BUDGET AND ACCOUNTS ACT

advertisement

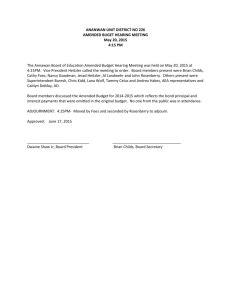

BUDGET AND ACCOUNTS ACT Wholly Amended Amended Amended Amended Amended Amended Amended Amended Amended Amended Amended CHAPTER I Mar. Nov. Dec. Dec. Dec. Jan. Dec. Jan. Feb. May Dec. 31, 30, 27, 31, 31, 5, 12, 21, 5, 24, 31, 1989 1991 1991 1991 1993 1995 1996 1999 1999 1999 1999 Act Act Act Act Act Act Act Act Act Act Act No. No. No. No. No. No. No. No. No. No. No. 4102 4408 4445 4461 4659 4868 5170 5662 5742 5982 6075 GENERAL PROVISIONS Article 1 (Purpose) (1) The purpose of this Act is to provide for the national budget and accounting and the fundamental matters related thereto. (2) The management and accounting of goods and national property shall be subject to such conditions as prescribed separately by other Acts, but matters for which no special provision is made by such Acts shall be subject to such conditions as provided for in this Act. Article 2 (Fiscal Year) The fiscal year of the State shall commence on the lst of January and end on the 31st of December every year. Article 3 (Principle of Independence of Fiscal Year) The expenditures of each shall be appropriated with the revenues of the same fiscal year. fiscal year Article 4 (Term of Receipts and Disbursements, and Division by Fiscal Year to which They Belong) (1) Affairs related to receipts and disbursements of the revenues and expenditures which belong to one fiscal year shall be completed by the 10th of March of the following calendar year. (2) Division of revenues and expenditures by the fiscal year to which they belong shall be determined by the Presidential Decree. Article 5 (Financial Resources for Annual Expenditure of State) The financial resources of the annual expenditure of the State shall be the revenue other than state bonds or borrowings (including loan funds introduced from foreign countries, international cooperative organizations and foreign corporations; hereinafter the same shall apply): Provided, That in an unavoidable case, it may be met with state bonds or borrowings in an amount, the limit of which is approved by the National Assembly. Article 6 (Treasury Bills and Temporary Borrowings) (1) When it is necessary for receipts and disbursements of national funds, the State may issue treasury bills or borrow funds from the Bank of Korea on a temporary basis. (2) The treasury bills as referred to in paragraph (1) may be redeemed within one year from the date of issuance. (3) The treasury bills and temporary borrowings as referred to in paragraphs (1) and (2) shall be redeemed with the revenue of the fiscal year concerned. (4) The issuance of the treasury bills and the maximum amount of the temporary borrowings shall be approved each fiscal year by the National Assembly by each account in need of them. Article 7 (Establishment of Fund) (1) The State may establish a special fund by an Act only when it is required to operate a certain fund for a specified purpose. (2) The fund as referred to in paragraph (1) may be operated without conforming to the budgets of revenues and expenditures. (3) through (7) Deleted. <by Act No. 4461, Dec. 31, 1991> Article 8 (Budget and Management of Subsidies) Matters concerning the budget and management of the State subsidies shall be determined separately by an Act. Article 9 (Division of Accounts) (1) The accounts of State shall be divided into general and special accounts. (2) Special accounts shall be established by an Act, when the State operates special enterprises, when the State holds and operates special funds, or when specified revenues are appropriated to specified expenditures and it is deemed necessary to account for distinctly from the general accounts. Article 10 (Principle of Enterprise Accounting) Enterprises operated by the Government under the special accounts may be administered on the principle of enterprise accounting in such a manner as may be prescribed separately by an Act. Article 11 (Budget and Accounting of Government-Invested Institutions) Matters concerning the budget and accounting of government-invested institutions shall be determined separately by an Act. Article 12 (Claim and Obligation of State) (1) The whole or partial exemption or alteration of effect of the claims held by the State shall be made in accordance with the provisions of any Act. (2) Except as otherwise provided by any Act or contract, the State shall not delay the fulfillment of its obligation. Article 13 (Disposal of State Property) (1) Except as otherwise provided by any Act, no property of the State shall be used for any exchange, concession, loan, contribution or means of payment. (2) The property as referred to in paragraph (1) shall be all property other than cash. Article 14 (Definition of Heads of Central Government Agencies and Prohibition of Direct Use of Revenues) (1) For the purpose of this Act, the term "heads of central government agencies" means the Speaker of the National Assembly, the Chief Justice of the Supreme Court, the President of the Constitutional Court, the Chairman of the National Election Commission, and heads of central administrative agencies established under the Constitution, the Government Organization Act or other Acts. (2) The Speaker of the National Assembly, the Chief Justice of the Supreme Court, the President of the Constitutional Court and the Chairman of the National Election Commission may delegate their duties as prescribed by this Act to the Secretary-General of the National Assembly, the Director of the Office of Court Administration of the Supreme Court, the Secretary-General of the Constitutional Court and the Secretary-General of the National Election Commission. In this case, the Secretary-General of the National Assembly, the Director of the Office of Court Administration of the Supreme Court, the Secretary-General of the Constitutional Court and the Secretary-General of the National Election Commission shall be considered as heads of central government agencies as referred to in paragraph (1) to the extent of delegation. <Amended by Act No. 4408, Nov. 30, 1991; Act No. 4659, Dec. 31, 1993> (3) When the Speaker of the National Assembly, the Chief Justice of the Supreme Court, the President of the Constitutional Court, and the Chairman of the National Election Commission delegate their duties under paragraph (2), they shall notify the Minister of Finance and Economy, the Minister of Planning and Budget and the Board of Audit and Inspection thereof. <Amended by Act No. 4408, Nov. 30, 1991; Act No. 4659, Dec. 31, 1993; Act No. 5742, Feb. 5, 1999; Act No. 5982, May 24, 1999> (4) Except as otherwise provided by other Acts, the head of each central government agency shall pay the revenues under his jurisdiction to the National Treasury, and shall not use them directly. Article 15 (Control over Affairs concerning Budget and Accounting) (1) Affairs concerning Acts and subordinate statutes related to the budget shall be controlled by the Minister of Planning and Budget and those concerning Acts and subordinate statutes related to accounting, by the Minister of Finance and Economy. <Amended by Act No. 5742, Feb. 5, 1999; Act No. 5982, May 24, 1999> (2) Deleted. <by Act No. 4659, Dec. 31, 1993> Article 16 (Establishment, etc. of Medium- and Long-Term Plan) (1) If it is deemed necessary to estimate the financial demand and available resources for several years for the purpose of the efficiency and soundness of the financial operation, the Minister of Planning and Budget may establish a medium-and long-term financial operation plan. <Amended by Act No. 5742, Feb. 5, 1999; Act No. 5982, May 24, 1999> (2) When the head of each central government agency establishes a medium-and longterm plan accompanied by the budget, he shall, in advance, consult with the Minister of Planning and Budget. <Amended by Act No. 5742, Feb. 5, 1999; Act No. 5982, May 24, 1999> (3) When a local government establishes a plan of projects to be carried out by the financial support of the