2-draft law for insolvency and precautionary conciliation

advertisement

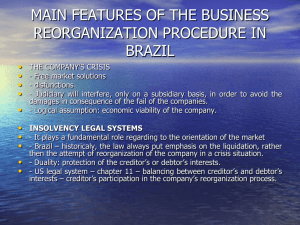

مركز المشروعات الدولية الخاصة PAPER ON POLICY MEASURES DRAFT LAW FOR INSOLVENCY AND PRECAUTIONARY CONCILIATION PREPARED BY FEDERATION OF EGYPTIAN DEVELOPMENT ASSOCIATIONS APRIL 2010 Introduction Economic reform policies are required in any country under the free market conditions. Those countries which can hasten the harmonization of their legal systems to cope with the current global changes would achieve the economic growth which in turn maintain the attraction of foreign direct investments. The issuance of a law on bankruptcy and precautionary conciliation in Egypt will considerably help make qualitative progress which would attract and prmote domestic as well as foreign direct investments. This law is expected to improve the position of Egypt in the related international ratings which usually put Egypt in a lower status in comparison with other countries whose governments seek direct and easy opportunities to withdraw themselves safely from the market. It is deemed that a package of policies and procedures to regulate bankruptcy (insolvency) will give the law the credibility which helps realize the required objective. Moreover, it is necessary for countries to put into consideration providing a package of encouraging policies and procedures to enhance the re-operation of projects which had no other option other than bankruptcy. We would like to thank our partners in the governorates of Port Said, Alexandria and Dakahliya for their active participation in enriching the discussions of this subject throughout three months. Their contributions made it easier for legal experts to draft the basic rules and policies of the law. Special thanks for the Center for International Private Enterprise (CIPE) for its effective directives throughout this activity period. We would also like to thank our colleagues members of the Federation for Egyptian Development Associations (FEDA), Prof. Dr. Mohamed Ahmed Abdel Na’eem Professor of Law in Ain Shams University, Mr. Adel El Ezaby ‘businessman’, Mr. Mohamed Elsayed Seleem and Mr. Wa’el Mohamed Abdu ‘lawyers’ and all the other participants for their contributions. Engineer Fouad Thabet Basic Policies of the Draft Insolvency Law It is necessary to pose certain significant questions which must be put into consideration while putting the basic policies of the suggested new Insolvency (Bankruptcy) Law: - What is the objective of the suggested Insolvency (Bankruptcy) and - Precautionary Conciliation Law? Does it aim to stop penalizing a bankrupt business or to find solutions for such a business in order to continue? What are the results of such an option? What are the interests that will be affected by this option? How can we prioritize these effects? The response of legislators and the judiciary to such questions will have a considerable and direct effect on the extent of economic freedoms and welfare in any country because this law exposes the possible success of the rehabilitation process of the insolvent business. For example, if a law is biased to the creditor’s interests, such a bias would represent a penalty for the creditor who takes risks and becomes inventive; and would also frighten project owners who at the end of the day may have to quit the market. However, the creditor may make a new attempt in a successful risk which could be fruitful not only for the project owner and his creditors but also for the project employees and the consumers. On the other hand, if the insolvency law is drafted in such a manner to make it very sympathetic with the bankrupt debtor, it would incite excessive caution of the creditors who, as a result, may refrain from lending and consequently, project owners would not get the finance which the creditors were willing to provide. In addition to the balanced interests of both the debtors and creditors, we have to determine which methods can secure the best possible benefit from capital utilization and distinguish between diligent borrowers and those who abuse the situation. These methods include quick, fair and participatory liquidation and rehabilitation of the insolvent business and protect the interests of the other parties such as the employees, clients and tax authorities. Chapter Eleven of the U.S. Bankruptcy Code stipulated to consider the financial reorganization and restructuring of an insolvent business so that it may continue to operate, provide job opportunities for the unemployed, pay due debts and generate profits for their shareholders. The Legal and Procedural Framework of Insolvency Systems: 1. Basic Objectives and Policies: Although methods differ from one country to another, effective insolvency systems must aim at: o Integration with the broader legal and trade systems of the country. o Augmentation of the business’s assets as much as possible and repayment of the creditors’ dues. o Preparation for efficient liquidation of the businesses which are unable to continue and whose liquidation will lead to the highest yield for creditors on one hand and to the reorganization of businesses which have the potential to continue on the other hand. o Securing fair treatment for both national and foreign creditors in the same situation. o Realization of a balanced relation between liquidation and reorganization and allowance to change easily from one procedure to another. o Reaching quick, effective and impartial solutions for insolvency cases. o Prevention of inconvenient utilization of insolvency cases. o Preventing the individual creditors, who seek quick solutions, from disposing of the debtor’s assets before the allocated time. o Providing transparent measures including applicable rules and incentives for data collection and presentation. o Respecting the claims’ priorities through stable and predictable procedures. o Preparing a framework for cross-border solvency cases and recognition of foreign procedures. 