Pure Exchange Economy

advertisement

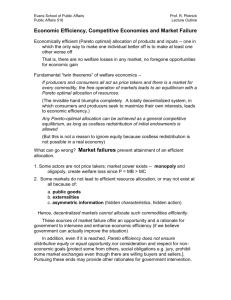

Pure Exchange Economy What is an economy? An economy consists of technologies, tastes, endowments. → Firms produce goods using inputs (technology of production) → Individuals consume goods and have preferences (utility function) → Endowments are the resources available in the economy (example: time, talent, goods) For simplicity we analyze the pure exchange economy. The economy consists of consumers only described by their preferences (utility function). They own some goods as initial endowment. The agents exchange these goods between themselves. Their goal is to maximize their utility. Question of interest of the theory of general equilibrium: How are goods allocated among agents? What is the outcome of such process? Is it desirable? What are the mechanisms achieving the desirable outcome? 1 Agents and goods There is a large number, n, of consumers in the economy indexed by i , i = 1, …, n. They have preferences described by the utility function u i There are k different goods in the economy. Each consumer has an initial endowment of the k commodities i Each consumer behaves competitively: prices are taken as given. Question How are goods allocated among agents? Notations and vocabulary j We denote by x i the amount of good j that individual i holds. The consumption bundle of individual i is xi ( xi1 , xi2 ,..., xik ) An allocation x ( x1 , x2 ,..., xn ) is a collection of n consumption bundles describing what each agent holds. A feasible allocation is one that is physically possible In the pure exchange economy: i xi i i (equality means that the allocation uses up all goods). n n The case of two agents with two goods is very convenient to represent allocations, preferences and endowments. → Edgeworth box Example 2 individuals: i = 1,2 Total amount of good 1: 1 11 21 ; width of the Edgeworth box Total amount of good 1: 2 12 22 ; height of the Edgeworth box Preferences: u1 x11 , x12 , u 2 x12 , x22 , Figure 1 Every feasible allocation of the two goods between the two agents is represented by a point in the box. The point x11 , x12 indicates how much of good 1 and 2 individual 1 holds. At the same time, the point x12 , x22 1 x11 , 2 x12 indicates how much of good 1 and 2 individual 2 holds. 2 Walrasian equilibrium There is a vector of market prices (one price for each good) p ( p1 , p 2 ,..., p k ) Each consumer takes the prices as given. He/she chooses the most preferred bundle from his/her consumption set. The problem is max ui xi xi subject to px i p i Spending must be lower or equal to the income. If preferences are monotonic, the budget constraint is binding: pxi pi The solution of this program leads to the demand function: xi ( p, pi ). The equilibrium price vector is the one that clears all markets. We define a Walrasian equilibrium to be a pair ( p * , x * ) such that: i xi p* , p*i i i n n p * is a Walrasian equilibrium if there is no positive excess demand for any good. 3 Graphical analysis It is very simple to describe the equilibrium in the 2 agents, 2 goods case (Edgeworth box) Figure 2 Every agent maximizes his utility on his budget line and the demands are compatible with the total supplies available. At equilibrium the two indifference curves are tangent: that is, the utility maximisation requires that each individual’s marginal rate of substitution equals the common price ratio. 4 Existence of Walrasian equilibria Recall that the demand functions are homogenous of degree zero in prices xi p, pi xi p, pi for all > 0. The aggregate excess demand is z( p) i [ xi ( p, pi ) i ] n It is homogenous of degree zero in prices as it is the sum of homogenous of degree zero functions. It is continuous as long as it is the sum of continuous functions. →It must satisfy the Walras’ Law. Walras’ Law. For any price vector p, we have pz ( p) 0 ; i.e. the value of the excess demand is identically zero. Proof: multiply the aggregate excess demand by p and simplify: pz( p) pi [ xi ( p, pi ) i ] i [ pxi ( p, pi ) pi ] 0 n n since xi p, pi satisfies the budget constraint which is binding: pxi pi . The Walras law says that if each individual satisfies his/her budget constraint, so that the value of his/her excess demand is zero, then the sum of the excess demands must be zero. Combining the Walras law with the definition of equilibrium, we obtain the following Propositions: Market clearing: If demand equals supply in k-1 markets, and pk 0 , then demand must equal supply in the kth market. Proof: If not, the Walras’ s Law would be violated. * Free goods: if p is a Walrasian equilibrium and * then p j 0 . →If some good is in excess supply at Walrasian equilibrium it must be a free good. z j ( p* ) 0 , Proof: Since p* is a Walrasian equilibrium, z ( p ) 0 . k Since prices are nonnegative, p* z( p * ) i1 pi* zi ( p* ) 