ASBFM Saqa Unit Standards Booklet

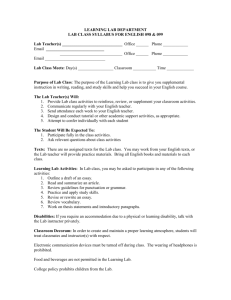

advertisement

ICB Certificate in Small Business Financial Management Summarised SAQA Unit Standards Booklet Page 1 of 28 REGISTERED LEARNERSHIP FASSET LEARNERSHIP CODE 01/Q010023/241/120/4 SAQA QUALIFICATION ID 48736 NATIONAL CERTIFICATE: SMALL BUSINESS FINANCIAL MANAGEMENT SUMMARISED SAQA UNIT STANDARDS BOOKLET PURPOSE OF THIS BOOKLET The aim of this document is to familiarise learners, training providers and assessors with all the unit standards that are included in this NQF level 4 learnership. It should be read in conjunction with the following related ICB publications: 1. ICB SBFM ‘Introductory Outline’ 2. ICB SBFM ‘Practical Training Logbook’ (including the Portfolio of Evidence and Training Record) 3. ICB SBFM ‘Assessment Record’ (including the Assessment Guide) TABLE OF UNIT STANDARDS ID UNIT STANDARD TITLE LEVEL CREDITS Core 114735 Perform VAT calculations and complete returns Level 4 5 Core 114736 Record business financial transactions Level 4 5 Core 114733 Complete PAYE documents Level 4 7 Core 114741 Finalise and interpret accounts Level 4 4 Core 114742 Calculate the tax payable by a small business Level 4 6 Core 114737 Cost and price a product Level 4 6 Core 114740 Manage working capital Level 4 5 Core 114738 Perform financial planning and control functions for a small business Level 4 6 There are 8 core unit standards totalling 44 credits at NQF level 4 Fundamental 8968 Accommodate audience and context needs in oral communication (second language) Level 3 5 Fundamental 8972 Interpret a variety of literary texts (second language) Level 3 5 Fundamental 8969 Interpret and use information from texts (second language) Level 3 5 Fundamental 8970 Write texts for a range of communicative contexts (second language) Level 3 5 There are 4 fundamental unit standards in second language ICB Certificate in Small Business Financial Management Summarised SAQA Unit Standards Booklet Page 2 of 28 communication totalling 20 credits at NQF level 3 Fundamental 9015 Apply knowledge of statistics and probability to critically interrogate and effectively communicate findings on life related problems Level 4 6 Fundamental 9016 or Represent, analyze and calculate shape and motion in 2- and 312417 dimensional space in different contexts Level 4 4 Fundamental 9014 or Use mathematics to investigate and monitor the financial aspects of 7468 personal, business and national issues Level 4 6 There are 3 fundamental unit standards in mathematical literacy totalling 16 credits at NQF level 4 Fundamental 8974 Engage in sustained oral communication and evaluate spoken texts Level 4 5 Fundamental 8975 Read analyse and respond to a variety of texts Level 4 5 Fundamental 12153 Use the writing process to compose texts required in the business environment Level 4 5 Fundamental 8976 Write for a wide range of contexts Level 4 5 There are 4 fundamental unit standards in first language communication totalling 20 credits at NQF level 4 Elective 7576 Demonstrate the ability to use a database for business purposes Level 3 5 Elective 7567 Produce and use spreadsheets for business Level 3 5 Elective 7575 Produce presentation documents for business Level 3 5 Elective 7570 Produce word processing documents for business Level 3 5 Level 3 (5) There are 4 elective unit standards in computer literacy totalling 20 credits at NQF level 3 Elective 7546 Not recommended – obtain written permission from the ICB before choosing this elective unit standard The total credit value of this NQF level 4 Fasset learnership is 120 credits ICB Certificate in Small Business Financial Management Summarised SAQA Unit Standards Booklet Page 3 of 28 Unit standard 114735 NQF level – 4 Credits - 5 Perform Value Added Tax calculations and complete returns On completion of this Unit standard, learners will be able to calculate VAT and prepare VAT returns Numbering system for outcomes and assessment criteria: 1 Outcome 1.1, 1.2//2.1, 2.2 etc Assessment criteria for the outcome 1. Understand and apply the current rules and rates of VAT 1.1. The reasons behind the introduction of VAT are understood and explained orally 1.2. The effect of VAT on small businesses, customers and the country is explained using examples that illustrate the advantages and disadvantages 1.3. The rules and rates relating to VAT are applied to the transactions of a small business 2. Calculate Value Added Tax 2.1. VAT output and input tax is calculated in accordance with current VAT rules from gross figures 2.2. VAT procedures are applied to cash discounts and trade discounts 2.3. Invoices are produced using VAT calculations correctly 3. Set up and maintain VAT records 3.1. VAT transactions are recorded and kept according to organisational and bookkeeping practice 3.2. Adequate and accurate sources of information is obtained for the completion of VAT returns 4. Complete VAT returns for both cash and credit transactions 4.1. VAT returns are completed using the records of VAT transactions to calculate the necessary entries ICB Certificate in Small Business Financial Management Summarised SAQA Unit Standards Booklet Page 4 of 28 Unit standard 114736 NQF level – 4 Credits - 5 Record business financial transactions People credited with this unit standard are able to: • Process Receipts and Payments • Enter records in an analysed cash book for both cash and bank entries • Check invoices received against orders • Produce quotations and invoices • Record debtors and creditors • Reconcile supplier’s statements • Prepare a bank reconciliation statement Numbering system for outcomes and assessment criteria: 1 Outcome 1.1, 1.2//2.1, 2.2 etc Assessment criteria for the outcome 1. Process Receipts and Payments 1.1. Cash payments are received and made according to organisational procedures and accepted bookkeeping practice 1.2. Cheque payments are received and made according to organisational procedures and accepted bookkeeping practice 1.3. Debit and Stop order payments are received and made according to organisational procedures and accepted bookkeeping practice 2. Enter records in an analysed cash book for both cash and bank entries. 2.1. Transactions are processed through a columnar/analysis cash book 2.2. The cash book is balanced and the cash and bank balances are brought down according to standard bookkeeping procedure 3. Check invoices received against orders 3.1. Invoices received are checked against relevant source information 3.2. Invoices received are checked for arithmetical accuracy 4. Produce quotations and invoices 4.1. Quotations are prepared from the relevant source documentation and information 4.2. Sales invoices are prepared from the relevant source documentation and information 5. Record debtors and creditors 5.1. Records of all debts owed to and by a business are kept securely 5.2. Outstanding debts that are owed to a business are calculated accurately 5.3. Outstanding debts that are owed by a business are calculated accurately 6. Reconcile supplier’s statements 6.1. A statement of account received from a trade creditor is reconciled with relevant source documentation and the cash book 7. Prepare a bank reconciliation statement 7.1. The time lag differences between the cash book bank account postings and the bank statement postings are accounted for using standard accounting practice 7.2. The cash book balance is updated for time lag differences following reconciliation ICB Certificate in Small Business Financial Management Summarised SAQA Unit Standards Booklet Page 5 of 28 Unit standard 114733 NQF level – 4 Credits - 7 Complete PAYE documents