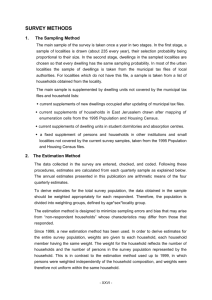

Paper 3.2. Accounting for the Diversity of Rural Income Sources in

advertisement