Education Bill Second Reading Debate 8 February

advertisement

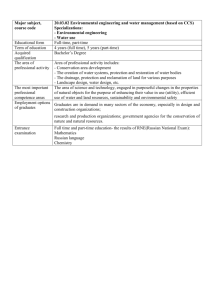

Education Bill 2011: Education Public Bill Committee million+ Evidence About million+ million+ is a university think-tank which provides evidence and policy analysis on policy and funding regimes that impact on universities, students and the services that universities and other higher education institutions provide for business, the NHS, education and the not-for-profit sectors. We welcome the opportunity to submit evidence to the Education Public Bill Committee in view of the role of universities in initial teacher training (ITT) and continuing professional development (CPD) provision and interest rates on student fee and maintenance loans. million+ also provided written and oral evidence to the Browne Review of Fees and Funding and has provided analysis of the Government’s response to the Browne Review. This submission addresses the proposals in the Education Bill to: abolish the Training and Development Agency for Schools extend the Secretary of State’s powers in respect of interest rates to be applied to student and graduate fee and maintenance loans provide for fee loans for part-time students in higher education Part 3: Abolition of the Training and Development Agency for Schools Section 14 1. TDA as an ‘Arms Length Body’ 1.1 The abolition of the TDA as an arms length body and the absorption of its functions within DfE may appear to be an administrative and technical proposal. However, there have been significant benefits in having an arm's length TDA (a body that has been very favourably reviewed by the NAO in the recent past) with an independent Board responsible to Parliament - rather than an Executive Agency within the DfE responsible solely to the Minister. The TDA has provided a more reflective and responsive body than the DfE and its predecessor departments and its establishment has largely avoided teacher training being the subject of political interference. The TDA has therefore offered the independence which the teaching profession and the nation’s schools deserve. 1.2 The TDA was put on the ‘at risk’ list of arms length bodies and its functions were brought into DfE in advance of the publication of the Bill. The Government appears not to have considered any alternative proposals. It would have been possible to transfer planning functions and the allocation of ITT numbers to the Higher Education Funding Council (Hefce) which currently allocates medical training numbers based on a budget and numbers provided by DoH. 1.3 Historically, the DfE has not had a good record in workforce planning needs in schools with a tendency towards micro-management that often ignored regional and in particular, locality needs. By abolishing the TDA, the Government will also lose the opportunity to combine the TDA and the Children’s Workforce Development Council (CWDC) into a single Non-Departmental Public Body or, in the alternative, to combine the TDA with CWDC and post-16 Lifelong Learning Sector ITT and create a single ITT and CPD Agency for all those engaged in learning-related work with children, young people and adults. 2. The link with Teaching Quality White Paper 2.1 The abolition of the TDA has raised wider concerns and appears to be linked with Ministerial objectives outlined in the Teaching Quality White Paper. This White Paper presumes that Teaching Schools should replace ITT provision in universities or at least that such schools should take the lead in future ITT provision. 1 2.2 This has profound implications not only for the teaching profession but also for universities which currently provide the overwhelming bulk of ITT for the nation’s school teachers. Those universities which offer ITT have education departments which are experienced and long-standing centres of teaching as well as research. University ITT is provided in conjunction with schools and ITT providers are inspected by OFSTED. Universities also offer CPD and relevant, specialist postgraduate qualifications. In some cases universities receive more funds from ITT contracts than from Hefce but they also generate income based on this expertise e.g. through partnership work with schools. 2.3 OFSTED inspections of ITT providers rate universities much more highly than school-based providers. There is therefore no robust evidence base for the DfE proposals and the abolition of the TDA as an arms length body suggests that future developments in ITT and the allocation of student numbers will be the subject of Ministerial preference rather than being evidence-bases. This shift of emphasis in ITT and CPD provision is already apparent as illustrated in the case-study below and in recent Ministerial decisions in relation to bursaries. University case-study The University has been judged to be an “outstanding” ITT provider by OFSTED for four successive inspections focused in specialist and clearly defined subject areas. The University has also developed strong partnerships regionally and nationally, for example, playing a leading role in developing the TDA’s Masters in Teaching and Learning initiative work nationally. In addition to ITT, the University provides Level 7 CPD which is equally high quality with almost 300 parttime students and course delivery undertaken by university staff in school, colleges and local authorities. This work is supporting school and college improvement as well as improvements in individual professional qualifications. Despite this track record, a non-university ITT provider with whom the University has a franchise agreement has recently been allocated PGCE numbers despite a lower quality rating and despite the fact that the University has received an OFTSED rating of excellence in its ITT provision. 2.4 The current Ministerial view appears to be that teaching can be primarily ‘learnt on the job’ i.e. teaching is about the acquisition of skills and not about the acquisition of knowledge and skills. This risks teaching as a profession being downgraded or subject to changing Ministerial priorities. Following the transfer of TDA to DfE, there has been evidence of reductions in funding as well as the transfer of some ITT student numbers and support to lower quality and untested non-university providers. There are therefore clear concerns that DfE is ignoring both the evidence of OFSTED and of research that has concluded that university-led ITT and CPD are much more effective than the alternatives. 