Pergamon

Journal of Management 2003 29(3) 427-442

Inter-Firm Networks and Entrepreneurial Behavior:

A Structural Embeddedness Perspective

Zeki Simsek∗

Management Department, School of Business Administration, University of Connecticut,

2100 Hillside Road Unit 1041, Storrs, CT 06269-1041, USA

Michael H. Lubatkin

University of Connecticut, 2100 Hillside Road Unit 1041, Storrs, CT 06269-1041, USA

Steven W. Floyd

University of Connecticut, 2100 Hillside Road Unit 1041, Storrs, CT 06269-1041, USA

We develop a theory of the effects of inter-organizational networks on both radical and incremental forms of firm-level entrepreneurial behavior (EB). The central argument is that

structural embeddedness, with its focus on the network as a whole, and its two consequences,

relational and cognitive embeddedness, individually and collectively influence incremental

and radical forms of EB. Relationships in our model are driven by reciprocal interactions

between intra- and inter-organizational sensemaking. This reasoning leads us to a dynamic,

co-evolutionary model of EB. © 2003 Elsevier Science Inc. All rights reserved.

Inter-firm networks are “a select, persistent, and structured set of autonomous firms (as

well as nonprofit agencies) engaged in creating products or services based on implicit

and open-ended contracts to adapt to environmental contingencies and to coordinate and

safeguard exchanges. These contracts are socially not legally-binding”1 (Jones, Hesterly &

Borgatti, 1997: 914). An insightful view for understanding these networks is Granovetter’s

(1985) structural embeddedness theory, which posits that firm behavior is embedded in, or

partially determined by ongoing systems of inter-firm relations. The word “partially” in the

description is important because it signals the view that firms’ economic behavior should

be seen as neither “undersocialized” nor “oversocialized.”2

We extend Granovetter’s theory to develop an explanation of firm-level entrepreneurial

behavior (EB), which we define as the sum of the firm’s innovation, venturing, and strategic

∗ Corresponding author. Tel.: +1-860-486-6423; fax: +1-860-486-6415.

E-mail addresses: simsek@business.uconn.edu (Z. Simsek), mike@business.uconn.edu (M.H. Lubatkin),

steven@business.uconn.edu (S.W. Floyd).

0149-2063/03/$ – see front matter © 2003 Elsevier Science Inc. All rights reserved.

doi:10.1016/S0149-2063(03)00018-7

428

Z. Simsek et al. /Journal of Management 2003 29(3) 427–442

renewal activities (Guth & Ginsberg, 1990; Zahra, 1996). Our thesis is that the social relationships comprised by a firm’s inter-firm network represents a sensemaking community,

and thus are driven by recursive cycles of individual and shared sensemaking. As such, these

networks are likely to be in a continual state of adjustment, or punctuated disequilibriums,

as member firms attempt to innovate, take risks, and act proactively. Put differently, we

posit that EB, like other firm behaviors, is embedded in the structure of a firm’s ongoing

inter-firm relations. In so doing, we depart from the tradition of explaining EB with firmand managerial-level explanations, and instead select the inter-firm network as the primary

unit of analysis.

Three gaps in the literature motivate our paper. First, while a growing number of researchers recognize the important role that inter-firm networks play in promoting entrepreneurial activities (e.g., Powell, Koput & Smith-Doerr, 1996), their explanations make

only indirect reference to the nature of ties a firm may have in a network, how those ties

may fit together, and the effects of such ties on firm behavior. Second, the pervasiveness

of networks in entrepreneurially intensive industries has been observed in a number of

recent empirical studies, including biotechnology (Barley, Freeman & Hybels, 1992), fashion (Uzzi, 1997), film (Faulkner & Anderson, 1987), financial services (Podolny, 1994),

and semiconductors (Saxenian, 1990). This persistence has been explained as resulting

from a reduction in transaction costs (Gulati & Gargiulo, 1999), the inertia of personal

and structural attachments (Seabright, Levinthal & Fichman, 1992), and absorptive capacity considerations (Dyer & Singh, 1998). Surprisingly absent in these explanations have

been network effects on EB. Finally, a growing body of evidence suggests that networks

affect firm processes, including trust, collective sanctions, and reputation (Dacin, Ventresca

& Beal, 1999). This work has focused largely on transactional efficiency as an outcome,

however, ignoring the possible effects on EB.

Our paper attempts to respond to these gaps. We argue that structural embeddedness

theory, with its explicit focus on the network as whole, and a sensemaking perspective on

networks, provide the basis for a model of the multilevel and multidirectional interactions

that relate inter-firm network characteristics to firm-level EB. In the next section, we differentiate EB into its incremental and radical forms. Then, we provide an overview of the

network antecedents of EB, conceptualized as the relational and cognitive consequences of

structural embeddedness. This is followed by detailed arguments leading to a set of testable

research propositions. Finally, the discussion traces the implications of the model for future

research.

Theoretical Model

The principle virtue of a structural embeddedness perspective lies in its ability to describe

action vis-à-vis networks of relationships while acknowledging the motives and interests

of individual actors (Granovetter, 1985). The theory’s core idea is that network relationships cannot be validly decomposed into independent “bilateral monopolies” (Baker, 1990).

Should firm dyads be used as the basis for analyzing socially motivated firm behavior, the

problem of atomization (inappropriately shifting the unit of analysis) occurs because the

locus of explanation is transferred from the actor to the dyad (Granovetter, 1992). In short,

Z. Simsek et al. /Journal of Management 2003 29(3) 427–442

429

“without reference to the nature of other ties in the network or how they fit together”

(Wellman, 1991), the analyst cannot adequately show how social relationships influence

firm behaviors such as EB.

In attempting to offer a theory of EB from an embeddedness perspective, it is important

to be clear about the meaning of firm-level EB. Miller (1983) defines entrepreneurship as

an orientation, or the degree to which a firm has a propensity to innovate, take risks, and act

proactively. Guth and Ginsberg (1990) and Zahra (1996) define it in terms of actual behaviors, that is, the sum of the firm’s innovation, venturing, and strategic renewal activities.

