Financial-Harm - COSLA Excellence Awards

advertisement

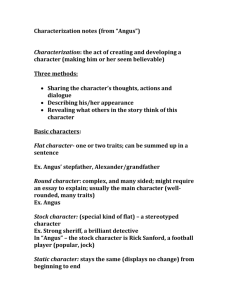

COSLA EXCELLENCE AWARDS 2015 APPLICATON FORM 01 APPLICATION FORM Please refer to the ‘2015 Guidance for Applicants’ before completing this application form. The application form is split over four sections. It is up to you to decide the content and length of each section, but your application must not exceed three pages in total (excluding the cover pages). Please ensure that your application covers the key criteria that we are looking for and is effectively presented. Any questions relating to your application or the submission process should be directed to awards@cosla.gov.uk or 0131 474 9275. The deadline for submission of entries is 5pm on Friday 24 October 2014. Submitting Your Application Form Please use our online application portal to submit this application form. 1 COSLA EXCELLENCE AWARDS 2015 APPLICATON FORM 02 PLEASE PROVIDE SOME DETAILS ABOUT YOUR APPLICATION: CATEGORY APPLIED FOR Service Innovation & Improvement PROJECT NAME (as you wish to see it published) Angus Financial Harm Sub Committee (AFHSC) LEAD ORGANISATION Angus Council DEPARTMENTS/TEAMS Trading Standards and Social Work PARTICIPANT NAMES OR PARTNER ORGANISATIONS Police Scotland Royal Bank of Scotland (RBS) Alzheimer’s Scotland Federation of Small Businesses (FSB) Citizens Advice Bureau (CAB) Post Offices in Angus Voluntary Action Angus (VAA) Angus Community Health Partnership (NHS) CONTACT NAME Peter Lennon CONTACT DETAILS LennonP@angus.gov.uk CAN WE PUBLISH THIS APPLICATION FORM ON OUR WEBSITE? 2 Yes COSLA EXCELLENCE AWARDS 2015 APPLICATON FORM 03 EXECUTIVE SUMMARY In one short paragraph please describe this project is about, what it has achieved, and why it is delivering excellence. The Angus Financial Harm Sub-Committee (AFHSC) is a sub-committee of Angus Adult Protection Committee involving officers from Angus Council, Police Scotland, voluntary sector partners and businesses, including financial institutions. The aim of AFHSC is to reduce the number of people being exposed to or suffering financial harm, reducing the amount of money lost to fraud and scams. AFHSC is innovative in that; It involves many external partners and drives actions for those partners; It increases the options for disposal of cases involving vulnerable adults; It uses technological solutions to protect victims and potential victims; It utilises the enforcement partners to visit victims and potential victims targeted by criminal gangs. The value of one operation (Operation Carpus1) was estimated to be £1 million in savings to vulnerable adults; It empowers key workers in daily contact with vulnerable adults to recognise signs of financial harm; It manages a constant stream of TV, radio, press and social media output to raise awareness of financial harm to the public and raise the profile of financial harm amongst the media; It has utilised existing resources to better effect to reduce harm to more vulnerable people. One user said “I have got my life back. I think “How did I let people get me like this?” Now I can protect myself - it is marvellous!” PLANNING What is your project about, and why is it important? What are you aiming to achieve, and how does this fit with the bigger picture? Does it tackle the issues that matter most to your community or your organisation? The AFHSC was formed in response to the increasing amount of financial harm occurring to people in Angus. The AFHSC has developed partnership methods of responding to both the broad issue of financial harm and also to specific cases. Prior to the AFHSC, police, trading standards and social work were already individually addressing financial harm by campaigns like “Doorstoppers” or through implementation of adult protection legislation. The AFHSC has united these departments and agencies into a single group enabling a coherent wide ranging response to the issue to be developed. The project is important because financial harm is such a massive problem. It is estimated that over £10 billion a year is lost in the UK to scams alone which equates to about £20 million a year in Angus. Since 2010 Angus adult protection statistics show that financial harm is over 3 times more prevalent than any other and that 80% of those victims also suffered other types of harm. Financial harm can come from many sources but most attacks come from either organised criminal gangs that perpetrate consumer scams or family members/acquaintances of the vulnerable with a “need” for money. Organised crime targets victims by doorstep, mail, phone and internet. There are six known instances of Angus residents losing their life savings, up to £140,000. In August 2014 criminals posing as bankers netted £1.3 million in Scotland. Five vulnerable elderly victims in Montrose lost over £90,000 collectively. The project