2. The Legal and Procedural Framework of Insolvency: Fair courts – reporting and information. Procedures’ initiation – legibility – ability to use. Temporary measures and effective initiation of procedures. Corporate governance. Creditors and creditors’ Committee. Assets collection, retention and management. Maintaining business stability and operation. Handling contractual obligations. Claims and procedures of solution (dealing with creditor rights and priorities). o Claims settlement, reorganization, planning and targeting. o o o o o o o o o o International considerations. Package of Procedures and Policies for Insolvency Prevention: It is important to confirm the package of the following procedures and policies while considering the insolvency and precautionary conciliation law in addition to the procedural framework and effects of insolvency: The competent court invites the creditors and suggests conciliation. Considering the creditors’ rights according to ratios decided by law. The obligations of the trader or creditor applying for settlement. Obliging the trader, in case of filling an insolvency petition, to provide the court with his books kept according to the norms which should cover ( a specified minimum number of years) or since the date he started commercial operation whatever is more. Detailed list of the business activities. Definition of all the creditors, the amount of debt for and the address of each creditor. Clarification and justification of the causes for requesting settlement. Details and ratios of the offer presented to the creditors. Determining the minimum accepted level in connection with the debt value, the period or the collateral. Definition of the conditions and cases of creditors’ entitlement to assigned percentages. Determination of the guarantees to be presented (in kind or personal guarantees). Definition of the effects of demanding regular and guaranteed loans and taxes on other parties rather than the creditors. Procedures in case the filled petition is accepted. Notification of creditors and deciding the place and date for the meeting of the parties. Definition of the mechanism of objection of documents and debts. Appointment of a supervisor from non creditors to supervise the debtor’s works (as the debtor is not deprived of the right to manage his own funds in this stage). Definition of the supervisor’s functions, the contents of his report and to whom the report is to be presented. (The supervisor’s fees are to be decided by a court decision. The law decides when the mechanism and the supervisor’s functions would come to an end). Definitions of actions the debtor is not allowed to do (and the subsequent procedures in case of non compliance). Definition of procedures to be taken in light of the report of the custodian. Definition of the creditors rights to information and objection (including periods). Definition of the majority required to approve conciliation. Definition of the debts which are not entitled to participate in voting. Definition of the conditions for the participation of senior and secured debt creditors. The impact of the participation of secured debts; and the situation in case conciliation is not approved. It is suggested that the draft law stipulates that “disapproving conciliation shall not necessarily lead to bankruptcy”. Judicial intervention may start at this point with certain controls and conditions. Procedures to announce the conciliation approval decision. The effect of the conciliation approval decision on the debtor’s partners, the debtor and the creditors. Definition of the parties and periods for objection of the decision. Definition of the restrictions which the debtor must comply with (selling, mortgage or assignment operations not required by the nature of the debtor’s work). Conditions and procedures of conciliation cancellation and resorting to bankruptcy. Fair Courts, Reporting and Information: For the protection of the parties’ rights and interests while implementing insolvency procedures, it is necessary that the parties have the right to express their opinions and to be informed with matters which affect their rights. They must gain access to the information which enable them to protect their rights and interests and to settle their disputes effectively. To achieve these objectives, the insolvency system must contain the following: A quick and suitable mechanism to inform the concerned parties with the procedures or matters which affect their interests. The insolvency system must regulate appeal procedures and promote the quick, good and unbiased settlement of disputes. As a general rule, appeal procedures should not stop insolvency procedures. The debtor must be obliged to disclose the information related to his business and financial affairs in details and as sufficient to enable the court, the creditors and the concerned parties to evaluate in an acceptable and convenient manner the possibilities of business reorganization. To make available a method that allows the appointment of experts to investigate, evaluate and obtain the essential information which enable decision taking. Such experts must be fair, unbiased and independent