State, it shall obtain a prior approval of the head of related central government agency before the fiscal year begins. (4) When the head of a central government agency grants an approval as referred to in paragraph (3), he shall also consult with the Minister of Planning and Budget in advance. <Amended by Act No. 5742, Feb. 5, 1999; Act No. 5982, May 24, 1999> Article 17 Deleted. <by Act No. 4659, Dec. 31, 1993> CHAPTER II SECTION 1 BUDGET General Provisions Article 18 (Definition of Revenue and Expenditure and Principle of Incorporation into Budget) (1) All revenues in a fiscal year shall be the annual revenue, and all expenditures shall be the annual expenditure. (2) All revenues and expenditures shall be incorporated into the budget: Provided, That if the State makes a contribution in kind or induces foreign loans and re-lends them, they may be disposed of apart from the budget of revenues and expenditures. (3) In case of foreign loans for purchase of goods, if the annual revenue exceeds the budget due to an unavoidable transfer of the predetermined portion to be drawn in the preceding year or a fluctuation of the exchange rate, the disbursement may be made in excess of the estimated expenditures concerned. Article 19 (Contents of Budget) The budget shall refer generally to the general budget rules, revenue and expenditure budgets, continuing expenditure, specified carry-over funds and action of Treasury to bear liability. Article 20 (Division of Budget) (1) The revenue and expenditure budgets may, if necessary, be divided into accounts. (2) The revenue and expenditure budgets shall be divided by organization of the central government agencies. (3) The contents of the revenue budget shall be divided into subchapters and sections by nature, and those of the expenditure budget, into chapters, subchapters and sections by function, nature or agency, in accordance with the division under paragraph (2). Article 21 (Reserve Fund) In order to meet unforeseeable extra-budgetary expenditures or expenditures in excess of the budget, the Government may appropriate such sum as deemed proper as reserve fund in the budget of revenue and expenditure. Article 22 (Continuing Expenditure) (1) The total expenditure and yearly installments of construction works or manufactures and research and development projects the completion of which demands several years shall be determined and may be disbursed over several years within the limit approved in advance by the National Assembly. (2) The period in which the State may make disbursements under paragraph (1), shall be not more than five years from the fiscal year concerned: Provided, That if it is deemed necessary to extend such period, it may be extended through an approval of the National Assembly. Article 23 (Specified Carry-Over Funds) If a disbursement of any item in the expenditure budget is not expected to be completed within the fiscal year due to its nature, such effect shall be specified in the budget of revenue and expenditure, and it may be carried over to and used in the following fiscal year with the prior approval of the National Assembly. Article 24 (Act to Which Liabilities are Borne from Treasury) (1) If the State bears liabilities other than those as prescribed by Acts or included within the limit of the annual expenditure amount or the total of continuing expenditure, it shall be approved in advance as a budget by the National Assembly. (2) The State may, if necessary for natural disaster relief other than those as referred to in paragraph (1), do any act bearing liabilities in each fiscal year within the limit approved by the National Assembly. <Newly Inserted by Act No. 4659, Dec. 31, 1993> (3) When the State has done any act bearing liabilities under paragraph (2), it shall submit a report thereof to the National Assembly not later than one hundred and twenty days before the next fiscal year commences. <Newly Inserted Act No. 4659, Dec. 31, 1993> SECTION 2 Compilation of Budget Bill Article 25 (Guideline for Compilation of Budget Bill and Term of Submission of Written Request for Budget) (1) The head of each central government agency shall submit an operation plan for new projects in the following year and major continuing projects as determined by the Minister of Planning and Budget to the Minister of Planning and Budget by the end of February every year. <Amended by Act No. 5742, Feb. 5, 1999; Act No. 5982, May 24, 1999> (2) The Minister of Planning and Budget shall notify the head of each central government agency of the guidelines for compilation of the budget bill of the following year, which is approved by the President through a deliberation of the State Council not later than the 31st of March every year. <Amended by Act No. 5742, Feb. 5, 1999; Act No. 5982, May 24, 1999> (3) The head of each central government agency shall prepare a written request for the revenue and expenditure budgets, continuing expenditure, specified carry-over funds and acts to which liabilities are borne from Treasury (hereinafter referred to as the "written request for budget") of the following year, which are under his jurisdiction, according to the guidelines for compilation of the budget bill as referred to in paragraph (2), and submit it to the Minister of Planning and Budget not later than the 31st of May every year. <Amended by Act No. 5742, Feb. 5, 1999; Act No. 5982, May 24, 1999> (4) A written request for budget as referred to in paragraph (3) shall be accompanied by documents necessary for the compilation of the budget and the application of budget management rules under the Presidential Decree. Article 26 (Budgetary General Provisions) The budgetary general provisions shall, in addition to the general provisions concerning the revenue and expenditure budgets, continuing expenditure, specified carry-over funds and acts to which liabilities are borne from Treasury, include the following matters: 1.The maximum amount of national bonds or borrowing funds under the proviso of Article 5; 2.The issuance of treasury bills and the maximum amount of temporary borrowing funds under Article 6; and 3.Other matters necessary for the execution of budget. Article 27 (Causes for Acts to Which Liabilities are Borne from Treasury and Amount thereof) For an act to which liabilities are borne from Treasury, the cause thereof shall be specified for each matter, and the year in which the act is performed, the redemption year and the amount of liability to be borne shall be indicated. Article 28 (Compilation of Budget Bill) The Minister of Planning and Budget shall compile the budget bill on the basis of a written request for budget under Article 25, and obtain the approval of the President through a deliberation of the State Council. <Amended by Act No. 5742, Feb. 5, 1999; Act No. 5982, May 24, 1999> Article 29 (Budget of Independent Institutions) If the requested amount of the annual expenditure budget of the National Assembly, the Supreme Court, the Constitutional Court, the Board of Audit and Inspection, and the National Election Commission (hereinafter referred to as "independent institutions") is to be reduced, an opinion of the head of the independent institution concerned shall be sought by a meeting of the State Council. Article 30 (Submission of Budget Bill to National Assembly) The Government shall submit the budget bill as prescribed in Article 28 to the National Assembly at least ninety days before the fiscal year begins. Article 31 (Documents Appended to Budget Bill) The budget bill submitted to the National Assembly shall be accompanied by the following documents: 1.The guidelines for compilation of the budget bill under Article 25 (2); 2.The item-by-item explanation of the revenue and expenditure budgets; 3.The explanation of acts to which liabilities are borne from Treasury; 4.The gross and net accounts of the revenue and expenditure budgets; 5.The statement on the actual results of the redemption of the national bonds and borrowing funds at the end of