March (1991), Morris (1998), and Tushman and Anderson (1986) suggest a useful distinction between two types of EB, based on the degree of change in existing organizational

arrangements. IncrementalEB (and its synonyms, such as adaptive or means-seeking behavior) involves innovation, venturing and strategic renewal activity, but all within the bounds

of the established premises, policies, and customary views. Accordingly, these behaviors

are typically focused on improvements in existing products or processes and doing (or making) things better or more efficiently (Argyris & Schon, 1978; March, 1991). By contrast,

radical EB is intended to produce fundamental changes in organizational routines and/or

approaches to products, processes, and markets (Lant & Mezias, 1990). Rather than doing

the same things better, these behaviors are focused on doing new things.

This distinction allows us to explore the relationship between embeddedness and EB in

two forms, incremental and radical. This is important since the literature views these two

types of behavior as competing for scarce organizational resources and managerial attention.

As Levinthal and March note, “the basic problem confronting an organization is to engage

in sufficient exploitation to ensure its current viability, and at the same time, devote enough

energy to exploration to ensure its future” (1993: 105). Thus, EB may involve innovation,

venturing, or renewal activities that are totally new (radical) or that improve on existing

(incremental) products or processes. In both cases, the firm may gain entrepreneurial profits,

but it does so in very different ways. Incremental EB generates predictable returns, while the

returns from radical EB, though are much more uncertain, are “the only way to finish first”

(Levinthal & March, 1993, p. 106). For example, entry into a small niche in an existing

market (incremental EB behavior) is likely to generate more certain but relatively low

returns, while entry into a totally new, unrelated market (radical EB behavior) is likely to

generate more uncertain but probably higher returns.

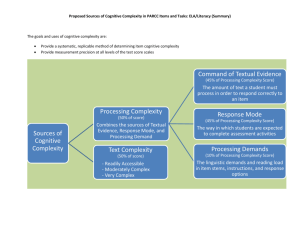

With these observations in mind, we propose the model in Figure 1 as a way of thinking

about how structural embeddedness influences EB. At the model’s center, sensemaking

allows the reciprocal relationships among network characteristics and EB occur. Specifying such intervening processes is important in order to avoid creating a “black box”—a

tendency in prior research that Uzzi (1997) describes as the “theoretical indefiniteness” of

embeddedness theory. As Granovetter notes, “the assertion that economic action is embedded in networks of personal relations among actors ties into the classic question in social

theory of just how any behavior and institution are affected by social relations” (1992: 27).

We will argue that sensemaking drives the co-evolutionary processes by which structural

embeddedness affects EB.Weuse “sensemaking”inthe way Weick (1995, pp. 91–100) does,

as an individual and social process by which organization members form understandings

from what they experience as ambiguous situations, and then use these understandings to

guide behavior.

430

Z. Simsek et al./Journal of Management 2003 29(3) 427–442

Figure 1. Relationships between inter-firm embeddedness and EB.

Use of the term co-evolution may also require a brief explanation. Co-evolution processes

exist as complex systems of continual and reciprocal interactions, where one condition

influences and is influenced by another (Lewin & Volberda, 1999; Bosch, Volberda & Boer,

1999). Thus, co-evolutionary processes do not lend themselves to simple linear progressions

or to directional relationships, but instead to recursive relationships among variables within

the system.

In our model, structural embeddedness describes the network’s overall architecture, encompassing the properties of inter-firm ties as a whole (Dacin et al., 1999). Among the

important facets of structural embeddedness is the presence or absence of ties between

actors. Variables along these lines include closure, density, connectivity, and hierarchy

(Wasserman & Faust, 1994). Relational embeddedness refers to the quality of dyadic exchanges, including the degree to which parties consider one another’s needs and goals as

well as the behaviors that they exhibit toward one another, such as trust, norms, reputation, sanctions, and obligations (Coleman, 1990). Finally, cognitive embeddedness refers

to similarity in the representations, interpretations, and systems of meaning among firms

(Nahapiet & Ghoshal, 1998). While it is new to the network literature, we include cognitive

embeddedness in our model based on related work on industry-level macro-cognitive elements (e.g., Scott, 1995). Here, cognition is treated as a social phenomenon being shaped

by, and shaping, interactions between actors (Abrahamson & Fombrun, 1994).

Finally, our model also considers Powell (1990) and Miller (1996), who caution that

embeddedness constructs may be too broad to develop refutable propositions. To avoid

Z. Simsek et al. /Journal of Management 2003 29(3) 427–442

431

this, we follow three decision rules in choosing how to conceptualize the components of

embeddedness. First, while the explanatory constructs in the model should emerge at the

network level of analysis, they should not exaggerate the effect of social context on firms

to a point of depicting them as “social dopes.” Second, the constructs should be sufficiently

developed in the literature to permit the identification of specific relationships and research

propositions. Third, wherever possible, the effects of the constructs should be profound, of

course, but also discriminate between radical and incremental forms of EB.

To represent structural embeddedness,we selected network closure; institutionalized reciprocity to represent relational embeddedness, and cognitive similarity to represent cognitive

embeddedness. As discussed below, we believe these specific facets of embeddedness meet

the above criteria and provide significant insight into EB, but we are not suggesting that

other facets should be ignored. As is in most theory building efforts, therefore, we frame

our arguments on the basis of “all else being equal” assumptions.

Structural and Relational Embeddedness

Structural embeddedness describes the network’s overall architecture. More specifically,

it is defined by the presence or absence of ties, and the boundaries of the network as a

whole can be conceptualized on the basis of network closure (Wasserman & Faust, 1994).

Following Coleman (1988), Krackhardt and Stern (1988), and Marsden (1990), we define

structural embeddedness as the relative proportion of internal and external ties, i.e., the

number of existing relationships to the total number of possible relationships among all

network members (if each network member were tied to every other member) and the

number of relationships that network members have to non-network members, respectively.

Theoretically, a totally closed network is one in which all organizations are directly tied

to each other and have no ties to organizations “outside” the network. This view suggests

that structural embeddedness increases when the number of external ties decreases or the

number of internal ties increases.