specialists. Initiation of Procedures (Eligibility, Usability and Effectiveness): Eligibility: o Insolvency procedures should apply on all commercial and industrial establishments be they owned by individuals, corporations, joint stock companies or even governmental companies. Any exception from this general rule must be defined and stipulated in a clear manner whether by virtue of a separate law or under special provisions of the new law for solvency and precautionary conciliation. Usability: o The application of the system must be efficient and economically feasible. Both the creditors and the debtors should have the right to file petitions for insolvency procedures. o The criteria for initiating insolvency procedures must be clearly defined in the law. The preferred option to start taking insolvency procedures is when the debtor is unable to repay his debts upon maturity. However, insolvency may take place when a debtor’s liabilities exceed the assets market value. o The debtor must be able to use the insolvency system easily and as soon as he provides the evidence that the basic criteria are satisfied. o If one of the creditors filed a petition for initiating procedures, the debtor has the right to be notified with the petition and has the right of defense against this notification. The court shall then issue an immediate decision either to start litigation procedures or to refuse the creditor’s petition. The Effectiveness of Procedures: o In case of filing a petition to initiate insolvency procedures and the court has not issued a decision concerning it, it is necessary to give a temporary guarantee or to take temporary procedures whenever necessary to protect the debtors’ assets and the shareholders’ interests on condition that the concerned parties shall be informed thereof. o Initiating insolvency procedures should prevent any inadmissible disposition of the debtors’ assets and lead to the suspension of all the procedures taken by the creditors for administered settlement of their dues or for obtaining compensation from the debtor or from his assets. o Legal suspension should be applied at the largest possible level and should include the biggest number of spheres to guarantee the rights in the assets used or operated by the debtor or found in his possession. o Creditors who have real estate collaterals should offer to stop the liquidation procedures in order to be able to recover the biggest possible amount of the assets through selling the debtors works in full or in part or selling the debtor’s productive units. They should also stop reorganization procedures if it becomes necessary to have a guarantee for reorganization. Governance: o When the liquidation procedures start, it is necessary to replace the management by a ‘receiver in insolvency’ who should be authorized to manage the debtor’s properties for the benefit of the creditors. Control on such properties should be handed over immediately to the ‘receiver in insolvency’ in case the creditors had filed a petition to initiate insolvency procedures. If this was necessary, a temporary manager shall be appointed to perform a specific function: to follow up the works and make sure that the creditors’ interests are protected. It shall be observed that there are three methodologies for the reorganization procedures process: 1. Procedures shall be controlled restrictively by an independent ‘receiver in insolvency’. 2. The top management remains responsible for corporate governance. 3. The ‘receiver in insolvency’ or an impartial and independent supervisor shall supervise the management. In the second and third cases, it is important to refer the management authority in full to the ‘receiver in insolvency’ if it was proved that the top management lacks efficiency, was negligent, participated in fraudulent action or misbehaved in any other form. Creditors and Creditors’ Committee: o The creditors’ role, rights, authorities and management must be defined together with the procedures. The creditors’ interests must be protected by suitable methods which enable them to follow up and effectively participate in the insolvency procedures in order to ensure that they are equitable and fair. The formation of a creditors’ committee is considered a preferred mechanism especially in cases where there is a big number of creditors. o In case such a committee is formed, the law should define its duties, functions, rules of membership, the quorum for decision taking, voting method and the way for managing its meetings. This committee should be consulted in non institutional matters related to the case. Its opinion must be heard in the essential decisions connected with the procedures. This committee must have the right to ask the debtor to give the necessary information related to the case and should act as a channel for collecting data and distributing them to other creditors. The committee must also have a role in bringing the creditors together to take decisions regarding vital matters. o In case of business reorganization, the creditor must have the right to participate in the procedures of restructuring and in choosing the ‘receiver in insolvency’. Collection, Conservation, Management and Disposal of Assets: Debtor’s obligations include insolvency of all what he possesses including debt burdened assets as well as assets obtained after the beginning of the case. Exceptions of some of the insolvent debtor’s possessions should be in the narrowest limits and as stipulated by law. After the beginning of insolvency procedures, the court or the ‘receiver in insolvency’ as