the year before the preceding year, the present amount thereof presumed at the end of the preceding and current years, and the annual redemption schedules; 6.For acts to which liabilities are borne from Treasury continuously after the following year, the statement on the amount or presumed amount of the expenditure by the end of the preceding year and the predetermined amount of the expenditure after the current year; 7.For the continuing expenditure, the statement on the amount or presumed amount of the expenditure until the end of the preceding year, the predetermined amount of the expenditure after the current year, the overall project plans and the situation of progress thereof; 8.The table of fixed number of personnel on the budget and the base unit price for compilation of the budget bill; 9.The statement on the present amount of the State property at the end of the year before the preceding year, and the presumption of the present amount thereof at the end of each of the preceding and current years; 10.If the budgetary amount requested by an independent institution is reduced, reasons of such reduction and opinions of the head of the independent institution concerned; and 11.Other documents clarifying the financial situation and contents of the budget bill. Article 32 (Revision of Budget Bill Submitted to National Assembly) When the Government wishes to partially revise the budget bill due to any inevitable reason after submitting it to the National Assembly, it may submit a revised budget bill to the National Assembly with the approval of the President through a deliberation of the State Council. Article 33 (Revised Supplementary Budget Bill) (1) If it is required to modify the already approved budget due to any cause which has taken place after the budget enters into force, the Government may compile a revised supplementary budget bill and submit it to the National Assembly. (2) If a revised budget bill or revised supplementary budget bill is submitted under Article 32 (1), all or part of documents appended to the budget bill under Article 31 may be omitted. Article 34 (Execution of Budget Pending Approval) (1) If a budget bill is not approved by the National Assembly for any inevitable reason before the fiscal year begins, the Government shall execute the budget pursuant to Article 54 (3) of the Constitution. (2) The budget executed under paragraph (1) shall, when the budget of the year concerned is approved, be considered to be executed under such approved budget. SECTION 3 Execution of Budget Article 35 (Allocation of Budget) (1) When the budget enters into force, the head of each central government agency shall submit a written request for budget allocation including the budget of revenue and expenditure, continuing expenditure and act to which liabilties are borne from Treasury to the Minister of Planning and Budget. <Amended by Act No. 5742, Feb. 5, 1999; Act No. 5982, May 24, 1999> (2) The Minister of Planning and Budget shall prepare a quarterly budget allocation plan on the basis of a written request for budget allocation as referred to in paragraph (1) and a monthly financing plan as prescribed in Article 57 (2), and obtain the approval of the President through a deliberation of the State Council together with the monthly financing plan submitted by the Minister of Finance and Economy: Provided, That if it is required to revise the monthly financing plan submitted by the Minister of Finance and Economy in preparing the annual expenditure budget allocation plan, the Minister of Planning and Budget shall consult with the Minister of Finance and Economy. <Amended by Act No. 5742, Feb. 5, 1999; Act No. 5982, May 24, 1999> (3) When the Minister of Planning and Budget allocates the budget to the head of each central government agency, he shall notify the Minister of Finance and Economy and the Board of Audit and Inspection thereof. <Amended by Act No. 5742, Feb. 5, 1999; Act No. 5982, May 24, 1999> (4) The Minister of Planning and Budget may, if necessary, allocate the budget before the fiscal year begins under the Presidential Decree. <Amended by Act No. 5742, Feb. 5, 1999; Act No. 5982, May 24, 1999> (5) With respect to a project the budget of which is appropriated in total amount, and which is prescribed in the Presidential Decree, the head of each central government agency shall establish an execution program of the project, and consult with the Minister of Planning and Budget thereon, before the budget is allocated. <Newly Inserted by Act No. 4659, Dec. 31, 1993; Act No. 5742, Feb. 5, 1999; Act No. 5982, May 24, 1999> Article 36 (Prohibition of Use of Budget for Unauthorized Purpose, and Transfer of Budget) (1) The head of each central government agency may neither use the expenditure budget for any purpose not specified in the budget, nor transfer it between agencies or chapters, sections or paragraphs as specified in the budget: Provided, That if it is approved in advance as a budget by the National Assembly under the necessity of executing the budget, it may be transferred and used with the approval of the Minister of Planning and Budget. <Amended by Act No. 5742, Feb. 5, 1999; Act No. 5982, May 24, 1999> (2) If any change in function and competence is caused by an enactment, revision or repeal of Acts and subordinate statutes relating to the organization, etc. of the Government, the Minister of Planning and Budget may, upon a request of the head of the central government agency concerned, divert and transfer the budget to each other. <Amended by Act No. 5742, Feb. 5, 1999; Act No. 5982, May 24, 1999> (3) When the Minister of Planning and Budget diverts or transfers the budget under the proviso of paragraphs (1) and (2), he shall notify the head of the central government agency concerned, the Minister of Finance and Economy and the Board of Audit and Inspection thereof. <Amended by Act No. 5742, Feb. 5, 1999; Act No. 5982, May 24, 1999> Article 36-2 (Payment of Incentive Allowance from Budget) (1) If revenues are increased or expenditures are retrenched due to the improvement of a budget execution method or system, the head of each central government agency may pay a person contributing thereto an incentive allowance from part of such increased or retrenched budget or appropriate it for any other project. (2) If the head of each central government agency intends to pay an incentive allowance from part of increased or retrenched budget or appropriate it to any other project under paragraph (1), he shall do so via the deliberation of the Budget Incentive Allowance Deliberation Committee. (3) Necessary matters concerning the payment of an incentive allowance, appropriation to any other project, and organization and operation of the Budget Incentive Allowance Deliberation Committee under paragraphs (1) and (2) shall be prescribed by the Presidential Decree. [This Article Newly Inserted by Act No. 5742, Feb. 5, 1999] Article 37 (Diversion of Budget) (1) The head of each central government agency may divert the amount of each subparagraph or item with the approval of the Minister of Planning and Budget under the Presidential Decree. <Amended by Act No. 5742, Feb. 5, 1999; Act No. 5982, May 24, 1999> (2) Notwithstanding the provisions of paragraph (1), the head of each central government agency may divert each fiscal year the amount of each subparagraph or clause within the limit as determined by the Minister of Planning and Budget. <Amended by Act No. 5742, Feb. 5, 1999; Act No. 5982, May 24, 1999> (3) When the Minister of Planning and Budget approves the diversion under paragraph (1), he shall deliver a statement as to such diversion to the head of the central government agency concerned, the Minister of Finance and Economy and the Board of Audit and Inspection, and when the head of each central government agency makes a diversion under paragraph (2), he shall deliver a statement specifying the amount of each diverted item and a reason thereof to the Minister of Finance and