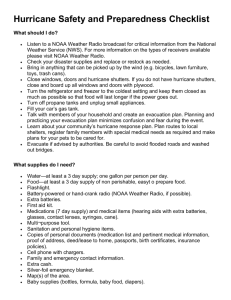

Insurance-rate hike causes a windstorm of anger and action

advertisement

Insurance-rate hike causes a windstorm of anger and action Angered by spiraling windstorm insurance costs, Keys residents are taking their arguments to Tallahassee and Washington BY JENNIFER BABSON jbabson@MiamiHerald.com KEY WEST - When Cindy Derocher opened her windstorm insurance bill last December, two months after Hurricane Wilma flooded her modest concrete block home, her heart nearly stopped. At $9,020, Derocher's bill from Citizens Property Insurance -- Florida's insurer of last resort and the only entity that provides major windstorm coverage in Monroe County -- was nearly $7,000 more than two years before. ''It was almost disbelief,'' she said. 'We were angry. It was like, `This can't be right.' '' Derocher and her partner, who own a two-bedroom house with an in-law suite, began talking to neighbors and found that everyone was pretty much in the same predicament. They reviewed Citizens' rate charts and found that Monroe had the highest base rate per $1,000 of insured home value -- $20.91 -- in the state, even though the Keys has not suffered widespread wind damage from a hurricane in years. From those facts has sprung a grass-roots movement that may be the most heartfelt in the Keys since the Conch Republic ''seceded'' to protest federal roadblocks 24 years ago. ''It definitely has blossomed,'' said Derocher, who helped co-found Fair Insurance Rates in Monroe, or FIRM, a group that has grown from two dozen to 2,000 members since its February inception. And the worst is yet to come. Citizens, which is staggering under a $1.7 billion deficit, has proposed another average rate increase here of about 34 percent later this year -- the second part of a hefty 2006 rate hike that already has raised Keys rates an average of 11 percent. Most mortgage holders have no alternative because private windstorm insurers, with few exceptions, won't cover the Keys. Citizens says the increases, felt in the Keys but also elsewhere in the state, came about after analysts began considering actuarial estimates in addition to the highest privately available rates. But Citizens' rates in the Keys are far higher than those in counties that recently suffered major wind damage from hurricanes. In parts of Palm Beach County, for example, residents are slated to pay $10.18 to $12.42 per $1,000 of coverage in 2006, while Charlotte County residents will be charged $7.17. ''Our rates are not based on past losses, they are based on future risk,'' Citizens spokesman Justin Glover said. Furor over such comments has allowed FIRM to make inroads in Tallahassee and Washington, where it has retained its own lobbyist. Meanwhile, the crisis has compounded two of the Keys' most pressing dilemmas: a lack of affordable housing and difficulty retaining a viable work force. ''It's had a dramatic effect,'' said Key West Mayor Morgan McPherson. ``We are going to have to litigate. This is not something that's going to go away.'' The current fight has united people from all economic walks of life. `BATTLE FOR THE SOUL' ''It literally is a battle for the soul of this community,'' said Peter Anderson, secretary general of the Conch Republic. Anderson is wondering how he'll pay a $7,000 bill next month on his 1,000-square-foot home. ''I don't have the money,'' he said. A rapid escalation in home values last year also may be feeding the increase. 'I am getting calls from existing clients [who] have mortgages, saying, `I am being forced to sell my home because my windstorm is so high I can't afford the payments.' They are asking if we will waive our windstorm requirements, and we can't,'' said Joe Clark, vice president for Key West Bank, which provides mortgages. ``I am getting four, five, six calls a day.'' Many people, he said, are trying to flee before another hurricane season hits. ''It's pushing them to the edge emotionally,'' said Clark, who is trying to help some clients by converting 30-year mortgages to 40 years to lower monthly payments. Even those who don't own homes feel the pressure. ''It's a train wreck, basically, and everybody just keeps standing around wringing their hands, and there is nobody helping us,'' laments Lisa Haas, a chef who rents a house on Sugarloaf Key. Her monthly payment, which she shares, is about to rise from $1,800 to $2,300 as her landlord tries to cope with higher insurance costs. ''I'm going to hold on till June 1. I gave my notice at my job,'' she said. Despite the anger it has unleashed, Citizens has not backed away from its hikes. ''Since the 1970s, private insurance companies have not written coverage in the Keys for wind, even prior to Hurricane Andrew,'' Glover said. ``You have to ask yourself, why would an insurance company not want to provide wind insurance in the Keys?'' RATES UNDER SCRUTINY The state's insurance consumer advocate, Steve Burgess, state legislators and even Gov. Jeb Bush are all scrutinizing the increases. Last week, Bush indicated he may allow part of the state's 2005 sales tax windfall to be applied to Citizens' deficit, but warned that legislators also must consider reforming the state's hurricane insurance system. Burgess has protested the increases across the state and contends that Citizens' actuarial calculations need a more thorough vetting. ''We are urging the insurance commissioner to set the rates at the currently approved rates, which are the 2005 rates, and in the meantime examine the issues,'' Burgess said. Citizens' Glover insists the Keys is not getting specially harsh treatment. ''Places like Dade County are receiving double-digit rate increases. In Pasco County -- they are being tremendously impacted by sinkholes -- we are proposing 100-percent rate increases,'' Glover said. ``We have a $1.7 billion deficit, and we didn't have enough money to pay claims out of our surplus. We have to turn to the people of Florida.''