Report of the Select Committee on Appropriations on its activities

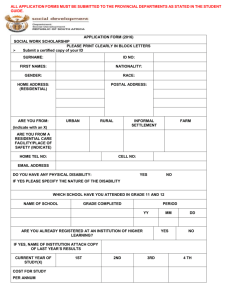

advertisement

Report of the Select Committee on Appropriations on its activities undertaken during the 4th Parliament (May 2009 – March 2014) 1. 1.1 Introduction Department/s and Entities falling within the Committee’s portfolio Due to the nature of the Committee’s oversight role, all national and provincial departments as well as municipalities, who receive conditional grants, fall within the Committee’s field of oversight. National Treasury as well as provincial treasuries are also vital stakeholders, as they are requested to make presentations whenever a department or municipality reports to the Committee on its spending and the performance of conditional grant funds. With regard to other stakeholders, the Financial and Fiscal Commission is a regular role player in the Committee’s oversight work. In terms of the Money Bills Act, the Committee must consider recommendations of the Financial and Fiscal Commission, including those referred to in the Intergovernmental Fiscal Relations Act, 1997 (Act No 97 of 1997). In addition, the Commission is also invited to make presentations when the Committee conducts oversight visits to specific provinces and municipalities. Another stakeholder that the Committee interacts with whenever matters affecting municipalities are considered is the South African Local Government Association (Salga). Other stakeholders that the Committee interacts with when conducting oversight visits to provinces and municipalities, are the Auditor-General of South Africa, the Department of Water and Environmental Affairs, national and provincial departments of Cooperative Governance and Eskom. 1.2 Functions of Committee: Parliamentary committees, in general, are mandated to: Monitor the financial and non-financial performance of government departments and their entities to ensure that national objectives are met. Process and pass legislation. Facilitate public participation in Parliament relating to issues of oversight and legislation. The Select Committee on Appropriations was established in terms of Section 4(3) of the Money Bills Amendment Procedure and Related Matters Act, 2009. According to Section 4(4) of this Act, “a committee on appropriations [in the National Council of Provinces] has the power and functions conferred to it by the Constitution, legislation, the standing rules or a resolution of a House, including the considering and reporting on- 1 (a) spending issues; (b) amendments to the Division of Revenue Bill, the Appropriation Bill, Supplementary Appropriations Bills and the Adjustment Appropriations Bill; (c) recommendations of the Financial and Fiscal Commission, including those referred to in the Intergovernmental Fiscal Relations Act, 1997 (No. 97 of 1997); (d) reports on actual expenditure published by the National Treasury; and (e) any other related matter set out in this Act. 1.3 Method of work of the Committee The Committee dealt with the legislation referred to it in terms of the requirements of the Money Bills Act, the Constitution and the Standing Rules of the National Council of Provinces. This included placing newspaper advertisements in all official languages to invite interesting persons and role players to comment on the Division of Revenue and the Medium Term Budget Policy Statement, as well as inviting specific stakeholders like the Financial and Fiscal Commission, the South African Local Government Association (Salga) and the Municipal Demarcation Board to submit comments. In the case of the Division of Revenue, which is Section 76 legislation, Members of the Committee also briefed their respective provinces on the Bills. This exercise took place with the technical assistance of officials from National Treasury. Thereafter the Committee considered and adopted Negotiating and Final Mandates from provinces before reporting on the Bill to the House. With regard to the Committee’s oversight over provincial conditional grant spending, the practice has mostly been to choose the three or four worst performing provinces in a particular quarter of the financial year and invite them, together with the national transferring department and National Treasury to come and report to the Committee at a hearing. The Committee would then report its findings and recommendations to the House. The Committee’s oversight role in respect of conditional grant allocations and spending in the local government sphere has mainly been a feature of oversight visits to a select number of municipalities within a province that have been chosen for oversight. Hereby municipalities are called upon to account before the Committee by reporting on conditional grant expenditure and service delivery performance and explaining reasons for any variation from budgetary and performance delivery targets. The Committee has also on occasion undertaken site inspections of projects funded by both provincial and local government conditional grants to verify the outputs and also assess if there is value for the money spent. 