3. Professional development 3.1 It should be noted that professional development is already being switched from the TDA to the NCLS (the National College for Leadership of Schools). The NCLS is well-known to only work with a limited number of universities and as an organisation it is effectively an Executive Agency of Government. The NCLS is already promoting the concept of Teaching Schools even though the merits of the latter and the future of ITT are currently the subject of consultation. The evidence of the NCLS’s own contribution to improvement of outcomes in schools and colleges remains weak. 4. Free schools 4.1 It appears that there will be no requirement for teaching staff to have qualified teacher status (QTS) in free schools even though QTS has been a long-standing requirement in state schools (although not in independent schools). 2 5. Withdrawal of Teaching Bursary 5.1 Teaching bursaries, worth up to £6,000, have been abolished for those training to teach English, geography, history, classics, business studies, religious education, design and technology, information and communication technology, art, dance, music, drama and media studies. DfE sources have advised that these were ‘soft subjects’. This is a value judgment which may affect the future supply of teachers in these areas. The bursary has been a key part of the financial support students needed and may affect many prospective students who currently hold conditional offers for courses commencing in 2011. This will include both those seeking to retrain as mature entrants to the profession as well as recent graduates/current undergraduates who may already have substantial student debt. 6. Teach First to ‘plug shortages’ 6.1 Following the reduction in ITT places in 2011, the DfE has suggested that any shortfalls in the number of recruits could be met with an expansion of Teach First, a charity which puts graduates into schools in certain deprived areas. Teach First does not work throughout the country and focuses its recruitment on graduates from research-intensive universities i.e. a very narrow profile of potential graduates, teachers and schools. Although Teach First celebrates those graduates who eventually decide to remain in teaching, the assumption of the scheme is that graduates will go on to other jobs after they have finished the Teach First scheme. 6.2 The TDA has been favourably reviewed by the National Audit Office and its Board is accountable to Parliament rather than being an Executive Agency within the DfE responsible solely to the Minister of the day. There are considerable advantages in an arm’s length body such as the TDA being responsible for the workforce planning needs of schools and the training and professional development of the teaching profession. Such a body can take both full and proper account of Ministerial policy and funding objectives but also give due regard to local and national needs and the evidence base as to how ITT, CPD and school and college improvement are best progressed. Part 8: Student Finance: Powers of the Secretary of State to set interest rates on student fee and maintenance loans Section 70 7. Extension of the Secretary of State’s powers 7.1 The Bill provides the Secretary of State with wide-ranging powers to adjust the interest rates to be charged on student loans for students entering English Universities as new entrants from 2012. Currently, adjustments to interest rates on student loans are subject to primary legislation. The Bill therefore represents an extension of the powers of the Secretary of State to make decisions in relation to interest rates which in turn have potentially significant implications for students, graduates and the taxpayer. 8. Current system: application of RPI 8.1 At present, the fee and maintenance loans of students who study at English universities attract interest both while individuals are students and when they graduate. It is charged in line with a predetermined measure of inflation (RPI). If no contributions (payments) are made, the size of the loans increases in cash terms but remains fixed in value terms. This means that the value of the money borrowed by students has the same value as the money repaid. 9. Impact of RPI and positive real rate of interest including on mature students 9.1 The Bill provides the Secretary of State with the power to introduce a positive real rate of interest in addition to RPI on fee and maintenance loans. Under a positive real rate of interest, the size of the loan increases over and above the rate of inflation. The size of the loan will increase annually in real terms if no contributions are made implying that graduates will eventually contribute a greater amount than they 3 originally borrowed in real terms. Depending on the size of the loan, and the real rate of interest charged in excess of RPI, more graduates than at present are likely find that they do not pay-off their loans in full. This may be in spite of many making repayments at 9% of earnings over the full repayment period. 9.2 In many modern universities, the average age of students and graduates is much higher and many widening participation students do not progress to university straight from school. A positive real rate of interest will therefore impact on mature students who may reach the end of their working lives without paying-off their student loans. The introduction of a positive real rate of interest is also likely to have adverse impact on some on female graduates and on men in the bottom decile of earnings who will pay more for their higher education and will pay for longer. 9.3 Ministers have indicated that, subject to the Education Bill, they intend to apply RPI plus a positive real rate of interest of 3% to the fee and maintenance loans of full-time students while they are studying, RPI alone for graduates earning below £21,000, RPI plus a taper of up to 3% for graduates earning between £21,000 and £41,000 and above £41,000, graduates will repay at the RPI plus 3%. 9.4 The removal of 80% of teaching funding and the assumption that in the future students will be required to take out fee loans of up to £9000 per annum (in addition to maintenance loans) means that overall loan ‘debt’ on graduation will be much higher than at present. The impact of a positive real rate of interest will therefore have a significant impact on student and graduate debt and will lead to graduates paying much more for their higher education and for longer than at present. Many more graduates are likely to reach the end of the repayment period (extended from 25 to 30 years under the Government’s proposals) without paying off their loans with obvious consequences for the taxpayer. Currently it is estimated that the cost of ‘write-off’ (the RAB charge) of the current system is approximately 27p in the pound. BIS estimates of write-off for the new system are much lower than those of other commentators – for example, London Economics has estimated that the RAB charge will increase to over 40p in the pound while Hepi has estimated that the RAB charge could increase to 50p in the pound. The Deputy Prime Minister has also recently stated that the Government has estimated that up to 60% of graduates are not expected to repay their loans in the future. 