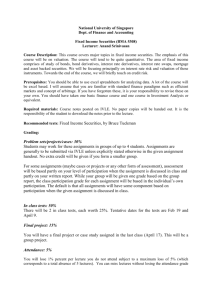

Reuters Fixed Income Services Financial Glossary

advertisement