1.4 Purpose of the report 2 The purpose of this report is to provide an account of the Select Committee on Appropriations’ work during the 4th Parliament and to inform the Members of the new Parliament of key outstanding issues pertaining to the oversight over the spending of conditional grant funds and the budget process. This report provides an overview of the activities the Committee undertook during the 4th Parliament, the outcome of key activities, as well as any challenges that emerged during the period under review and issues that should be considered for follow up during the 5 th Parliament. It summarises the key issues for follow-up and concludes with recommendations to strengthen operational and procedural processes to enhance the Committee’s oversight and legislative roles in future. 2. Key statistics 2.1 Meetings The table below provides an overview of the number of meetings held, legislation and international agreements processed and the number of oversight trips and study tours undertaken by the Committee, as well as any statutory appointments the Committee made, during the 4th Parliament: Activity Meetings held Legislation processed Oversight trips undertaken Study tours undertaken 2009/10 No meetings, the Committee started operating in 2010/11 No meetings, the Committee started operating in 2010/11 No meetings, the Committee started operating in 2010/11 No study tours 2010/11 2011/12 19 22 25 2013/14 28 (up until 25 March) 4 6 4 5 19 (up until 25 March) 1 2 1 None 4 No study tours No study tours No study tours No study tours Nil 3 2012/13 Total 94 (up until 25 March) Activity International agreements processed Statutory appointments made Interventions considered Petitions considered 2009/10 were undertaken. The Committee only started functioning in 2010/11 No international agreements were processed by the Committee. No statutory appointments were made by the Committee. No interventions were considered by the Committee. No petitions were received by the Committee. 2010/11 were undertaken. 2011/12 were undertaken. 2012/13 were undertaken. 2013/14 were undertaken. 2 No international agreements were processed by the Committee No statutory appointments were made by the Committee. No interventions were considered by the Committee No petitions were received by the Committee. No international agreements were processed by the Committee No statutory appointments were made by the Committee. No interventions were considered by the Committee No petitions were received by the Committee. No international agreements were processed by the Committee 1 2 No interventions were considered by the Committee No petitions were received by the Committee. Nil No statutory appointments were made by the Committee. No interventions were considered by the Committee No petitions were received by the Committee. 4 Total 1 2.2 Date Reports (other than legislation) Report Responsible Department 5 01 June 2010 Third Quarter of 2009/10 expenditure patterns of Community Library Grant 01 June 2010 Third Quarter 0f 2009/10 expenditure patterns of Devolution of Property Rates Grant 01 June 2010 Third Quarter of 2009/10 expenditure patterns of HIV and AIDS (Life Skills) Grant 14 June 2010 Third Quarter of 2009/10 expenditure patterns of Comprehensive HIV and AIDS, Forensic Pathology and Hospital Revitalisation Grants First Quarter of 2010/11 expenditure patterns of National School Nutrition Grant 14 September 2010 14 September 2010 14 September 2010 Oversight visit to Eastern Cape Municipalities First Quarter of 2010/11 expenditure patterns of Mass Participation and Sport Programme Grant 14 September 2010 First Quarter of 2010/11 National School Nutrition Programme Grant 09 March 2011 First Quarter of 2010/11 spending patterns of the Hospital Revitalisation Grant 22 June 2011 Third Quarter of 2010/11 expenditure patterns of Community Library Grant 19 October 2011 First Quarter of 2011/12 Spending of Provincial Roads Maintenance Grant 19 October 2011 First Quarter of 2011/12 spending of Comprehensive HIV and AIDS Grant, Hospital Revitalisation grant and forensic Pathology Services Grant Fourth Quarter of 2011/12 spending patterns of Land Care Programme Grant, and Poverty Relief and Infrastructure Development Grant Oversight visit to Pelonomi Hospital in Free State to assess value for money spent on Hospital Revitalisation Grant 19 October 2011 19 October 2011 6 National and Provincial Departments of Arts and Culture National and Provincial Departments of Public Works National and Provincial Departments of Basic Education National and Provincial Department of Health National and Provincial Department of Basic Education Eastern Cape Municipalities National and Provincial Departments of Sport and Recreation National and Provincial Departments of Basic Education National Department of Health National department of Arts and Culture National Department of Transport National Department of Health National department of Agriculture National Department of health 19 October 2011 23 November 2011 First Quarter of 2011/12 spending of Mass Sport and Recreation Participation Programme Grant Oversight visit to conditional grant projects in North West Province 24 January 2012 Oversight visit to conditional grant projects in Northern Cape 05 June 2012 Fourth Quarter of 2011/12 expenditure of Forensic Pathology Services Grant 19 