Research shows that networks in the same industry and across industries tend to have

varying levels of closure (e.g., Gulati, 1995; Uzzi, 1997). These differences are due to

organizations’ attempts to maximize their status (i.e., avoiding partners of lower status) and

to relational contracting, that is, working with fewer partners more often (Jones et al., 1997).

We argue that variability in this structural facet is a determinant of the level of relational

embeddedness in a network, or the quality of reciprocal exchange. Such quality, in turn,

may be defined along three dimensions: (1) the dependence of one actor’s behavior on

another’s; (2) equivalence of returns for reciprocating (i.e., good is repaid by good, and

harm by harm); and (3) the immediacy of such returns (i.e., the timing of reciprocation).

Thus, perfect reciprocity exists when exchanges between two organizations are maximally

contingent, functionally equivalent, and immediately reciprocated (Molm, 1994).

Consistent with structural embeddedness theory, the concept of reciprocity can be extended beyond the dyadic level of analysis to include cases where a network of actors is

involved. For example, Ekeh (1974) uses the concept of generalized norms of reciprocity

to describe situations in which reciprocation involves multiple actors (more than just two)

and where it creates indirect (rather than direct) benefits. Axelrod and Keohane (1985)

argue that reciprocity can become widespread and “institutionalized” because reciprocity

432

Z. Simsek et al. /Journal of Management 2003 29(3) 427–442

is economically beneficial; member firms have incentives to institutionalize it so that they

will benefit from its wider use. Exchange theory (Blau, 1964) suggests that reciprocity

might promote the development of trust-like social mechanisms because there is inherently

greater risk in reciprocal transactions than discreet ones, and because reciprocity allows the

demonstration of trust and intentions.

A maximally embedded network, therefore, is one where all exchanges are guided by

generalized norms of reciprocity. Here, all member firms would undertake transactions confident that others will reciprocate. The efficiencies in such a “clan governance” arrangement

are believed to be significant (Ouchi, 1980).

Why then don’t all networks evolve into a state of maximum embeddedness? Reciprocity

is impeded by information asymmetries among network actors. For example, member firms

may intuit an incentive to withhold, filter, and misrepresent information in a particular

transaction. If opportunism results, it introduces ambiguities into network relationships that

cannot be resolved by means of rational decision-making. Instead, such ambiguities become

the focus of organizational and inter-organizational sensemaking (Weick, 1995), whereby

actors interpret individually and socially construct their understandings and potential responses to discrepant behaviors. Like that among individuals, sensemaking at the level of

inter-organizational networks occurs as the result of a set of ongoing series of replicated

(or not) interactions. Tying this notion to Axelrod and Keohane (1985) suggests that the

direction and pace of sensemaking about the extent of reciprocity in the network is impeded

by lack of information about the extent of conformance and the presence of defectors. Said

differently, an inter-organizational environment where defectors cannot be identified (or

interpreted as such) is less likely to produce norms of reciprocity among firms.

Structural embeddedness (network closure) can minimize this problem and thus engender

relational embeddedness (i.e., the institutionalization of reciprocity) within the network

structural embeddedness increases the likelihood of identifying defectors because of the

amount and speed with which information about actors circulates within an embedded

network. Evidence suggests that actors become aware of others’ activities and behaviors as

a by-product of direct and indirect relationships (e.g., Friedkin, 1982). As the proportion of

internal over external ties increases for a particular network, then, this is likely to produce

a higher level of awareness of discrepant cues, such as defection, among network actors.

In the presence of ambiguous norms of reciprocity, network closure makes high quality

information about defectors more accessible and facilitates the identification of defectors

(Uzzi, 1997).

Although identificationofdefectors maybethe trigger for sensemaking, the process might

also include the construction of actors’ responses, particularly the use of collective sanctions (Coleman, 1988). Collective sanctions “. . . involve group members punishing other

members who violate group norms, values, or goals and range from gossip and rumors to ostracism (exclusion from the network for short periods or indefinitely) and sabotage” (Jones

et al., 1997: 931). As a form of retaliation against defectors, collective sanctions define

and reinforce the parameters of acceptable behavior (Jones et al., 1997). In a closed such

information is more likely to travel faster and spread more widely among network members, thereby enforcing reciprocal behavior. Moreover, since information about defection is

diffused more widely within a closed network, the costs of defection in one relationship are

likely to carry over other relationships. In short, the costs on reputation and transactional

Z. Simsek et al. /Journal of Management 2003 29(3) 427–442

433

integrity go up as closure increases, and with increasing closure, there is greater incentive

for actors to abide by norms of reciprocity and to impose sanctions on defectors. This has

the effect of increasing the institutionalization of reciprocity within the network. Formally

stated:

Proposition 1: Structural embeddedness is positively associated with relational embeddedness, such that as network closure increases, so too will the levels of institutionalized

reciprocity in the network.

Structural and Cognitive Embeddedness

Another mechanism through which structural embeddedness may influenceEB is through

its effects on cognitive embeddedness. Consistent with previous work on macro cognitive

elements in inter-organizational fields (Abrahamson & Fombrun, 1994), we define cognitive

embeddedness as the degree of similarity among network actors (i.e., individuals in network

member firms who are central in the intra-organizational network) concerning their beliefs

about the types of issues perceived to be important, how such issues are conceptualized and,

perhaps, alternative approaches for dealing with such issues.

Structural embeddedness in the form of network closure promotes cognitive similarity

among its members through partner selection and recruitment practices. Because organizations tend to be status maximizers and employ relational contracting strategies, a closed

network tends to limit new relationships to individuals who are similar in terms of their

socioeconomic backgrounds, educational levels, and industrial tenures. For example, in a

study of a large population of corporations and investment banks, Baker (1990) found

that about 30% of those corporations gave 100% of their investment banking business to

a single bank. Common experiences and socialization of this sort should generate similar

perspectives on intra- and inter-organizational issues (Hambrick & Mason, 1984).

