Comparison of Workers` Compensation Arrangements for Asbestos

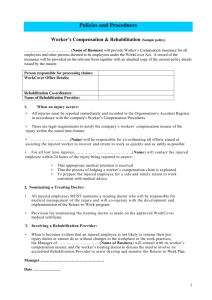

advertisement