0 . If * * and p j 0 we would have p* z ( p* ) < 0, contradicting Walras’ Law. z j ( p* ) 0 Suppose that all goods are desirable in the following sense: Desirability: If pi 0 , then z ( p ) 0 for i = 1, …, k. If some price is zero, the aggregate excess demand for that good is strictly positive. Equality of demand and supply: If all goods are desirable * and p is a Walrasian equilibrium, then z ( p * ) 0 . Proof: Assume z i ( p * ) 0 , then by the free good Proposition, p * = 0. But then, by the desirability assumption, z i ( p * ) 0 a contradiction. To sum-up: All we require for an equilibrium is that there is no excess demand for any good. If a good is in excess supply, its price must be zero. 5 Existence of an equilibrium The aggregate demand function is homogenous of degree zero. →We can normalize prices. → express demands in terms of relative prices. We replace each absolute price pi by a normalized price pi pi k j 1 pj A consequence of this normalization: k j 1 pj 1. Therefore, we can restrict our attention to the k-1 dimensional unit simplex S k 1 p k : j 1 p j 1 k Figure 3 about here. The proof uses the Brouwer fixed-point theorem. Brouwer fixed-point theorem. If f : S k 1 S k 1 is a continuous function from the unit simplex to itself, there exists some x in S k 1 such that x f (x) . Existence of Walrasian equilibria. If z : S k 1 k is a continuous function that satisfies Walras’ Law, pz ( p ) 0 , * k 1 then there exists some p in S such that z ( p * ) 0 . Proof: Exercise. The theorem of existence is very general. All that is needed is the excess demand function to be continuous and satisfy Walras’ Law. Even though at the individual level demands function display discontinuities, at the aggregate level the demand may be continuous. The continuous assumption at the aggregate level is a weak requirement. Example Assume that x u ( x , x ) x x u1 ( x11 , x12 ) x11 2 1 2 2 2 a 1 b 2 2 1a 1 2 1b 2 , with 0<a<1 and 1 1,0 , with 0<b<1 and 2 0,1 Demand functions are x11 ( p1 , p2 , m1 ) am1 p1 , where is the income of agent 1. m1 1 p1 0 p2 p1 x12 ( p1 , p2 , m2 ) bm2 p1 , where m2 0 p1 1 p2 p2 is the income of agent 2. The equilibrium price is such that Demand=Supply By Walras’ Law, we only need to find the system of prices that clear the market of good 1. x11 ( p1 , p2 , m1 ) x12 ( p1 , p2 , m2 ) am1 bm2 aP1 bP2 bP a 2 1 p1 p1 p1 p1 p1 p2 1 a p1 b Only the relative price is determined at equilibrium. 6 The first theorem of welfare economics The Walrasian equilibrium theory is very interesting from a positive perspective as long as we believe in the behavioural assumptions on which the model is based. Even if sometimes, the assumptions are not especially plausible, the Walrasian equilibrium theory is interesting for its normative content. Definition of Pareto efficiency: 1) A feasible allocation x is a weakly Pareto efficient allocation if there is no feasible allocation x’ such that all agents strictly prefer x’ to x. 2) A feasible allocation x is a strongly Pareto efficient allocation if there is no feasible allocation x’ such that all agents weakly prefer x’ to x and some agent strictly prefers x’ to x. A strongly Pareto efficient allocation is weakly Pareto efficient. But the reverse is, in general not true. Equivalence of strongly and weakly Pareto efficiency: Suppose that preferences are continuous and monotonic. Then, an allocation is weakly Pareto efficient if and only if it is strongly Pareto efficient. Proof: a) strongly Pareto efficient implies weakly Pareto efficient. If an allocation is strongly Pareto efficient, then it is weakly Pareto efficient: if you can’t make one person better off without hurting someone else, you can’t make everyone better off. b) weakly Pareto efficient implies strongly Pareto efficient. Suppose that it is possible to make some particular agent i better off without hurting anyone. We must find a way to make everyone better off. To do this, scale back i’s consumption bundle by a small amount and redistribute the good equally to the others. Specifically,, replace i’s consumption xi by x i and replace each other agent j’s consumption bundle by x j (1 ) xi /( n 1) . By continuity of preferences, it is possible to choose close enough to one so that agent i is still better off. By monotonicity, the other are all better off. In general ‘Pareto efficient’ is said to mean ‘weakly Pareto efficient’. Pareto efficiency is a weak normative concept. An allocation where an agent gets everything and the others nothing is Pareto efficient (if agents are not satiated). Pareto efficient allocations can be depicted in the Edgeworth box. Pareto efficient allocations are found by fixing one agent’s utility at a given level and maximizing the other agent’s utility. Formally the problem to solve is max u1x1 x1 subject to u 2 ( x2 ) u 2 x1 x 2 1 2 This problem can be solved