Forecasting Model for Peak Demand

advertisement

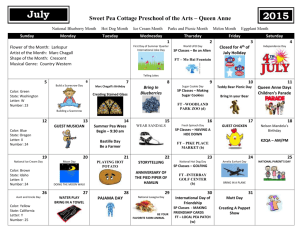

Chapter 6 Forecasting Model for Peak Demand 6.1 Introduction The models for peak demand will be developed within the same frame work as the electricity energy demand models. Peak demand will be modeled at the EGAT’s gross generation level, the MEA purchasing point, and the PEA purchasing point. The maximum demand model has the same specifications as the electricity energy demand model. The only difference is the dependent variable where electricity energy demand variable is replaced by peak power demand variable. 6.2 EGAT’s Peak Demand Model Peak demand in the model is the coincident peak demand of electrical power generated by EGAT, power purchased from the independent power producers, and power from foreign sources in a given month. Monthly data between January 1999 and December 2004 are used to estimate the models. The following notations are used in EGAT’s peak demand model. DEGAT = EGAT’gross peak demand in month t t EGAT_D rt = EGAT’gross peak demand in region r in month t TEMPt = sum of average kingdom daily temperature in month t TEMPtr = sum of average daily temperature in region r in month t PRICE t = average electricity prices in month t Average electricity prices in the EGAT’s total gross generation model and the central region model are averages of the MEA and PEA system. Electricity prices in the EGAT’s northeastern, northern, and southern models are averages in the PEA system. Two specifications are proposed for the peak demand model i.e. 3 nD t = CON + A j nD t j + M j nM1t j + T nTEMPt + P nPRICE t 1 jIS j=0 + D2 FEB + D3MAR + D4 APR + D5 MAY + D6 JUN + D7 JUL + D8 AUG + D9SEP + D10 OCT + D11NOV + D12 DEC + u t (6.1) nD t = CON + A j nD t j + B*t + T nTEMPt + P nPRICE t 1 + D 2 FEB + D3MAR jIS + D4 APR + D5 MAY + D6 JUN + D7 JUL + D8 AUG + D9SEP + D10OCT + D11NOV + D12 DEC + u t (6.2) Estimation results of the proposed models are summarized in Table 6.1. The 93 model selection is based on the value of adjusted R2. Estimation Results of EGAT’s Peak Demand Model Table 6.1 Model (6.1) Price variable Model Total Gross Generation Central Northeast North South 6.2.1 sign – P–value Neg. Neg. – – 0.0008 0.0007 – – – adj.R2 0.9880 Model (6.1) with EC Price variable P–value adj.R2 sign – – – 0.9741 0.9876 0.9634 0.9432 Neg. Neg. – – 0.0042 0.0051 – – 0.9755 0.9880 0.9675 0.9460 Model (6.2) Price variable sign Neg. P–value 0.0360 adj.R2 0.9830 Model (6.2) EC Price variable P–value adj.R2 sign 0.5061 0.9859 Neg. Neg. Neg. Neg. Neg. 0.0015 0.0290 0.5117 0.3097 0.9711 0.9835 0.9545 0.9470 Neg. – Neg. Neg. 0.0018 – 0.5914 0.3823 0.9733 0.9867 0.9719 0.9503 EGAT’s Total Gross Generation Model (6.1) is selected as the long term and short term forecasting model since the coefficient of the EC term is not significant. nDEGAT = 2.5438 + 0.3088 nDEGAT + 0.2451 nM1t 