People credited with this unit standard are able to: • Calculate gross wages from either time records or a productivity scheme • Make and record the correct deductions • Complete a payslip and other forms to show both Income Tax and deductions • Complete IRP5 and IT3(a) certificates Numbering system for outcomes and assessment criteria: 1 Outcome 1.1, 1.2//2.1, 2.2 etc Assessment criteria for the outcome 1. Calculate gross wages from either time records or a productivity scheme 1.1. The difference between gross pay and net pay is explained with examples 1.2. Payments that are made to and/or by the worker that are not subject to tax or that give a tax rebate are explained with examples 1.3. Gross Pay for a weekly/monthly pay roll is calculated for Income Tax purposes 2. Make and record the correct deductions 2.1. The deductions that are to be paid by the employer are explained with examples of what they are and to whom they are paid 2.2. The deductions that are to be paid by the employee are explained with examples of what they are and to whom they are paid 2.3. The various deductions to be paid are calculated on Gross Pay and the necessary forms completed accurately 3. Complete payslips and other forms to show both Income Tax and deductions 3.1. Information is extracted from weekly/monthly working sheets to produce pay slips and to complete the required forms for submission to the Receiver of Revenue - UIF, PAYE, SDL 3.2. Pay slips and the necessary forms are completed for submission to the Receiver of Revenue on time 3.3. The deadlines, requirements and the procedures for monthly and quarterly payments to the Receiver of Revenue are known and adhered to at all times 4. Complete IRP 5 and IT 3(a) certificates 4.1. Information from weekly/monthly working sheets is extracted to produce IRP5 and IT3(a) certificates for each employee ICB Certificate in Small Business Financial Management Summarised SAQA Unit Standards Booklet Page 6 of 28 Unit standard 114741 NQF level – 4 Credits - 4 Finalise and interpret accounts People credited with this unit standard are able to: • Make adjustments to total expenses and purchases of assets • Prepare a trading and profit & loss account and balance sheet for a small business • Understand the distinctions between gross profit, net profit and cash in hand • Calculate and use basic liquidity and profitability ratios to assess the performance of a small business Notes to ICB Assessors and Learners: Wherever ‘Trading and Profit & Loss Account’ appears in this standard it can be substituted with the term ‘Income Statement’ It will be enough to actually draft and interpret the statements of sole traders and close corporations only and just be able to explain the differences that apply in respect of partnerships and companies Numbering system for outcomes and assessment criteria 1 Outcome 1.1, 1.2//2.1, 2.2 etc Assessment criteria for the outcome 1. Make adjustments to total expenses and purchases of assets 1.1. The straight line and reducing balance methods of stock evaluation are understood and examples given of how each is used in an organisation 1.2. Adjustments are made for stock evaluation, depreciation of fixed assets, pre-payments and bad debts of a small business using the straight line and reducing balance methods 2. Prepare a trading and profit and loss account and balance sheet for a small business. 2.1. The reasons for preparing a trading account, a profit and loss account and a balance sheet for a small business are explained giving examples of the advantages and disadvantages for the business if they are not prepared 2.2. A trading account, a profit and loss account and a balance sheet are prepared for a small business using information from the financial records of the business 3. Understand the distinctions between gross profit, net profit and cash in hand 3.1. The differences between gross and net profit and cash in hand are known and explained using examples from a small business 3.2. The significance of these distinctions is explained for a business 4. Calculate and use basic liquidity and profitability ratios 4.1. Ratio calculations are made in respect of profitability and liquidity for a small business 4.2. The performance of a business is appraised and commented on following a ratio and liquidity analysis 4.3. The limitations of ratio analysis for assessing the current and future potential performance is understood for a business ICB Certificate in Small Business Financial Management Summarised SAQA Unit Standards Booklet Page 7 of 28 Units standard 114742 NQF level – 4 Credits - 6 Calculate tax payable by a small business People credited with this standard are able to • Distinguish between expenses that are allowable and which are not allowable as tax rebates/deductions for a sole trader • Calculate capital allowances • Calculate the figures required for the completion of an income tax return • Calculate the tax payable by an individual who is a sole trader • Apply the concepts of limited liability and incorporation to a sole trader Numbering system for outcomes and assessment criteria 1 Outcome 1.1, 1.2//2.1, 2.2 etc Assessment criteria for the outcome 1. Distinguish between the main business expenses that are not allowable for income tax purposes 1.1. The concepts of tax rebates and expenses that are tax deductible are explained using examples from the expenses of a small business 1.2. Expenditure items that are tax deductible and those that are not are identified and listed for a small business for use on a tax return 2. Understand and calculate capital allowances. 2.1. The concept of Capital Allowances is understood and illustrated with examples from a sole trader 2.2. Capital Allowances are calculated for the purpose of making the appropriate entries in an income tax return 3. Calculate the figures required for the completion of an income tax return 3.1. The information that is required to enable tax returns to be completed is identified and explained with examples 3.2. The required entries for an income tax return, including turnover for tax purposes, are calculated where the small business is the single source of income 4. Calculate the tax payable by an individual who is a sole trader 4.1. The tax payable by an individual who is a sole trader or where a small business is the sole source of income is calculated using the Receiver of Revenue’s tax tables 4.2. The required tax forms are completed correctly for an individual who is a sole trader or who derives income entirely from a small business 5. The concepts of limited liability and incorporation are applied 5.1. The concepts of limited liability and legal status is explained for a limited company 5.2. The tax liability of a small business is explained with examples of the implications of compliance and noncompliance ICB Certificate in Small Business Financial Management Summarised SAQA Unit Standards Booklet Page 8 of 28 Unit standard 114737 NQF level – 4 Credits - 6 Cost and price a product People credited with this unit standard are able to: • Calculate the total costs involved in producing a product • Distinguish between fixed and variable costs • Carry out a break-even analysis • Calculate the selling price of a product Numbering system for outcomes and assessment criteria 1 Outcome 1.1, 1.2//2.1, 2.2 etc Assessment criteria for the outcome 1. Calculate the total production, administration, selling and distribution costs of a product 1.1. The costs involved in producing a product are identified, including the apportionment of overheads 1.2. The total production cost of a product is calculated using all available information 2. Distinguish between fixed and variable costs 2.1. The differences between fixed and variable costs is explained using examples of each 2.2. The factors increasing or decreasing variable costs are explained with examples 2.3. Ways in which the variable costs associated with the production of a particular product by an organization can be reduced are identified and an explanation given of the advantages and disadvantages of implementing each 3. Carry out simple break-even analysis. 