analytically using the Lagrangian method. In the Edgeworth box, we simply find the point on one agent’s indifference curve where the other agent reaches the highest utility. Figure 5 about here. Pareto efficient points are characterized by a tangency condition: the marginal rate of substitution must be the same for each agent. The set of Pareto efficient points, the Pareto set, is the locus of tangencies drawn in the Edgeworth box. This is known as the contract curve. It gives the set of efficient ‘contract’ or allocation. In fact comparing Figure 2 and 5, we see there is a one to one correspondence between the set of Walrasian equilibria and the set of Pareto efficient allocations. The Walrasian equilibrium satisfies the first order condition for utility maximisation that the marginal rate of substitution between the two goods. Since agents face the same price at a Walrasian equilibrium, all agents must have the same marginal rates of substitution. If we pick an arbitrary Pareto efficient allocation, the marginal rate of substitution are equal across two agents. Thus, there exists a system of price that equals to this common value, i.e. which sustains a Walrasian equilibrium. Definition of a Walrasian equilibrium. An allocationprice pair (x, p) is a Walrasian equilibrium if 1) the allocation is feasible, and 2) each agent is making an optimal choice from his budget set. In equations: n n 1) i xi i i 2) if x i' is preferred by agent i to xi , then pxi' p i This definition is equivalent to the original definition of Walrasian equilibrium as long as the desirability assumption is satisfied. First Theorem of Welfare Economics. If (x, p) is a Walrasian equilibrium, then x is Pareto efficient. Proof: Suppose not and let x’ be a feasible allocation that all agents prefer to x. Then, by property 2 of the definition of Walrasian equilibrium, we have pxi' p i , for i=1, …, n . Summing over i=1, …., n, and using the fact that x’ is feasible we have n n n pi 1i pi 1 xi' pi 1 xi which is a contradiction. This says that if the behavioral assumptions of the model are satisfied then, the market equilibrium is efficient. A market equilibrium is not necessarily ‘optimal’ in the ethical sense since it can be ‘unfair’. The outcome depends on the initial endowment. To choose among the efficient allocation further ethical criterion are needed. → concept of welfare function (see end of the chapter). 7 The Second Welfare Theorem Second Theorem of Welfare Economics (Version 1). Suppose x * is a Pareto efficient allocation in which each agent holds a positive amount of each good. Suppose that preferences are convex, continuous, and monotonic. Then x * is a Walrasian equilibrium for the initial endowment i x * for i=1, …, n. Proof: Exercise. Second Theorem of Welfare Economics (Version 2). Suppose x is a Pareto efficient allocation and that preferences are non-satiated. Suppose further that a competitive equilibrium exists from the initial endowment x and let it be given by (p’, x’). Then, (p’, x*) is a competitive equilibrium. * * i * Proof: Since x i is in the consumer i’s budget set by ' * x construction, i is preferred or indifferent to x i . Since x* ' is Pareto efficient, this implies that x i* is indifferent to x i . ' * Thus, x i is optimal, so is x i . Hence, (p’, x*) is a competitive equilibrium. 8 Pareto efficiency and calculus We have shown that if a competitive equilibrium exists from a Pareto efficient allocation, then that Pareto efficient allocation is itself a competitive equilibrium. In this section we derive the first order conditions that characterize market equilibria and Pareto efficiency. Then we compare these two sets of conditions. Calculus characterization of equilibrium. If (x*, p*) is a market equilibrium with each consumer holding a positive amount of every good, then there exists a set of numbers (1 , 2 ,..., n ) such that: Du i ( x * ) i p * , i=1, …, n. Proof : if we have a market equilibrium, then each agent is maximised o his budget set, and these are just the first order conditions for such utility maximisation. The i ’s are the agents’ marginal utilities of income. Calculus characterization of Pareto efficiency. A feasible allocation x* is Pareto efficient if and only if x* solves the following n maximization problems for i=1,…,n: max ui xi such that x g = 1, …, k. u x u x , j i n i 1 j * j g i g j j Proof :Suppose x* solves all maximisation problems but x* is not Pareto efficient. This means that there is some allocation x’ where everyone is better off. But then, x* could not solve any of the problems, a contradiction. Conversely, suppose x* is Pareto efficient, but it does not solve one of the problems. Instead, let x’ solve that particular problem. Then x’ makes one of the agent better off without hurting any of the other agents, which contradicts the assumption that x* is