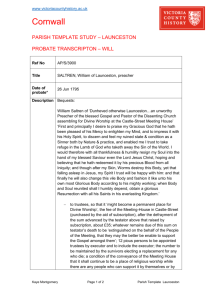

deceased 1890

advertisement