September 2012 Fourth Quarter expenditure of Community Library Services Grant 19 September 2012 Progress Report on 12 Eastern Cape Municipalities visited in 2010 19 September 2012 Progress Report on Northern Cape and North West Hospital Revitalisation Grant 19 September 2012 08 May 2013 18 June 2013 Fourth Quarter of 2011/12 Dinaledi Schools Grant, Technical secondary Schools Recapitalisation Grant and Schools Infrastructure Backlog Grant Fourth Quarter of 2011/12 expenditures of Social sector Expanded Public Works Programme Incentive Grant Progress Report on Local Turn-Around Strategy, Operation Clean Audit by 2014 and establishment of Municipal Infrastructure Support agency Report on the Appointment of Director for Parliamentary Budget Office Fourth Quarter of 2012/13 expenditure of Community Library Services Grant 18 June 2013 Fourth Quarter of 2012/13 expenditure of Ilima/Litsema Project Grant 18 June 2013 Third and Fourth Quarter of 2012/13 of Dinaledi Schools Grant 18 June 2013 Third and Fourth of 2012/13 Quarter expenditure of National Health Insurance Grant 18 June 2013 Report on FFC submission on Local Government Fiscal Framework 27 November 2012 27 November 2012 7 National Department of Sports and Recreation National Departments of Health, Public Works, Transport, Arts and Culture, Sports and Recreation National Department of Education and Health National Department of Health National Department of Arts and Culture Department of Cooperative Governance National Department of Health Department of Basic Education National Department of Public Works National Department of Cooperative Governance Parliament National Department of Arts and Culture National Department of Agriculture Department of Basic Education National Department of Health Department of Finance 09 October 2013 First Quarter of 2013/14 of Human Settlements Development Grant 09 October 2013 Annual Performance Evaluation Report of Provincial Roads maintenance Grant 09 October 2013 Annual Performance of Further Education and Training Colleges Grant for 2012/13 13 November 2013 Medium Term Budget Policy Statement 3. National Department of Human Settlements National Department of Transport Department of Higher Education Department of Finance Issues arising from hearings With regard to the Committee’s oversight over provincial conditional grant spending, the key findings are as follows: 1 A number of grants register significant under-expenditure at financial year-end. Under-expenditure is more prevalent in respect of capital grant allocations, which can mainly be attributed to poor planning and budgeting. Poor capital grant expenditure has also been attributed to a lack of expertise in terms of project and contract management, lack of technical expertise such as engineering and poor performance of contractors due to a lack of appropriate supervision by the contracting department or implementing agent. Grant under-expenditure is mainly attributed to significant capacity constraints within both the national and provincial departments with regard to the availability of human resources; grant management ability; inadequate supply chain management skills; and a lack of budgeting and monitoring and evaluation skills. Under-expenditure of grant allocations at year-end is generally accompanied by requests for roll-overs. The approval of rolled-over funds in most cases was not a guarantee in itself that the rolled-over funds are spent according to the grant framework. National Treasury as the approver was accordingly advised to strengthen its oversight over roll-over requests and was requested to report to Parliament whether the rolled-over funds were spent accordingly. Fiscal dumping1 is also a major feature of some grants, which in turn undermines the credibility of the grant expenditure. In addition, when fiscal dumping takes place, funds are usually spent on goods and services that are unrelated to the purpose of the grant. Expenditure of grant allocations is sometimes used to fund other operational expenses such as staff salaries which is not compliant with the conditional grant framework. Fiscal dumping refers to the expenditure phenomenon whereby departments under-spend significantly on their budget in the first nine months of the financial year, only to spend a greater proportion (i.e. between 40 to 50 percent) of their allocated budgets in the fourth and final quarter of the financial year. 8 Reporting of grant expenditure against projected quarterly budget targets is lacking, which made it difficult for the Committee to gauge whether grant expenditure is on track or deviating from planned expenditure. This highlights the need for national departments, together with provincial departments and National Treasury, to develop sectoral budgeting norms per quarter that takes into account the nature and implementation conditions of the relevant sector. Reporting of non-financial performance information has also been poor. Both national and provincial departments would report on service delivery outputs but in the absence of predetermined targets. This kind of reporting is meaningless because it does not allow the Committee to perform its oversight role in determining whether grant spending is resulting in the desired service delivery outcomes. The Committee in its oversight over provincial conditional grants have made countless recommendations in respect of improving both the quality of grant spending and service delivery outputs and the reporting thereof. The Committee has also made follow-ups regarding the implementation of its recommendations in order to ensure progress is made with regard to the quality of conditional grant spending and service delivery outputs with the intent purpose of supporting departments in achieving the goals of the grant. 