Structural embeddedness also increases cognitive similarity through its effect on the ongoing sensemaking processes in the network. Common socialization promotes interaction,

and thus reinforces the process through which individuals share information among others

who are like themselves. Thus, closed networks are more likely to develop a common sense

of identity and shared mental framework, and these in turn are likely to influence their

actions and interpretation of future events. This argument for cognitive similarity resonates

with Burt’s (1987) concept of social cohesion whereby organizations influence the content

of one another’s cognitions. Like social cohesion, we would expect that cognitive similarity,

among actors within a network will be a function of the proximity and frequency of interactions, such that directly linked and frequently interacting managers are more likely to have

similar cognitive content than non-linked members. Since the proximity and frequency of interactions in a network increase with increasing closure, cognitive embeddedness increases

with network closure.

Cognitive embeddednessisalso positively associated with relational embeddedness. Simply put, as firms develop a closer agreement on core beliefs, assumptions, and expectations

within the network, norms of reciprocity are likely to become stronger. Since we identify

sensemaking as the mechanism underlying this relationship, however, the relationship between beliefs and actions is a two-way street. That is, as reciprocity becomes increasingly

434

Z. Simsek et al. /Journal of Management 2003 29(3) 427–442

institutionalized, actors develop common behavior patterns, such as “tit for tat” routines,

that harmonize their behavior. These behavioral similarities, in turn, lead to the development

of similar beliefs, i.e., cognitive similarities. Hence:

Proposition 2a: Structural embeddedness is positively associated with cognitive embeddedness, such that as network closure increases, so too will cognitive similarity about

network issues among central actors within member firms.

Proposition 2b: A common set of network sensemaking processes produce and reinforce relationships between structural, relational and cognitive embeddedness, causing

such network characteristics to co-evolve, such that the levels of closure, institutionalized

reciprocity, and cognitive similarity are reciprocally and positively associated with one

another.

Relational Embeddedness and Entrepreneurial Behaviors

The existing literature on networks and the diffusion of innovations implies two opposing arguments as to the effects of relational embeddedness (specifically institutionalized

reciprocity) on network members’ EB. The first of these is the strength of weak ties perspective (Granovetter, 1973). According to the weak-tie theory (Granovetter, 1973), distant

and infrequent relationships (i.e., weak ties) are efficient for accessing novel information

because weak-tie bridge otherwise disconnected individuals and groups. Because they represent previously unconnected actors, however, bridging relationships are unlikely to have

been influenced by shared norms of any kind, including the norm of reciprocity. Hence, a

network characterized by weak relationships and, therefore, low levels of reciprocity, is

more conducive to entrepreneurship because actors can build relationships with multiple

disconnected clusters and use these connections to obtain novel information that may, in

turn, generate EB. For example, Uzzi (1997, p. 675) studied clothing firms and found that

as the number of strong ties in their network increased, so did the “sealing of firms in the

network from new and novel information or opportunities that exist outside the network.”

This suggests that low reciprocity promotes greater levels of EB because weak ties

broaden members’ awareness of new ideas and insights from outside the network. Said

simply, EB should be higher in networks that are rich in “structural holes” (Burt, 1992). A

second view, however, called the strength of strong ties perspective, suggests the opposite

line of reasoning: The more the strong ties in a network, the greater the level of EB. Proponents of this view (Krackhardt, 1992; Uzzi, 1997) argue that strong ties have several benefits

that facilitate entrepreneurship. Strong ties are more likely to promote in-depth communication as well as valuable and accurate information exchange. Granovetter (1985) argues,

for example, that the information acquired from reciprocal relationships is inexpensive and

accurate, while also being more detailed than commercially available information. Thus,

although strong ties may not generate new information, they tend to be more useful than

weak ties in helping network members to interpret external opportunities and threats and

formulate potential responses (Krackhardt, 1992; Uzzi, 1997).

The discrepancy between these competing arguments may be partly due to differences

in focus. The strength of weak ties perspective tends to focus on finding new information,

Z. Simsek et al. /Journal of Management 2003 29(3) 427–442

435

detecting environmental changes, and discovering new entrepreneurial opportunities. The

strength of strong ties perspectives, on the other hand, concentrates on how strong ties

facilitate exchanges of high quality information, knowledge, and resources between organizations and, therefore, help network members discover new ways to exploit opportunities

that are already known or already existing within the network. We, therefore, suggest that the

extent to which reciprocity facilitates or impedes entrepreneurial behavior varies across the

two types of EB. In particular, weak reciprocity norms are more significant in relationship

to radical EB and strong reciprocity norms are more significant for incremental EB.

There are three reasons why weak reciprocity norms enhance radical EB within firms. The

first has already been mentioned: A network characterized by low reciprocity increases informational diversity because the penetrationofnovel information from different partsofthe

industry into the network is easier. As information diversity in the network increases, diversity within each organization and, therefore, the potential for EB also increases (DiMaggio

& Powell, 1983). Second, relationships low in reciprocity are less likely to constrain the

ability of firms to undertake radical change. Indeed, Uzzi (1997) suggests that tightly coupled relationships may negatively influence radical or divergent knowledge-sharing among

firms because the social aspects of exchange (the desire to preserve harmony) supersede the

economic imperative to learn. Finally, a reciprocally coupled network might interfere with

radical EB because the incentives to engage in this type of behavior will be “low-powered”

or “flat” in such a social context (Williamson, 1991). A network of strong relationships degrades the perceived importance of economic incentives in comparison to social legitimacy

and preservation of order within the network, however. Thus, a network without such strong

ties and with more structural holes is likelyto amplify the perceived importance of long-term

economic incentives relative to social concerns and hence encourage radical forms of EB.

On the other hand, a high level of reciprocity is more valuable in relation to incremental

EB. Reciprocity promotes the development of inter-firm knowledge-sharing routines (Dyer

& Singh, 1998). This suggests that as reciprocity becomes institutionalized in a network,

it endows each member firm with adaptive capabilities. Actors may activate the network

when seeking guidance about best practice, technical assistance or inspiration. Reciprocity

might also facilitate incremental EB through its effects on relation-specific investments.

