Recycled PET shortage serious, growing

By Joe Truini

WASTE NEWS

AKRON, OHIO (April 27, 4:30 p.m. EDT) –

Recyclers and recycling advocates could

be missing a golden opportunity to

improve sagging plastic bottle recycling

rates significantly.

Since humans began roaming the earth,

demand often has dictated supply.

Basically, if someone wants something,

there is someone else willing to provide it

— for a price.

But demand for recycled PET containers

from carpet makers, beverage companies,

strapping manufacturers and overseas

buyers is outpacing supply.

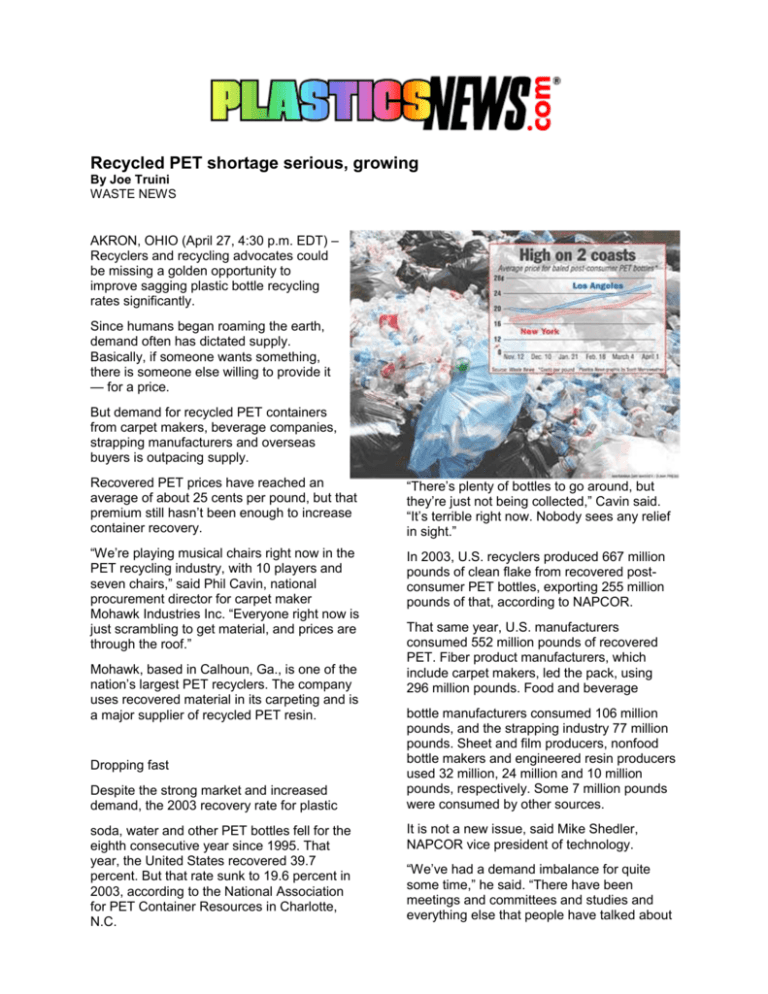

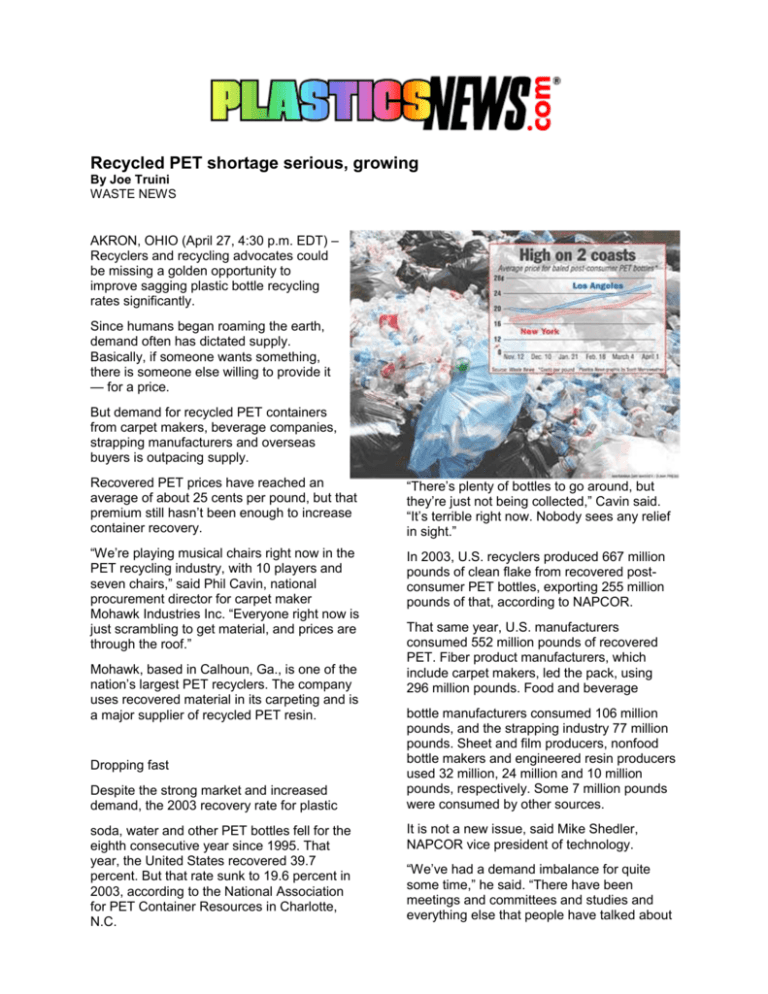

Recovered PET prices have reached an

average of about 25 cents per pound, but that

premium still hasn’t been enough to increase

container recovery.

“There’s plenty of bottles to go around, but

they’re just not being collected,” Cavin said.

“It’s terrible right now. Nobody sees any relief

in sight.”

“We’re playing musical chairs right now in the

PET recycling industry, with 10 players and

seven chairs,” said Phil Cavin, national

procurement director for carpet maker

Mohawk Industries Inc. “Everyone right now is

just scrambling to get material, and prices are

through the roof.”

In 2003, U.S. recyclers produced 667 million

pounds of clean flake from recovered postconsumer PET bottles, exporting 255 million

pounds of that, according to NAPCOR.

Mohawk, based in Calhoun, Ga., is one of the

nation’s largest PET recyclers. The company

uses recovered material in its carpeting and is

a major supplier of recycled PET resin.

Dropping fast

Despite the strong market and increased

demand, the 2003 recovery rate for plastic