3.1. The concept of break-even for a small business is explained with examples 3.2. The necessary sales volumes to reach break-even for an organisation are calculated using total cost of production. 3.3. Break-even analysis is used to make investment, pricing and purchasing decisions 4. Calculate a selling price by using the mark-up or the margin 4.1. The concepts of "mark-up" and "profit" are explained with examples 4.2. The selling prices of a product are calculated using mark-up and profit (margin) and a recommendation is made as to the advantages and disadvantages of each method of calculation for the product in question 5. Apply the concepts of chargeable hours and total hours worked 5.1. The concepts of "chargeable hours" and "total hours worked" are explained using examples from an organization 5.2. The cost and resultant price of a product are calculated using chargeable hours 5.3. The cost and resultant price of a product are calculated using a costing for total hours worked and an explanation given of why chargeable hours is generally used for this purpose ICB Certificate in Small Business Financial Management Summarised SAQA Unit Standards Booklet Page 9 of 28 Unit standard 114740 NQF level – 4 Credits - 5 Manage working capital People credited with this unit standard are able to: • Calculate working capital in a business. • Identify and explain the dangers of over trading. • Demonstrate the effects that external and internal events and actions have on cash flow • Calculate an approximate APR for an organisation Note to Assessors and Learners: Wherever ‘APR’ (average percentage rate) appears in this standard it can be taken to mean ‘WACC’ (weighted average cost of capital) Numbering system for outcomes and assessment criteria 1 Outcome 1.1, 1.2//2.1, 2.2 etc Assessment criteria for the outcome 1. Calculate the level of working capital in a business 1.1. The current assets and liabilities of an organisation are calculated correctly 1.2. The working capital of the organisation is calculated using all available information 2. Identify and explain the dangers of overtrading 2.1. The concept of overtrading is explained with examples 2.2. Low or negative levels of working capital are identified for an organization and an explanation given with regard to the potential risks 3. Understand the effects on cash flow of external and internal events and actions 3.1. The external events that can affect the cash flow of an organisation are identified and an explanation given of how each can affect the organisation 3.2. The internal events and actions that can affect the cash flow of an organisation are identified and an explanation given of how each can affect the organisation 4. Calculate an approximate APR 4.1. The concept of APR is explained with examples 4.2. An approximate APR is calculated for an organization from a given cash flow or Hire Purchase scheme in order to be able to compare rates and make finance choices ICB Certificate in Small Business Financial Management Summarised SAQA Unit Standards Booklet Page 10 of 28 Unit standard 114738 NQF level – 4 Credits - 6 Perform financial planning and control functions for a small business People credited with this unit standard are able to: • Prepare a business plan • Monitor actual performance against a budget • Make decisions on purchasing of fixed assets • Understand the importance of financial reporting Numbering system for outcomes and assessment criteria 1 Outcome 1.1, 1.2//2.1, 2.2 etc Assessment criteria for the outcome 1. Prepare a business plan suitable for submission to a financial institution 1.1. The various components that should be included in a business plan that will be submitted to a financial institution, are identified with examples given from the plan of a successful organisation 1.2. A business plan is constructed in a form that would be generally acceptable by a financial institution 2. Monitor actual performance of an organisation against budget 2.1. A columnar budget is constructed so that planned income and expenditure can be compared against actual income and expenditure 2.2. Positive and negative variances are identified using standard financial management practice 2.3. A report is drawn up on the financial position of the organization resulting from the comparison of actual versus budgeted income and expenditure so as to aid decision-making and future action for the organisation 3. Decide on the purchase of fixed assets based on highest financial return 3.1. Investment appraisal techniques are used to calculate forecast returns from the potential purchase of fixed assets 3.2. The results of investment appraisal calculations are used to decide which fixed assets to purchase 4. Understand the importance of financial reporting 4.1. The different types of financial reporting done by a small organization are identified and an indication given of the target audience of each report 4.2. The advantages of producing periodic financial reports/statements are explained with examples 4.3. The dangers presented to a small business by the absence of financial reports are explained with the use of examples ICB Certificate in Small Business Financial Management Summarised SAQA Unit Standards Booklet Page 11 of 28 Unit Standard 8968 NQF level – 3 Credits - 5 Accommodate audience and context needs in oral communication People credited with this unit standard are able to: interact successfully with audience in oral communication use strategies that capture and retain the interest of an audience identify and respond to manipulative use of language Note to Assessors and Learners: This unit standard is to be assessed in the learner’s second language Numbering system for outcomes and assessment criteria 1 Outcome 1.1, 1.2//2.1, 2.2 etc Assessment criteria for the outcome 1. Interact successfully with audience in oral communication 1.1. Contributions to group work are appropriate to the task and nature of the group, and promote effective communication and teamwork 1.2. Interviews successfully establish a relationship appropriate to the context, and provide a non-threatening opportunity for participants to share information 1.3. Participation in formal meetings is appropriate to the purpose and context of the meeting. Participation is consistent with meeting procedures and contributes to the achievement of meeting objectives 1.4. Participation in debates or negotiations is appropriate to the purpose and topic. Participation is consistent with formal procedures and contributes to meaningful interaction between participants 1.5. Responses to the ways others express themselves are sensitive to differing socio-cultural contexts 2. Use strategies that capture and retain the interest of an audience 2.1. Key words, pace and pause, stress, volume and intonation are used in appropriate ways to reinforce the message 2.2. Body language is appropriate to context and topic, and reinforces main ideas and attitudes 2.3. Formal communications are planned in writing, and plans are detailed, complete, and realistic with respect to time allocation and content 2.4. Visual aids are appropriate to topic and