Investments are specific to a relationship when they are highly specialized and thus have

little or no general-purpose use outside of the relationship (Williamson, 1991). Because

there is typically a maintenance cost associated with these investments, firms need to assess

whether they will obtain economic returns from such investments and be confident that their

partners will not act opportunistically. Therefore, absent reciprocity, firms are less likely

to make these investments. In turn, the reason why these investments are important for

incremental EB is that they allow firms to focus on and exploit their existing capabilities

(Williamson, 1985).

In sum, while some network theorists posit that strong ties promote EB and others posit

that weak ties promote EB, we deduce from the literature that both positions are too broad

to be refuted. Both schools ignore the different types of EB, and both have a tendency to

treat concepts like reciprocity as an either/or phenomenon. Finally, both schools assume

that the direction of influence is one-way, going from the network to the firm. In a later

section, we will posit a two-way pattern of influence. However, for present purposes, we

posit:

436

Z. Simsek et al. /Journal of Management 2003 29(3) 427–442

Proposition 3: The level of relational embeddedness (the degree to which reciprocity is

institutionalized in a network) is positively associated with a firm’s incremental EBs and

negatively associated with its radical EBs.

Cognitive Embeddedness and Entrepreneurial Behaviors

A long held understanding in the literature is that the cognitions of a firm’s key actors influences the firm’s EB by affecting how the firm identifies environmental opportunities and

problems, considers organizational capabilities and constraints, and formulates and implements strategies (Gavetti&Levinthal, 2000; Hambrick&Mason, 1984; Walsh, 1995).While

most of the theory about cognition’s effects on communications pertains to teams within

an organization (e.g., Nahapiet & Ghoshal, 1998), in this paper, we extend this reasoning

to actors within inter-organizational networks. For example, from the within organization

studies of top management team consensus (e.g., Dess & Priem, 1995), communication frequency (e.g., Katz, 1982), communication effectiveness (e.g., Zenger & Lawrence, 1989),

we might deduce that alignment of cognitions within a network leads to more efficient

inter-organizational communication.

Like reciprocity, however, cognitive embeddedness is a two-sided endowment to the

firm, in that it promotes incremental entrepreneurial orientations and outcomes, but inhibits

the firm’s ability to sustain its viability through radical EB. On the one hand, cognitive

similarities can positively influence the rate of incremental EB by increasing efficiency of

inter-organizational communication and allowing executives across the network to quickly

acquire a common definition of the situation (Scott, 1995). By having similar cognitive

content, key actors across organizations are more likely to understand each other and more

likely to need a minimum of cognitive effort to communicate. Therefore, cognitive similarities may increase the rate of incremental EB by permitting communication economies to

be realized, allowing nuances to be signaled and received and thereby increase information

processing across the network. Confirming this, decades of research conducted in the realm

of diversity, organizational demography and upper-echelon theory finds that actors have

difficulties working and sharing knowledge in cognitively diverse contexts (e.g., Amason,

1996; Ancona & Caldwell, 1992).

On the other hand, cognitive differences are necessary for radical EB. Heterogeneity

of cognitive content stimulates discussion, decreases groupthink and leads to more

original ideas (Janis, 1972; Katz, 1982; Weick, 1976). Dutton and Duncan (1987) argue

that differentiation in belief structures enhances the search for information, increase the

perception that change is feasible, and generates momentum for change. The importance

of cognitive diversity is also a central feature in March’s (1991) discussion of the

exploration/exploitation trade-off, where diversity sustains the capacity for exploration

and for avoiding competency traps. High cognitive similarities also adversely affect the

rate of radical EB by compressing search times, resulting in a failure to consider multiple

alternatives and push for “one” best solution. In fact, at high levels of similarity,

consensus becomes so widely shared and articulated that it reduces the urge to communicate (Hambrick, 1994). Conversely, if key actors have more varied issue sets and

agendas, they are likely to exert more cognitive effort, attend to more aspects of the situation, and detect novel solutions. Holding constant the concurrent network influences of

Z. Simsek et al. /Journal of Management 2003 29(3) 427–442

437

relational embeddedness, which were specified in the third proposition, we propose the

following:

Proposition 4: The level of cognitive embeddedness (the degree of inter-firm cognitive

similarities in a network) is positively associated with a firm’s incremental EB and negatively associated with its radical EB.

Entrepreneurial Behavior as a Co-Evolutionary Sensemaking Process

As we previously noted, our intent in this paper is to use Granovetter’s (1985) structural

embeddedness theory to explain how networks affect firm-level EBs. As such, our model is

novel in that it departs from the tradition of explaining EBs with firm- and managerial-level

explanations. Up to this point, however, our model is incomplete, for it implies a one-way

direction of influence, going from inter-firm networks to the firm, potentially producing an

overly deterministic setof effects, orinGranovetter’s terms,an“oversocialized” explanation

of EB.

In addition, without reciprocal effects between firm-level EB and network-level characteristics our model remains static and closed. This raises fundamental questions like,

“How did the network emerge into its current structure?” Our thesis in advancing the

model beyond an oversocialized, static description of EB is that the overall architecture of

an inter-firm network (i.e., its level of structural, relational and cognitive embeddedness) is

partly shaped by the each member firm’s entrepreneurial needs, which themselves are driven

by intra-organizational sensemaking. More simply put, just as the inter-firm network influences each member firm’s EBs, so too does each member firm’s EB influence the network.

At the core of this thesis is the recognition that within every firm resides a network of

decision makers. These can be seen as intra-firm sensemaking communities that are nested

within the inter-firm sensemaking community. While sensemaking occurs at both levels,

the contexts for sensemaking are different. As we have detailed in this paper, inter-firm

communities are concerned primarily with the challenge of attaining effective governance

over a set of autonomous firms based on open-ended social contracts that are not legally

binding (Jones et al., 1997). Here, we have defined effective governance largely in terms of

reciprocity norms and cognitive similarity.