soda, water and other PET bottles fell for the

eighth consecutive year since 1995. That

year, the United States recovered 39.7

percent. But that rate sunk to 19.6 percent in

2003, according to the National Association

for PET Container Resources in Charlotte,

N.C.

That same year, U.S. manufacturers

consumed 552 million pounds of recovered

PET. Fiber product manufacturers, which

include carpet makers, led the pack, using

296 million pounds. Food and beverage

bottle manufacturers consumed 106 million

pounds, and the strapping industry 77 million

pounds. Sheet and film producers, nonfood

bottle makers and engineered resin producers

used 32 million, 24 million and 10 million

pounds, respectively. Some 7 million pounds

were consumed by other sources.

It is not a new issue, said Mike Shedler,

NAPCOR vice president of technology.

“We’ve had a demand imbalance for quite

some time,” he said. “There have been

meetings and committees and studies and

everything else that people have talked about

over the years in terms of how we can

address supply issues. Not a whole lot,

though, has happened.”

“We could essentially double the demand for

strapping in the next 12 months,” he said.

“That would put the strapping segment, in

terms of [recovered PET] content, very close

to where the carpet industry is today.”

Stuck in the middle

Many people agree that container-deposit

laws, or bottle bills, are effective in recovering

PET bottles, but stakeholders are split on their

support, said Pat Franklin, executive director

of the Container Recycling Institute in

Arlington, Va. Beverage manufacturers, the

grocery industry and retailers oppose bottle

bills.