context, and enhance the presentation and the transfer of information and understanding 2.5. Techniques are used to maintain continuity and interaction 3. Identify and respond to manipulative use of language 3.1. Facts and opinion are identified and distinguished 3.2. Omission of necessary information is noted and addressed 3.3. The implications of how the choice of language structures and features, specifically tone, style and point of view affect audience’s interpretations of spoken texts are explained 3.4. Distortion of a contributor’s position on a given issue is explored with specific reference to what has been selected and omitted ICB Certificate in Small Business Financial Management Summarised SAQA Unit Standards Booklet Page 12 of 28 Unit Standard 8972 NQF level – 3 Credits - 5 Interpret a variety of literary texts People credited with this unit standard are able to: extract meaning from a variety of literary texts identify and explain features that influence response to texts produce texts in response to literary texts Note to Assessors and Learners: This unit standard is to be assessed in the learner’s second language Numbering system for outcomes and assessment criteria 1 Outcome 1.1, 1.2//2.1, 2.2 etc Assessment criteria for the outcome 1. Extract meaning from a variety of literary texts 1.1. Listening/reading/viewing strategies appropriate to the purposes for study are adopted 1.2. Organisational features of literary texts are identified and the role of each is explained 1.3. One’s responses are confirmed and/or adapted after interaction with others in discussing a text 1.4. Evidence cited from texts in defence of a position is relevant 2. Identify and explain features that influence response to texts 2.1. The human experiences and values in texts are explored and explained 2.2. A variety of texts are explored and explained in terms of social or personal relevance 2.3. Responses to points of view in text are imaginative and an understanding of surface or embedded meaning in the text is reflected in presentations of own viewpoints 2.4. The way in which different people respond differently to texts is explored and discussed 3. Produce own texts in response to literary texts 3.1. Content is outlined and related to theme and character development 3.2. A good grasp of the significant ideas of the texts is demonstrated 3.3. Author’s use of certain stylistic devices is identified, and the effects created are described 3.4. One’s understanding of characterisation is justified 3.5. Selected literary texts are used as a basis for writing in different formats and registers ICB Certificate in Small Business Financial Management Summarised SAQA Unit Standards Booklet Page 13 of 28 Unit Standard 8969 NQF level – 3 Credits - 5 Interpret and use information from texts People credited with this unit standard are able to: use a range of reading and viewing strategies to understand the literal meaning of specific texts use strategies for extracting implicit messages in texts respond to selected texts in a manner appropriate to the context explore and explain how language structures and features may influence a reader Note to Assessors and Learners: This unit standard is to be assessed in the learner’s second language Numbering system for outcomes and assessment criteria 1 Outcome 1.1, 1.2//2.1, 2.2 etc Assessment criteria for the outcome 1. Use a range of reading and viewing strategies to understand the literal meaning of specific texts 1.1. Unfamiliar words are identified. Their meanings are correctly determined by using knowledge of syntax, wordattack skills, and contextual clues 1.2. Different options for the meanings of ambiguous words are tested, and selected meanings are correct in relation to the context 1.3. Main ideas are separated from supporting evidence and paraphrased or summarised 1.4. The purpose of visual and/or graphic representations in texts are recognised and explained 2. Use strategies for extracting implicit messages in texts 2.1. Source of text is identified and discussed in terms of reliability and possible bias 2.2. Author’s attitude, beliefs and intentions are explored in order to determine the point of view expressed either directly or indirectly 2.3. Author’s techniques are explored and explained in terms of purpose and audience 2.4. Promotion of, or support for, a particular line of thought/cause is identified and explained with reference to selection or omission of materials 3. Respond to selected texts in a manner appropriate to the context 3.1. Instructions and requests are acted upon 3.2. Text-type, format and register used are on the correct level of formality 4. Explore and explain how language structures and features may influence a reader 4.1. The choice of words, language usage, symbols, pictures and tone is described in terms of how a point of view is shaped or supported. ICB Certificate in Small Business Financial Management Summarised SAQA Unit Standards Booklet Page 14 of 28 Unit Standard 8970 NQF level – 3 Credits - 5 Write texts for a range of communicative contexts People credited with this unit standard are able to: write for a specified audience and purpose use language structures and features to produce coherent and cohesive texts for a wide range of contexts draft own writing and edit to improve clarity and correctness Note to Assessors and Learners: This unit standard is to be assessed in the learner’s second language Numbering system for outcomes and assessment criteria 1 Outcome 1.1, 1.2//2.1, 2.2 etc Assessment criteria for the outcome 1. Write for a specified audience and purpose 1.1. The purpose for writing, the target audience and the context is clear, in relation to the learning task or activity 1.2. The text-type, style, and register selected are appropriate to audience, purpose and context 1.3. Language appropriate to socio-cultural sensitivities is selected and used in an appropriate manner without compromising own values or arguments 1.4. Writing is well-structured and conveys its message clearly 1.5. Critical thinking skills are used as strategies for planning 1.6. Arguments are supported with sound reasons and facts, and writing reflects a clear point of view, and shows logical development of a clearly articulated premise 1.7. Research skills are evident in the way data and information relevant to the context is identified, located and selected for inclusion in the final text 2. Use language structures and features 2.1. Meaning is clearly expressed through the use of a range of sentence lengths, types, and complexities 2.2. The use of paragraph conventions, including links between paragraphs in texts, promotes coherence and cohesion in writing. Their use is explained with reference to logical progression, cause and effect, and contrast 2.3. The overall structure of a piece of writing is controlled and the conclusion is clearly formulated 3. Draft own writing and edit to improve clarity and correctness 3.1. Writing produced is appropriate to audience, purpose and context. Corrections are an improvement on the original 3.2. Control of grammar, diction, sentence and paragraph structure is checked and adapted for consistency 3.3. Logical sequencing of ideas and overall unity is achieved through redrafting 3.4. There is clear evidence that major grammatical and linguistic errors are edited out in redrafts 3.5. Inappropriate or potentially offensive language is identified and adapted/removed 3.6. Experimentation with different layout and options for presentation are appropriate to the nature and purpose of the task ICB Certificate in Small Business Financial Management Summarised