Economy, the Minister of Planning and Budget and the Board of Audit and Inspection. <Amended by Act No. 5742, Feb. 5, 1999; Act No. 5982, May 24, 1999> (4) The amount of budget diverted under paragraph (1) or (2) shall be specified on a written settlement report of revenue and expenditure accounts in which a reason thereof is stated. Article 38 (Carry-Over of Expenditure Budget) (1) The expenditure budget of each fiscal year shall not be carried over and used in the following year: Provided, That the following expenses in the expenditure budget may be carried over and used in the following fiscal year: <Amended by Act No. 4659, Dec. 31, 1993; Act No. 5742, Feb. 5, 1999> 1.Specified carry-over fund; 2.Expenses for which an act causing disbursement is performed in the year, but the act of disbursement is not performed in the year by any inevitable reason, and those incidental to them, for which no act causing disbursement is performed; 3.In a case where a long time is required until an act causing disbursement is performed after a public notice on a tender, expenses notified publicly for a tender to do the act responsible for disbursement and prescribed by the Presidential Decree; 4.Compensations for losses necessary for the execution of any project for public interests or other public services, which are prescribed by the Presidential Decree; and 5. Ordinary expenditures prescribed by the Presidential Decree. (2) Notwithstanding the provisions of paragraph (1), the amount of yearly installments of the continuing expenditure, which is not disbursed in the year concerned, may be carried over and used gradually by the year in which the project of the continuing expenditure is completed. (3) When the head of each central government agency carries over the budget under paragraphs (1) and (2), he shall prepare a carry-over statement under the Presidential Decree, and deliver it to the Minister of Finance and Economy, the Minister of Planning and Budget and the Board of Audit and Inspection not later than the 31st of January of the following year. <Amended by Act No. 5742, Feb. 5, 1999; Act No. 5982, May 24, 1999> (4) When the head of each central government agency carries over the budget under paragraphs (1) and (2), the amount carried over by item shall be considered to be allocated as a carry-over budget in the following year. (5) The Minister of Planning and Budget may, if deemed necessary in consideration of the revenue collection situation, etc., take a prior measure to restrict any carry-over and use of the expenditure budget under paragraphs (1) and (2) after consulting with the Minister of Finance and Economy. <Amended by Act No. 5742, Feb. 5, 1999; Act No. 5982, May 24, 1999> Article 39 (Control and Use of Reserve Fund) (1) The reserve fund shall be controlled by the Minister of Planning and Budget. <Amended by Act No. 5742, Feb. 5, 1999; Act No. 5982, May 24, 1999> (2) In a case where it is required to use the reserve fund, the head of each central government agency shall prepare a statement specifying the reason therefor, amount and base of estimate, and submit it to the Minister of Planning and Budget: Provided, That he may, if necessary for prompt relief from large-scale natural disasters, demand the reserve fund by making a rough estimate of amounts required for emergency disaster aid and relief on the basis of a report on situation of damage as prescribed in Article 52 of the Countermeasures against Natural Disasters Act. <Amended by Act No. 5742, Feb. 5, 1999; Act No. 5982, May 24, 1999> (3) The Minister of Planning and Budget shall, if deemed necessary after examining the request as referred to in paragraph (2), coordinate it, prepare a statement of use of the reserve fund, and obtain the approval of the President through a deliberation of the State Council. <Amended by Act No. 5742, Feb. 5, 1999; Act No. 5982, May 24, 1999> (4) The reserve fund of the general accounts may, if necessary, be transferred to the special accounts as revenue, and used as the expenditure of the special accounts. Article 40 (Preparation of Reserve Fund Use Statement and Submission to National Assembly) (1) The head of each central government agency shall prepare a statement of the amount used as the reserve fund and submit it to the Minister of Finance and Economy. <Amended by Act No. 5742, Feb. 5, 1999> (2) The Minister of Finance and Economy shall prepare an all-inclusive table of the amount used as the reserve fund on the basis of the statement as referred to in paragraph (1), and obtain the approval of the President through a deliberation of the State Council. <Amended by Act No. 5742, Feb. 5, 1999> (3) The Minister of Finance and Economy shall submit the all-inclusive table as referred to in paragraph (2) to the Board of Audit and Inspection. <Amended by Act No. 5742, Feb. 5, 1999> (4) The Government shall submit the all-inclusive table of the amount used as the reserve fund to the National Assembly to be approved one hundred twenty days before the following fiscal year after the next one begins. Article 41 (Revenue Substitute Expenses) (1) Notwithstanding the provisions of Articles 14 (4) and 52, the head of each central government agency may directly disburse expenses which are related to revenue accruing from the provision of services and facilities and which are prescribed by the Presidential Decree (hereinafter referred to as "revenue substitute expenses") to the extent that such revenue is secured: Provided, That if the revenue exceeds or is expected to exceed the budget, the excess revenue may be disbursed in excess, to expenses directly related to such excess revenue and expenses accompanied thereby under the Presidential Decree. <Amended by Act No. 5742, Feb. 5, 1999> (2) The head of each central government agency may appoint a public official in charge of the revenue substitute expenses for the purpose of separate accounting of such revenue substitute expenses as referred to in paragraph (1). CHAPTER III SETTLEMENT OF ACCOUNTS Article 42 (Preparation and Submission of Settlement of Accounts, etc.) The head of each central government agency shall prepare each fiscal year a settlement of revenue and expenditure accounts, a settlement of continuing expenditure accounts and a statement of accounts as to the obligation of the State, which are under his jurisdiction, under the conditions as prescribed by the Presidential Decree, and submit them to the Minister of Finance and Economy by the end of February the following year. <Amended by Act No. 5742, Feb. 5, 1999> Article 43 (Preparation of Closing Accounts of Revenue and Expenditure) (1) The Minister of Finance and Economy shall prepare a closing account of revenues and expenditures on the basis of the settlement of revenue and expenditure accounts, and obtain the approval of the President through a deliberation of the State Council. <Amended by Act No. 5742, Feb. 5, 1999> (2) The closing account of revenues and expenditures shall be prepared by the same division as the revenue and expenditure budgets, and the following matters shall be specified therein: <Amended by Act No. 4659, Dec. 31, 1993> 1.Revenues: (a) Amount of the revenue budget; (b) Amount increased or decreased due to transfer, etc.; (c) Amount of the current balance of the revenue budget; (d) Amount decided to be collected; (f) Amount of the revenue received; (g) Amount of unpaid deficits; and (h) Amount of the revenue not collected. 