Important Notice to Employees Residing in the State of Nevada

advertisement

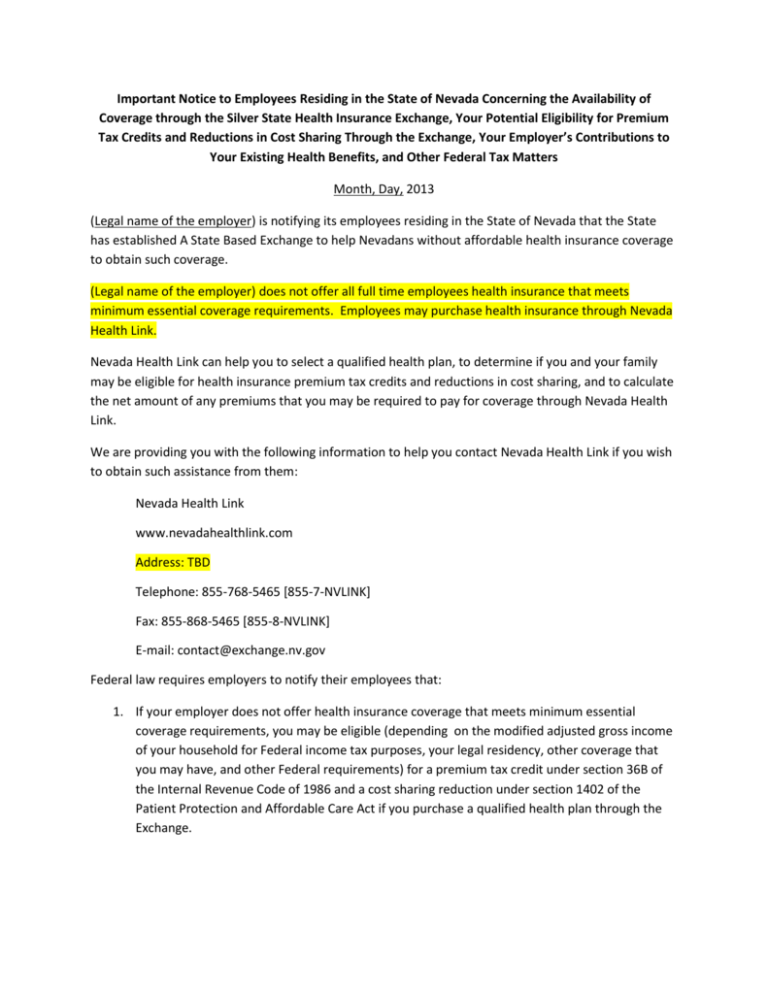

Important Notice to Employees Residing in the State of Nevada Concerning the Availability of Coverage through the Silver State Health Insurance Exchange, Your Potential Eligibility for Premium Tax Credits and Reductions in Cost Sharing Through the Exchange, Your Employer’s Contributions to Your Existing Health Benefits, and Other Federal Tax Matters Month, Day, 2013 (Legal name of the employer) is notifying its employees residing in the State of Nevada that the State has established A State Based Exchange to help Nevadans without affordable health insurance coverage to obtain such coverage. (Legal name of the employer) does not offer all full time employees health insurance that meets minimum essential coverage requirements. Employees may purchase health insurance through Nevada Health Link. Nevada Health Link can help you to select a qualified health plan, to determine if you and your family may be eligible for health insurance premium tax credits and reductions in cost sharing, and to calculate the net amount of any premiums that you may be required to pay for coverage through Nevada Health Link. We are providing you with the following information to help you contact Nevada Health Link if you wish to obtain such assistance from them: Nevada Health Link www.nevadahealthlink.com Address: TBD Telephone: 855-768-5465 [855-7-NVLINK] Fax: 855-868-5465 [855-8-NVLINK] E-mail: contact@exchange.nv.gov Federal law requires employers to notify their employees that: 1. If your employer does not offer health insurance coverage that meets minimum essential coverage requirements, you may be eligible (depending on the modified adjusted gross income of your household for Federal income tax purposes, your legal residency, other coverage that you may have, and other Federal requirements) for a premium tax credit under section 36B of the Internal Revenue Code of 1986 and a cost sharing reduction under section 1402 of the Patient Protection and Affordable Care Act if you purchase a qualified health plan through the Exchange. This notice is being provided to you in accordance with the requirements of the Patient Protection and Affordable Care Act (Public Law 111-148) and Health-Related Portions of the Health Care and Education Reconciliation Act of 2010 (Public Law 111-152), section 1512. Please contact (employer HR department contact) if you have any questions concerning this notice or if you have any questions concerning your existing benefits through (legal name of employer), your employer’s contributions to your benefits, and any exclusions from your income for Federal income tax purposes.