SAQA Unit Standards Booklet Page 15 of 28 Unit Standard 9015 NQF level – 4 Credits - 6 Apply knowledge of statistics and probability to critically integrate and effectively communicate findings on life related problems People credited with this unit standard are able to: Collect, organize and represent data Experimental probability to develop models and make predictions Use probability/statistical models in problem solving and decision making Numbering system for outcomes and assessment criteria 1 Outcome 1.1, 1.2//2.1, 2.2 etc Assessment criteria for the outcome 1. Critique and use techniques for collecting, organizing and representing data 1.1 Situations or issues that can be dealt with through statistical methods are identified correctly 1.2 Appropriate methods for collecting, recording and organizing (data are used so as to maximize efficiency and ensure the resolution of a problem or issue) 1.3 Data sources and data bases are selected in a manner that ensures the representativeness of the sample and the validity of resolutions 1.4 Activities that could result in contamination of data are identified and explanations are provided of the effects of contaminated data 1.5 Data is gathered using methods appropriate to the data type and purpose for gathering the data 1.6 Data collection methods are used correctly 1.7 Calculations and the use of statistics are correct 1.8 Graphical representations and numerical summaries are consistent with the data, are clear and appropriate to the situation and target audience 1.9 Resolutions for the situation or issue are supported by the data and are validated in terms of the context 2. Use theoretical and experimental probability to develop models 2.1 Experiments and simulations are chosen and/or designed appropriately in terms of the situation to be modelled 2.2 Predictions are based on validated experimental or theoretical probabilities 2.3 The results of experiments and simulations are interpreted in terms of the real context 2.4 The outcomes of experiments and simulations are communicated clearly 3. Critically interrogate and use probability and statistical models in problem solving and decision making in real work situations 3.1 Statistics generated from the data are interpreted meaningfully and interpretations are justified or critiqued 3.2 Assumptions made in the collection or generation of data and statistics are defined or critiqued appropriately 3.3 Tables, diagrams, charts and graphs are used or critiqued appropriately in the analysis and representation of data, statistics and probability values 3.4 Predictions, conclusions and judgments are made on the basis of valid arguments and supporting data, statistics and probability models 3.5 Evaluations of the statistics identify potential source of bias, errors in measurement, potential uses and misuses and their effects ICB Certificate in Small Business Financial Management Summarised SAQA Unit Standards Booklet Page 16 of 28 Unit Standard 9016 (or 12417) NQF level – 4 Credits - 4 Represent, analyse and calculate shape and motion in 2-and 3-dimensional space in different contexts People credited with this unit standard are able to: • Measure, estimate, and calculate physical quantities in practical situations relevant to the adult with increasing responsibilities in life or the workplace • Explore analyse and critique, describe and represent, interpret and justify geometrical relationships and conjectures to solve problems in two and three dimensional geometrical situations Numbering system for outcomes and assessment criteria 1 Outcome 1.1, 1.2//2.1, 2.2 etc Assessment criteria for the outcome 1. Measure, estimate, and calculate physical quantities in practical situations relevant to the adult 1.1. Scales on the measuring instruments are read correctly 1.2. Quantities are estimated to a tolerance justified in the context of the need 1.3. The appropriate instrument is chosen to measure a particular quantity 1.4. Quantities are measured correctly to within the least step of the instrument 1.5. Appropriate formulae are selected and used 1.6. Calculations are carried out correctly and the least steps of instruments used are taken into account when reporting final values 1.7. Symbols and units are used in accordance with SI conventions and as appropriate to the situation 2. Explore, analyse & critique, describe & represent, interpret and justify geometrical relationships 2.1. Descriptions are based on a systematic analysis of the shapes and reflect the properties of the shapes accurately, clearly and completely 2.2. Descriptions include quantitative information appropriate to the situation and need 2.3. 3 dimensional objects are represented by top, front and side views 2.4. Different views are correctly assimilated to describe 3-dimensional objects 2.5. Available and appropriate technology is used in producing and analysing representations 2.6. Relations of distance and positions between objects are analysed from different views 2.7. Conjectures as appropriate to the situation, are based on well-planned investigations of geometrical properties 2.8. Representations of the problems are consistent with and appropriate to the problem context. The problems are represented comprehensively and in mathematical terms 2.9. Results are achieved through efficient and correct analysis and manipulation of representations 2.10. Problem-solving methods are presented clearly, logically and in mathematical terms 2.11. Reflections on the chosen problem solving strategy reveal strengths and weaknesses of the strategy 2.12. Alternative strategies to obtain the solution are identified and compared in terms of appropriateness and effectiveness ICB Certificate in Small Business Financial Management Summarised SAQA Unit Standards Booklet Page 17 of 28 Unit Standard 9014 (or 7468) NQF level – 4 Credits - 6 Use mathematics to investigate and monitor the financial aspects of personal, business and national issues People credited with this unit standard are able to: Use mathematics to investigate and analyse, regional and/or national budgets and income and expenditure Use compound growth to make sense of inflationary effects on the national economy Use mathematics to critique and debate aspects of the national economy Numbering system for outcomes and assessment criteria 1 Outcome 1.1, 1.2//2.1, 2.2 etc Assessment criteria for the outcome 1. Use mathematics to investigate and analyse regional and/or national budgets and income 1.1. Regional and/or national budgets from the media and other sources are accessed, and income and expenditure are described realistically 1.2. Calculations are carried out efficiently and correctly using computational tools 1.3. Solutions obtained are verified in terms of the context 1.4. Different ways of representing budgets are critically analysed and related 1.5. Actual income and expenditure is analysed and compared to planned income and expenditure. Variances are identified 2. Use compound growth to make sense of inflationary effects on the national economy 2.1. Methods of calculation are appropriate to the problem types 2.2. Computational tools are used efficiently and correctly and solutions obtained are verified in terms of the context or problem 2.3. Solutions to calculations are interpreted in terms of base rates or indices 2.4. Appropriate formulae are understood and used to calculate solutions to problems 3. Use mathematics to critique and debate aspects of the national economy 3.1. Values are calculated correctly 3.2. Mathematical tools are used to compare the effects of changes in different sectors of the national economy 