Pareto efficient. Let us solve one maximisation problem. Let q g for g=1, …, k be the Kuhn-Tucker multipliers for the resource constraints, and a j j i be the multipliers for the utility constraints: L ui xi g 1 q g k g g * x a u ( x i i j j j ) u j (x j ) i 1 j 1 n n The first order conditions lead to u i xi* q g 0 , g= 1, …, k. g xi aj q u i x *j x g j g 0, j i, g= 1, …, k. These conditions imply that the relative values of the q are independent of the choice of i: u i xi* / xig qg h * h u i xi / xi q , g= 1, …, k, ji , h= 1, …, k. Since x* is given, q g / q h must be independent of the problem we solve. In fact, when we maximise agent i’s utility, it is as if we are arbitrarily setting agent i’s KuhnTucker multiplier to one: ai 1 . Using the First Welfare theorem, we get interpretations of the weights ( ai ) and ( q g ). If x* is a market equilibrium: Du i ( x * ) i p * , i=1, …, n. All market equilibria are Pareto efficient and satisfy ai Du i ( x * ) q , i=1, …, n. From above, we can choose p*=q and ai 1/ . i That is, the multipliers on the resources constraints are just the competitive prices, and the multipliers on the utilities are the reciprocals of their marginal utilities of income. Rearranging the above conditions, one gets: p *g q g u i xi* / xig * h , g= 1, …, k, * h ui xi / xi ph q ji , h= 1, …, k. Each Pareto efficient allocation must satisfy the condition that the marginal rates of substitution between each pair of goods is the same for every agent. This value corresponds to the ratio of the competitive prices. Intuition: If two agents had different marginal rates of substitution, they could arrange a small trade that would make them better off, contradicting the Pareto efficiency. It is useful to note that the first order conditions for a Pareto efficient allocation are the same as the ones maximizing a weighted sum of utilities: max i 1 ai ui xi n such that g g x g = 1, …, k. i i 1 n This gives ai Du i ( x * ) q i=1, …, n. The weights (a1 , a2 ,..., an ) are called ‘welfare weights’. As they vary, we can trace out the set of Pareto efficient allocations. 9 Welfare maximization The criterion of Pareto efficiency is normative but not very specific. In particular it is not concerned about distribution of welfare. A way to solve this problem is to assume the existence of a social welfare function. This function aggregates the utility of all agents to come up with a social utility. We can interpret it as a social decision maker’s preferences about how to trade-off the utilities of individuals. Specifically, we have W : n so that W (u1 , u 2 ,..., u n ) is the social utility function. We assume that W( ) is increasing in each of its arguments. The society chooses an allocation x max W u1 x1 , u 2 x2 ,..., u n xn such that * solution of g g x g = 1, …, k. i i 1 n Question: How do the allocations that maximize this welfare function compare to the Pareto efficient allocations? * Welfare maximization and Pareto efficiency. If x maximizes a social welfare function, then x * is Pareto efficient. * Proof: If x were not Pareto efficient, then there would be some feasible allocation x’ such that u i ( xi' ) u i ( xi* ) for i=1,…,n. But then, W u1 x1' , u 2 x2' ,..., u n xn' > W u1 x1*' , u 2 x2* ,..., u n xn*' . The property of Pareto efficient allocation and welfare maxima are the same: - Welfare maxima satisfy the same first order conditions as Pareto efficient allocation. - Under convexity assumption, every welfare maxima is a competitive equilibrium: every welfare maxima is a competitive equilibrium for some distribution of endowments. Welfare maximum are Pareto efficient. Is the converse true? Pareto efficiency and Welfare maximization. Let x * be a * Pareto efficient allocation with x >>0 for i=1,…,n. Let the utility functions u i be concave, continuous, and monotonic. Then, there is some choice of welfare weights a such that * x maximizes ai ui ( xi ) subject to the resource constraints. * * Furthermore, the weights are such that ai 1/ where *i is the ith agent’s marginal utility of income; that is, if mi is the value of agent i’s endowment at the equilibrium prices p*, then * i * i vi ( p * , mi ) vi ( p* , mi ) is the indirect utility , where mi * i function. Proof: Exercise. Summary 1) Competitive equilibria are always Pareto efficient; 2) Pareto efficient allocations are competitive equilibria under convexity assumptions and endowments redistribution; 3) Welfare maxima are always Pareto efficient; 4) Pareto efficient allocations are welfare maxima under convexity assumptions for some choice of welfare weights. A competitive market leads to efficient allocations, but this says nothing about distribution. The choice of distribution of income is the same as the choice of a reallocation of endowments, and this in turn is equivalent to choosing a particular welfare function.