AGEC $424$ EXAM 2 (125 points)

advertisement

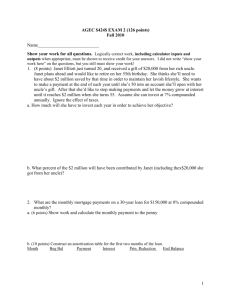

AGEC $424$ EXAM 2 (121 points) Spring 2011 Name___________________________ Show your work for all questions. Logically correct work, including calculator inputs and outputs when appropriate, must be shown to receive credit for your answers. I did not write “show your work here” on the questions, but you still must show your work! 1. (8 points) Merritt Manufacturing needs to accumulate $20 million to retire a bond issue that matures in 13 years. The firm’s manufacturing division can contribute $100,000 per quarter to an account that will pay 8%, compounded quarterly. How much will the remaining divisions have to contribute every month to a second account that pays 6% compounded monthly in order to reach the $20 million goal? 2. What are the monthly mortgage payments on a 30-year loan for $150,000 at 5% compounded monthly? a. (6 points) Show work and calculate the monthly payment (round to the penny) b. (10 points) Construct an amortization table for the first two months of the loan. Month Beg Bal Payment Interest Prin. Reduction End Balance 1 3. Adam Wilson just purchased a home and took out a $250,000 mortgage for 30 years at 8%, compounded monthly. a. (3 points) How much is Adam’s monthly mortgage payment (round to the penny)? b. (3 points) How much sooner would Adam pay off his mortgage if he made an additional $100 payment each month? c. (4 points) Assume Adam makes his normal mortgage payments and at the end of five years, he refinances the balance of his loan at 6%. i. What is the balance when he refinances? ii. If he continues to make the same mortgage payments, how soon after the first five years will he pay off his mortgage? 4. (3 points) First Bank offers you a car loan at an annual interest rate of 10% compounded monthly. What effective annual interest rate is the bank charging you? 5. (4 points) You want to purchase a beach house for $220,000, funding as much of the cost as possible with a home mortgage loan. Banks are currently offering standard thirty year mortgages at 8% (monthly compounding). Unfortunately, you can only afford payments of $1,500 per month. How much cash will you need for a down payment in order to buy the home? 2 6. (3 points) Ralph has decided to put $2,400 a year (at the end of each year) into an IRA over his 40 year working life and then retire. What will Ralph have at retirement if the account earns 10 percent compounded annually? 7. (5 points) J&J Manufacturing issued a bond with a $1,000 par value. The bond has a coupon rate of 7% and makes payments semiannually. If the bond has 30 years remaining and the annual market interest rate is 9.4%, what will the bond sell for today? 8. (4 points) If a 30-year, $1,000 bond has a 9% coupon and is currently selling for $826, its current yield is: 9. (5 points) Williamson Inc.’s bonds have a coupon rate of 12% and a par value of $1,000. The bonds have 15 years left to maturity. If Williamson’s bonds are currently selling for $1,430, calculate their yield to maturity. Assume semiannual coupon payments. 10. (5 points) Assume the Thompson Tires bond in #4 is callable in 5 years with a $50 call premium. What is the YTC? 11. (5 points) Undue Perversity Inc. has a 10 year, callable, semiannual, $1000 face value, 12% coupon bond for sale. It is callable in 3 years with a $100 call premium. If comparable bonds of this risk yield 6% and you expect this bond to be called, what is its value? 3 12. (5 points) A stock just paid a $2.00 dividend that is anticipated to grow at 6% indefinitely. Similar stocks are returning about 13%. The estimated selling price of this stock is: 13. (14 points) The Miller Milk Company has just come up with a new lactose free dessert product for people who can’t eat or drink ordinary dairy products. Management expects the new product to fuel sales growth at 30% for about two years. After that competitors will copy the idea and produce similar products, and growth will return to about 3% which is normal for the dairy industry in the area. Miller recently paid an annual dividend of $2.60, which will grow with the company. The return on stocks like the Miller Company is typically around 10%. What is the most you would pay for a share of Miller? 14. (4 points) Elephant Company common stock has a beta of 1.2. The risk-free rate is 6 percent and the expected market rate of return is 12 percent. Determine the required rate of return on the security. 15. (6 points) Stock X paid a dividend of $2.50 yesterday. It is expected to grow at 7% indefinitely. X’s return generally responds to market changes twice as much as does the average stock. Treasury bills currently yield 8%. The market is yielding 11%. What should X sell for today? 4 16. (2 points) Determine the beta of a portfolio consisting of equal investments in the following common stocks: Security Beta Apple Computer 1.15 Coca-Cola 1.05 Harley-Davidson 1.50 Homestake Mining 0.50 17. (2 points) The underlying principles of portfolio theory include: a. diversifying business-specific risk away. b. basing decisions on stocks’ risk/return characteristics in a portfolio context rather than on a stand-alone basis. c. getting the highest available return for the amount of risk the investor is comfortable with. d. all of the above 18. (2 points) Market risk: a. is the degree to which a stock’s return moves with the market’s return. b. is caused by things that affect specific companies or industries. c. can be diversified away. d. is the chance of losing money in the stock market. 19. (2 points) The use of fixed-cost financing is referred to as: a. operating leverage. b. a leveraged buyout. c. financial leverage. d. combined leverage. 20. (2 points) The degree of financial leverage is measured by relating the percentage change in earnings per share to the percentage change in: a. sales. b. EBIT. c. debt ratio. d. share price. 21. (2 points) A statistic known as a stock’s beta coefficient measures: a. total risk. b. systematic or market risk. c. unsystematic or business-specific risk. d. none of the above 5 22. (3 points) Assume the facts below about a single product firm. What is the firm’s annual breakeven volume in sales revenues? Selling price per unit = $25.00 Variable costs per unit = $20.00 Total annual fixed costs = $30,000 23. (3 points) Porter Productions sells videotapes for $15.00 each. Their variable cost per unit is $9.00. In addition, they incur $180,000 in fixed costs each year. At 40,000 units of sale, what is Porter’s degree of operating leverage (DOL)? 24. (3 points) Illinois Tool Company’s (ITC) degree of total leverage (DTL) is 3.00 at a sales volume of $9 million. Determine ITC’s percentage change in earnings per share (EPS) if forecasted sales increase by 20 percent to $10,800,000. 25. (3 points) A DFL (degree of financial leverage) of 3.0 indicates that a 27% increase in EPS is the result of a _____ increase in EBIT. 26. (4 points extra credit) Use the following information to calculate expected return, variance, standard deviation, and coefficient of variation of Macadam Corp.’s returns. State Probability Return Boom .20 40% Normal .60 15% Recession .20 (20%) 6