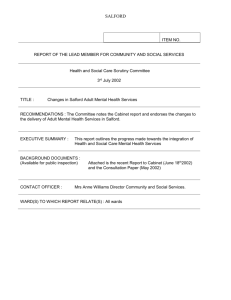

Encourage Inward Moving Businesses to Invest in Salford

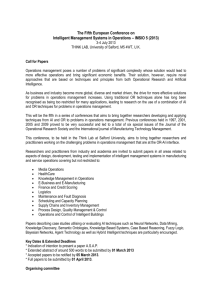

advertisement