2.Expenditures: (a) Amount of the expenditure budget; (b) Amount carried over from the preceding year; (c) Amount of the reserve fund used; (d) Amount increased or decreased due to diversion, etc.; (e) Amount disbursed in excess under the proviso of Article 41 (1); (f) Amount of the current balance of expenditure budget; (g) Amount of expenditure disbursed; (h) Amount carried over to the following year; and (i) Amount unused. Article 44 (Submission and Delivery of Closed Revenue and Expenditure Accounts) (1) The Minister of Finance and Economy shall submit the closed revenue and expenditure accounts to the Minister of Planning and Budget and the Board of Audit and Inspection with statements as to settlement of revenue and expenditure accounts, settlement of continuing expenditure accounts and statement of accounts as to any obligation of the State not later than the 10th of June of the following year. <Amended by Act No. 5742, Feb. 5, 1999; Act No. 5982, May 24, 1999> (2) The Board of Audit and Inspection shall examine the settlement of revenue and expenditure accounts as referred to in paragraph (1), and deliver its report to the Minister of Finance and Economy not later than the 20th of August of the following year. <Amended by Act No. 5742, Feb. 5, 1999> Article 45 (Submission of Closed Revenue and Expenditure Accounts to National Assembly) The Government shall submit a closed revenue and expenditure account as examined by the Board of Audit and Inspection to the National Assembly every fiscal year one hundred twenty days before the following fiscal year after the next one begins. Article 46 (Documents Appended to Closed Revenue and Expenditure Accounts) The closed revenue and expenditure accounts transmitted to the National Assembly by the Government shall be accompanied by the statements as to settlement of revenue and expenditure accounts, settlement of continuing expenditure accounts, and statement of accounts as to obligation of the State. Article 47 (Disposal of Annual Settlement Surplus) (1) Any surplus resulted from a settlement of revenue and expenditure accounts in each fiscal year (hereinafter referred to as the "annual settlement surplus") shall be counted in the revenue of the following year as the resource for the amount of expenditure budget carried over under Article 38. (2) Of annual settlement surpluses, those prescribed by other Acts and a balance after deducting the amount carried over under paragraph (1) may be used for the following purposes with the approval of the President through a deliberation of the State Council, regardless of the expenditure budget in the current fiscal year until the year following the year in which the annual settlement surplus accrues: 1.Redemption of the principal and interest of the state bonds or borrowing funds; and 2.Payment of national indemnities fixed under the State Compensation Act. (3) The balance obtained by deducting the amount as referred to in paragraphs (1) and (2) from the annual settlement surplus shall be counted in the revenue of the following year. Article 47-2 (Exception to Disposal of Annual Settlement Surplus in General Accounts) (1) Notwithstanding the provisions of Article 47 (3), the annual settlement surplus in general accounts may be used for the following with the approval of the President through a deliberation of the State Council up to the year following the year in which such annual settlement surplus is produced, regardless of the estimated expenditures of the general accounts: <Amended by Act No. 4659, Dec. 31, 1993; Act No. 5170, Dec. 12, 1996; Act No. 5662, Jan. 21, 1999; Act No. 6075, Dec. 31, 1999> 1.Redemption of debts under the Grain Bonds Act; 2.Redemption of the principal and interest of loans (including the amount received in advance) under the Act on the Special Accounts on Treasury Loans; or 3.Redemption of the principal and interest of state bonds issued under the main sentence of Article 3 (1) of the State Bonds Act. (2) If it is required to repay the principal and interest with the annual settlement surplus under paragraph (1), the Minister of Finance and Economy shall consult with the Minister of Planning and Budget regarding the scale, etc. of the repayment of principal and interest. <Amended by Act No. 5742, Feb. 5, 1999; Act No. 5982, May 24, 1999> [This Article Newly Inserted by Act No. 4445, Dec. 27, 1991] CHAPTER IV REVENUES Article 48 (Principle of Collection and Receipt of Revenue) Taxes and other revenues shall be collected and received under the conditions as prescribed by Acts and subordinate statutes. Article 49 (General Control over Revenue) The Minister of Finance and Economy shall control general affairs concerning the collection and receipt of revenues, and the head of each central government agency shall take charge of affairs concerning the collection and receipt of revenues under his jurisdiction. <Amended by Act No. 5742, Feb. 5, 1999> Article 50 (Delegation, etc. of Revenue Collection Affairs) (1) The head of each central government agency may delegate affairs concerning the collection of revenue under his jurisdiction to a public official under his control under the conditions as prescribed by the Presidential Decree. (2) No person other than a public official to whom affairs concerning the collection of the revenue are delegated under paragraph (1) (hereinafter referred to as the "revenue collector") may collect taxes and other revenues. (3) The head of each central government agency may substitute the delegation of affairs concerning collection of the revenue under paragraph (1) by designating an official position established in the agency. Article 51 (Method of Collection of Revenue) When a revenue collector intends to collect taxes and other revenues, he shall conduct an investigation, make a decision and give notice of payment to a person liable for tax payment and other obligors. Article 52 (Receiving Organs) (1) Taxes and other revenues shall be received only by accounting officials: Provided, That this shall not apply in case of entrusting the Bank of Korea or postal agencies with receiving affairs. (2) When an accounting official receives taxes and other revenues, he shall pay the amount received to the Bank of Korea or postal agencies without delay. (3) Postal agencies shall, upon receiving taxes and other revenues under paragraph (2), pay them to the Bank of Korea without delay. Article 53 (Separation of Collection and Receiving Organs) No revenue collector shall concurrently perform functions related to the disbursement and receipt of cash: Provided, That if there is any special reason, any exception may be prescribed by the Presidential Decree. Article 54 (Refund of Revenue and Expenditure in Preceding Fiscal Year) Revenues pertaining to a fiscal year for which disbursements and receipts have been concluded, and other extrabudgetary revenues shall be incorporated into the revenue for the current fiscal year: Provided, That the amount disbursed as annual expenditure may be refunded to the corresponding items of disbursed expenditure under the conditions as prescribed by the Presidential Decree. Article 55 (Refund of Erroneously Received Revenue) If any revenue is received erroneously, such revenue may be refunded to the revenue of the current fiscal year under the conditions as prescribed by the Presidential Decree, regardless of the expenditure budget. CHAPTER V SECTION 1 EXPENDITURES General Provisions Article 56 (General Control of Expenditure) The Minister of Finance and Economy shall control general affairs concerning the expenditure, and the head of each central government agency shall take charge of affairs concerning acts causing expenditure and expenditures under his jurisdiction. <Amended by Act No. 5742, Feb. 5, 1999> Article 57 (Notification of Limits on Expenditure) (1) When the budget is approved, the head of each central government agency shall submit a monthly revenue collection plan and a monthly expenditure disbursement plan to the Minister of Finance and Economy on the basis of a written request for allocation of budget under Article 35 (1). <Amended by Act No. 5742, Feb. 5, 1999> (2) The Minister of Finance and Economy shall prepare a monthly financing plan on the basis of a plan as referred to in paragraph (1) and submit it to the Minister of Planning and Budget. <Amended by Act No. 5742, Feb. 5, 1999; Act No. 5982, May 24, 1999> (3) The Minister of Finance and Economy shall notify the head of each central government agency and the Bank of Korea of the limits on annual expenditure