Italian Circuitist Approach - Facoltà di Scienze Economiche ed

advertisement

Italian Circuitist Approach

Riccardo Realfonzo

in P. Arestis and M. Sawyer (eds), A Handbook of Alternative Monetary Economics, Edward Elgar,

Cheltenham (UK) and Northampton (USA), 2006, pp. 105-121.

1. Introduction

The Italian Circuitist Approach (hereafter: ICA) is part of the broad and heterogeneous

course of heterodox economics literature. It is an approach linked with Augusto

Graziani’s work on the subject since the early 1980s, and with publications by the

authors who have developed his analysis in various directions (Riccardo Bellofiore,

Marcello Messori, Riccardo Realfonzo; but also Biagio Bossone, Emiliano Brancaccio,

Giuseppe Fontana, Guglielmo Forges Davanzati, Alberto Zazzaro and others). It is not

only in Italy that circuit theory is widespread. In fact, during the second half of the

1900s a growing number of increasingly systematic studies were devoted to it by

scholars from France (Alain Parguez, Bernard Schmitt, François Poulon; but also

Claude Gnos, Elie Sadigh), Canada (Marc Lavoie, Mario Seccareccia, Louis-Philippe

Rochon), Britain (Wynne Godley, Francis Cripps) and Switzerland (Alvaro Cencini,

Sergio Rossi). The growing interest aroused by the ICA, and in general by monetary

circuit theory, is witnessed by countless conferences and seminars exploring the

possible avenues of comparison with the other heterodox approaches, mainly postKeynesian and Sraffian (see Deleplace-Nell eds. 1996 and Fontana-Realfonzo eds.

2005; but also Rochon and Rossi eds. 2003).

In this chapter I will try to provide a simplified exposition of the contributions by the

Italian school of the monetary circuit and an overall interpretation.

2. Main “sources’and arguments of the ICA

The ICA has drawn sustenance from some great works from the history of economic

thought, belonging to traditions which are different in many respects but which share

the idea that the economic process must be described as a circular sequence of monetary

flows. It is for this reason that the M-C-M’ capital cycle described by Karl Marx in Das

Kapital has always been recognised as the starting point of circuit theory. Marx’s

influence on circuit theory, and in general on macroeconomics in the tradition of the

monetary theory of production, has been underlined repeatedly by the supporters of the

ICA. In Graziani’s vision, scholars like Wicksell, Schumpeter and Keynes made up a

veritable “underground Marxist genre” (Graziani, 1982). It is no coincidence that ICA

literature has put forward a re-reading of Marx’s theory of money and value. According

to this macroeconomic approach to Marx, money is essentially the means of

commanding over living labour in production. In the view of some of the Italian

scholars, the Marxian labour theory of value can be set out in terms of the monetary

circuit model (Bellofiore eds. 1997; Bellofiore 1989; Bellofiore and Realfonzo 2003).

The other main reference points for the ICA are represented by the pure credit model

theorized by Knut Wicksell in Interest and Prices (ch. 9, sect. B) and by the theory of

economic dynamics contained in Schumpeter’s Theory of economic development1. But

the overriding source of inspiration of the monetary circuit approach is undoubtedly

found in the works of John Maynard Keynes; not only the General Theory but also

Treatise on Money and some other writings that preceded and followed the General

Theory dealing with the “monetary theory of production” (see in particular Keynes

1933). The ICA gives a “continuist” interpretation of Keynes’s work, sustaining the

complementary nature of the Treatise and The General Theory (Forges DavanzatiRealfonzo 2005a; Realfonzo 1998)2.

With reference to the Italian tradition, the authors that cleared the way for studies on the

monetary circuit were Antonio de Viti de Marco (1898), Marco Fanno (1993 [1931],

1947, 1992 [1932-4]), Luigi Lugli (1939) and Paolo Sylos Labini (1948)3. However, it

is only with the contributions of the last thirty years that the ICA has acquired the

continuity and homogeneity typical of any consolidated line of research. Graziani and

the other proponents of the monetary circuit theory worked both towards the historicaltheoretical reconstruction and towards a more profound analysis. Their work gave rise

to a debate between supporters and critics which is still underway.

The ICA rejects the methodological individualism typical of the neoclassical tradition,

and, in line with the socio-historical method of analysis associated with the classical,

Marxian and Keynesian traditions, assumes a triangular structure of agents (banks,

firms, workers). It proposes a sequential model in which the economic process is

described by means of a flow of money into the economic circuit. The ICA emphasises

the profoundly conflicting monetary nature of capitalist economies. The most

significant conclusions maintained by the Italian studies on the monetary circuit are as

follows:

a) money is a pure symbol, the result of a bank loan; money supply is endogenous;

b) the volume of production and employment depends on the expected level of

aggregate demand;

c) income distribution essentially depends on the relative market power of the

macroeconomic agents and on their access to bank finance;

d) the role of the money market (that of supplying firms with initial finance) is

distinguished from the role of the financial market (that of trying to contrast the

household’s propensity for liquidity by supplying firms with final finance).

3. The monetary circuit

The Italian literature on the monetary circuit sprang from a simple description of the

sequence of the phases of the circuit put forward by Graziani (1984, 1989, 1994, 2003)4.