9.5 The combined impact of rising levels of inflation and a real interest rate of 3% on student fee and maintenance loans is illustrated in Table 1. This models the impact of RPI plus a 3% on a fee of £7,500 and assumes that fee and maintenance loans increase by inflation each year (as under the present system) and that RPI remains at current levels (4.8%). As the ‘full-rate’ of RPI plus 3% will be levied whilst students are still at university the final total could reasonably reflect debt on graduation of someone paying what BIS has assumed will be the average fee. Table 1 Year Fee Maintenance RPI 1 £7,500 £3,575 2 £7,860 3 £8,237 TOTAL 0.048 Real Interest 0.03 £3,747 0.048 0.03 £25,382 £3,926 0.048 0.03 £40,474 £11,939 10. Other issues for students and graduates 10.1 The application of interest rates could impact on the Government’s aspirations to improve social mobility. The application of a real rate of interest will have no impact on students who are wealthy enough to pay upfront and it will have a reduced impact on graduates who leave university with much smaller debts because they can rely on their families for financial support while they are studying or who can pay off their loans early. However, it is well known that students from more disadvantaged 4 backgrounds are both more debt and risk averse. Moreover students from some backgrounds e.g. some Muslim students, may not be attracted by loans which accrue interest. 11. Part-time students, interest rates and repayment of fee loans 11.1 Ministers have indicated that part-time students will be treated differently from full-time students. Subject to the Education Bill being approved, part-time students will be entitled to access fee loans (but not maintenance loans) if they study at 25% intensity or more per annum. Part-time student loans will have the same conditions attached to them as for full-time students for the first three and half years of study i.e. loans will attract RPI plus interest at 3%. Thereafter part-time students whose earnings rise above the earnings threshold of £21,000 will be required to start repaying loans at 9% of earnings. It is not clear whether their fee loans will thereafter attract interest charged at RPI plus a taper of 3% or the full rate of RPI plus 3% (the rate applied whilst you are still studying). 12. Administrative complexity 12.1 Ministerial decisions in relation to interest rates have the potential to increase complexity in an already complex system. For example, for graduates on PAYE, employers calculate and deduct repayments based on earnings. HRMC collects and advises the SLC of repayments and the loan balance is adjusted. However, the SLC has to be informed at the end of the tax year and graduates can wait up to 18 months for the adjusted balance statement. In future, the system being proposed by Ministers will require the balance statements of graduates to be adjusted by RPI, plus / minus a taper of up to 3% and to be further adjusted for the annual uprating of the earnings threshold. It is therefore difficult to see how the application of interest rates to the fee levels approved by Parliament, as currently proposed by Ministers, will provide a more transparent and accurate system for students and graduates in the future. At the present time, there has been no assessment of the potential for economic inefficiencies and increased administrative costs which are implied by these interest rate proposals. 12.2 The application of a real rate of interest is not uncommon in other EU countries. For example, it is applied in the Netherlands on fee and maintenance loans and in Sweden on maintenance loans. However, student fees are not applied in Sweden and fees are much lower elsewhere with the result that the application of a real rate of interest on student and graduate debt has a much smaller impact on debt. 13. Sale of the student loan book 13.1 Write-off charges and interest rates will impact on the capacity of the current and any future Government to sell the student loan-book. 14. Investment in higher education 14.1 At face value, it can be argued that the Bill offers the Secretary of State appropriate powers to apply and adjust a real rate of interest on student loans. However, the extension of the Secretary of State’s powers does imply less Parliamentary scrutiny in the future on matters which are of importance to students, graduates and taxpayers as well as universities. As tabled, this extension of powers offers no guarantee that any additional revenue which is raised as a result of the application of real rates of interest on student and graduate loans will be spent on universities or higher education in the future. Part 8: Student Finance, Fee Loans for part-time students Section 71 15. Fee Loans for part-time students and a unified system 15.1 million+ welcomes the principle that part-time students will be eligible for fee loans under circumstances prescribed by Ministers. Part-time students are not confined to ‘part-time’ institutions such as the OU and Birkbeck. In many modern universities, over a third of students study on a part-time and flexible basis. As a result of the exclusion of part-time students from the 2004 HE Act, million+ submitted 5 evidence to the Browne Review but also to a series of Select Committee Inquiries advocating a unified system of student support. 15.2 Under the Bill’s proposals, part-time students will still not be eligible for maintenance loans and, as outlined above, part-time students are likely to be subject to different repayment regimes when compared to full-time students. This means that the Government has not yet adopted the more unified system which is applied to student support in many other EU countries where no distinction is made on the basis of mode of study of the student. It is therefore likely that full-time provision will continue to be incentivised. However, the Bill will introduce a welcome improvement for part-time students. Victoria Mills Public Affairs Officer million+ T: 020 7717 1659 victoriamills@millionplus.ac.uk March 2011 6