3.3. Critique and debating points are based on well-reasoned arguments and are supported by mathematical information ICB Certificate in Small Business Financial Management Summarised SAQA Unit Standards Booklet Page 18 of 28 Units Standard 8974 NQF level – 4 Credits - 5 Engage in sustained oral communication and evaluate spoken texts People credited with this unit standard are able to: Respond critically yet sensitively as a listener Analyse own responses to spoken texts and adjust as required Use strategies to be an effective speaker in sustained oral interactions Evaluate spoken discourse Numbering system for outcomes and assessment criteria 1 Outcome 1.1, 1.2//2.1, 2.2 etc Assessment criteria for the outcome 1. Respond critically yet sensitively as a listener 1.1. Responses show a clearly developed understanding of complex issues under discussion in one-on-one or group situations. One’s understanding is clarified and further developed during discussions and opportunity is provided during interactions for the clarification of one another’s understanding 1.2. Discussions and/or conflicts are managed sensitively and in a manner that supports the goal of group or one-onone interaction 1.3. The underlying assumptions, points of view and subtexts in spoken texts are identified and challenged when appropriate to clarify understanding, remove bias and/or sustain interaction 2. Analyse own responses to spoken texts and adjust as required 2.1. One’s responses to spoken texts are analysed in relation to audience, purpose and context. Inappropriate responses are identified and adjusted accordingly 2.2. When confronted by opposing views, own position is put forward with confidence in a manner appropriate to the interaction 2.3. Tone, approach or style is appropriate to context, and is adapted so as to maintain oral interaction when it breaks down or is difficult to initiate or maintain. Pedantic, illogical or aggressive language is identified and modified to sustain interaction 3. Use strategies to be an effective speaker in sustained oral interactions 3.1. Characteristics of a speaker’s style and tone that attract or alienate an audience are identified with reference to the particular effect of each feature in creating audience response 3.2. The impact of non-verbal cues/body language and signals on audiences is analysed and used appropriately 3.3. The influence of rhetorical devices is analysed and used for effect on an audience 4. Evaluate spoken discourse 4.1. Point of view in spoken texts is identified and meaning described in relation to context and purpose of the interaction 4.2. Values, attitudes and assumptions in discourse are identified and their influence on the interaction described 4.3. Techniques used by speakers to evade or dissipate responsibility for an issue are identified and interpretations of the text reflect this insight 4.4. The impact (e.g. clarity of purpose, speaker’s capability) is described, explained and judged ICB Certificate in Small Business Financial Management Summarised SAQA Unit Standards Booklet Page 19 of 28 Unit Standard 8975 NQF level – 4 Credits - 5 Read, analyze and respond to a variety of texts People credited with this unit standard are able to: • analyze and criticize texts produced for a range of purposes, audiences and contexts • identify and explain the values, attitudes and assumptions in texts • evaluate the effects of content, language and style on readers’ responses in specific text Numbering system for outcomes and assessment criteria 1 Outcome 1.1, 1.2//2.1, 2.2 etc Assessment criteria for the outcome 1. Analyze and criticize texts produced for a range of purposes, audiences and contexts 1.1 Reading strategies appropriate to the purposes for reading are adopted 1.2 Organizational features of texts are identified. The role of each of the features is explained in relation to usefulness in making meaning of readings and viewing 1.3 Synthesis of information from texts, and generalization of patterns and trends, result in appropriate conclusions about purpose and audience 2. Identify and explain the values, attitudes and assumptions in texts 2.1 An understanding of surface and embedded meaning in the text is reflected in presentations of viewpoints 2.2 The effect of an author’s values and views on selected texts is identified and explained in terms of the impact on meaning and target audience 2.3 Evidence cited from texts in defence of a position is relevant 3. Evaluate the effects of content, language and style on readers, responses in specific texts 3.1 Content is outlined and its possible effects on different readers are explored 3.2 The impact of different writing techniques on reader perspective are identified and explained in terms of the particular effect produced by each 3.3 The influence of specific language structures and features is analyzed 3.4 The effect of selected production techniques in visuals is explained ICB Certificate in Small Business Financial Management Summarised SAQA Unit Standards Booklet Page 20 of 28 Unit Standard 12153 NQF level – 4 Credits - 5 Use the writing process to compose texts required in the business environment People credited with this unit standard are able to: • using textual features and conventions specific to texts • identifying the intended audience for the communication • identifying the purpose of a text • selecting the appropriate text type, format and layout for the purpose • organising and structuring a technical text appropriately • using appropriate grammar conventions • drafting and editing a technical text • recognising errors and checking for accuracy • presenting the same information in different ways • using plain language in business Numbering system for outcomes and assessment criteria 1 Outcome 1.1, 1.2//2.1, 2.2 etc Assessment criteria for the outcome 1. Use textual features and conventions specific to business texts for effective writing 1.1. Texts specific to a particular function in a business environment are identified and an indication is given of industry specific and/or legislative requirements for each text 1.2. Texts specific to a particular function in a business environment are produced in response to defined requirements 1.3. The implications of not following the industry specific or legislative requirements for a specific type of text are explained and an indication is given of the possible consequences of non-compliance 1.4. Terminology and conventions specific to a particular function in a business environment are used appropriately 2. Identify and collect information needed to write a text specific to a particular function 2.1. The intended or incidental audience for whom the text is to be written, are identified for a specific field or sub field in order to focus the information needs 2.2. The purpose of the text is identified within a specific field or sub-field and according to the information. 