Let us consider a closed economy with no State sector, in which there are three macro

agents operating: banks, firms and workers. Banks have the task of financing the

production process through the creation of money, and of selecting business plans;

firms, through access to credit, buy factors of production and direct the production

2

process, making decisions on the quantity and quality of output; workers supply labour

services. The working of the economy is described as a sequential process,

characterized by successive phases whose links form a circuit of money. A clear

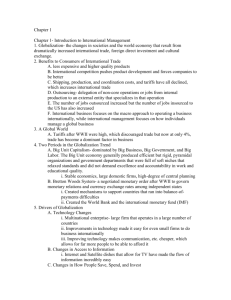

understanding of the circuit theory can be obtained from the following diagram:

Figure 1 near here

The phases in the circuit are:

1) banks grant (totally or in part) the financing requested by firms, creating money

(opening of the circuit);

2) once financing has been obtained, firms buy inputs. Considering firms in the

aggregate, their only expenditure coincides with the total wage bill; at this point money

passes from firms to workers;

3) once labour services have been purchased, firms carry out production; in the simplest

case, firms produce homogeneous goods;

4) at the end of the production process, firms put the goods on the market. It can be

envisaged that firms set the sale price following a mark-up principle. Supposing

workers have a propensity to consume equal to one, firms recover the entire wage bill

and maintain ownership of a proportion (corresponding to the mark-up) of the goods

produced. If the propensity to consume is less than one, once the workers have

purchased consumer goods they must make a further choice about how to use their

savings, either hoarding (increase in cash reserves) or investing (purchase of shares). If

all the money savings are invested in shares on the financial market, firms manage to

recover the whole wage bill;

5) once goods and shares have been sold, firms repay the banks (closure of the circuit).

In the following sections we will examine specific aspects of monetary circuit theory.

4. Theory of money

In the area of monetary theory the ICA reaches the following conclusions:

a) in the capitalist economy money is necessarily a pure symbol, a bank liability, with

no intrinsic value and no necessary relation with an exogenous money base;

b) the injection of money into the economic circuit takes place when there is a demand

for financing: the money supply is demand driven;

c) there may be a stock of money with the agents at the closure of the circuit if there is a

demand for cash reserves;

d) from the above it is deduced that money supply is fully endogenous.

In order to understand the arguments set out above, we need to go back to the triangular

definition of the structure of agents and to the representation of the working of the

monetary circuit. As has been pointed out, in order for there to be production, firms

must buy labour power but, as production has not yet taken place, no goods exist to pay

for it; the real wage is necessarily paid in arrears. Thus there are two possibilities

(Graziani 1994):

1) firms do not make any advance payment to workers and, at the end of the production

process, share with them the goods produced. But in this case, as Robertson (1926)

3

recalled, the theory would lead to a model of the economy with the double features of a

“barter economy” (money has no significant function) and of a “cooperative economy”

(agents take production decisions together and share the final product);

2) firms pay money wages in advance.

It is evident that a consistent model of a monetary economy requires the second option.

At this point there are again two possible choices:

a) firms pay workers with promises of payment (promissory notes);

b) firms resort to the banks, which create money.

The possibility of firms paying workers with promissory notes must be rejected. Let us

see why. Firms’ promissory notes are either final means of payment or merely promises

to pay. Let us assume that firms pay for labour power by issuing liabilities which are

accepted by workers as final means of payment. In such a situation, firms enjoy “rights

of seigniorage”. Indeed, in exchange for a paper instrument of no value issued by

themselves they obtain labour power and are released from any subsequent payment.

The possibility that liabilities issued by firms give rise to final payments can be

discarded if one is looking for a model in which all parties possess equal rights and

there are no seignioral powers. Alternatively, it could be supposed that workers are paid

by means of liabilities issued by firms and that these liabilities do not give rise to final

payments. In this case the liabilities are, in effect, mere promises to pay, i.e. certificates

of credit. With this formulation we arrive at a credit economy model, whose substance

is no different from that of a barter economy. Indeed, if firms initially pay their workers

with mere promissory notes, they will subsequently have to extinguish their debt by

transferring goods directly. In this way, barter is merely postponed.

Therefore, if one wants to describe the functioning of a system characterised by a

triangular structure of agents, i.e. a system which includes a labour market and, at the

same time, one wants to exclude a barter model, the only possible means of payment

consists of liabilities issued by the banking system.

What has just been said does not mean that, from the point of view of the ICA, money

has always been a pure sign. In this regard, the logical reconstruction of the history of

money and banking can follow two possible approaches: an ‘evolutionary approach’

and an ‘institutional approach’ (Realfonzo 2001).

The ‘evolutionary approach’ considers it possible that in pre-capitalistic forms of the

economy money had a commodity nature. In this respect the neoclassical description of

the evolution of the payment system from pure barter to the introduction of a

commodity money is considered correct for the initial stages of the development. At the

same time, the idea that, initially, banks were nothing more than pure financial

intermediaries is also confirmed. However, according to this heterodox ‘evolutionary

approach’, the neoclassical description proves to be valid for the pre-capitalist stages

alone. In fact, with the advent of capitalism, money took on the nature of a pure symbol

and banks became creators of money. A similar approach has recently been developed

by Chick (1986) and in Italy it was put forward by de Viti de Marco (1898).

According to the ‘institutional approach’ money has never possessed a commodity

nature and banks have never acted as pure financial intermediaries. Money is defined as

a social institution; it may have a ‘commodity vehicle’ (a ‘material support’), however

this has nothing to do with the nature of money. Within the ‘institutional approach’,

money can be alternatively described either as the result of a social convention or as the

4

outcome of a state imposition. In the Italian debate the article by Heinsohn and Steiger

(1983) has had a certain influence. According to the two authors, money has always

been a pure symbol: it was created as a result of the uncertainty which followed the

introduction of the system of private property and the consequent ‘abolition of

collective security provided by tribal and feudal estate’ (Heinsohn and Steiger 1983, p.

14)5. But a certain influence has also been exerted by the other branch of the

institutionalist approach, which holds that ‘credit money could not exist without the

State [...] all credit-driven money is by its very nature a fiat money irrespective of

whether it takes the form of commercial bank or Central Bank liability’ (Parguez and

Seccareccia 1999).

In any case the two approaches agree that in capitalist economies, given the triangular

structure of operators (banks, firms, workers), money is necessarily a book-keeping

entry in the bank’s balance sheets: it is pure credit.

