17200, et seq.); and [5] Injunctive Relief and Restitution (Bus. & Prof. Code, § 17535). On April 15, 2015, following a day-long mediation, the parties reached a settlement. Following the settlement, the Plaintiff moved for preliminary approval before this Court on July 24, 2015. In its Order, this Court granted conditional certification of the putative class and granted preliminary approval of the settlement. Plaintiff now moves for Final Approval of the Class Action Settlement. As set forth in the Preliminary Approval Order, “questions whether a settlement was fair and reasonable, whether notice to the class was adequate, whether certification of the class was proper, and whether the attorney fee award was proper are matters addressed to the trial court’s broad discretion.” (Wershba v. Apple Computer, Inc. (2001) 91 Cal.App.4th 224, 234235, citing Dunk v. Ford Motor Co. (1996) 48 Cal.App.4th 1794.) In determining whether a class settlement is fair, adequate and reasonable, the trial court should consider relevant factors, such as “the strength of plaintiffs’ case, the risk, expense, complexity and likely duration of further litigation, the risk of maintaining class action status through trial, the amount offered in settlement, the extent of discovery completed and the stage of the proceedings, the experience and views of counsel, the presence of a governmental participant, and the reaction of the class members to the proposed settlement.” (Wershba v. Apple Computer, Inc., supra, 91 Cal.App.4th at pp. 244-245, citing Dunk, supra, 48 Cal.App.4th at p. 1801 and Officers for Justice v. Civil Service Com’n, etc. (9th Cir. 1982) 688 F.2d 615, 624.) “The list of factors is not exclusive and the court is free to engage in a balancing and weighing of factors depending on the circumstances of each case.” (Wershba v. Apple Computer, Inc., supra, 91 Cal.App.4th at p. 245.) The court must examine the “proposed settlement agreement to the extent necessary to reach a reasoned judgment that the agreement is not the product of fraud or overreaching by, or collusion between, the negotiating parties, and that the settlement, taken as a whole, is fair, reasonable and adequate to all concerned.” (Ibid., quoting Dunk, supra, 48 Cal.App.4th at p. 1801 and Officers for Justice v. Civil Service Com’n, etc., supra, 688 F.2d at p. 625, internal quotation marks omitted.) The burden is on the proponent of the settlement to show that it is fair and reasonable. However “a presumption of fairness exists where: (1) the settlement is reached through arm’s-length bargaining; (2) investigation and discovery are sufficient to allow counsel and the court to act intelligently; (3) counsel is experienced in similar litigation; and (4) the percentage of objectors is small.” (Wershba v. Apple Computer, Inc., supra, 91 Cal.App.4th at p. 245, citing Dunk, supra, 48 Cal.App.4th at p. 1802.) According to the final moving papers, the Settlement terms require Lifelock to pay a total of $2.5 million into the Settlement Fund to be distributed to: (1) the Settlement Class Members who did not opt out; (2) an incentive award to the named Class Representative in the amount of $5000; (3) attorney’s fees and costs not to exceed $500,000; and (4) administrative costs to the Settlement Administrator in the amount of $300,000. The Settlement does not include a claims process, but rather each of the class members shall receive a pro rata share of the settlement amount estimated to be $5.27. As part of the settlement, Plaintiff and the settlement class members will release Lifelock from all claims arising from or related to Defendant’s conduct alleged in the Complaint. Any settlement checks that are not cashed within 110 days will be distributed to a designated cy pres recipient, Identity Theft Research. According to the final approval papers, each class member will receive approximately $5.27 which is more than half of the average monthly revenue per Lifelock member ($9.91). The settlement was reached following extensive arms-length negotiations that included a full day session with an experienced mediator. The parties also exchanged informal discovery before the lawsuit was filed and obtained information regarding the number of members who enrolled each year during the class period. Furthermore class counsel provided information to support their extensive experience in litigation class action settlements and properly outlined the risks of continuing with the litigation and the benefits of an early settlement. As the Court noted in its Preliminary Approval Order, there are many benefits to the settlement. The papers also indicate that out of a total of 321,570 Class Members, only 55 chose to opt out, a percentage rate of .02% of the total class. All of these factors as well as those set forth in the Preliminary Approval Order support a finding that the settlement is fair and reasonable. The Court also has an independent right and responsibility to review the requested attorney’s fees and only award so much as it determines reasonable. (See Garabedian v. Los Angeles Cellular Telephone Co. (2004) 118 Cal.App.4th 123, 127128.) Plaintiff’s attorneys are seeking fees in the amount of $500,000. (Hammond Decl., ¶ 14.) While this is 20% of the total settlement fund, which would normally be a fair amount of fees, the case was only filed approximately half a year ago and the Preliminary Approval Order expressed concern about the amount being too high. In support of their request for attorney’s fees and expenses, Plaintiff submitted a separate Memorandum in Support of Motion for Attorney’s Fees which the Court has now reviewed. According to the moving papers and the Declaration of Julian Hammond, Class Counsel has expended at least 425.3 hours in the litigation for a combined lodestar of $232,517.50. The Court notes the hourly rates of counsel which include rates up to $830/hr. by a couple of the partners and paralegal rates up to $320/hr. The Court finds these rates to be on the high end of what would be considered reasonable for experienced class counsel and will approve the rates for purposes of this Motion. The Court does find, however, that the effective multiplier of 2.15 is too high and will reduce the multiplier to 1.6 for a total amount of attorney’s fees in the sum of $372,027. While the Court recognizes the benefit of the settlement to class members and the risks associated with the litigation, the Court finds that a multiplier of 1.6 together with the hourly rates requested is reasonable given the fact that the lawsuit was filed within approximately 6 months of the settlement. With regard to the incentive award, the Court has reviewed the Declaration of Etan Goldman and approves the requested award of $5000. As this Court already granted conditional certification to the proposed class, the Court will not repeat its analysis in this Order. Regarding the dissemination of Notice to the Class Members, the Court has reviewed the Declaration of Lori Castenada. The Castenada Declaration indicates that there were 321,570 unique Class Members included in the class data provided by Lifelock. Notice was sent out both by email and by mail (postcard) for Class Members whose email was returned as undeliverable or did not have an email. Exhibit A and Exhibit B to the Castenada Declaration are templates of the Summary Notice that was delivered to Class Members. After extensive efforts to serve Notice, the Declaration indicates that there were a total of 824 Class Members to whom an email Notice could not be delivered and for whom no valid physical address could be located. Accordingly, 99.5% of the Class Members did not have their Summary Notice returned as undeliverable. Combined with the Settlement Website and the toll free number for inquiries, the Court is satisfied that proper Notice was given and due process concerns are properly addressed. The very small percentage of people opting out of the settlement is further evidence of the reasonable and fairness of the settlement. For the reasons set forth above and in the Preliminary Approval Order, the Court finds the settlement to be reasonable and fair and subject to the terms above, Plaintiff’s Motion for Final Approval of Class Action Settlement is GRANTED. - oo0oo - Calendar line 7 - oo0oo -