1 + 0.1197 nM1t 2 t t 1 + 0.6522 nTEMPt + 0.0721FEB 0.0010MAR 0.0096APR 0.0390MAY 0.0149JUN 0.0272JUL 0.0104AUG 0.0074SEP 0.0089OCT + 0.0325NOV + 0.0096DEC t = January 1999, February 1999, March 1999, … (6.3) 6.2.2 EGAT’s Central Region Model (6.1) without the EC term is selected as the long term forecasting model and the same model with the EC term is selected as the short term forecasting model. The two models are presented below nEGAT_DCt = 3.0531 + 0.5227 nEGAT_D Ct 1 + 0.2989 nEGAT_DCt 12 0.1623 nEGAT_DCt 14 + 0.2383 nM1t 2 + 0.4759 nTEMPtC 0.1501 nPRICE t 1 + 0.0593FEB 0.0071MAR 0.0124APR 0.0244MAY 0.0058JUN 0.0127JUL + 0.0001AUG + 0.0120SEP + 0.0078OCT 0.0119NOV + 0.0023DEC (6.4) nEGAT_DCt = 2.9308 + 0.5471 nEGAT_DCt 1 + 0.3158 nEGAT_DCt 12 0.1884 nEGAT_DCt 14 + 0.2200 nM1t 2 + 0.4707 nTEMPtC 0.1309 nPRICE t 1 + 0.0577FEB 0.0127MAR 0.0162APR 0.0286MAY 0.0085JUN 0.0168JUL 0.0029AUG + 0.0089SEP + 0.0027OCT 0.0138NOV + 0.0014DEC + 0.2853u t 10 t = January 1999, February 1999, March 1999, … (6.5) 94 EGAT’ Northeastern Region Model (6.1) without the EC term is selected as the long term forecasting model and the same model with the EC term is selected as the short term forecasting model. The two models are presented below NE nEGAT_D tNE = 3.7218 + 0.4208 nEGAT_D tNE 1 + 0.1470 nEGAT_D t 2 NE + 0.2566 nEGAT_D tNE 12 + 0.1766 nM1t 1 + 0.4279 nTEMPt 0.1488 nPRICE PEA t 1 + 0.0042FEB 0.0265MAR 0.0729APR 0.0837MAY 0.0750JUN 0.0623JUL 0.0510AUG 0.0377SEP 0.0381OCT 0.0247NOV 0.0144DEC (6.6) NE nEGAT_D tNE = 3.7461 + 0.3932 nEGAT_D tNE 1 + 0.1419 nEGAT_D t 2 NE + 0.2687 nEGAT_D tNE 12 + 0.1815 nM1t 1 + 0.4428 nTEMPt 0.1313 nPRICE PEA t 1 + 0.0031FEB 0.0292MAR 0.0738APR 0.0851MAY 0.0760JUN 0.0629JUL 0.0514AUG 0.0384SEP 0.0387OCT 0.0240NOV 0.0125DEC + 0.2151u t 5 t = January 1999, February 1999, March 1999, … (6.7) EGAT’ Northern Region Model (6.1) without the EC term is selected as the long term forecasting model and the same model with the EC term is selected as the short term forecasting model. The two models are presented below nEGAT_D tN = 1.9506 + 0.2719 nEGAT_D tN1 + 0.2482 nEGAT_D tN12 + 0.2452 nM1t 3 + 0.3451 nTEMPtN + 0.0043FEB 0.0294MAR 0.0414APR 0.0510MAY 0.0579JUN 0.0339JUL 0.0396AUG 0.0173SEP 0.0410OCT + 0.0018NOV + 0.0144DEC (6.8) nEGAT_D tN = 1.4667 + 0.5639 nEGAT_DtN1 + 0.1374 nEGAT_D tN12 + 0.1517 nM1t 3 + 0.2545 nTEMPtN + 0.0168FEB 0.0043MAR 0.0234APR 0.0416MAY 0.0520JUN 0.0167JUL 0.0324AUG 0.0100SEP 0.0425OCT + 0.0103NOV + 0.0026DEC 0.4334u t 1 + 0.1827u t 6 t = January 1999, February 1999, March 1999, … (6.9) 95 EGAT’ Southern Region Model (6.2) without the EC term is selected as the long term forecasting model and the same model with the EC term is selected as the short term forecasting model. The two models are presented below nEGAT_DSt = 7.3092 + 0.3145 nEGAT_DSt 1 + 0.4750 nM1t 3 + 0.8840 nTEMPtS 0.0157FEB 0.0652MAR 0.0907APR 0.1018MAY 