Ginger Beer Problem - Fisher College of Business

advertisement

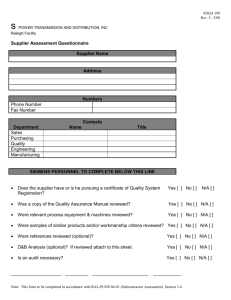

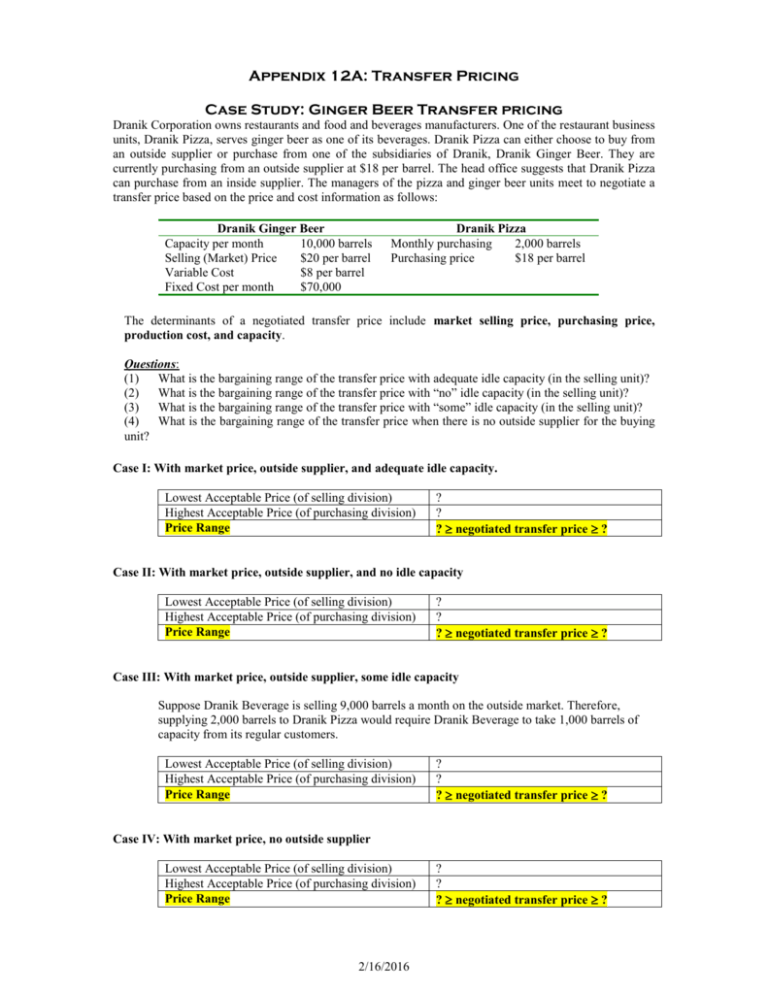

Appendix 12A: Transfer Pricing Case Study: Ginger Beer Transfer pricing Dranik Corporation owns restaurants and food and beverages manufacturers. One of the restaurant business units, Dranik Pizza, serves ginger beer as one of its beverages. Dranik Pizza can either choose to buy from an outside supplier or purchase from one of the subsidiaries of Dranik, Dranik Ginger Beer. They are currently purchasing from an outside supplier at $18 per barrel. The head office suggests that Dranik Pizza can purchase from an inside supplier. The managers of the pizza and ginger beer units meet to negotiate a transfer price based on the price and cost information as follows: Dranik Ginger Beer Capacity per month 10,000 barrels Selling (Market) Price $20 per barrel Variable Cost $8 per barrel Fixed Cost per month $70,000 Dranik Pizza Monthly purchasing 2,000 barrels Purchasing price $18 per barrel The determinants of a negotiated transfer price include market selling price, purchasing price, production cost, and capacity. Questions: (1) What is the bargaining range of the transfer price with adequate idle capacity (in the selling unit)? (2) What is the bargaining range of the transfer price with “no” idle capacity (in the selling unit)? (3) What is the bargaining range of the transfer price with “some” idle capacity (in the selling unit)? (4) What is the bargaining range of the transfer price when there is no outside supplier for the buying unit? Case I: With market price, outside supplier, and adequate idle capacity. Lowest Acceptable Price (of selling division) Highest Acceptable Price (of purchasing division) Price Range ? ? ? negotiated transfer price ? Case II: With market price, outside supplier, and no idle capacity Lowest Acceptable Price (of selling division) Highest Acceptable Price (of purchasing division) Price Range ? ? ? negotiated transfer price ? Case III: With market price, outside supplier, some idle capacity Suppose Dranik Beverage is selling 9,000 barrels a month on the outside market. Therefore, supplying 2,000 barrels to Dranik Pizza would require Dranik Beverage to take 1,000 barrels of capacity from its regular customers. Lowest Acceptable Price (of selling division) Highest Acceptable Price (of purchasing division) Price Range ? ? ? negotiated transfer price ? Case IV: With market price, no outside supplier Lowest Acceptable Price (of selling division) Highest Acceptable Price (of purchasing division) Price Range 2/16/2016 ? ? ? negotiated transfer price ? Case I: With market price, outside supplier, and idle capacity. Lowest Acceptable Price (of selling division) Highest Acceptable Price (of purchasing division) Price Range $8 $18 $18 negotiated transfer price $8 Case II: With market price, outside supplier, and no idle capacity Lowest Acceptable Price (of selling division) Highest Acceptable Price (of purchasing division) Price Range $8 + ($20-$8)*2,000/2,000 = $20 $18 No feasible range exists Case III: With market price, outside supplier, some idle capacity Suppose Dranik Beverage is selling 9,000 barrels a month on the outside market. Therefore, supplying 2,000 barrels to Dranik Pizza would require Dranik Beverage to take 1,000 barrels of capacity from its regular customers sales. Lowest Acceptable Price (of selling division) Highest Acceptable Price (of purchasing division) Price Range $8 + ($20-$8)*1000/2000 = $14 $18 $18 negotiated transfer price $14 Case IV: With market price, no outside supplier The highest price that the buying division would be willing to pay depends on contribution margin of the buying division. Lowest Acceptable Price (of selling division) Highest Acceptable Price (of purchasing division) Price Range 2/16/2016 $8 or $20 or $14 [depends on external demand situation] p – v except for the transfer price (see above) negotiated transfer price (see above)