appropriate should be allowed to take immediate steps to conserve the possessions subject to insolvency procedures and to protect the debtor’s establishment. The management system of the debtor’s possessions shall observe flexibility and transparency in handling these possessions so that disposal of the assets becomes efficient and yields the highest possible value. The system must allow, as necessary, to sell the assets free from any mortgage, concession or any other burdens on condition of observing the priorities of repayments from the disposed of assets. It is necessary to protect the rights and interests of the other owners of the assets if such assets are used during insolvency procedures by the ‘receiver in insolvency’ or the debtor. Preserving the Stability of Establishment Activities: The establishment should be allowed to operate in the normal manner. Transactions which do not represent part of the debtor’s regular activities and works should be subject to the court decision. While observing due diligence against risks, the establishment should be able to gain access to sound methods for commercial finance even if the finance conditions give it, in extraordinary circumstances, the status of a ‘priority creditor’. The objective is to enable the debtor to meet legal commercial requirements. Dealing with Contractual Obligations: To achieve the objectives of the insolvency procedures, the system must be allowed to interfere in contract implementation in cases where both the two parties of the contract have fulfilled their contractual obligations in full. Such an interference may mean to continue the contracts, refuse them or assign them. To benefit from contracts of high value, the receiver in insolvency should have the option to continue such contracts and to bear the obligations arising thereof. The implementation of such a condition shall not be obligatory except in special exceptional cases if the contract stipulated that “it will be terminated as soon as a petition is filed to initiate insolvency procedures or as soon as such procedures are started”. Exceptions from the general contractual rules in insolvency procedures shall be limited and stated very clear. Exceptions shall be allowed only for commercial necessities or for observing the interests of the society such as: 1. Observing the general clearance rights and the rules of nullity. 2. Observing the provisions of automatic termination, liquidation and closure contained in financial contracts. 3. Preventing the continuity or assignment of irreplaceable service contracts or exclusive contracts in cases where the law does not require contract fulfillment by another party. 4. Putting special rules to deal with labour contracts and collective labour contracts. Transactions to be Avoided: The debtor is not allowed to make any transactions outside his regular works after the beginning of the insolvency procedures or if practicing such actions is a part of an action required by a liquidator of deceased estate. Avoid cancellation of some transactions which began before the date of starting insolvency procedures or on such a date. This includes transactions which may contain fraud or preference treatments which took place when the project was insolvent or which led to the project insolvency. The “suspicion” period - during which a repayment may be considered as having the preference – must be somehow short for all the creditors in order to avoid any breach of the regular commercial contracts or the credit relations. Dealing with the Creditors’ Rights and Priorities: Insolvency procedures should take into consideration the creditors rights and the claims priorities which were approved prior to the initiation of such procedures according to the commercial laws or the other current laws in order to protect the legal anticipations of the creditors and to encourage more ability of prediction in trade relations. No deviation from this general rule should be allowed unless it is necessary to promote other binding policies such as policies which support the reorganization of the establishment or to magnify the value of the insolvent possessions to the highest possible degree. The priority rules should enable the creditors to see credit worthiness in harmony with the following additional principles: 1. The priorities of secured creditors on the guaranty funds must be respected. Those rights or amounts due to priority creditors as decided during the insolvency should not be delayed without their approval. The dues of secured creditors must be disbursed as soon as possible. 2. After distributing the guaranty funds to secured creditors, and after meeting the claims related to management costs and expenses, the distributable amounts remaining from the selling value should be distributed to other creditors each according to his share unless there are other binding conditions which justify giving priority to a certain category of the dues. As a general rule, sovereign debts should have the priority before the individuals’ debts. The categories of priority should be reduced to the least possible number. 3. The workers are a very important part of any establishment. It is necessary to strike the balance between the workers’ rights and those of other creditors. 