0.0835JUN 0.1188JUL 0.0262AUG 0.0051SEP 0.0183OCT 0.0131NOV 0.0003DEC (6.10) nEGAT_DSt = 8.8691 + 0.2025 nEGAT_DSt 1 + 0.5488 nM1t 3 + 1.0893 nTEMPtS 0.0184FEB 0.0770MAR 0.1053APR 0.1148MAY 0.0941JUN 0.1269JUL 0.0381AUG 0.0042SEP 0.0133OCT 0.0099NOV + 0.0069DEC + 0.1968u t 2 + 0.1972u t 3 t = January 1999, February 1999, March 1999, … (6.11) 6.3 MEA’s Peak Demand Model Peak demand in the MEA system is the maximum demand that MEA purchases from EGAT in a given month. The MEA model have the same specifications as the EGAT model with the following notations D MEA = peak demand MEA’s system in month t t TEMPtC = sum of average daily temperature in central region in month t PRICE MEA = average electricity price in MEA’s system in month t t Estimation Results of MEA’s Peak Demand Model Table 6.2 Model (6.1) Price variable sign – P–value adj.R2 – 0.9449 Model (6.1) with EC Price variable P–value adj.R2 sign – – 0.9556 Model (6.2) Price variable Sign – Model (6.2) EC Price variable P–value adj.R2 – 0.9685 sign – P–value adj.R2 – 0.9801 Estimation results of the models are summarized in Table 6.2. Model (6.1) without the EC term is selected as the long term forecasting model and the same model with the EC term is selected as the short term forecasting model. The two models are presented below nD MEA = 1.7915 + 0.3960 nM1t 1 + 0.7647 nTEMPtC + 0.1072FEB + 0.0436MAR t + 0.0695APR + 0.0480MAY + 0.0723JUN + 0.0506JUL + 0.0475AUG + 0.0803SEP 0.0500OCT + 0.0700NOV + 0.0286DEC (6.12) 96 nD MEA = 1.7129 + 0.3881 nM1t 1 + 0.7685 nTEMPtC + 0.1053FEB + 0.0437MAR t + 0.0688APR + 0.0485MAY + 0.0722JUN + 0.0510JUL + 0.0471AUG + 0.0810SEP + 0.0492OCT + 0.0709NOV + 0.0267DEC + 0.4727u t 2 (6.13) 6.4 PEA’s Peak Demand Model The peak demand in the PEA distribution system is defined similar to the MEA case. The basic models may be expressed as (6.1) and (6.2) where the temperature variable is the cumulative average daily temperature in Thailand, TEMPt and the price variable is the average PEA consumer electricity price per KWh, PRICE PEA . t The results of forecasting models of peak demand in the PEA distribution system and the PEA regional distribution systems are summarized in Table 6.3. The long–term forecasts of PEA’s peak demands follow the model (6.1) and the short– term forecasts follow model (6.1) with EC terms. nD MEA = 1.7915 + 0.3960 nM1t 1 + 0.7647 nTEMPtC + 0.1072FEB + 0.0436MAR t + 0.0695APR + 0.0480MAY + 0.0723JUN + 0.0506JUL + 0.0475AUG + 0.0803SEP 0.0500OCT + 0.0700NOV + 0.0286DEC (6.14) PEA nDPEA = 0.1404 + 0.2131 nDPEA t t 1 + 0.6285 nD t 12 + 0.1021 nM1t 2 0.2983u t 9 0.3875u t 12 t = January 1999, February 1999, … (6.15) Estimation Results of PEA’s Peak Demand Model Table 6.3 Model (6.1) Price variable Model PEA Central Northeast North South sign P–value adj.R2 – – – – – – – – – – 0.9686 0.9698 0.8966 0.9599 0.9762 Model (6.1) with EC Price variable P–value