EIB prices 3-year US$ 3bn Global bond

advertisement

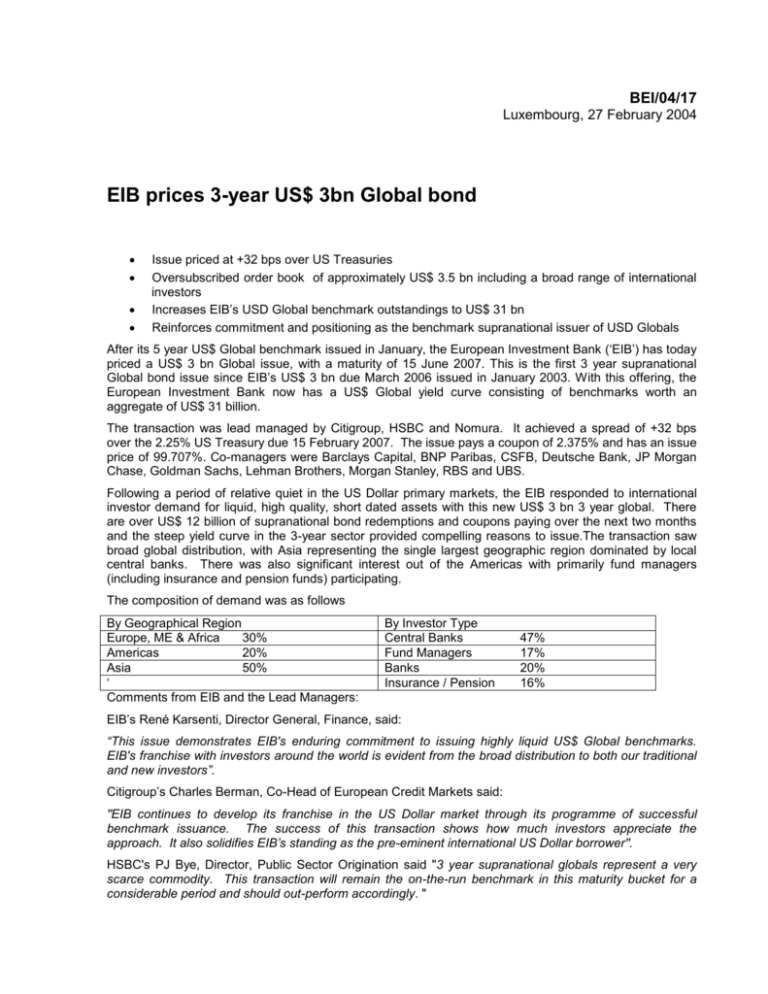

BEI/04/17 Luxembourg, 27 February 2004 EIB prices 3-year US$ 3bn Global bond Issue priced at +32 bps over US Treasuries Oversubscribed order book of approximately US$ 3.5 bn including a broad range of international investors Increases EIB’s USD Global benchmark outstandings to US$ 31 bn Reinforces commitment and positioning as the benchmark supranational issuer of USD Globals After its 5 year US$ Global benchmark issued in January, the European Investment Bank (‘EIB’) has today priced a US$ 3 bn Global issue, with a maturity of 15 June 2007. This is the first 3 year supranational Global bond issue since EIB’s US$ 3 bn due March 2006 issued in January 2003. With this offering, the European Investment Bank now has a US$ Global yield curve consisting of benchmarks worth an aggregate of US$ 31 billion. The transaction was lead managed by Citigroup, HSBC and Nomura. It achieved a spread of +32 bps over the 2.25% US Treasury due 15 February 2007. The issue pays a coupon of 2.375% and has an issue price of 99.707%. Co-managers were Barclays Capital, BNP Paribas, CSFB, Deutsche Bank, JP Morgan Chase, Goldman Sachs, Lehman Brothers, Morgan Stanley, RBS and UBS. Following a period of relative quiet in the US Dollar primary markets, the EIB responded to international investor demand for liquid, high quality, short dated assets with this new US$ 3 bn 3 year global. There are over US$ 12 billion of supranational bond redemptions and coupons paying over the next two months and the steep yield curve in the 3-year sector provided compelling reasons to issue.The transaction saw broad global distribution, with Asia representing the single largest geographic region dominated by local central banks. There was also significant interest out of the Americas with primarily fund managers (including insurance and pension funds) participating. The composition of demand was as follows By Geographical Region Europe, ME & Africa 30% Americas 20% Asia 50% ‘ Comments from EIB and the Lead Managers: By Investor Type Central Banks Fund Managers Banks Insurance / Pension 47% 17% 20% 16% EIB’s René Karsenti, Director General, Finance, said: “This issue demonstrates EIB's enduring commitment to issuing highly liquid US$ Global benchmarks. EIB's franchise with investors around the world is evident from the broad distribution to both our traditional and new investors”. Citigroup’s Charles Berman, Co-Head of European Credit Markets said: "EIB continues to develop its franchise in the US Dollar market through its programme of successful benchmark issuance. The success of this transaction shows how much investors appreciate the approach. It also solidifies EIB’s standing as the pre-eminent international US Dollar borrower". HSBC's PJ Bye, Director, Public Sector Origination said "3 year supranational globals represent a very scarce commodity. This transaction will remain the on-the-run benchmark in this maturity bucket for a considerable period and should out-perform accordingly. " Brian Lawson, Chief Operating Officer at Nomura added that "This was an exceptional deal. This transaction has truly been a tremendous success for all parties involved. EIB has delivered a well priced 3 year USD issue that was the perfect fit for our global investor base, with first rate order books from Asia and Japan. There will not be many other oversubscribed USD 3bn transactions under the current adverse market conditions and the strong response seen from investors worldwide and the co-lead group is a great testament to EIB. It was a pleasure working with our lead management partners and the borrower. In the period after pricing, despite a 0.75bp move wider in swap spreads, the deal maintained its spread to Treasuries at +32/+31, thus demonstrating a positive performance from the outset" EIB’s US$ issuance program The USD funding strategy is based on a foundation of liquidity, transparency and investor diversification, and comprises global bond issuance, targeted eurodollar issues and structured transactions. 2003 was a record year for EIB US Dollar issuance, with overall volume reaching US$13.6 bn. This in particular reflected growth in the number and volume of structured transactions. So far this year EIB’s US Dollar issuance accounts for US$ 7.2 bn. Background information on EIB Owned by the European Union Member States, the EIB is the EU’s long-term lending institution, financing projects that promote European economic development and integration. Besides supporting projects in the Member States, its main lending priorities include financing investments to prepare the economies of the EU Accession Countries. The EIB operates on a non-profit maximising basis and lends at close to the cost of borrowing. The Bank has AAA credit ratings with a stable outlook. In 2003, EIB borrowed nearly EUR 42 billion, which consolidates its position as the largest supranational borrower. In 2004 EIB plans to issue around EUR 47 bn. So far this year the EIB has raised more than EUR 10 bn, in 10 different currencies. For further information please contact: Eila Kreivi, EIB: Tel: +352 4379 4234, e.kreivi@eib.org Sandeep Dhawan, EIB: Tel: +352 4379 4227, s.dhawan@eib.org http://www.eib.org/investor_info/