5. The bank as creator of money

Let us suppose that in order to finance their production, firms resort to bank credit

(Graziani 1987 and 2003b). Banks register the credit granted to firms on the credit side

of their balance sheets, and the amount of the deposits created in favour of firms on the

debit side. Subsequently, firms use the deposits to pay their workers. At this point,

banks transfer ownership of the deposits to workers, cancelling those of the

entrepreneurs. In this new situation, firms remain indebted to the banks, the workers are

the banks’ creditors, while bank balance sheets report the credits granted to firms on the

asset side and debts to workers as a liability. Bank deposits have acted as final means of

payment for firms, inasmuch as they have effectively freed themselves of any debt

relationship with workers. In an economy without barter, the only possible money is the

bank promissory note: even though it is not a commodity, only this promissory note can

release firms from all the debts owed to their workers. In this sense, the means of

payment ‘assumes the form of a triangular transaction’. It is therefore clear that the

theorists of the monetary circuit define the bank as the agent that has the function of

creating money. This expression refers to the capacity of ordinary credit institutions

(commercial banks) to transform non monetary activity, like simple promises to pay,

into activities that are money, in other words that are accepted by the community as a

final means of payment. In the monetary economy money is therefore embodied in

entries in bank’s balance sheets. Naturally every act of creating money is registered in a

double entry in the balance sheet (on one side the issue of money is entered as a bank

liability, on the other it is entered as a credit towards the lender). In this sense it is clear

that from the point of view of the economy as a whole money does not represent

wealth; the exact opposite is however true from the point of view of the individual

possessor of money6.

It should be stressed that in their examination of the money supply, the circuit theorists

invert the mainstream approach (Realfonzo 1998; Zazzaro 1995). The mainstream, in

fact, envisages firstly the definition of the concept of money base (legal tender issued by

the central bank), then the construction of the multiplier of bank deposits, and lastly the

5

definition of the supply (effective and potential) of money. In other words the

mainstream confirms the old saw that “deposits make loans”.

The circuit theorists reverse the traditional approach following Schumpeter’s argument

that the functioning of the accounting system in a capitalist society emerges with great

clarity if one begins with the study of the ‘fundamental theoretical case’, which is,

basically, the Wicksellian model of pure credit (a ‘pure accounting system’) where all

payments take place by means of entries in bank balance sheets (the ‘fundamental

concept of the theory of money’). In other words the circuit theorists show that even

without legal tender, the system could theoretically work since bank money is accepted

through the confidence that agents have in the bank.

It follows that the logic of the multiplier of bank deposits is completely rejected.

Ordinary credit institutions do not multiply anything; they create money (“loans make

deposits”). Obviously this is not to deny that a specific monetary setup where bank

money is by law tied to a money that commercial banks cannot create can tend to place

a cap on the expansion of bank credits. But in this regard some circuit theorists express

doubt. Ultimately, this concerns “the limit to the credit which the bank can grant [...]

cannot be fixed, either rationally or practically... [it] depends on the forecast [...] of the

amount of future compensations” (de Viti de Marco 1934, p. 51). As can be seen, the

Italian monetary circuit authors adopt positions near to (but not coinciding with) the

horizontalist ones expressed by Moore (1988).

6. Demand for money and the endogenous nature of the money supply

Having clarified the banking system’s capacity to create money theoretically with no

limits, the Italian authors show that the size of the monetary flows involving the circuit

and of the stocks of cash reserves found at the closure of the circuit (in equilibrium)

depend (essentially) on the demand for money. Following Keynes’s teaching, monetary

circuit theory distinguishes between the demand for money to finance production

(which Keynes called ‘finance motive’) and the demand for cash reserves (dependent on

the famous transactions, precautionary and speculative motives) (Graziani 1987, 1994,

1996; Messori 1991).

The finance motive explains the creation of money and its injection into the economy.

As has already been pointed out, in order for production of goods to take place, firms

have to obtain bank financing. They will therefore apply to the banks, which will grant

financing to the firms considered credit-worthy, by opening a deposit in their favour. In

this way money is injected into the economy, enabling the businessman to purchase raw

materials and labour. Supposing for the sake of simplicity that the banks accept all the

requests for financing (absence of rationing), the size of the monetary flows (i.e. the

quantity of money which, at any given period, flows into the economy) depends on the

firms’ demand for finance.

The demand for cash reserves leads to the formation of money stocks which are present

at the closure of the circuit. Let us just suppose that the agents have a zero propensity to

liquidity. This would mean that once firms have paid wages, and production has been

completed, and wages have been spent on consumer goods and in the financial market,

then the firms would come back into possession of the whole amount of initial financing

6

and would therefore be able to repay the bank. In this way, money initially injected into

the circuit would flow back to the banks (destruction of money). This would mean that

at the end of the circuit there would be no stock of money reserves. In a stationary

economy (and disregarding the question of interest payments) it can be imagined that in

the following period the amount of money flowing into the circuit (and in the end

flowing back to the banks) is constant. Let us now suppose that the propensity to

liquidity becomes positive: agents will not spend all the money that enters their coffers

and will keep some cash reserves. In this case the “final finance”, namely the income of

firms as a whole from the sale of goods and shares, is lower than the “initial finance”.

This simply means that at the closure of the circuit a certain amount of money remains

“idle” in the agents’ reserves. From what has been observed above, it can be deduced

that both money flows and the formation of money stocks depend essentially on the

demand for money.

However, one needs to notice several aspects that do not escape the attention of the

Italian interpreters of the monetary circuit. Firstly, it seems evident that there is a

relation between the size of money flows and the formation of money reserves. All

other conditions being equal, the more money flows into the circuit, the higher the

money incomes will be and the more cash reserves will be formed. On the other hand,

all conditions still being equal, an increase in the propensity to liquidity leads to a

reduction in the money flowing back to the banks. It is also clear that in the case of a

closed economy with no state sector, the formation of cash reserves must correspond to

a situation of firms’ indebtedness towards the banks and/or of firm bankruptcy.