In contrast, intra-firm communities are concerned primarily with their firm’s current and

future viability. The role of central actors within these networks, as the principal architects

of their firm’s strategy and administrative system, is to adjust firm-level attributes to suit

competitive realities, including imperfections in the firm’s resource and output markets and

information asymmetries in inter-firm networks. As such, central actors within a firm are

faced with the challenge of making sense of proposed inter-firm resource commitments

before the relationship between those commitments and their potential outcomes for firm

performance are fully understood. Such a context calls for the kind of innovative, risk taking,

proactive behavior that lies at the heart of EB.

As the result of sensemaking, then, some actors within an inter-firm network may conclude that the pool of resources and capabilities already embedded in the network are

sufficient for the firms’ entrepreneurial needs. They look within the network for the information and capabilities needed to sustain them and seek to strengthen inter-firm ties through

438

Z. Simsek et al. /Journal of Management 2003 29(3) 427–442

more intimate and frequent interaction. These actors may also seek to form new reciprocal

ties, thereby bridging existing structural holes in the inter-firm network. By virtue of this

EB, which as we have argued is largely incremental, these actors increase network closure

and thus contribute to the level of structural embeddedness.

At the same time, other actors from the same inter-firm network may decide on a more

radical adaptive response, and, therefore, look outside the network for resources and capabilities to supplement those already available within the network. In the process, these

actors may distance themselves from other network partners (weaken existing strong ties)

while introducing new firms with new competencies into the network (bridging weak ties).

As with organizations pursuing incremental EB, these more radical behaviors disrupt the

network’s overall architecture. Rather than filling structural holes, however, radical EB on

the part ofnetwork members engenders new holes and more weak ties. This may enhance the

network’s potential to produce novel information and facilitate radical EBs in other firms.

We argued with our first four propositions that the embeddedness of inter-firm networks

affects the locus of firm-level EB. In this section, we are proposing that the direction of

influence flows both ways, or that firm EB and network embeddedness co-evolves. This

recognition completes our model’s development bysuggesting that the relationship between

inter-firm networks and firm-level EBs is both embedded and dynamic. Stated formally:

Proposition 5: The structural, relational, and cognitive embeddedness attributes of an

inter-firm network and the EBs of its member firms co-evolve as the result of inter- and

intra-organizational sensemaking processes.

Implications and Conclusion

Explanations of entrepreneurial firms have to date focused on either the entrepreneur

or the processes in an organization that promotes EBs, while giving short shrift to the

influence of inter-organizational networks. We argue that this oversight promotes a problem

of atomization, or prematurely shifting the unit of analysis from networks to individual firms

without first taking into the effects of the network. Our multilevel co-evolutionary model,

with structural embeddedness at its core, offers a more holistic view. Specifically, structural

embeddedness provides a theory to explain how ties in inter-organizational settings shape

firm behavior, something that the larger literature about embeddedness tends to be silent

about. Moreover, by distinguishing between incremental and radical EB, we provide a

richer description of network effects, including why the network structure simultaneously

constrains and enables entrepreneurial firm behavior.

Our model suggests several avenues for further research. For example, we limited our

argumentto a select set of network-level variables inthe attempt to theorizean “all else being

equal” link between structural embeddedness and EB and to advance refutable propositions.

By doing so, we overlooked other network variables that might enrich the linkage, such as

centralization. Not to be confused with “centrality,” which is an individual-level construct

that measures the relative position of actors within the network, centralization refers to the

variability in centrality scores in anetwork and captures the extent that network members are

heterogeneous in the number of ties each has (Marsden, 1990). The maximally centralized

Z. Simsek et al. /Journal of Management 2003 29(3) 427–442

439

“star” network concentrates all relationships in one central actor who communicates directly

with all other network members (Freeman, 1979). Consistent with Burt’s (1992) contention

that a central actors’ ties to outside network, particularly those characterized by weak ties

or structural holes (i.e., disconnections or non-equivalencies among players in an arena)

will increase the efficiency of new information diffusion throughout the network while

minimizing redundancy of central actors’ ties, we, therefore, speculate that the presence of

a centralized firm can enhance the network’s entrepreneurial ability to endow its member

firms with both incremental and radical EBs.

Important questions remain: Is there a particular level of structural embeddedness that

produces the optimal balance of incremental and radical EBs to ensure the member firm’s

long-term viability? Is that optimal mix contingent upon market effects like dynamism

and munificence? These questions and propositions advanced in this paper suggest the

fruitfulness of examining EB with a structural embedded theoretic lens.

The difficulty in testing models involving network embeddedness variables has to do

with collecting data on structural and compositional network constructs. However, studying inter-firm networks is not an impossible undertaking, as exemplified by studies on

takeover defenses, corporate acquisitions, total quality management, multidivisional and

matrix structures, and strategic alliances. Several other studies have examined how inter-firm

networks can directly affect organizational outcomes including organizational survival and

adaptation to changes (e.g., Uzzi, 1997). These investigations suggest that one or two principal investigators with relatively modest research funds might be sufficient to conduct

successful investigations of EB in inter-firm settings.

Finally, our model is managerially relevant. For example, by providing an understanding

about how specific aspects of the firm’s network influence EB, it offers managers insight

as to how they can position their firms within inter-firm networks to balance the need for

incremental forms of EB with the need for radical EB. According to our model, managers

might attain the former by positioning their firm in a network characterized by closure,

reciprocity, and cognitive similarity, while attain the latter by positioning their firm in a

network with weak ties and many structural holes.

Inconclusion,weextendfirm and managerial explanationsofEBbyfocusingoninter-firm

networks as the primary unit of analysis. Our core argument is that structural embeddedness,

with its focus on the network as a whole, and its two consequences, relational and cognitive

embeddedness, individually and collectively influence incremental and radical forms of EB.

The underlying mechanisms driving these relationships are intra- and inter-organizational

sensemaking. The ongoing reciprocal interaction between these two levels of analysis produces dynamic, co-evolutionary effects on EB. By defining the concepts and developing

specific propositions about these relationships, we hope that we have suggested an agenda

for future empirical research.