2.3. Questions are asked to help understand client needs and to focus information gathering 2.4. Information required for the document is accessed from a variety of sources 2.5. Information accessed is checked for accuracy, bias, stereotypes, and other offensive details 2.6. The focus of the proposed text is defined and decision is made about what information should be included or omitted in order to ensure the focus 2.7. A checklist is created to facilitate reflection and editing 3. Compose a text using plain language for a specific function 3.1. A format and structure is selected for the text that is appropriate for the intended audience and function 3.2. The main points to be included in the text are identified and the necessary supporting details are added 3.3. A first draft of the text is written that collates the necessary information in a rough framework 4. Organise and structure a text appropriately for a business function 4.1. The first draft is checked to ensure that appropriate grammar has been used and where necessary the draft is rewritten in plain language using clear accessible language that avoids over-complex syntax 4.2. Different ways of presenting the same information are considered and used where these enhance the meaning of the text 4.3. Technical or marketing terms and jargon are interpreted and rephrased in plain language or used appropriately in the correct context where the terminology is essential to the understanding of the text 4.4. All information is checked for accuracy, and factual correctness ICB Certificate in Small Business Financial Management Summarised SAQA Unit Standards Booklet Page 21 of 28 5. Present a written text for a particular function in a business environment 5.1. A text type, format and layout are selected that is appropriate for the audience and purpose 5.2. Layout and formatting techniques are used correctly to enhance the readability of the text 5.3. Information in the document is evaluated in terms of its appropriateness for the intended audience and business function 5.4. The final draft is proof read to check that it is completely correct 5.5. The final copy is self assessed using a rubric or checklist based on the requirements of the writing task and the items on the checklist created in outcome 2.7 above ICB Certificate in Small Business Financial Management Summarised SAQA Unit Standards Booklet Page 22 of 28 Unit Standard 8976 NQF level – 4 Credits - 5 Write for a wide range of contexts People credited with this unit standard are able to: Write effectively and creatively on a range of topics Choose language structures and features to suit communicative purposes Edit writing for fluency and unity Numbering system for outcomes and assessment criteria 1 Outcome 1.1, 1.2//2.1, 2.2 etc Assessment criteria for the outcome 1. Write effectively and creatively on a range of topics 1.1 Imaginative texts are convincing, and appropriate to the topic and purpose 1.2 Expository/factual texts are convincing and well developed with respect to clearly articulated purposes, using fully developed paragraphs and resulting in a unified text 1.3 Writing on personal interests is convincing in terms of issues and concerns addressed 1.4 Choose the narrative voice appropriate to context, purpose and audience 2. Choose language structures and features to suit communicative purposes 2.1 Points in argument are logically and deliberately sequenced to build up a convincing conclusion 2.2 Devices are employed to create particular rhythmic or tonal effects 2.3 Stylistic devices that enhance meaning are used effectively 3. Edit writing for fluency and unity 3.1 Text is checked for coherence, logical sequence and structure. Weaknesses and/or errors are identified and adjustments improve coherence and flow 3.2 Information is re-arranged in ways that promote interest in, and impact of, the text for a defined target audience 3.3 Layout, spelling, punctuation and syntax are checked for accuracy and readability. Major grammatical and linguistic errors are identified and changes made as required 3.4 The whole, completed text is checked against the purposes for writing to verify that these purposes have been satisfied ICB Certificate in Small Business Financial Management Summarised SAQA Unit Standards Booklet Page 23 of 28 Unit Standard 7576 NQF level – 3 Credits - 5 Demonstrate the ability to use a database for business purposes People credited with this standard are able to: demonstrate the ability to retrieve information from an existing database using query sort tools enter data into the database using simple forms create and modify reports using a standard database package Numbering system for outcomes and assessment criteria 1 Outcome 1.1, 1.2//2.1, 2.2 etc Assessment criteria for the outcome 1. Retrieve information from an existing database 1.1. An existing database is loaded or logged into 1.2. A record is found based on given criteria 1.3. A simple query is created and saved 1.4. A query with multiple criteria is created 1.5. A filter is added 1.6. A filter is removed 2. Refine a query and select and sort data 2.1. Fields are added to a query 2.2. Fields are removed from query 2.3. Data is selected and sorted based on given criteria 2.4. Data is sorted and selected based on common logical operators 3. Use form to enter data into a database 3.1. Form is modified 3.2. A simple form is created 3.3. Data is entered into database using form 4. Create reports 4.1. Selected data is presented in a particular sequence on screen and in reports 4.2. A report is modified 4.3. Customised headers and footers are created 4.4. Field attributes are modified 4.5. Data is grouped in a report 4.6. Report is printed using installed printer ICB Certificate in Small Business Financial Management Summarised SAQA Unit Standards Booklet Page 24 of 28 Unit Standard 7567 NQF level – 3 Credits - 5 Produce and use spreadsheets for business People credited with this unit standard are able to: • Plan and design computer spreadsheet documents to solve a business problem • Format data in a spreadsheet. • Create graphs • Write macros • Solve problems using a spreadsheet Numbering system for outcomes and assessment criteria 1 Outcome 1.1, 1.2//2.1, 2.2 etc Assessment criteria for the outcome 1. Plan and design computer spreadsheet documents to solve a business problem 1.1. The problem is identified as being solvable by a spreadsheet 1.2. The spreadsheet is designed and documented in keeping with the nature of the problem 2. Produce a computer spreadsheet file to solve a business problem 2.1. Data is entered into the spreadsheet using labels and values 2.2. Data is formatted to produce the required spreadsheet in terms of cell width, alignment, number and date and time formats 2.3. Spreadsheet formulae are applied in order to produce the required spreadsheet in terms of statistical, time and date, financial and logical functions 2.4. Absolute cell referencing is used in order to copy formulae across and down 2.5. Template files are created, used and documented to meet the user requirements 2.6. Data integrity practices are demonstrated in terms of comparison with original information sources, audited formulae, check-totals and sort 2.7. The spreadsheet contains cells, which are sorted numerically and alphabetically 3. Use a computer spreadsheet file to solve a business problem 3.1. Cell ranges within the spreadsheet are charted to meet user requirements 3.2. Cell range within a spreadsheet is graphed to user requirements 3.3. The problem is solved by the spreadsheet created 3.4. "What if" exercises are applied to the spreadsheet in order to accommodate changes in requirements 3.5. Where available, the use of the onscreen help facility is demonstrated 3.6. File management techniques are demonstrated in terms of creating, naming, saving, copying, renaming, deleting, locating directory (folder), displaying directory contents printing and relocating 3.7. The file is previewed and printed using page setup appropriate to the layout 4. Manipulate the data in a spreadsheet 4.1. The appearance of spreadsheet is modified to user requirements using formatting facilities 4.2. Selected cells within an existing spreadsheet file are sorted numerically and alphabetically ICB Certificate in Small Business Financial Management Summarised SAQA Unit Standards Booklet Page 25 of 28 Unit Standard 7575 NQF level – 3 Credits - 5 Produce presentation documents for business People credited with this unit standard are able to: • demonstrate knowledge of the uses and advanced features of a presentation graphics package on a personal computer? create, import and modify drawn objects, charts, images and other objects into a presentation document? apply pre-set animations and transitions to slides within a presentation document • deliver a slide show Numbering system for outcomes and assessment criteria 1 Outcome 1.1, 1.2//2.1, 2.2 etc Assessment criteria for the outcome 1. Add, 1.1. 