Secondly, it should be underlined that the hypothesis that the banking system fulfils all

the requests for financing is hardly credible (Forges Davanzati and Realfonzo 2005). It

is far more realistic to assume that the banks assess credit-worthiness and therefore do

not accept all the applications for financing (rationing of bank credit). This simple

observation leads the Italian monetary circuit scholars to clarify the meaning of the

thesis that money supply is demand driven. It is true that the size of the circuit’s money

flows and the size of the money stocks depend respectively on the demand for money

for financial purposes and on the demand for money as a store of value. However,

money flows and stocks are affected by the behaviour of the bankers: if there is bank

credit rationing, these flows and funds are just a fraction of the potential demand for

money.

In conclusion, in the vision of the theorists of the circuit, the functions of demand for

money and the function of money supply are interdependent (see Graziani 1989, 1994;

Realfonzo 1998, Chapters 2 and 6).

7. Equilibrium, disequilibrium, the closure of the circuit

The Italian authors of the monetary circuit show that this approach is able to explain the

reproduction of the monetary economy in equilibrium as well as disequilibrium. Circuit

theorists point out that as long as agents consider money exclusively in its function as a

means of payment, the circuit closes in equilibrium (Graziani 1984). Let us suppose in

fact that each agent, whether it be businessperson or worker, immediately spends the

money that enters his possession by purchasing goods or services. In that case all the

7

money injected initially into the economy will flow back to the firms and from them to

the banks (destruction of money). In this respect the circuit school refers to the

teachings of Keynes’s Treatise on Money. In this case the circuit closes in equilibrium.

However, equilibrium is only one of the two possible ways in which the circuit can

close. In this regard the monetary circuit theorists return to the teaching of The General

Theory. They maintain that because of its structural features, the capitalist economy is

characterized by the presence of systemic uncertainty (Fontana 2000; Fontana and

Gerrard 2002; Graziani 1994). And for this reason it is impossible to ignore that money

functions as a store of value to give a form of insurance against uncertainty. Agents’

attitude to money therefore depends on the widespread expectations in the economy.

When negative expectations spread, agents start to use money increasingly as a store of

value and less as a means of payment. Money reserves grow and this rules out the

possibility that money can flow back to the banks and therefore that the circuit can

close in equilibrium. A crisis occurs when negative expectations spread. It takes the

form of an interruption of the monetary circuit due to the accumulation of cash reserves

and leads to a drop in production and in employment.

From these comments it emerges clearly that the Italian school of the monetary circuit is

putting forward a “continuist” interpretation of Keynes (Forges Davanzati and

Realfonzo 2005). In other words it sees The Treatise on Money and The General Theory

as two consistent and complementary works. The ICA theorists intend to create a

macroeconomic model that keeps Keynes’s two works together: a single coherent

theory capable of demonstrating the conditions of equilibrium and the causes of

disequilibrium of a monetary economy in which money is a means of payment and a

store of value.

At this point it may be useful to examine the concept of equilibrium and of the closure

of the monetary circuit in greater depth. These are in fact issues that have generated a

debate among the scholars (Messori 1985; Graziani 1994; Messori-Zazzaro 2004 and

2005), the conclusions of which can be summed up as follows.

Let us consider the simplest monetary circuit schema, with assumptions of a closed

economy and no state sector. Let us suppose the agents decide to keep their cash

reserves constant. In this case money injected into the circuit at the beginning of the

period will flow back to the banks. But it is clear that firms as a whole will not be able

to repay the money interest to banks and they will remain indebted to them. There is an

even worse situation for firms if the agents decide to increase their money reserves. If

this happens, in fact, firms will owe not only the interest but also part of the capital. On

the other hand, it is clear that firms will be able to repay the initial financing and the

related total interest only in the following cases:

a) there is a reduction of the cash reserves and the consequent expenditure on goods,

services and shares is sufficient to assure the firms an income equal to the size of the

initial financing plus the relative interest;

b) supposing there is a foreign sector and assuming a foreign surplus that is sufficient to

assure the firms an income equal to the size of the initial financing plus interest;

c) supposing there is a state sector and assuming a public deficit that is sufficient to

assure the firms an income equal to the size of the initial financing plus relative interest.

If a state sector is considered in the model, and a deficit expenditure (for example, the

payment of pensions) financed by money issued by the central bank is assumed, it is of

8

relevance that public expenditure acts as a new source of finance for firms: it will

increase the “final finance” (the amount of money spent in order to buy goods and

securities). It is interesting to point out – at least with reference to the share of state

expenditure that increases firms’ returns in the goods market – that this is free finance

for firms: it is not a consequence of a firm's debt towards commercial banks but of a

state debt towards the central bank. It is worthwhile stressing that the increase in inflow

of money into circulation due to state deficit spending could give firms a chance to

reimburse (the totality or a share of) bank interest in money terms.

The three cases above show that, according to the ICA, it is theoretically possible for

the circuit to close with the destruction of the money initially injected into the economy

and with the payment of money interest to banks by firms. However, if one looks

closely, case a) implies an explanation of the formation of money reserves in the

previous periods and this necessarily leads to the presence either of firms’ debts or of

firms’ bankruptcy inherited from the past; alternatively, case a) above can be explained

with the foreign surplus or with the public deficit in the previous periods and this

therefore refers essentially to cases b) and c). Cases b) and c) are significant. In this

respect it should however be underlined that the reproduction of the monetary economy

in an equilibrium of steady state would imply either a permanent surplus in the foreign

balance of payments or a continuous growth of the public debt (Graziani 1994).