also addresses local and national priorities: Scottish Government’s first priority for Police Scotland is “Make communities safer and reduce harm by tackling and investigating crime and demonstrating pioneering approaches to prevention and collaboration at a national and local level”. Financial Harm is a National Priority Work stream in the Scottish Government Adult Protection Section. “Safer and Stronger Communities” is specified as a national priority specified by the Scottish Government in the guidance on Single Outcome Agreements and Community Plans and “Communities that are safe, secure and vibrant” is a local outcome specified in the Angus SOA & Community Plan. 1 http://www.aapc.org.uk/pdfs/OperationCarpusSummaryAbstract.pdf 3 COSLA EXCELLENCE AWARDS 2015 APPLICATON FORM 04 DELIVERING How have you carried out your project? How did you ensure that this was done effectively? What are you doing to continue to improve? The AFHSC has an action plan which is reviewed and monitored by the AAPC. The AAPC reports locally to the executive group for public protection, and nationally to the Scottish Government through biennial reports.2 The AFHSC’s work has so far included: Awareness raising of key staff in the council and NHS working with vulnerable people. The staff were briefed on how to spot instances of financial harm, especially phone calls and scam mail. Awareness raising of staff working in financial institutions so they can identify financial abuse through suspicious cash withdrawals and transfers. Banks, Post Offices and money transfer facilities are kept updated about current scams. Raising public awareness of key events through radio, TV and press releases. The AFHSC twitter account has led to newspaper editors creating larger features about financial scams. Creating and promoting Angus Council's Policy on Financial Harm (the first UK local authority to have such a policy). Reacting to cases of financial harm, stopping further harm through support and protection by using phone call blocking devices, door stickers and providing advice, known as “target hardening”. Receiving and disseminating intelligence concerning any allegation of financial abuse to partners. There are aspects of the project that can be improved. We are starting to engage with Royal Mail to ensure that scam mail is identified and actions taken to ensure that this does not reach vulnerable people as postal scams are estimated to be 70% of all losses. Technological solutions such as call blocking can lead to social isolation which we will address by engaging with befriending organisations to maintain social contact. The level of awareness of the risk of scams and the success of the AFHSC is being monitored through use of the Angus Citizens Panel and the regular reports to the AAPC. The AFHSC ensures improvement through devising, implementing and evaluation of an annual plan reported to the AAPC. INNOVATION & LEADING PRACTICE Why is your project innovative? How is it helping to prepare for the future? What is happening to help other organisations benefit from your approach? Trading Standards officers provide advice at adult protection case conferences and direct support to victims in cases involving consumer legislation through attempting to recover losses. The AFHSC has key local financial bodies as members who deal with many potential scam transactions. This work has resulted in adult protection referrals being received from banks, post offices etc. Every local financial institution in Angus is supplied with information on the regular visits made by AFHSC partners. The AFHSC engages with appropriate retailers to reach vulnerable persons. Pharmacists in Angus agreed to enclose a “Scam Free Angus” leaflet3 with prescriptions and Asda enclose it with home deliveries in Angus, as vulnerable consumers are more likely to use these services. The adoption, by Angus Council, of a formal policy on financial harm is the first in the UK. This led to a TV news article4 and was discussed at First Minister’s Question Time at Holyrood. Angus Council has also enabled caller identification from its telephone exchanges so that customers recognise Angus Council as the caller. The AFHSC partners have developed a method of prioritising, contacting, advising and supporting possible victims of financial scams. For example Operation Carpus was a response to receipt of a list of 193 Angus names of possible victims from the National Scam Hub (a “suckers list”). Most people on that list were visited by the Police and appropriate protective measures were taken by Angus Council staff. The methodology employed has been replicated in other areas and shared with the National Police Adult Protection Group and the National Scam Hub. 2 http://www.aapc.org.uk/annrep.cfm 3 http://archive.angus.gov.uk/ac/documents/ItsaScam/Leaflet.pdf 4 