adj.R2 sign – – – – – – – – – – 0.9743 0.9741 0.9019 0.9683 0.9779 Model (6.2) Price variable Model (6.2) EC Price variable sign P–value adj.R2 sign P–value adj.R2 Neg. Neg. Neg. – Neg. 0.1036 0.1896 0.5771 – 0.7353 0.9885 0.9713 0.9164 0.9629 0.9738 – – 0.0422 0.1680 – 0.6535 – 0.9748 0.9251 0.9699 0.9794 Neg. Neg. – Neg. The model of long–term forecasts of peak demands in the PEA central region is chosen to use the model (6.2). nPEA_DCt = 2.7125 + 0.2725 nPEA_D Ct 1 + 0.0052t + 0.4982 nTEMPtC 0.0999 nPRICE t 1 + 0.0665FEB + 0.0131MAR + 0.0024APR 0.0056MAY + 0.0044JUN 0.0091JUL 0.0094AUG + 0.0133SEP 0.0072OCT + 0.0184NOV 0.0404DEC (6.16) 97 The short–term forecast model of peak demands in the PEA central region is the model (6.2) with EC terms. nPEA_DCt = 2.5258 + 0.3558 nPEA_DCt 1 + 0.0047t + 0.4258 nTEMPtC 0.1122 nPRICE Ct1 + 0.0575FEB + 0.0137MAR + 0.0008APR 0.0077MAY 0.0006JUN 0.0104JUL 0.0113AUG + 0.0081SEP 0.0100OCT + 0.0123NOV 0.0482DEC 0.3985u t 2 t = 1(January 1999), 2(February 1999), … (6.17) The long–term and short–term forecast models of peak demands in the PEA northeast region are the model (6.2) and the model (6.2) with EC terms respectively as the following details. nPEA_D tNE = 4.2325 + 0.0036t + 0.4614 nTEMPtNE + 0.0480 nPRICE t 1 + 0.0052FEB 0.0067MAR 0.0183APR 0.0318MAY 0.0385JUN 0.0476JUL 0.0062AUG 0.0151SEP 0.0071OCT + 0.0302NOV + 0.0099DEC (6.18) nPEA_D tNE = 4.2521 + 0.0038t + 0.4646 nTEMPtNE 0.1033 nPRICE t 1 + 0.0053FEB 0.0072MAR 0.0184APR 0.0384MAY 0.0406JUN 0.0488JUL 0.0067AUG 0.0175SEP 0.0121OCT + 0.0258NOV + 0.0076DEC 0.4377u t 9 t = 1(January 1999), 2(February 1999), … (6.19) In the PEA north region, the long–term and short–term forecasts of peak demands are modeled as (6.2) and (6.2) with EC terms respectively as follows. nPEA_D tN = 5.6967 0.2527 nPEA_D tN12 + 0.0055t + 0.4840 nTEMPtN + 0.0010FEB + 0.0118MAR + 0.0243APR + 0.0062MAY 0.0184JUN + 0.0095JUL + 0.0248AUG + 0.0144SEP + 0.0059OCT + 0.0506NOV + 0.0383DEC (6.20) nPEA_D tN = 5.1877 0.1443 nPEA_D tN12 + 0.0050t + 0.4453 nTEMPtN + 0.0017FEB + 0.0101MAR + 0.0197APR + 0.0012MAY 0.0223JUN + 0.0051JUL + 0.0225AUG + 0.0147SEP + 0.0032OCT + 0.0431NOV + 0.0323DEC 0.5407u t 9 t = 1(January 1999), 2(February 1999), … (6.21) 98 In the PEA south region, the long–term and short–term forecasts of peak demands follow the model (6.1) and model (6.1) with EC terms respectively as the following details. nPEA_DSt = 0.0921 + 0.2958 nPEA_DSt 1 + 0.0032t + 0.7698 nTEMPtS 0.0203 nPRICE PEA t 1 + 0.0139FEB 0.0038MAR 0.0361APR 0.0335MAY 0.0392JUN 0.0280JUL 0.0102AUG 0.0130SEP + 0.0061OCT + 0.0034NOV + 0.0046DEC (6.22) nPEA_DSt = 1.2382 + 0.1884 nPEA_DSt 1 + 0.0038t + 0.6865 nTEMPtS 0.0273 nPRICE PEA t 1 0.0210FEB + 0.0032MAR 0.0206APR 0.0218MAY 0.0307JUN 0.0214JUL 0.0079AUG 0.0033SEP + 0.0086OCT + 0.0055NOV + 0.0084DEC + 0.3141u t 5 0.5252u t 11 t = 1(January 1999), 2(February 1999), … (6.23)