Let us now return to the basic case (closed economy without a state sector, constant

cash reserves), since it will enable us to pinpoint one of the typical features of the

monetary economy according to the ICA. In the basic schema of the monetary circuit,

firms repay the initial financing but cannot reimburse interest to banks in money terms:

they can just repay interest in kind or postpone the payment. From this the exponents of

the monetary circuit draw the conclusion that the concept of equilibrium of a monetary

economy envisages the presence of “a normal level of firms’ debt to banks” (Graziani

1994). The debt level is “normal” if it is judged sustainable by the banks that agree to

continue financing firms in spite of existing debt. Obviously, in the monetary economy

the whole amount of firms’ debt to banks tends to grow (suffice it to think of the simple

mechanism of compound interest). This is a growth that may be considered normal by

banks and therefore perfectly compatible with the reproduction of the system.

8. Money market and financial market

The ICA makes a sharp distinction between the nature and functions of the money

market and those of the financial market (Graziani 1984, 1994). In the money market

banks and firms bargain. The aim of the bargaining is the initial finance as well as the

interest rate. As has been pointed out, the money market is the “place” where banks

select firms and where the overall monetary financing is decided. The financial market

logically comes into operation at a later moment in the economic process. When

households have received their money income and they have subdivided it into savings

and consumption, they can decide to use part of their savings for the purchase of shares

in the financial market. From the households’ point of view, therefore, the financial

market is the “place” where they try to use their savings in a remunerative way. From

the point of view of firms as a whole, the financial market plays the role of recuperating

9

the liquidity not collected through the sale of goods and services. In the financial market

therefore, those who operate are households and firms.

In view of the above, it becomes clear that according to the ICA there is a sort of

hierarchy between the money market and the financial market: in fact the financial

market could not even operate if money had not been previously created and injected

into the circuit through the money market. As a result, while it is possible for a single

firm to finance itself exclusively through the financial market, it is impossible for firms

as a whole. This conclusion is valid unless there are such levels of public deficit

spending and/or of surplus in the balance of payments that enough money flows into the

financial market through the workers’ decisions to buy shares.

The interest rate that is formed in the financial market is the price firms have to pay to

collect money savings. In this regard, circuit theorists underline the difference between

the interest rate that is formed in the money market and the interest rate that is formed in

the financial market. Mainly, the scholars of the ICA underline the difference between

the debt contracted by firms to banks (strong agents, able to exert real influence on the

running of firms) and the debt contracted with households (who in contrast are

substantially incapable of influencing firms). On this point, although shares are

formally a slice of the ownership of firms, Graziani talks about firms’ “figurative debt”

towards the households (Gaziani 1984 and 1994).

9. Production, employment, distribution

The ICA follows the Keynesian approach in maintaining that the volume of production

is autonomously fixed by firms, based on the expected level of aggregate demand.

Naturally, production decisions taken by firms may or may not be supported by banks.

If there is credit rationing by banks, firms are unable to translate their production plans

into real production processes. To make the matter more complicated, it can be shown

that the production decisions taken by firms are also influenced by the possibility of

equity rationing. One conclusion drawn by theorists of the circuit is that the financial

structure of firms is not neutral with respect to production decisions.

Let us consider the simplest case of a closed economy without a public sector.

Supposing that Ye is the expected level of aggregate demand for the period in

question, firms will fix the level of production Ys of the single good produced so as to

satisfy the demand:

Ys = Ye.

If is the average labour productivity, the level of employment desired by firms will

be established as follows:

Ys/ = N.

The employment level depends on firms’ production decisions and therefore on the

expected aggregate demand. The labour market is thus described as the place where

any shortage in aggregate demand is dumped (generating involuntary unemployment).

If w is the average money wage agreed in bargaining with workers, then wN will be

the total money wage bill and this will correspond to the total demand for financing F

that firms as a whole will make of the banking system:

F = wN.

10

If banks totally fulfil the firms’ request for financing, employment N and production

Ys will be realized. Once production has occurred, firms, which operate in nonperfectly competitive markets, will use the mark-up principle to set the price of the

single good produced, applying the margin q to the cost of production:

p = (w/) (1 + q).

The level of q depends on market power (degree of monopoly) and this in turn can be

made to depend on the industrial concentration ratio (Forges Davanzati and Realfonzo

2005). The greater the firms’ market power, the higher the price/production costs ratio

will be.

Once the price is fixed, then the distribution of income is clearly also fixed. The ratio

of wages to total product W/Y = wN/pN and the ratio of profits to total product P/Y =

1 – W/Y will be:

W/Y = 1/(1 + q);

P/Y = q/(1 + q).

These are, as one can see, the very well-known results reached by Kalecki (1971).

Clearly then, the ICA develops a theory of distribution of a post-Keynesian type,

influenced primarily by the works of Kalecki and Keynes.

Naturally, given the mark-up, the higher the level of production (and therefore the

expenditure on inputs), the higher the firm's real profit. So the higher the expected

aggregate demand, the higher the level of production and the higher the absolute

values of total profits and of real money wages. It is understandable why the advocates

of the ICA repeat Kalechi’s old thesis that whereas wage-earners can spend as much as

they have earned, firms as a whole earn as much as they have spent. This means that

the more businesses as a whole spend on inputs (and therefore the more financing is

granted by banks), the higher production and therefore profits will be 7.

A peculiar contribution by the ICA to the theory of distribution concerns the question

of wage bargaining and particularly the relation between the bargained real wage, the

actual real wage and the labour productivity (Forges Davanzati and Realfonzo 2000

and 2004)8. On this point it is very useful to refer to the sequential nature of the

economy described by the ICA.

In the ICA model, as in Keynes’s original work, in the labour market bargaining

concerns only money wages. In fact, the price level (and therefore the real wage) is

known only at a later phase, when workers spend their money wage in the goods

market. This obviously does not mean that, at the time when they bargain for their

money wage, workers have no expectations about the price level, but their expectations

will not necessarily be confirmed by the market. Consequently, there may be a

difference between the ex ante real wage (expected by workers) and the ex post real

wage (the actual real wage). If workers’ expectations about the price level are

confirmed, the expected real wage coincides with the actual real wage9.