Notes

1. The term “select” indicates that network members are only a subset of the firms with

which a given organization has contact; “persistent” means that relationships are

characterized by repeated and recurrent transactions; “structured” indicates that these

440

Z. Simsek et al. /Journal of Management 2003 29(3) 427–442

exchanges are neither random nor uniform; “autonomous firm” conveys the idea that

each network member is legally independent; and finally “implicit and open-ended

contracts” highlights the fact that network relationships and exchanges do not rely on

authority or legal contracts (Jones et al., 1997: 914–916). 2. The undersocialized view

refers to explanations in which economic action is assumed toberational and minimally

influencedbyrelationships and social context.Inthis view, actors arrive at goals

independently and are entirely self-interested (Granovetter, 1985; Coleman, 1988).

Whatever happens in the network can be described exhaustively in terms of the

individuals involved. TCE represents an undersocialized theory because it posits that

economic action is an amalgamation of discrete transactions and atomistic motives and

beliefs. By contrast, the oversocialized view portrays actors as completely socialized.

Their behavior is governed by the social context, which manifests itself in the form of

generalized norms, socialization rules, and obligations (Coleman, 1988; Granovetter,

1985). Institutional theory may represent an oversocialized perspective because it

tends to downplay actors’ strategic goals and self-interests.

References

Abrahamson, E., & Fombrun, C. J. 1994. Macrocultures: Determinants and consequences. Academy of

Management Review, 19: 728–755. Amason, A. C. 1996. Distinguishing the effects of functional and

dysfunctional conflict on strategic decision

making: Resolving a paradox for top management teams. Academy of Management Journal, 1: 123–148.

Ancona, D. A., & Caldwell, D. F. 1992. Demography and design: Predictors of new product team performance.

Organization Science, 3: 321–341. Argyris, C., & Schon, D. A. 1978. Organizational learning. Reading,

MA: Addison-Wesley. Axelrod, R., & Keohane, R. O. 1985. Achieving cooperation under anarchy: Strategies

and institutions. World

Politics, 38: 226–254. Baker, W. E. 1990. Market networks and corporate behavior. American Journal of

Sociology, 96: 589–625. Barley, S., Freeman, J., & Hybels, R. 1992. Strategic alliances in commercial

biotechnology. In N. Nohria & R.

Eccles (Eds.), Networks and organizations: Structure form, and action: 311–347. Boston: Harvard University.

Blau, P. 1964. Exchange and power in social life. New York: Wiley. Bosch, F. A. J. V., Volberda, H. W., &

Boer, M. D. 1999. Coevolution of firm absorptive capacity and knowledge

environment: Organizational forms and combinative capabilities. Organization Science, 10: 551–568. Burt,

R. S. 1987. Social contagion and innovation: Cohesion versus structural equivalence. American Journal of

Sociology, 92: 1287–1335. Burt, R. S. 1992. Structural holes: The social structure of competition. Cambridge,

MA: Harvard University Press. Coleman, J. S. 1988. Social capital in the creation of human capital. American

Journal of Sociology, 4: 95–120. Coleman, J. S. 1990. Rational action, social networks, and the emergence of

norms. In C. Calhoun, M. W. Meyer,

& W. R. Scott (Eds.), Structures of power and constraint: 91–112. New York: Cambridge University Press.

Dacin, M. T., Ventresca, M. J., & Beal, B. D. 1999. The embeddedness of organizations: Dialogue directions.

Journal of Management, 25: 317–356. Dess, G. G., & Priem, R. L. 1995. Consensus-performance research:

Theoretical and empirical extensions. Journal

of Management Studies, 32: 401–417. DiMaggio, P.J., & Powell,W.W.1983. The iron cage revisited:

Institutional isomorphism and collective rationality

in organizational fields. American Sociological Review, 48: 147–160. Dutton, J. E., & Duncan, R. B. 1987.

The creation of momentum for change through the process of strategic issue

diagnosis. Strategic Management Journal, 8: 279–295. Dyer, J. H., & Singh, H. 1998. The relational view:

Cooperative strategy and sources of interorganizational

competitive advantage. Academy of Management Review, 23: 660–679.

Z. Simsek et al. /Journal of Management 2003 29(3) 427–442

441

Ekeh, P. P. 1974. Social exchange theory: The two traditions. Cambridge, MA: Harvard University Press. Faulkner,

R. E., & Anderson, A. B. 1987. Short-term projects and emergent careers: Evidence from Hollywood.

American Journal of Sociology, 92: 879–909. Freeman, L. C. 1979. Centrality in social networks: I. Conceptual

clarifications. Social Networks, 1: 215–239. Friedkin, N. E. 1982. Information flow through strong and weak ties in

interorganizational social networks. Social

Networks, 3: 273–285. Gavetti, G., & Levinthal, D. 2000. Looking forward and looking backward: Cognitive

and experiential search.

Administrative Science Quarterly, 45: 113–137. Granovetter, M. 1985. Economic action and social structure:

The problem of embeddedness. American Journal

of Sociology, 91: 481–510. Granovetter, M. 1992. Problems of explanation in economic sociology. In N.

Nohria & R. G. Eccles (Eds.),

Networks and organizations: Structure, form, and action: 25–56. Boston: Harvard Business School Press.

Granovetter, M. S. 1973. The strength of weak ties. American Journal of Sociology, 78: 1360–1380. Gulati, R.

1995. Does familiarity breed trust? The implications of repeated ties for contractual choice in alliances.

Academy of Management Journal, 38: 85–112. Gulati, R., & Gargiulo, M. 1999. Where do interorganizational

networks come from? American Journal of

Sociology, 104: 1439–1459. Guth, W.D., & Ginsberg,A.1990. Guest editors’ introduction: Corporate

entrepreneurship.Strategic Management

Journal, 11: 5–15. Hambrick, D. C. 1994. Top management groups: A conceptual integration and

reconsideration of the team label.

In B. M. Staw & L. L. Cummings (Eds.), Research in organizational behavior: Vol. 16, 171–214. Greenwich,

CT: JAI Press. Hambrick, D. C., & Mason, P. A. 1984. Upper echelon: The organization as a reflection of its

top managers.