4. Legislation The following pieces of legislation were referred to the Committee and processed during the 4 th Parliament: Year Name of Legislation Tagging Objectives 2009/10 No Legislation was referred. The Committee operated with effect from 2010. Not applicable Not applicable 2010/11 Division of Revenue Bill [B4 – 2010] Section 76 Appropriation Bill [B3 – 2010] Division of Revenue Amendment Bill [B35 – 2010] Section 75 To provide for the equitable division of revenue raised nationally among the national, provincial and local spheres of government for the 2011/12 financial year To appropriate money from the National Revenue Fund for the requirements of the State for the 2011/12 financial year. To provide for the equitable division of revenue raised nationally among the national, provincial and local spheres of government for the 2011/12 financial year Section 76 9 Completed/Not Completed Not applicable Completed Completed Completed Year 2011/12 2012/13 Name of Legislation Tagging Objectives Adjustments Appropriation Bill [B34 – 2010] Section 77 To appropriate adjusted funds to all three spheres of government Finance Bill [B5 – 2012] Section 77 To approve unauthorised expenditure Completed Additional Adjustment Appropriation Bill [B6 – 2012] Section 77 Completed Division of Revenue Bill [B4 – 2011] Section 76 Appropriation Bill [B3 – 2011] Division of Revenue Amendment Bill [B17 – 2011] Adjustments Appropriation Bill [B18 – 2011] Section 75 To appropriate an additional amount of money for the requirements of the Department of Transport for the 2011/12 financial year to support the SA National Roads Agency in paying debt relating to the Gauteng Freeway Improvement Project To provide for the equitable division of revenue raised nationally among the national, provincial and local spheres of government for the 2011/12 financial year To appropriate money from the National Revenue Fund for the requirements of the State for the 2011/12 financial year. To provide for the equitable division of revenue raised nationally among the national, provincial and local spheres of government for the 2011/12 financial year To appropriate adjusted funds to all three spheres of government Division of Revenue Bill [B4 – 2012] Section 76 Completed Appropriation Bill [B3 – 2012] Section 77 To provide for the equitable division of revenue raised nationally among the national, provincial and local spheres of government for the 2012/13 financial year To appropriate money from the National Revenue Fund for the requirements of the State for the 2012/13 financial year. Division of Revenue Amendment Bill [33-2012] Section 76 To provide for the equitable division of revenue raised nationally among the national, provincial and local spheres of government for the 2012/13 financial year Completed Section 76 Section 77 10 Completed/Not Completed Completed Completed Completed Completed Completed Completed Year 2013/14 Name of Legislation Tagging Objectives Adjustments Appropriation Bill [B32-2012] Section 77 To appropriate adjusted funds to all three spheres of government Division of Revenue Bill [B2 - 2013] Section 76 Appropriation Bill [B1 – 2013] Division of Revenue Amendment Bill [38 -2013] Section 77 Adjustments Appropriation Bill [B37 -2013] Division of Revenue Bill [B5 – 2014] Section 77 To provide for the equitable division of revenue raised nationally among the national, provincial and local spheres of government for the 2013/14 financial year To appropriate money from the National Revenue Fund for the requirements of the State for the 2013/14 financial year. To provide for the equitable division of revenue raised nationally among the national, provincial and local spheres of government for the 2013/14 financial year To appropriate adjusted funds to all three spheres of government To provide for the equitable division of revenue raised nationally among the national, provincial and local spheres of government for the 2014/15 financial year Section 76 Section 76 Completed/Not Completed Completed Completed Completed Completed Completed Completed (on 25 March 2014) a) Challenges emerging The following challenges emerged during the processing of legislation: Technical/operational challenges that were encountered relate to constraints created by the Parliamentary Programme that at times would not provide sufficient time for the Committee to comply with time frames in terms of the Money Bills Amendment Procedure and Related Matters Act, 2009 as well as Mandating Procedures of Provinces Act, 2008. This in some instances led to clashes in NCOP processes with some Provincial Legislature processes. Content-related challenges: 11 Although over the