Let us suppose that firms fix a price higher than the expected price. As a result, there

would be a decrease in the real wage below the expected level. According to the ICA,

workers cannot oppose the decrease in the real wage by wage bargaining. In fact, they

only negotiate the money wage with firms. Let us assume that workers later demand an

increase in the money wage that re-establishes, at the new level of prices, the expected

real wage. As we know, banks have no constraints in granting firms credit and it can be

supposed that they agree to the businesses’ requests for expansion of credit.

11

Consequently the amount of financing will grow and, with it, money wages.

Nevertheless, if firms do not reduce q, in the market for goods the price will increase

again and workers will find their expectations dashed once more. This means that an

increase in prices, an increase in money wages, a further increase in prices and so on

may in principle be repeated ad infinitum10.

From this point of view, the only effective reaction by the workers is a reduction of

labour productivity in the production process. To understand this conclusion, let us

suppose for the sake of simplicity that workers have adaptive expectations about price

levels and a propensity to consume equal to 1; and that the banks fulfil the firms’

requests for financing. Let us then make the following specific hypotheses about the

labour market: the higher the expected real wage, the higher the labour productivity11;

the agreed real wage grows with the growth of employment. Let us use q to indicate the

mark-up that firms can set, given the industrial concentration ratio. Under this

hypothesis it is possible to show that the conclusions reached are those illustrated in

Figure 2 (Forges Davanzati and Realfonzo 2000):

Figure 2 near here

In Figure 2, the line w/pe indicates the expected real wage which is, by assumption,

positively dependent on the level of employment. The lines and w/p respectively

indicate the relationship between productivity and employment (via the expected real

wage) and between the actual real wage and employment for the mark-up q. The line Ns

indicates the total number of workers available in the economy. In the lower panel,

production functions are represented. The technical production function, Q=N shows

the maximum output that can be obtained for any level of employment (given the

technology) assuming that workers display full cooperative behaviour. The endogenous

production function - Q=[w/pe]N - shows the relationship between employment and

the level of output produced for each value of labour intensity. In this analysis the

endogenous production function is the relevant production function: actual production

depends on labour productivity and output is lower than or (in the case of fully

cooperative behaviour) equal to the maximum level technologically feasible. Notice that

there is stability of prices and wages (monetary equilibrium) in correspondence to the

employment level E*, when the expected real wage is equal to the effective real wage.

In the case of Figure 2, firms will maximize profits by employing all the workers (Ns)

and the expected real wage will be greater than the actual real wage. Workers will react

by demanding increases in money wages; firms will grant these increases and will apply

to the banks for greater financing; the banks will grant the loans, production will be

carried out and prices will again be higher than the workers expected and the real wage

will therefore be lower than they expected. In this way a cumulative process of wage

and price rises is triggered, which could in theory continue ad infinitum.

At this point it can be supposed that workers will reduce their productivity in the

consequent production period when the actual real wage is lower than the expected real

wage. This is the workers' reaction function; it works when the actual real wage is lower

than the expected real wage12. In this case, if we assume that firms are not “hit and run”

but have an interest in continuing to operate in the economy in the future, then they

must respect workers’ expectations about real wages. In fact, a price level higher than

12

that expected by workers would determine a reduction in labour productivity, output,

and consequently profits in the ensuing periods of production. When a workers’ reaction

function is taken into consideration, the equilibrium employment necessarily

corresponds to the “monetary equilibrium” (in correspondence with E*), for the simple

reason that firms are forced to respect workers’ expectations. Therefore, workers’

reaction allows inflationary pushes to be avoided.

Another significant conclusion of the ICA is that deregulation of the labour market does

not increase employment (Forges Davanzati and Realfonzo 2004). A model exploring

the effects of labour relationship deregulation on employment has been put forward.

Two basic assumptions have been superimposed on the standard Keynesian theoretical

framework: (a) deregulation increases uncertainty and therefore reduces the propensity

to consume and (b) it works as a discipline device, in that – due to the credibility of the

threat of dismissal – there is an increase in worker effort, and thus in labour

productivity. The overall effect of labour market deregulation is the reduction in

equilibrium employment, due both to the fall of aggregate demand and to the increase in

labour productivity13.

10. Concluding Remarks

The ICA reaches conclusions that radically differ from those of the orthodox

neoclassical theory. The starting point of the ICA is the idea that in capitalist economies

power is not fairly distributed among macroeconomic agents; the consequence is that

only the entrepreneurs have access to bank finance. The availability of money capital is

the means to impose the firm’s decisions concerning production, employment and

distribution. The capitalist process is described as the working of the sequential process

of an intrinsically monetary economy. In capitalist economies there is systemic

uncertainty and for this reason firms’ decisions on both the level of production and

employment are essentially determined by the expected level of the aggregate demand.

Endnotes

1

For an interpretation of the 20th century debate on money and banking from a circuitist

point of view see Realfonzo 1998.

2

3

On this topic see also Fontana (2003).

De Viti de Marco maintained a theory of the development stages of the banking

system and showed that banks are creators of money; according to de Viti de Marco

money supply is demand driven. The most famous works by Fanno (1993 [1931], 1947,

1992 [1932-4]) are inspired by Wicksell’s pure credit model. They centre around a

description of the process of a sequential monetary economy and the analysis of the

permanent tendency towards disequilibrium between savings and investment.

13

Considerably less well-known are the theoretical contributions by the banker Lugli

(1939). This author takes up the version of the evolution of the payment system

proposed by de Viti de Marco and L.A. Hahn, maintaining the need to develop a model

of monetary economy to set against the neoclassical model of a barter economy. The

essay by Sylos Labini (1948) is an early work in which the author clearly feels the

influence of Schumpeter. In particular, he develops the Schumpeterian approach to the

theory of interest and to bank credit as the means to remove inputs from their previous

uses.