4. In case of liquidation, the shareholders or project owners should not take any portion from the distributable amounts accrued from selling before the creditors’ rights are completely repaid. Claims, Settlements and Reorganization Procedures: Procedures for creditors’ notification and claims presentation should be cost effective, efficient and immediate. In spite of the necessity of having a strict system to examine claims and to assure claims validity, the settlements of disputes arising from claims, similar to all other disputes, should not be delayed. It shall not be allowed to delay insolvency procedures. The system must be promoted to allow easy implementation of the procedures, secure quick and efficient management, provide sufficient protection for all the concerned parties, encourage negotiations to prepare a commercial plan and to facilitate the adoption of this plan by a reasonable majority of creditors. The procedures of reorganization should include the following: 1. Plan preparation and revision: There should be a flexible methodology to prepare a plan in harmony with the essential requirements and designed to promote justice and prevent commercial exploitation. 2. Voting on the Plan: Creditors should be categorized according to their voting rights which, in turn, are decided according to the claim amounts of each creditor. All the claims and the voting rights of the employees should be dealt with in a manner that secures justice. The adoption of the plan should depend on clear criteria which aim to achieve justice amongst the creditors who have the same status, on estimating their relative priorities and according to the approval of the majority. At the same time, the creditors or the categories who oppose the plan should also take their share in the allocation of profits. In case of resorting to the court, courts usually respect the creditors’ decision which is based upon the approval the majority of creditors. 3. Plan Implementation and Amendment: Plan implementation should be supervised by an independent agency. The plan contents must be amendable (such as the creditors voting system if it is in favor of the creditors). The debtor’s failure or inability to implement the plan will be a good reason to terminate the plan and liquidate the insolvent possessions. 4. Acquittal and Binding Effects: The system should necessarily stipulate that the effects resulting from the implementation of the plan regarding acquittal, cancellation or change of debt shall be binding. As the plan is approved by the majority of creditors, the results of its implementation shall be binding for all the creditors including the minorities who had a different opinion. 5. Plan Cancellation and Termination: If it was found that the plan was approved by fraud, the plan must be revisited or cancelled. As soon as the plan is drafted and completed, it should stipulate terminating the procedures and enabling the project activities to continue under regular and normal conditions. International Considerations: Insolvency considerations may have international aspects. So, the legal system of the country should put clear rules regarding litigation, recognition of foreign provisions and cooperation with courts in different countries and in choosing the applicable law. The basic elements of the effective handling of affairs abroad include the following: 1. The recognition of foreign insolvency procedures should be clear and easily accessible. 2. Acquittal should take place immediately after recognizing foreign procedures for insolvency. 3. Representatives of foreign insolvency procedures shall have the right to approach the courts and other concerned agencies. 4. There shall be no distinction between national and foreign creditors. Principles of Public Policies for Insolvency Legal Systems: There are different system for handling insolvency. The most effective systems which have the same goals and targets should: involve in the general legal and commercial systems of the country, magnify the assets value of the establishment and the creditors chances to collect their monies, stipulate the possibility of liquidating the establishments which are incapable to exist and those whose liquidation will bring high yield for the creditors and stipulate the possibility of restructuring or reorganizing the establishments which can survive, set a balance between liquidation and restructure in a manner which makes it possible to change the procedures from one of them to the other, stipulate equal treatment for creditors with equal status without discrimination between national and foreign creditors, stipulate the necessity to issue the decisions of the insolvency creditors group in the appropriate time and in a neutral and effective manner, prevent abusing the insolvency systems, prevent premature stocking of the debtor’s assets by creditors seeking urgent court sentences, provide publicized measures which ensure and regularly apply clear rules for data collection and handling and observe the responsible positions and the incentives for data disclosure, observe the creditors rights, the established priority of claims and the ensured results, and provide a referential framework for cross-borders insolvency and recognition o foreign procedures. It shall be observed in insolvency procedures that if the establishment is unable to survive, legal intervention should be fast and decisive and the result of liquidation should be magnified for the benefit of the creditors. During liquidation it may be more beneficial to keep the establishment to be sold separately from the legal person. On the other hand, if the business is found viable for requalification, the value of its assets after qualification must be higher than the price of its liquidation. All the policies and procedures which must be included in the suggested law for insolvency and liquidation depend on the