course of the Fourth Parliament, the Committee has not proposed any amendments to the Division of Revenue Bills, the Committee has raised a number of issues for consideration by the Minister of Finance. Some of the issues that were raised during the Committee interaction with National Treasury and also in Committee Reports are as follows: - Strengthening payment schedules of conditional grants to create certainty for receiving institutions; - How to avoid the unintended consequences of withholding of funds; - Ensuring that devolution of functions to other spheres of government does not lead to unfunded mandates, by making sure that funding follows functions; - Poor infrastructure management (maintenance and repairs) by municipalities that contributes to increasing backlogs, aging infrastructure, wastage/spillage and poor service delivery; - Revision of local government equitable share of revenue formula; and - Provision of funding to ensure that changes in municipal boundaries that lead to merging of certain municipalities minimise unintended consequences such as inheritance of debts, backlogs and contractual obligations. b) Issues for follow-up The 5th Parliament should consider following up on the following concerns that arose: During the 5th Parliament the Committee should ensure that its legislative plans and processes are timeously shared with the Provincial Legislatures as well as Parliament as a whole to ensure that there is an alignment of plans and processes within Parliament and also Legislatures. 5. Oversight trips undertaken The following oversight trips were undertaken: Date Area Visited Objective 27- 30 July 2010 Eastern Cape Meetings with identified Eastern Cape municipalities and other stakeholders Issues to be followed up from Committee Recommendations 12 A joint follow-up visit with the Select Committee on Local Government and Traditional Affairs, to ascertain the progress made with implementation of commitments by stakeholders in trying to assist the Status of Report Adopted by House Date Area Visited Objective Issues to be followed up from Committee Recommendations Status of Report above municipalities, should be considered. The Public Protector should investigate the misappropriation of funds by municipalities. The National and Provincial Department of Cooperative Governance, the Auditor-General, Provincial and National Treasury should contribute to the Municipal Turnaround Strategy by developing tools to assist municipalities to comply with all provisions of the Municipal Finance Management Act. 16-19 August 2011 Free State Site visit to Pelonomi Hospital to monitor progress with the Hospital Revitalisation Project The Free State Health Department should work closely with and support the consultants it appoints to monitor the quality of work of contractors and furthermore be vigilant and make every effort to avoid overspending on its projects. Adopted by House 14 October 2011 North West Briefings by provincial departments and to visit hospitals, community libraries and road maintenance projects to monitor spending on conditional grants The national Department of Health should investigate factors contributing to the escalating costs of hospital projects. Adopted by House 24 – 27 January 2012 Northern Cape Interact with the Northern Cape Department of Education on their conditional grant spending. 13 The National Department of Health should conduct thorough investigations into the Northern Cape Mental Health Hospital Project, as the completion date was shifted back yearly and the costs kept escalating. The Northern Cape Department of Health should Adopted by House Date Area Visited Objective 21-24 August 2012 21-24 August 2012 Issues to be followed up from Committee Recommendations Assess the performance of these grants as at the end of the third quarter of the 2011/12 financial year. Interact with the Northern Cape Department of Health on Hospital Revitalisation Grant projects. View and verify the progress made thus far on these projects. Ascertain how much has been spent on these projects to date and the projected overall cost of each project. Find out if project management principles are adhered to. Ascertain the completion dates of the projects. Engage with five identified municipalities on 14 Status of Report refrain from contravening the Division of Revenue Act by spending conditional grant funds meant for other projects on the Northern Cape Mental Health Project. The capacity of the Northern Cape provincial departments of Education and of Health to manage capital infrastructure projects was a concern and the Committee recommended that the national departments of Basic Education and Health should consider providing in-house building engineers to these provincial departments. The Committee further recommended that the Northern Cape Department of Education consider utilising the 5 percent allocation for staff within each conditional grant to employ project managers and support staff to manage grants. Measures taken to improve audit outcomes of municipalities. Steps taken to enforce municipalities’ compliance Adopted by House Date Area Visited Objective Issues to be followed up from Committee Recommendations issues regarding service