Academy of Management Review, 9: 193–206. Janis, I. L. 1972. Victims of groupthink. Boston: Houghton

Mifflin. Jones, C., Hesterly, W. S., & Borgatti, S. P. 1997. A general theory of network governance: Exchange

conditions

and social mechanisms. Academy of Management Review, 22: 911–945. Katz, R. 1982. The effects of group

longevity on project communication and performance. Administrative Science

Quarterly, 27: 81–104. Krackhardt, D. 1992. The strength of strong ties: The importance of Philos in

organizations. In N. Nohria & R.

G. Eccles (Eds.), Networks and organizations: Structure, form, and action: 216–239. Boston MA: Harvard

Business School Press. Krackhardt, D., & Stern, R. N. 1988. Informal networks and organizational crises: An

experimental simulation.

Social Psychology Quarterly, 51: 123–140. Lant, T. K., & Mezias, S. J. 1990. Managing discontinuous change: A

simulation study of organizational learning

and entrepreneurship. Strategic Management Journal, 11: 147–179. Levinthal, D. A., & March, J. G. 1993. The

myopia of learning. Strategic Management Journal, 14: 95–112. Lewin, A., & Volberda, H. 1999. Prolegomena

on coevolution: A framework for research on strategy and new

organizational forms. Organization Science, 10: 519–534. March, J. G. 1991. Exploration and exploitation in

organizational learning. Organization Science, 2: 71–87. Marsden, P. V. 1990. Network data and measurement.

Annual Review of Sociology, 16: 435–463. Miller, D. 1983. Entrepreneurship correlates in three types of firms.

Management Science, 29: 770–791. Miller, D. 1996. The embeddedness of corporate strategy: Isomorphism vs.

differentiation. In J. A. C. Baum & J.

E. Dutton (Eds.), Advances in strategic management: Vol. 13. Greenwich, CT: JAI Press. Molm, L. D. 1994.

Dependence and risk: Transforming the structure of social exchange. Social Psychology

Quarterly, 57: 163–176. Morris, M. H. 1998. Entrepreneurial intensity: Sustainable advantages for

individuals, organizations, and

societies. West-port, CT: Quorum Books. Nahapiet, J., & Ghoshal, S. 1998. Social capital, intellectual capital,

and the organizational advantage. Academy

of Management Review, 23: 242–266. Ouchi, G. 1980. Markets, bureaucracies, and clans. Administrative

Science Quarterly, 25: 129–142. Podolny, J. 1994. Market uncertainty and the social character of economic

exchange. Administrative Science

Quarterly, 39: 458–483.

442

Z. Simsek et al. /Journal of Management 2003 29(3) 427–442

Powell, W. W. 1990. Neither market nor hierarchy: Network forms of organization. Research in Organizational

Behavior, 12: 295–336. Powell, W. W., Koput, K., & Smith-Doerr, L. 1996. Interorganizational collaborations

and the locus of innovation:

Networks of learning in biotechnology. Administrative Science Quarterly, 41: 116–145. Saxenian, A. 1990.

Regional networks and the resurgence of Silicon Valley. California Management Review,

33(1): 89–112. Scott, W. R. 1995. Institutions and organizations. Thousand Oaks, CA: Sage. Seabright, M.

A., Levinthal, D. A., & Fichman, M. 1992. Role of individual attachment in the dissolution of

interorganizational relationships. Academy of Management Journal, 35: 122–160. Tushman, M. J., &

Anderson, P. 1986. Technological discontinuities and organizational environments.

Administrative Science Quarterly, 31: 439–465. Uzzi, B. 1997. Social structure and competition in interfirm

networks: The paradox of embeddedness.

Administrative Science Quarterly, 42: 35–67. Walsh, J. 1995. Managerial and organizational cognition:

Notes from a trip down memory lane. Organization

Science, 6: 280–321. Wasserman, S.,& Faust,K.1994. Social network analysis: Methods and applications.

Cambridge, UK: Cambridge

University Press. Weick, K. 1976. Educational organizations as loosely coupled systems. Administrative

Science Quarterly, 21:

1–119. Weick, K. E. 1995. Sensemaking in organizations. London: Sage. Wellman, B. 1991. Structural

analysis: From method and metaphor to theory and substance. In B. Wellman & S.

D. Berkowitz (Eds.), Social structures: A network approach: 19–61. Cambridge, UK: Cambridge University

Press. Williamson, O. E. 1985. The economic institutions of capitalism: Firms, markets and relational

contracting. New

York: Free Press. Williamson, O. E. 1991. Comparative economic organization: The analysis of discrete

structural alternatives.

Administrative Science Quarterly, 36: 269–296. Zahra, S. A. 1996. Governance, ownership, and corporate

entrepreneurship: The moderating impact of industry

technological opportunities. Academy of Management Journal, 39: 1713–1735. Zenger, T. R., & Lawrence,

B. S. 1989. Organizational demography: The differential effects of age and tenure

distribution on technical communication. Academy of Management Journal, 32: 353–376.

Zeki Simsek is an Assistant Professor of strategic management in the School of Business at

University of Connecticut. He received his Ph.D. from University of Connecticut. His current research interests include inter-firm networks,firm-level entrepreneurship, and strategic

management of organizations.

Michael H. Lubatkin is the Wolff Family Chair in Strategic Entrepreneurship in the School

of Business at the University of Connecticut and Professor at Ecole de Management de Lyon

(France). His current research interests include the modeling and testing of governance

problems that are unique to family firms, the debating of paradigmatic differences between

strategy and various sub-fields of economics, including financial economics, agency theory, and industrial organizations, and the problems of core competency transfer between

divisions and across national boundaries.

Steven W. Floyd is the Cizik Chair of Strategic Management, Technology and Manufacturing, and an Associate Professor of strategic management at the School of Business at

the University of Connecticut. His recent research focuses on the role of social context in

the development of strategic initiatives, the contributions of middle-level management to

strategy-making and the organizational processes associated with strategic renewal.