Normal Level of Manufacturing Support Costs

advertisement

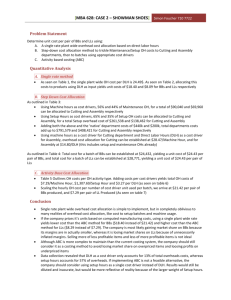

Chapter 4 Solutions Problem 4-24 (a) Support Cost Driver Rate: $5,000,000 $2,500,000 (Direct Labor $) = 2 times Direct Labor Cost (b) Consulting Engagement Cost: Labor Cost Support Cost (2 * Labor Cost) $20,000 Total Cost $60,000 40,000 Problem 4-27 Ingredient A: ($0.40 * 10,000) Ingredient B: ($0.60 * 20,000) $4,000 12,000 $16,000 Conversion Costs: ($0.55 * 30,000) $16,500 Total Costs Number of gallons of blended vegetable juice Cost per gallon of blended vegetable juice $32,500 27,000 $ 1.204 Problem 4-31 (b) (b) Determine the cost per monitor? Direct Materials: Part A327 Part B149 $ 60 120 $180 Direct Labor: Assembly (6 hrs * $10) Inspection (1 hr * $12) 60 12 72 Manufacturing Support: ($5 * 7 DL Hrs) Total Cost per Monitor 35 $287 1 Chapter 4 Solutions Problem 4-33 (a) Plantwide Cost Driver Rate: $120,000 + $160,000 (8,000 + 12,000) DL Hours $280,000 20,000 DLH = $14 per Direct Labor Hour Job Cost Sheet: Job #691 Direct Materials: Milling Assembly Totals $800 50 $850 Direct Labor: Milling Assembly Totals $100 600 $700 Manufacturing Support: 50 DLH * $14 per DLH Total Cost 700 $2,250 (b) Milling Cost Driver Rate: $120,000 12,000 Machine Hours = $10 per Machine Hour Assembly Cost Driver Rate: $160,000 12,000 DL Hours = $13.33 per Direct Labor Hour 2 Chapter 4 Solutions Job Cost Sheet: Job #691 Direct Materials: Milling Assembly Totals $800 50 $850 Direct Labor: Milling Assembly Totals $100 600 $700 Manufacturing Support: Milling: 18 MH * $10 per MH Assembly: 40 DLH * $13.33 per DLH Totals $180 533 $713 Total Cost $2,263 (c ) Part A $2,250.00 562.50 $2,812.50 Manufacturing cost 25% Markup Bid price Part B $2,263.00 565.75 $2,828.75 (d) The company may favor the method in (b) if support activity costs in the milling department have a cause-and-effect relationship with machine hours, while those in the assembly department have a cause-and-effect relationship with direct labor costs. In this case, the computed total manufacturing cost in part (a) is of similar magnitude to the cost in part (b), and therefore, the bid prices are also of similar magnitude. Given this result, one might be inclined to use the simpler method in part (a) rather than the more accurate but more complex method in part (b). However, comparisons across different products may produce greater differences in computed costs and bid prices. Problem 4-39 (a) Cutting Grinding Drilling Total Support Cost $42,000 $192,000 $228,000 $462,000 5,000 8,000 12,000 25,000 Direct Labor Hours 3 Chapter 4 Solutions Plantwide Cost Driver Rate: $462,000 25,000 DL Hours = $18.48 per Direct Labor Hour Support Cost Applied to Job ST101: = $18.48 * (2,000 + 2,500 + 3,000) = $18.48 * 7,500 = $138,600 (b) Cutting Cost Driver Rate: $42,000 80,000 MH = $0.525 per Machine Hour Grinding Cost Driver Rate: $192,000 8,000 DL Hours = $24 per Direct Labor Hour Drilling Cost Driver Rate: $228,000 12,000 DL Hours = $19 per Direct Labor Hour Support Cost Applied to Job ST101: Dept Cutting Grinding Drilling Totals Rate $0.525 $24.00 $19.00 Units of Base Used 20,000 MH 2,500 DLH 3,000 DLH 4 Overhead Cost $ 10,500 60,000 57,000 $127,500 Chapter 4 Solutions ( c) The Company may favor departmental support cost driver rates if support activity costs in the cutting department have a cause-and-effect relationship with machine hours, while those in the grinding and drilling departments have a cause-and-effect relationship with direct labor hours. The company may use a plantwide cost driver rate because it is simpler than using multiple departmental rates, though the departmental rate method is potentially more accurate. Process-Costing Example Neptune Company produces customized sailboats. Its plant has 3 production departments: Cutting, Machining, and Assembly. Estimated manufacturing support costs and direct labor costs for each department for 2001 are as follows: Manufacturing support cost Direct labor hours Cutting $540,000 30,000 Machining $800,000 20,000 Assembly $100,000 40,000 In May 2001, the company received an invitation from Duluth Sailing Company to bid for an order of 5 sailboats that must be delivered by the end of December 2001. This job would require direct manufacturing costs in the three departments as follows: Direct material cost Direct labor hours Cutting $12,000 6,500 Machining $900 1,700 Assembly $5,600 13,000 Assume that a single, plant-wide manufacturing support cost driver based on direct labor hours is used. Determine the plant-wide support cost rate and manufacturing support costs (overhead) applied to the Duluth job. Normal Level of Manufacturing Support Costs Normal Level of Activity (DL Hours) $540,000 + $800,000 + $100,000 30,000 + 20,000 + 40,000 $1,440,000 90,000 $16 / DL Hour Mfg. Support Costs Applied = $16 * 21,200 DL Hours (6,500 + 1,700 + 13,000) =$339,200 5 Chapter 4 Solutions Process-Costing Example – Continued: Assume that instead of a plant-wide manufacturing support cost rate, Neptune Company is using departmental manufacturing support cost rates based on direct labor hours. Determine the manufacturing support cost rate for each of the three departments and support costs applied to Duluth job. Manufacturing support cost Direct labor hours Cost Driver Rate Direct labor hours Cost driver rate Support Costs Applied Cutting $540,000 30,000 $18 Machining $800,000 20,000 $40 Cutting Machining 6,500 1,700 $18 $40 $117,000 $68,000 Total Support Costs Applied = $217,500 6 Assembly $100,000 40,000 $2.50 Assembly 13,000 $2.50 $32,500