delivery and the prudent management of financial resources Visit identified projects to monitor whether resources are being spent in an efficient manner, promoting delivery of services to communities. Status of Report with legislation and policies. Follow up on servicing of ESKOM debt by Randfontein Local Municipality. Follow-up on steps taken against employees who failed to disclose their interests. Action taken against section 21 schools who owe municipalities. Measures in place to minimise losses of water and electricity in municipalities. a) Challenges emerging The following challenges emerged during the oversight visits: Technical/operational challenges encountered have to do with the congested Parliamentary and NCOP Programmes and activities that at times led to the cancellation of planned oversight trips. b) Issues for follow-up The 5th Parliament should consider following up on the following concerns that arose: 6. To ensure that Committee oversight activities are not compromised by other Parliament/NCOP Programmes and activities Study tours undertaken 15 No study tours were undertaken due to time constraints and Parliamentary Programmes /activities. 7. International Agreements and protocols: Year 2011 Nature of the agreement Trade agreement 2011 Protocol 8. Purpose Agreement between Republic of South Africa and Republic of Kenya for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income. Protocol between the Government of the Republic of South Africa and the Government of the United Kingdom of Great Britain and Northern Ireland to amend the conversion for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and on capital gains Completion Completed Completed Statutory appointments In terms of subsections 15(5) (a) and (b) of the Money Bills Amendment Procedure and Related Matters, Act 2009, the Committee must recommend to the House a person for appointment as the Director of the Parliamentary Budget Office, as well as the conditions of service including the salary of the Director. The following appointment was made: Date 9 May 2013 Type of appointment Director of Parliamentary Budget Office Period of appointment Five years a) Challenges emerging The following challenges emerged during the statutory appointments: 16 Status of Report Adopted by House Technical/operational challenges were due to a lack of clarity on the appropriate procedure to be followed when appointing the Director for the Parliamentary Budget Office. In terms of section 15(7) of the Act, any Committee considering making a recommendation for the appointment of the Director for the Parliamentary Budget Office must do so in an open and transparent manner. This section however does not unequivocally stipulate that a formal interview process should be followed hence no formal interviews were conducted when the current Director was recommended for appointment. b) Issues for follow-up The 5th Parliament should consider following up on the following concerns that arose: 9. The Committee during the 5th Parliament should ensure that the procedure to be followed when appointing the Director for the Parliamentary Budget Office is unequivocally stipulated by means of either legislation/Rules/policies to avoid any ambiguity in this process. Interventions No interventions were referred to the Committee. 10. Petitions No petitions were referred to the Committee. 11. Obligations conferred on Committee by legislation: As mentioned above, the Committee was established in terms of Section 4(3) of the Money Bills Act. According to Section 4(4) of this Act, “a committee on appropriations [in the National Council of Provinces] has the power and functions conferred to it by the Constitution, legislation, the standing rules or a resolution of a House, including the considering and reporting on(a) spending issues; 17 (b) amendments to the Division of Revenue Bill, the Appropriation Bill, Supplementary Appropriations Bills and the Adjustment Appropriations Bill; (c) recommendations of the Financial and Fiscal Commission, including those referred to in the Intergovernmental Fiscal Relations Act, 1997 (No. 97 of 1997); (d) reports on actual expenditure published by the National Treasury; and (e) any other related matter set out in this Act.” 12. Summary of outstanding issues relating to the department/entities that the Committee has been grappling with The following key issues are outstanding from the Committee’s activities during the 4 th Parliament: Responsibility Department of Higher Education National Department of Transport Department of Human Settlements 13. Issue(s) Response to the Committee Report dated 09 October 2013 Response to the Committee Report dated 09 October 2013 Response to the Committee Report dated 09 October 2013 Recommendations As indicated earlier on there is a need for proper planning and alignment of the Parliamentary Programme and activities of the two Houses of Parliament as well as Provincial Legislatures to enable the Committee to comply with legislative processes as well as its oversight work. 14. Committee strategic plan The Committee held its first strategic planning workshop during March 2011. An updated strategic plan was adopted during a second workshop on 26 July 2012. 18 19