budget on the basis of a monthly financing plan approved by the President under Article 35 (2). <Amended by Act No. 5742, Feb. 5, 1999> (4) The head of each central government agency shall, upon receiving a notification of the limit on expenditure under paragraph (3), instruct the limit on expenditure to each disbursing official under his control, and notify the Minister of Finance and Economy and the Bank of Korea thereof. <Amended by Act No. 5742, Feb. 5, 1999> SECTION 2 Acts Causing Expenditure Article 58 (Rules for Acts Causing Expenditures) Any act causing expenditure shall be done by the head of each central government agency within the limit of the budgetary amount allocated under Acts and subordinate statutes or Article 35 of this Act. Article 59 (Entrustment with Act Causing Expenditure) (1) The head of each central government agency may entrust any public official under his control with an act causing expenditure under the conditions as prescribed by the Presidential Decree. (2) The provisions of Article 50 (3) shall be applicable mutatis mutandis to any case as referred to in paragraph (1). Article 60 (Act Causing Expenditure of Specified Carry-Over Funds through Following Year) (1) If there is any inevitable reason in the execution of budget with respect to the specified carry-over funds, the head of each central government agency may do an act causing expenditure to disburse through the following year within the limit of the amount as approved by the Minister of Planning and Budget with the reason and amount thereof specified. <Amended by Act No. 5742, Feb. 5, 1999; Act No. 5982, May 24, 1999> (2) When the Minister of Planning and Budget approves an act causing expenditure to disburse through the following year under paragraph (1), he shall notify the Minister of Finance and Economy. <Amended by Act No. 5742, Feb. 5, 1999; Act No. 5982, May 24, 1999> SECTION 3 Disbursement Article 61 (Procedure for Disbursement) (1) When the head of each central government agency or any public official entrusted under Article 59 (hereinafter referred to as the "financial officer") intends to make a disbursement on the basis of the expenditure budget under his jurisdiction, he shall deliver documents related to the acts causing expenditure to a public official appointed by the head of the central government agency to which he belongs (hereinafter referred to as the "disbursing officer") under the conditions as prescribed by the Presidential Decree. (2) The appointment of a disbursing officer under paragraph (1) may be substituted with a designation of an official position established in the agency by the head of each central government agency. (3) Matters necessary for disbursement of national funds other than the annual expenditure shall be prescribed by the Presidential Decree. Article 62 (Joint Disbursement) (1) The head of each central government agency may have joint disbursement officers pursuant to the Presidential Decree in order to jointly disburse national funds of two or more agencies under his control (hereinafter referred to as the "joint disbursement"). (2) The head of each central government agency shall appoint joint disbursement officers from among public officials under his control. In this case, the provisions of Article 61 (2) shall apply mutatis mutandis to the appointment of a joint disbursement officer. (3) In order to assist joint disbursement officers, the head of each central government agency may establish disbursement confirmation officers in an agency under his control. (4) Notwithstanding the provisions of Article 57 (4), the head of each central government agency may have joint disbursement officers deliver funds necessary for the management of an agency under his control to disbursement confirmation officers. (5) If a joint disbursement officer or a disbursement confirmation officer intends to make any disbursement on the basis of an act causing expenditure, he may make any transfer payment in an deposit account of an obligee pursuant to the Presidential Decree, notwithstanding the provisions of Article 63. (6) A joint disbursement officer and a disbursement confirmation officer shall perform duties of a disbursing officer under this Act in connection with the joint disbursement. In this case, a "disbursing officer" as referred to in Articles 61 (1) and (2), 65 (1) and (2), 68, 69 and 106, a "disbursing officer" as referred to in Article 66 (1), a "disbursing officer" as referred to in Article 108, and a "disbursing officer" as referred to in Articles 113 (2) and 114 (1) shall be deemed to be a "joint disbursement officer and disbursement confirmation officer", a "joint disbursement officer", a "joint disbursement officer or disbursement confirmation officer", and a "disbursement confirmation officer" respectively. (7) Necessary matters concerning duties of a joint disbursement officer and a disbursement confirmation officer and procedures for joint disbursement, shall be prescribed by the Presidential Decree. [This Article Wholly Amended by Act No. 5742, Feb. 5, 1999] Article 63 (Issuance of Check) If a disbursing officer intends to make a disbursement on the basis of an act causing expenditure, he shall, in lieu of payment in cash, issue a check the payer of which is the Bank of Korea: Provided, That in case of transfer of national funds between government accounts, an order for transfer payment of national funds may be substituted for the said check. [This Article Wholly Amended by Act No. 5742, Feb. 5, 1999] Article 64 (Restriction on Issuance of Check) No disbursing officer shall issue a check without designating the creditor as payee: Provided, That this shall not apply in a case where he delivers funds to an accounting official, the Bank of Korea or a postal agency. Article 65 (Payment of Ordinary Expenses of Agency) (1) In a case where the fulfillment of duties might be impeded, if the ordinary expenses of an agency and other expenses as prescribed by the Presidential Decree are not paid in cash, the head of each central government agency or a public official entrusted by him may have an accounting official receive the necessary funds from a disbursing officer and make a disbursement. (2) The head of each central government agency or a public official entrusted by him may have an accounting official receive necessary funds from a disbursing officer and make a disbursement before the fiscal year begins only for such expenses as referred to in paragraph (1). (3) With respect to funds to be delivered before the fiscal year begins under paragraph (2), the Minister of Finance and Economy may temporarily borrow such funds within the limit of the maximum amount of the temporary borrowing funds in the fiscal year. <Amended by Act No. 5742, Feb. 5, 1999> Article 66 (Delivery of Funds to Bank of Korea, etc.) (1) The head of each central government agency may have a disbursing officer deliver necessary funds to the Bank of Korea or a postal agency under the conditions as prescribed by the Presidential Decree. (2) In a case as referred to in paragraph (1), the head of each central government agency shall consult with the Minister of Finance and Economy. <Amended by Act No. 5742, Feb. 5, 1999> Article 67 Deleted. <by Act No. 5742, Feb. 5, 1999> Article 68 (Advance and Estimate Payments) The disbursing officer may pay in advance or by estimate any fare, charterage, travel expense, cost of construction work, manufacturing or service contract, or other expenses as prescribed by the Presidential Decree and that, if not doing so, might cause by nature any impediment in affairs or business. <Amended by Act No. 4659, Dec. 31, 1993> Article 69 (Contract Expenses) A disbursing officer may pay as contract expenses all or part of the necessary expenses for postal agencies, diplomatic establishments abroad and other agencies requiring special accounting under the conditions as prescribed by the Presidential Decree. Article 70 (Separation of Disbursing and Accounting Organs) Duties