Recyclers are stuck in the middle, Franklin

said. Major beverage companies are their

customers, whether buying processed

material from recyclers or selling them

recovered bottles, she said.

“It’s like they’ve got a gag order,” Franklin

said.

Recycling advocates praise the effectiveness

of bottle bills. The 10 states that have had

deposit laws running for some time — Hawaii,

the most recent state to pass deposit

legislation, just started its program this year —

collect about three of every four bottles

consumed, she said. Recovery rates can

reach higher than 80 percent in those states.

“You’re looking at single-digit recycling rates

in nonbottle-bill states,” she said.

No consensus

And over the past six to nine months, virgin

PET price increases have created even more

demand for alternative raw materials,

including recovered PET, said Shedler of

NAPCOR.

“There’s no question we need more supply out

there,” he said. “The issue is that no one can

agree on just how to do it.”

And the incredibly high demand for strapping,

which is used to secure a range of products

such as baled materials, could add to the

need for more PET, Shedler said. Strapping

manufacturers are adding capacity to fill

orders, as most of them are sold out of

product.

You just might get what you wish for

In 2000, recycling advocacy groups led by the

GrassRoots Recycling Network started

pressuring Coca-Cola Co. and PepsiCo Inc. to

use more recycled PET.

That year, Coke officials agreed to start using

10 percent recycled content in billions of the

company’s bottles.

In 2002, PepsiCo officials outlined a goal to

use 10 percent recycled content in their firm’s

containers.

But those environmental community victories

are putting recyclers and processors on the

spot to come up with enough material for

everybody.

Coke and Pepsi together are consuming in the

neighborhood of an additional 200 million

pounds of recovered PET bottles or so per

year, according to recycling industry

estimates.

The additional demand has led to shortages of

100 million to 200 million pounds per year,

according to Cavin.

“That’s getting many in the industry upset

because that’s lessening the quantity that’s

out there on the market,” said Rob Krebs, a

spokesman for the American Plastics Council

in Arlington. “It’s a valued commodity. It’s

needed and desired.”

Beverage makers have not had recycled PET

shortage issues, though the industry is

pursuing ways to increase the amount of

material recovered, said Preston Read, vice

president of environmental affairs for the

American Beverage Association in

Washington.

“Our members are getting what they need,” he

said. “We’re not seeing anyone right now

saying, ‘I absolutely can’t satisfy my needs.’

“I think it’s become a bit more expensive for

people to satisfy their needs, but that’s the

nature of the market.”

Recovered-PET price hikes are likely to entice

commercial businesses to recycle more of

their waste material instead of throwing it

away, Shedler said. But that increase may be

only about 10 million pounds.

U.S. PET recyclers collected 841 million

pounds of bottles in 2003, the most of any

year including 1995, according to NAPCOR.

That is the most significant trend, Read said.

“There’s been so much growth in the use of

the package, and that has a direct bearing on

the rate,” he said.

Most likely, more material will be collected in

2004 and 2005, Shedler said.

“Will it keep pace with any increased

demand? No. Not going to happen,” he said.

Recyclers definitely can handle more material,

as many PET processors are operating at

about 50 percent capacity, Krebs said.

NAPCOR’s 2003 data shows the 14 U.S. PET

processing plants had total capacity of 877

million pounds and ran at 71 percent capacity.

To get more PET bottles to those recyclers,

APC promotes an all-bottle recycling program

that encourages communities to allow

residents to put plastic bottles of all types into

their recycling bins. The goal is to make it

easier for consumers to recycle.

Processors then sort the bottles to separate

the grades. The increased material collected

offsets the additional costs associated with the

sorting, according to APC.

“It brings home to the consumer that there are

bottles there that are not being recycled,”

APC’s Krebs said.

“There’s a tremendous amount of education

that needs to happen there.”

Entire contents copyright 2005 by Crain

Communications Inc. All rights reserved.