fact that to rescue an establishment it is essential to preserve its employees and to provide higher yields for its creditors. This depends on the establishment’s potential to continue its activities and to provide higher returns which benefit the establishment’s owners and the state as well. Formal and informal procedures should encourage policies to rescue establishments. Requalification makes it possible to take quick procedures to protect all the concerned parties and to negotiate on commercial plans. It allows the majority of creditors who support the plan to direct the activities and to oblige the other creditors with their decision provided there are suitable guarantees and supervision to ensure the safety of the procedures. Modern rescue policies in general face a wide spectrum of probabilities in the open and liberal trade markets. Because insolvency laws cannot be drafted in rigid templates, modern systems depend generally on the broad lines which realize the above mentioned objectives. The Institutional and Organizational Framework: An effective insolvency system depends to a big extent on the presence of strong institutions and organizations. The institutional and organizational framework should include three main components: the institutions responsible for insolvency procedures, the operation systems through which judgments are issued and the necessary elements for securing impartiality. Impartiality is the corner stone for the success of an insolvency system. Important Considerations to Establish a Suitable Environment for Investments: Transparency, Accountability and Corporate Governance: There should be a reasonable level of transparency, accountability and corporate governance to secure cooperation and exchange of information. Disclosure of important information including balance sheets, statistics and detailed list of cash flows is required for accurate risk assessment. International accountancy and auditing principles must be adopted to enable the creditors to assess credit risks and to supervise the debtor’s financial position and to improve his project potentials to survive. Implementation of reforms and fair treatment for all the parties and prevention of unacceptable practices require a stable and reliable legal framework and judiciary system. The Corporate Law and its Regulations should include guidelines for the debtor’s shareholders. The company’s board of directors must be responsible, accountable, independent and committed to the optimal rules of corporate governance. Impartial law enforcement is indispensable and inevitable. The effect of creditors rights and insolvency systems are interrelated and depend on each other together with the other additional systems. They become stronger when good practices prevail throughout the legal system and concerning the trade laws in particular. The principles of transparency, accountability and corporate governance are the corner stone in the package of policies and legal and organizational procedures of the bankruptcy and insolvency law especially at the early stage of credit granting and during the credit duration. They are essential for risk management and in particular when the debtor faces apparent financial hurdles which make the creditor seek an end for the credit. Creditors need to be assured that their investments are safe. Such an assurance can be built through continuous follow up before and after the rescheduling process or after the implementation of the project reorganization plan: From the debtor’s point of view, the continuous development of the money market is reflected on the changing price of the financial tools of the co-creditors. Loans may be obtained from sources other than the conventional commercial banks, i.e. from leasing processes, an investment bank, risk insurance fund, insurance company, an investor in insolvent debts or a financial services provider. In addition, complex financial tools such as credit derivatives of the interest rates and currencies have become more common. Although such tools were meant in principle to mitigate risks during volatility periods of market, they may become higher than the assumed risk levels because they add mixed elements for liquidation and for tracking the infiltration of different risks. From the lender’s point of view, the main objective of a creditor - when it becomes apparent that the debtor’s business suffers financial hurdles and is about to become insolvent - is to try to magnify the value of the debtor’s assets in order to collect the biggest amount of the debt. The creditor’s support of the ‘exit plan’ – be it through reorganization and requalification or through liquidation - depends mainly on the efficiency of the available data. To restructure the budget of a certain company, the borrower must be in a situation that enables him to decide the feasibility of extending the debt duration, rescheduling the repayment on a longer period, postponing the repayment of debt interests, or transferring the debt to a syndicate loan accompanied by the encouragement to sell the essential assets and declare the non profitable activities. The economic value of the establishment should be assessed in order to evaluate the practical benefit of selling such an establishment, dispose of it or sell the dominant share of its stock. Such an assessment should be based on the consideration that the activities of the concerned establishment are continuous and that the establishment deserves liquidation once again in order to make clear the approach which can help the recovery of the investments.