http://news.stv.tv/tayside/229477-councils-crackdown-on-scams-sends-a-message-to-postal-fraudsters/ 4 COSLA EXCELLENCE AWARDS 2015 APPLICATON FORM 05 The award winning trialling and testing of call blocking technology with partner local authorities to protect adults at risk from scam phone calls has informed Scottish and UK policy and has enabled manufacturers of these devices to improve the design to meet the particular needs of vulnerable adults. A Scottish Government national working group led by Police Scotland and the Scottish Business Resilience Centre invited AFHSC partners to be members. The outcomes and recommendations of that group will continue to inform ongoing practice with financial harm recognised as a national issue. Considerable use has been made of media with individual partners making regular local press releases. This publicity has been enhanced by use of a twitter account (https://twitter.com/scamfreeangus) and the local press now pick up tweets and link it to previous press releases to produce major articles. 18,000 revised Doorstoppers door and window stickers have been distributed. By inclusion of particular wording this sticker effectively makes it a criminal offence for a doorstep seller to knock at the door. As part of an initiative on doorstep crime, all builders’ merchants in Angus have been visited by partners to offer advice on doorstep criminals buying building materials locally to undertaking building work. Printers were also visited and advised about doorstep sellers who usually source and distribute leaflets locally. RESULTS & IMPACT What impact are you having, or expect to have? How are you measuring this, and what does this tell you? Are you delivering what you set out to achieve? Banks, post offices, the private and voluntary sector (including independent financial advisors) along with Police, Trading Standards, Social Work and NHS have formed a unique partnership. This has been achieved within existing budgets and has subsequently attracted additional resources from partners in recognition of its value. All relevant Angus staff in Social Work and Health, Police Scotland and Housing have been briefed about financial scams and how to recognise them. During 2013/14, 65 presentations were made to community groups, community councils, stroke support groups, carers and students reaching hundreds more people. A recent survey of awareness of the risk of scams was undertaken through the Angus Citizens Panel5. 28% of respondents were aware of family members having experienced scams. 75% of respondents were aware of the “No Cold Callers/ Doorstoppers” initiative. 17.5% are already aware of “Scam Free Angus”. By raising awareness and protecting those already victimised we expect to reduce the number of people being scammed and the money lost to be reduced. The use of the phone call blocking technology developed in Angus has been replicated in over 100 other local authority areas and over 18,000 Doorstopper stickers have been distributed since April 2014, adding to previous distributions. Most genuine doorstep sellers will respect the sign and will not call if it will be a criminal offence to do so. It is not possible to quantify the savings made by the awareness raising and publicity campaign undertaken by the AFHSC. However given that a single person in Angus lost £140,000 in a single scam, the probable savings so far are certainly significant and will have made progress towards preventing some of the estimated £20 million losses a year in Angus. Operation Carpus resulted in police visits to 113 people. The total loss to 16 people who were identified as victims was £155,000. Police Scotland has calculated that the visits, support and preventive measures taken have saved potential and actual victims over £1m. In 18 months 32 vulnerable adults with call blockers had 98.5% of unwanted telephone calls blocked. This was over 11,500 calls. Of these 15% are estimated to be scam calls with potential savings of over £2 million. Such measures help change a person’s behaviour and empower them. One user said “I have got my life back. I think “How did I let people get me like this?” Now I can protect myself - it is marvellous!” 5 http://www.angus.gov.uk/citizenspanel/Analysisreportfinal.pdf 5 COSLA EXCELLENCE AWARDS 2015 APPLICATON FORM 06 NEXT STEPS Have you answered the criteria set out in the guidance? Is your application form 3 pages or less. (Anything more, including appendices, will be automatically rejected) Has your application form been authorised by an appropriate person? Have you indicated whether you wish the application form to be published? Have you provided details for someone we can contact about your application? SUBMITTING YOUR APPLICATION PLEASE SUBMIT YOUR APPLICATION BY 24 OCTOBER 2014 USING OUR ONLINE APPLICATIONS PORTAL: CLICK HERE TO SUBMIT YOUR APPLICATION FORM 6