of a financial officer, a disbursing officer (including a joint disbursement officer) and a cashier shall not be performed concurrently: Provided, That a disbursement confirmation officer as prescribed in Article 62 (3) may perform duties of a cashier concurrently pursuant to the Presidential Decree. <Amended by Act No. 5742, Feb. 5, 1999> Article 71 (Disbursement for Past Fiscal Year) The fixed amount of liability which was incurred in the past fiscal year and not disbursed, shall be disbursed from the expenditure budget in the current year, and it shall not exceed the unused amount of the amount of each item of the year to which the expenses belong: Provided, That this shall not apply in a case where the expenses belong by nature to supplementary purposes as prescribed by the Presidential Decree. SECTION 4 Payment Article 72 (Payment Period of Check) (1) When a person presents a check issued by a disbursing officer, the Bank of Korea shall pay it unless one year has passed after the check is issued. (2) Deleted. <by Act No. 5742, Feb. 5, 1999> CHAPTER VI Deleted. Articles 73 through 95 Deleted. <by Act No. 4868, Jan. 5, 1995> CHAPTER VII STATUTE OF LIMITATION Article 96 (Extinctive Prescription of Pecuniary Obligation) (1) Any right of the State, the object of which is a pecuniary benefit, and the statute of limitation of which is not provided for in other Acts, shall be extinguished by the statute of limitation unless it is exercised within five years. (2) The provisions of paragraph (1) shall also apply to a right to the State the object of which is a pecuniary benefit. Article 97 (Interruption and Suspension of Statute of Limitation) With respect to a right of the State the object of which is a pecuniary benefit, if there is no provisions of other Acts applicable to an interruption or suspension of the statute of limitation and other matters, the provisions of the Civil Act shall be applicable mutatis mutandis. This provisions shall also apply to a right to the State, the object of which is a pecuniary benefit. Article 98 (Effect of Statute of Limitation) Any notice of payment issued by the State pursuant to the provisions of Acts and subordinate statutes shall have an effect of interrupting the statute of limitation. CHAPTER VIII NATIONAL FUNDS AND SECURITIES Article 99 (Restriction on Holding of Cash and Securities) The head of each central government agency may not have the custody of any public or private-owned cash or securities unless it is provided for by Acts and subordinate statutes. Article 100 (Receipt and Disbursement of National Funds by Bank of Korea) (1) The Bank of Korea shall take charge of affairs concerning receipt and disbursement of the national funds under the conditions as prescribed by the Presidential Decree. (2) The national funds received by the Bank of Korea under paragraph (1) shall be deposits of the State under the conditions as prescribed by the Presidential Decree. Article 101 (Management of Securities by Bank of Korea or Financial Institutions) The State may order the Bank of Korea or financial institutions as prescribed by the Presidential Decree (hereinafter referred to as "financial institutions") to manage securities owned by or in custody of the State. Article 102 (Inspection to Bank of Korea) The Bank of Korea shall be subject to any inspection of the Board of Audit and Inspection with respect to receipt and disbursement of the national funds managed by it, receipts of revenue derived from issuing national bonds, balance of funds as delivered under Article 66 or 67, or receipts and payments of securities which it has managed under Article 101. Article 103 (Liability for Indemnification of Bank of Korea) If the Bank of Korea has caused any damage to the State in connection with receipts, disbursements and safekeeping of cash or securities managed by it on behalf of the State, the Civil Act and the Commercial Act shall be applicable to the liability for indemnification of the Bank of Korea. CHAPTER IX ACCOUNTING OFFICIALS Article 104 (Function of Accounting Official) Accounting officials shall disburse, receive and have the custody of cash under the conditions as prescribed by Acts and subordinate statutes. Article 105 (Appointment of Accounting Officials) (1) Accounting officials shall be appointed by the head of each central government agency or a public official entrusted by him. (2) The appointment of accounting officials under paragraph (1) may be substituted by a designation of an official position established in the agency to which the head of each central government agency or a public official entrusted by him belongs. CHAPTER X RECORD AND REPORT Article 106 (Keeping of Books) The Minister of Finance and Economy, the Minister of Planning and Budget, the head of each central government agency, revenue collectors, financial officers, disbursing officers, accounting officials and the Bank of Korea shall keep books and record necessary matters therein under the conditions as prescribed by the Presidential Decree: Provided, That they may, if necessary, be recorded and kept in any manner other than documents with the approval of the Minister of Finance and Economy and the Board of Audit and Inspection. <Amended by Act No. 5742, Feb. 5, 1999; Act No. 5982, May 24, 1999> Article 107 (Financial and Operational Reports) (1) The head of each central government agency shall submit the following financial reports to the Minister of Finance and Economy under the conditions as prescribed by the Presidential Decree: <Amended by Act No. 4659, Dec. 31, 1993; Act No. 5742, Feb. 5, 1999> 1.Report on acts by which disbursements are caused; 2.Report on revenues and expenditures; and 3.Report on other accounts. (2) The Minister of Finance and Economy shall put each quarter reports as referred to in paragraph (1) together, and submit it to the Minister of Planning and Budget. <Amended by Act No. 5742, Feb. 5, 1999; Act No. 5982, May 24, 1999> (3) The head of each central government agency shall submit each quarter reports on the execution of projects and on the budget to the Minister of Planning and Budget under the conditions as prescribed by the Presidential Decree. <Amended by Act No. 5742, Feb. 5, 1999; Act No. 5982, May 24, 1999> (4) The Minister of Planning and Budget may analyze the contents of the reports as referred to in paragraph (3), and if necessary, take proper measures. <Amended by Act No. 5742, Feb. 5, 1999; Act No. 5982, May 24, 1999> Article 108 (Submission of Reports and Account Statements) (1) Revenue collectors, financial officers, disbursing officers, accounting officials, the Bank of Korea and postal agencies shall prepare reports and account statements under the conditions as prescribed by the Presidential Decree, and submit them to the head of each central government agency, the Minister of Finance and Economy and the Board of Audit and Inspection. <Amended by Act No. 5742, Feb. 5, 1999> (2) Accounting officials, the Bank of Korea and postal agencies shall report on such revenues and expenditures as they have received or disbursed, to revenue collectors or disbursing officers under the conditions as prescribed by the Presidential Decree. Article 109 (Report on Financial Status) The Government shall, immediately after the budget is approved, inform the public of the budget, settlement of accounts for the preceding year, the present balance of State bonds, borrowings and State property, and other general matters related to finance by means of printed matter or in an other adequate manner. CHAPTER XI SUPPLEMENTARY PROVISIONS Article 110 (Act bearing Liability for Guarantee) (1) If the State intends to bear a liability for guarantee, it shall obtain the prior consent of the National Assembly. (2) Necessary matters for the management of the liability for guarantee as referred to in paragraph (1) shall be prescribed by the Presidential Decree. Article 111 (Consultation on Acts and Subordinate Statutes Relating to Budget and Accounting) When the