4

For other general descriptions of the monetary circuit see Messori 1988, Bellofiore

and Seccareccia 1999; Bossone 2001; Figuera 2001; Realfonzo 1998 and 2003. About

the monetary circuit in the light of the French school see Realfonzo 1999.

5

Heinsohn and Steiger advance a ‘witness theory’ of the origin of banks (see also Wray

1990, Chapter 1).

“Nobody who has ever lost a sixpence through a crack in the floor will dispute this.

6

But it is by no means obvious that the world as a whole would be impoverished in the

same degree”. Robertson 1928, p. 31.

7

In a model with two types of goods – consumer-goods (wage-goods) and investment-

goods – decisions about the composition of production determine the distribution of

income. The higher the demand for and production of investment-goods, the higher the

profits for firms.

8

For an interpretation of the working of the labour market in a monetary economy of

production from a Marxian point of view see Bellofiore and Realfonzo 1997; Bellofiore,

Forges Davanzati and Realfonzo 2000.

9

In a model with two types of goods (consumer-goods and investment-goods) this

happens when voluntary saving equals investments. When investments exceed

voluntary savings there is a positive gap between the expected real wage and the actual

real wage which gives rise to forced saving.

10

For this reason, even if workers could impose a cost-of-living escalator agreement,

this would not affect the real wage since the ex-post money wage increase can always

be annulled by a further growth in prices.

14

11

It is assumed that workers can choose the level of labour productivity in an interval

going from fully cooperative behaviour to fully conflictual behaviour (Forges Davanzati

and Realfonzo 2000).

12

The workers' reaction function can be written as: t+1= {[t/(1+q)]e-t/(1+q)} ; with

'<0 and t+1<t .

13

However, it has also been argued that deregulation may improve entrepreneurs’

expectations and, thus, may increase investment and aggregate demand, acting as a

counterbalancing effect.

15

References

Bellofiore R. (1989), ‘A Monetary Labor Theory of Value’, Review of Radical

Political Economics, 21(1-2).

Bellofiore R. ed. (1997), ‘Marxian Theory: the Italian Debate’, special issue of the

International Journal of Political Economy, 27(2).

Bellofiore R., Forges Davanzati G. and Realfonzo R (2000) ‘Marx inside the Circuit.

Discipline Device, Wage Bargaining and Unemployment in a Sequential

Monetary Economy’, Review of Political Economy, 12( 1), 403-17.

Bellofiore R. and Realfonzo R. (1997), ‘Finance and the Labor Theory of Value:

toward a Macroeconomic Theory of Distribution from a Monetary Perspective’,

International Journal of Political Economy, 27 (2), 97-118.

Bellofiore R. and Realfonzo R. (2003), ‘Money as Finance and Money as Universal

Equivalent: Re-reading Marxian Monetary Theory’, in L.-P. Rochon and S. Rossi

eds., Modern theories of Money: The Nature and Role of Money in Capitalist

Economies, Elgar, Cheltenham and Northampton, 198-218.

Bellofiore R. and Seccareccia M. (1999), ‘Monetary Circuit’, in P.A. O’Hara ed.,

Encyclopedia of Political Economy, Routledge, London and New York, 753-6.

Bossone B. (2001), ‘Circuit theory of banking and finance’, Journal of banking and

finance, 25(5), 857-90.

Brancaccio E. (2005), ‘Un modello di teoria monetaria della produzione capitalistica.

Un’alternativa <<classico-circuitista>> al paradigma neoclassico della scarsità’,

Il pensiero economico italiano, 13(1).

Chick V. (1986), ‘The Evolution of the Banking System and the Theory of Saving,

Investment and Interest’, Economies et Sociétés, 20 (8-9), 111-26.

Deleplace G. and Nell E. eds. (1996), Money in Motion: The Post Keynesian and

Circulation Approaches, Macmillan and St. Martin’s Press, London and New

York.

de Viti de Marco A. (1898), La funzione della banca, Rendiconti della Reale

Accademia dei Lincei, V, vol.VII; 2nd ed. 1934, 3rd ed. 1936.

Fanno M. (1947), La teoria delle fluttuazioni economiche, CEDAM, Padova.

Fanno M. (1992) [1932-4], Teoria del credito e della circolazione, ESI, Napoli.

Fanno M. (1993) [1931], ‘Production Cycles, Credit Cycles and Industrial

Fluctuations’, Structural Change and Economic Dynamics, 4 (2), 403-37.

Fontana G. (2000), ‘Post Keynesians and Circuitists on money and uncertainty: an

attempt at generality’, Journal of Post Keynesian Economics, 23 (1), 27–48.

Fontana G. (2003), ‘Keynes’s A Treatise on Money’, in J. King ed., Elgar Companion

to Post Keynesian Economics, Elgar, Cheltenham, 237-41.

Fontana G. and Gerrard B. (2002), ‘The monetary context of economic behaviour’,

Review of Social Economy, 60(2), 243-62.

Fontana G. and Realfonzo R. eds. (2005), The Monetary Theory of Production.

Tradition and Perspectives, Macmillan-Palgrave, Basingstoke.

Forges Davanzati G. and Realfonzo R. (2000), ‘Wages, Labour Productivity and

Unemployment in a Model of the Monetary Theory of Production’, Economie

appliquée, 4, 117-38.

Forges Davanzati G. and Realfonzo R. (2004), ‘Labour market deregulation and

unemployment in a monetary economy’, in R. Arena and N. Salvadori eds.,

Money, Credit and the Role of the State, Ashgate, Aldershot, 2004, 65-74.

Forges Davanzati G. and Realfonzo R. (2005a), ‘Bank mergers, monopoly power and

unemployment. A Post Keynesian-Circuitiste approach’, in Fontana and

Realfonzo eds. (2005), 155-71.

Forges Davanzati G. and Realfonzo R. (2005b), ‘Towards a <<continuist>>

interpretation of Keynes: Labour Market Deregulation in a Monetary Economy’,

mimeo.