1.2. 1.3. 1.4. 1.5. 1.6. modify and move drawn objects within a presentation slide Different types of lines are added to a slide Lines within a slide are modified Shapes are added to slide An object is rotated or flipped Attributes of a shape are changed Shadow is applied to shape 2. Create, add and manipulate charts within a slide 2.1. Different kinds of chart are created 2.2. An organisational chart is created 2.3. A chart is imported from another source 2.4. The structure of an organisational chart is modified 3. Manage images and other objects within a slide 3.1. Images are imported from another file 3.2. Images are re-sized and moved within a slide 3.3. An imported object is copied to a master slide 3.4. Border effects are added to an object 3.5. Hyperlinks are inserted 4. Apply animation and transitions to a presentation document 4.1. Pre-set animation effects are applied to a slide 4.2. Pre-set animation effects are changed 4.3. Slide transition effects are added 4.4. Sounds are added to effects 5. Viewing and presenting a slide show 5.1. A slide show is started on any slide 5.2. On-screen navigation tools are used 5.3. Slides are hidden during presentation 6. Save presentation document in another file format 6.1. An existing presentation document is saved in another format ICB Certificate in Small Business Financial Management Summarised SAQA Unit Standards Booklet Page 26 of 28 Unit Standard 7570 NQF level – 3 Credits - 5 Produce word processing documents for business People credited with this unit standard are able to: demonstrate knowledge of the uses and advanced features of a word processing package on a personal computer (including use of spell-check and grammar checking tools)? create and use bulleted and numbered lists and tables? import and position pictures, images and objects into a word processing document? use the mail merge feature? use the mail merge feature Save the document in a format that it can be used in other applications Numbering system for outcomes and assessment criteria 1 Outcome 1.1, 1.2//2.1, 2.2 etc Assessment criteria for the outcome 1. Change appearance of document 1.1. Borders are added to a document 1.2. An appropriate document template is chosen or created and used for a specific task 1.3. Existing styles are applied to document 1.4. Headers and footers are inserted into document and formatted 1.5. Page breaks and section breaks are inserted 1.6. Symbols, date and time and page numbers are inserted in the text 1.7. Endnotes and footnotes are inserted 2. Check document for spelling and grammar 2.1. Spell-check tool is used and appropriate changes are made 2.2. Grammar tool is used and changes are made where appropriate 2.3. Thesaurus is used 3. Create lists and tables in document 3.1. Bulleted or numbered lists are inserted into document 3.2. Bullets and numbers are formatted 3.3. A standard table is created 3.4. Table cell attributes are changed 3.5. Rows and columns are inserted and deleted 3.6. Borders are added to table 3.7. Automatic table formatting tool is used 4. Add 4.1. 4.2. 4.3. 4.4. 5. Use mail merge feature 5.1. A mailing list or data file is created 5.2. A letter or label list is created by merging mailing or data list with letter, label document or envelope 6. Document is saved in a different file format 6.1. Document is saved in a different file format 6.2. Document is saved in format appropriate for viewing by a web browser and manipulate pictures, images and objects in a document A picture, image or graphics file is added to document Autoshapes are added to a document and manipulated A spreadsheet or derived image, chart or graph is added to a document An image within a document is manipulated ICB Certificate in Small Business Financial Management Summarised SAQA Unit Standards Booklet Page 27 of 28 Unit Standard 7546 NQF level – 2 Credits - 5 Describe the application and impact as well as social implications of information technology People credited with this unit standard are able to describe Information Technology (IT) describe the use of IT in local organizations describe the IT occupations in an organization describe the social implications of IT Note to Assessor and Learner: This Unit Standard should only be assessed if the Learner has received written permission from the ICB to include it in the qualification Numbering system for outcomes and assessment criteria 1 Outcome 1.1, 1.2//2.1, 2.2 etc Assessment criteria for the outcome 1. Describe Information Technology 1.1. The term "Information Technology" is defined in lay terms 1.2. Equipment use in IT is identified with respect to current practice 1.3. Examples and the use of range of current IT applications are stated 2. Describe the uses of IT in organisations 2.1. A description of the functional areas of an organisation identifies their purpose 2.2. A description of an organisation identifies the IT activities of the organisations 2.3. A description of personnel involved in IT within an organisation identifies their purpose 3. Describe IT occupations in an organisation 3.1. A description of an organisation identifies its goals and activity 3.2. The functions of IT occupations are described with respect to the functions of the organisation 4. Identify the social implications of IT 4.1. The social impact of IT is identified 4.2. Social controls over the use of computer data are identified 4.3. Sources of information about future trends in IT are identified 5. Describe the past impact of information technology on various aspects of society 5.1. The discussion identifies trends in information technology that have had a significant social impact and identifies this social impact 5.2. The discussion proposes the social outcomes if the past trends in information technology have not occurred 6. Discuss the future implications of information technology on aspects of society 6.1. The discussion proposes current trends in information technology that seem likely to have a significant social impact in the future, and the social impact of these trends 6.2. The discussion proposes future trends in information technology that seem likely to occur and the social impact of these trends 7. Describe ergonomic principles for computer workstations 7.1. The description outlines the purpose of ergonomic principles 7.2. The description outlines the symptoms of health problems that may be caused by poor ergonomic design 7.3. The description is consistent with the current South African Government occupational safety and health guidelines 8. Operate a computer workstation according to ergonomic principles 8.1. The workstation arrangement conforms to South African Government occupational safety and health guidelines 8.2. The position of the operator conforms to South African Government occupational safety and health guidelines 8.3. The operation of the keyboard conforms to South African Government occupational safety and health guidelines ICB Certificate in Small Business Financial Management Summarised SAQA Unit Standards Booklet Page 28 of 28