head of each central government agency drafts Acts and subordinate statutes relating to the budget and accounting, he shall consult with the Minister of Planning and Budget in case of Acts and subordinate statutes relating to the budget, and with the Minister of Finance and Economy in case of those relating to accounting. <Amended by Act No. 5742, Feb. 5, 1999; Act No. 5982, May 24, 1999> Article 112 (Consultation on Other Acts and Subordinate Statutes) The provisions of Article 111 shall also be applicable mutatis mutandis if the head of each central government agency intends to provide for the contents of the budget and accounting in Acts and subordinate statutes other than those relating to the budget and accounting. Article 113 (Representation and Share of Responsibility of Public Officials in Charge of Accounting) (1) The head of each central government agency may, if deemed necessary, have a public official under his control carry out on his behalf the whole of, or share the responsibility for part of, the affairs of revenue collectors and financial officers. <Amended by Act No. 4868, Jan. 5, 1995> (2) The head of each central government agency or a public official entrusted by him may, if deemed necessary, appoint a public official to carry out on his behalf the whole of, or to share the responsibility for part of, the affairs of disbursing officers or accounting officials. (3) The provisions of Article 50 (3), 59 (2), 61 (2), or 105 (2) shall be applicable mutatis mutandis in cases as referred to in paragraphs (1) and (2). <Amended by Act No. 4868, Jan. 5, 1995> Article 114 (Special Cases of Appointment of Public Official in Charge of Accounting) (1) The head of each central government agency may, if deemed necessary, entrust any public official under the control of another central government agency with the affairs of a revenue collector, financial officer or appoint such public official as a disbursing officer or accounting official under the conditions as prescribed by the Presidential Decree. <Amended by Act No. 4868, Jan. 5, 1995> (2) The provisions of Article 50 (3), 59 (2), 61 (2), or 105 (2) shall be applicable mutatis mutandis in the case as referred to in paragraph (1). <Amended by Act No. 4868, Jan. 5, 1995> Article 115 (Holding of Funds) The State may hold any special fund only in a case where it is prescribed by Acts. Article 116 (Exceptional Provisions for Special Accounts) If it is required for each special account, the provisions different from those of this Act may be prescribed by an Act. Article 117 (Supervision over Execution of Budget) In order to ensure proper management of the budget and accounting, the Minister of Planning and Budget and the Minister of Finance and Economy may have their subordinate public officials conduct on-the-spot investigations, and if necessary, give the head of each central government agency instructions as to the budget and accounting with the approval of the President through a deliberation of the State Council. <Amended by Act No. 5742, Feb. 5, 1999; Act No. 5982, May 24, 1999> Article 118 (Internal Control) In order to analyze and evaluate the effectiveness of financial management, the propriety of use of revenue source and the reliability of data reported in the course of execution, the head of each central government agency shall have a public official under his control carry out an internal control as to necessary matters. Article 119 (Entrustment of Accounting Affairs to Local Government, etc.) (1) The State may have public officials of local governments or officers and personnel of government-invested institutions or financial institutions take charge of affairs concerning the annual revenues and expenditures, and cash other than the annual revenues and expenditures, under the conditions as prescribed by the Presidential Decree. (2) With respect to public officials of local governments and officers and personnel of government-invested institutions or financial institutions, who take charge of affairs concerning the annual revenues and expenditures, and cash other than such annual revenues and expenditures under paragraph (1), the provisions of this Act or other Acts and subordinate statutes relating to the accounting, concerning the management of such affairs shall be applicable mutatis mutandis. Article 120 (Entrustment of Affairs as to Contract and Disbursement) (1) The head of each central government agency may entrust another agency with affairs concerning disbursements under his jurisdiction under the conditions as prescribed by the Presidential Decree. <Amended by Act No. 4868, Jan. 5, 1995> (2) Any public official taking charge of the accounting who is to execute affairs entrusted under paragraph (1) shall be appointed by the Minister of Finance and Economy under the conditions as prescribed by the Presidential Decree. <Amended by Act No. 5742, Feb. 5, 1999> Article 121 (Disbursement of National Funds Other than Annual Expenditures) The provisions of Article 63 shall also be applicable mutatis mutandis in a case where an accounting official disburses the national funds other than those based on the annual expenditures. Article 122 (Responsibility of Public Officials taking Charge of Accounting) The responsibility of public officials taking charge of accounting shall be prescribed separately by an Act. Article 123 (Financial Guarantee of Public Officials taking Charge of Accounting) No revenue collector, financial officer, disbursing officer (including a joint disbursement officer and a disbursement confirmation officer) and accounting official may take charge of their duties without providing any financial guarantee under the conditions as prescribed by the Presidential Decree. <Amended by Act No. 4868, Jan. 5, 1995; Act No. 5742, Feb. 5, 1999> Article 124 (Education for Public Officials taking Charge of Accounting) The Government may conduct any education for improving the quality of public officials taking charge of accounting under the conditions as prescribed by the Presidential Decree. ADDENDA (1) (Enforcement Date) This Act shall enter into force on the date of its promulgation: Provided, That the provisions of Articles 7 (7), 40 (4), 42, 44, 45, 76 and 81 (3) shall enter into force on January 1, 1990. (2) (Relation with Other Acts and Subordinate Statutes) Any citation of previous provisions in other Acts and subordinate statutes at the time this Act enters into force shall be considered to cite the corresponding provisions of this Act. ADDENDA <Act No. 4408, Nov. 30, 1991> Article 1 (Enforcement Date) This Act shall enter into force on the date of its promulgation. Articles 2 and 3 Omitted. ADDENDA <Act No. 4445, Dec. 27, 1991> (1) (Enforcement Date) This Act shall enter into force on the date of its promulgation. (2) Deleted. <by Act No. 4659, Dec. 31, 1993> ADDENDA <Act No. 4461, Dec. 31, 1991> Article 1 (Enforcement Date) This Act shall enter into force on January 1, 1992. (Proviso Omitted.) Articles 2 and 3 Omitted. ADDENDUM <Act No. 4659, Dec. 31, 1993> This Act shall enter into force on January 1, 1994. ADDENDA <Act No. 4868, Jan. 5, 1995> Article 1 (Enforcement Date) This Act shall enter into force six months after the date of its promulgation. (Proviso Omitted.) Articles 2 through 4 Omitted. ADDENDA <Act No. 5170, Dec. 12, 1996> Article 1 (Enforcement Date) This Act shall enter into force on January 1, 1997. Articles 2 through 6 Omitted. ADDENDA <Act No. 5662, Jan. 21, 1999> Article 1 (Enforcement Date) This Act shall enter into force on January 1, 2000. Articles 2 through 4 Omitted. ADDENDUM <Act No. 5742, Feb. 5, 1999> This Act shall enter into force on the date of its promulgation. ADDENDA <Act No. 5982, May 24, 1999> Article 1 (Enforcement Date) This Act shall enter into force on the date of its promulgation. (Proviso Omitted.) Articles 2 through 6 Omitted. ADDENDA <Act No. 6075, Dec. 31, 1999> Article 1 (Enforcement Date) This Act shall enter into force on April 1, 2000. Articles 2 through 4 Omitted.