Graziani A. (1982) ‘L’analisi marxista e la struttura del capitalismo moderno’, in

Storia del marxismo, 4th vol., Einaudi, Turin.

Graziani A. (1984), ‘Moneta senza crisi’, Studi economici, 39(24), 3-37.

Graziani A. (1989), The Theory of Monetary Circuit, Thames Papers in Political

Economy, London.

Graziani A. (1994), La teoria monetaria della produzione, Banca Popolare

dell’Etruria e del Lazio/Studi e ricerche, Arezzo.

Graziani A. (1987), ‘Keynes’s Finance Motive’, Économies et Sociétés (‘Série Monnaie

et Production’, 4), 21(9), 23–42.

Graziani, A. (1996), ‘Money as Purchasing Power and Money as a Stock of Wealth in

Keynesian Economic Thought’, in Deleplace and Nell eds. (1996), 139-154.

Graziani A. (2003a), The Monetary Theory of Production, Cambridge University

Press, Cambridge.

Graziani A. (2003b), ‘Finance Motive’, in J.E. King ed., Elgar Companion to Post

Keynesian Economics, Elgar, Cheltenham, 142-45.

Heinshon G. and Steiger O. (1983), ‘Private Property, Debts and Interest or: the

Origin of Money and the Rise and Fall of Monetary Economies’, Studi

economici, 21, 3-56.

Kalecki M. (1971) Selected Essays on the Dynamics of the Capitalist Economy,

Cambridge University Press, Cambridge.

Keynes J.M. (1930), A Treatise on Money; reprinted in J.M. Keynes, Collected

Writings, vols. V and VI, Macmillan, London, 1971.

Keynes J.M. (1933), ‘The Monetary Theory of Production’; reprinted in J.M. Keynes,

Collected Writings, vol. XIII, Macmillan, London, 1973, 408-11.

Keynes, J. M. (1936), The General Theory of Employment, Interest and Money;

reprinted in J.M. Keynes, Collected Writings, vol. VII, Macmillan, London, 1973.

Lavoie M. (1992), Foundations of Post-Keynesian Economic Analysis, Elgar,

Cheltenham.

Lugli L. (1939), Economia monetaria ed economia creditizia, Giuffré, Milano.

Marx K. (1976), Capital, Penguin, London.

Messori M. (1985), ‘Le circuit de la monnaie. Acquis et problèmes non résolus’, in R.

Arena and A. Graziani eds., Production, circulation et monnaie, Presses

Universitaires de France, Paris.

Messori M. (1988), ‘Agenti e mercati in uno schema periodale’, in A. Graziani and M.

Messori eds., Moneta e produzione, Einaudi, Torino, 285-330.

Messori M. (1991), ‘Keynes’ General Theory and the Endogenous Money Supply’,

Economie Appliquée, 44(1), 125-32.

17

Messori M. and Zazzaro A. (2004), ‘Monetary profits within the circuit onzi finance

or mors tua, vita mea?’, Quaderni di ricerca, 200, Università Politecnica delle

Marche.

Messori M. and Zazzaro A. (2005), ‘Single period analysis: financial markets, firms’

failures and closure of the monetary circuit’, in Fontana-Realfonzo eds. 2005,

111-23.

Moore B. (1988), Horizontalists and Verticalists. The Macroeconomics of CreditMoney, Cambridge University Press, Cambridge.

Parguez A. (1996), ‘Financial Markets, Unemployment and Inflation within a

Circuitist Framework’, Économies et sociétés, 30(2-3), 163-92.

Parguez A. and M. Seccareccia (1999), ‘A Credit Theory of Money: the Monetary

Circuit Approach’, in J. Smithin ed., What is Money?, Routledge, London.

Realfonzo R. (1998), Money and Banking: Theory and Debate (1900-1940), Elgar,

Cheltenham and Northampton.

Realfonzo R. (1999), ‘French Circuit School’, in P. O’Hara ed., Encyclopedia of

Political Economy, Routledge, London and New York, vol. 1, 398-400.

Realfonzo R. (2001) ‘Bank Creation of Money and Endogenous Money Supply as the

Outcome of the Evolution of the Banking System: Antonio de Viti de Marco’s

Contribution’, in Rochon and Vernengo eds., Credit, Interest Rates and the Open

Economy. Essays in the Horizontalist Tradition, Elgar, Cheltenham, 193-212.

Realfonzo R. (2003), ‘Circuit Theory’, in J. King ed., Elgar Companion to PostKeynesian Economics, Elgar, Cheltenham, 60-4.

Robertson D.H. (1926), Banking Policy and the Price Level, King, London.

Rochon L.-P. and Rossi S. eds. (2003), Modern Theories of Money: The Nature and

Role of Money in Capitalist Economies, Elgar, Cheltenham and Northampton.

Schumpeter J.A. (1959) [1912], The Theory of Economic Development, Harvard

University Press, Cambridge Mass..

Schumpeter J.A. (1970), Das Wesen des Geldes, Vandenhoeck & Ruprecht,

Göttingen.

Sylos Labini P. (1948), ‘Saggio dell’interesse e reddito sociale’, Rendiconti della

classe di scienze morali, storiche e filologiche, Accademia Nazionale dei Lincei,

3(11-12), 426-53.

Wicksell K. (1962) [1898], Interest and Prices, Kelley, New York;

Wray L.R. (1990), Money and Credit in Capitalist Economies. The Endogenous

Approach, Elgar, Aldershot.

Zazzaro A. (1995), ‘La specificità delle banche. Teorie a confronto da una prospettiva

schumpeteriana’, Studi economici, 50 (55), 113-51.

18

Banks

initial finance

final

reimbursement

Firms

savings

purchasing of

labour services

purchasing of

consumer goods

Workers

Figure 1

19

w/p,

Ns

w/p

e

w/p

E*

N

Q

Q=

Figure 1

endogenous production

function

N

Figure 2

20