the influence of manager´s values on salience stakeholder

advertisement

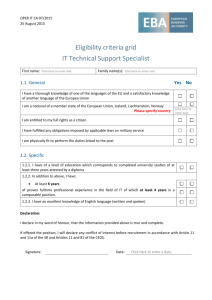

CORPORATE GOVERNANCE: SHAREHOLDER VERSUS STAKEHOLDER. A PERSPECTIVE FROM CEOs’ PERSONAL VALUES Frende Vega, María Ángeles. mangele.frende@uca.es Facultad de Ciencias Sociales y de la Comunicación Universidad de Cádiz Avda. de l a Universidad, s/n 11405 Jerez de la Frontera (Spain) Phone: 34 956 030 7086 Fax: 34 956 01 5402 Abstract The debate of corporate governance has polarised between two opposite perspectives: shareholder versus stakeholders. The shareholder perspective assumes that the firm’s only purpose is to maximise company benefits and, thus, the stakeholder concept is a means to fulfil shareholder objectives (Eden and Ackerman, 1999; Freeman, 1984; Harrison and Caron, 1994). By contrary, the ethical perspective considers that all stakeholders are ends by themselves and pursuing the interests of all them is the true purpose of the organisation (Donaldson and Preston, 1995; Evan and Freeman, 1988). Most of the works until now have focused on justifying whether the shareholder or stakeholders perspective should be entrenched in a given firm’s behaviour (Donaldson and Preston, 1995; Evan and Freeman, 1988; Freeman, 1994; Freeman y Evan, 1990; Jones, 1995; Maitland, 1994). Although theses contributions are significant, few efforts have been made to provide a comprehensive basis for an understanding of why firms differ so widely how they are being managed. The idea that CEOs are at the core of corporate governance has been suggested by various academics. “Managers´ responsibility is to reconcile divergent interests by making strategic decisions and allocating strategic resources in a manner that is most consistent with claims of the other stakeholder groups” (Hill and Jones, 1992: 134), and they are “who determine which stakeholders are salient and therefore will receive 1 management attention” (Mitchell et al., 1997: 296). Consequently, if managers are central in firm-stakeholders relationship, an understanding of their own characteristics could explains the differences existing in the firm’s behaviour in relation to the degree of importance that each stakeholder is getting. In this vein, Winn and Brenner (2001) propose integrating top CEOs´ personal values into the firm-stakeholder relationships as a way to achieve more explanatory power. The study of the influence of top CEOs´ values upon their decision making and behaviour is well documented. This positive relationship was initially proposed by Hambrick and Mason (1984) and Hambrick and Brandon (1984). This relationship was supported empirically before by Guth and Taiguri (1965: 123): “…, based on direct observation and systematic studies on the behaviour of the executives in a firm, that personal values are a determining factor in the decisions of the corporate strategy”. Given the results of the empirical investigation by Sharfman (1997) it is known the role that CEO values play in the issue evaluation process. Other studies have found a positive statistical relationship in manager values-ethical dimension of making decisions linkages (Akaah and Lund, 1994; Bailey and Burnett, 1997; Barnett and Karson, 1989; Fritzsche, 1991; Singhapakdi and Vitell, 1993). Although in the stakeholder context Agle et al. (1999) have integrated CEO values into firm-stakeholder relationships, much more work is needed to understanding the role of managers values in firm-stakeholder relationships (Winn and Brenner, 2001). With the purpose of covering the existent gap in the literature, the objective of this paper is to explore the relationship between CEOs’ personal values and corporate governance. However, an important aspect to consider in the study of values is the fact that they are of little significance if they are studied in isolation (England, 1975; Hambrick and Brandon, 1988; Rokeach, 1973). This issue leads us to introduce the concept of the “system of values”. A system of values is a complete network of values in which each value is prioritized and weighed in relative terms by the individual (Hambrick and Brandon, 1988; Rokeach, 1973). Following to Agle et al. (1999) and Brunson (1985) we distinguish between self-interest and other regarding values. Therefore, we test two hypotheses: 2 H1: CEOs with self-interest values will govern their firms with an orientation toward shareholder. H2: CEOs with other-regarding values will govern their firms with an orientation toward stakeholders. However, the CEOs’ personal values not always are manifested into firm’s decisions. Such link depends on how much discretion theses executives possess (Hambrick and Brandon, 1988). Following to Hambrick and Finkelstein (1987) one of the determinants of CEOs’ discretion is the composition and structure of the board. Based on that, I hypothesize that: H3: The link between CEOs’ personal values (self-interest versus other-regarding values) and corporate governance (shareholder versus stakeholders) depends on the composite and structure of the board. Specifically, H3a: If duality exists, CEOs’ discretion is high and the link between their values and corporate governance orientation is strong. H3b: When the board is dominated for outsider directors, CEOs’ discretion is low and the link between their values and corporate governance orientation is weak. H3c: If the size of the board is big, CEOs’ discretion is high and the link between their values and corporate governance orientation is strong. Regarding the dependent variable –corporate governance perspectives- we used the Data Envelopment Analysis (DEA) as Jones (1995) proposed and Bendheim et al. (1998) used it to assess if there was differences between industries with respect to companies was managing their relations with some primary stakeholders groups. Dates on firms-stakeholders relationships were from KLD (Graves y Waddock, 1994; Waddock y Graves, 1997 a, b, 2000). To measure the CEO’ personal values orientation –independent variable- a shorted the Rokeach Value Survey (RVS) was distributed to CEOs to elicit value preference in order to classify each subject’s responses into a personal value orientation (self-interest versus other-regarding). 3 Moderated variables were measured following the literature. As such: Duality: 1 if exists and 0 if not exists Outsiders director: number of outsiders directors regarding internal directors Size board: total number of directors 4