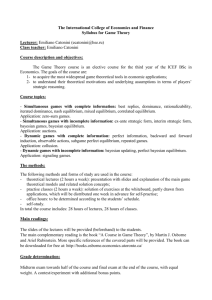

Conditional Distributions and a Few Example Problems

advertisement

Equilibrium Notes The models we will consider generally have game theoretic foundation and employ variants of the standard Nash equilibrium. The key features of any equilibrium in these models are as follows: > Each player’s strategy maximizes an objective function given conjectured beliefs about the other player’s strategies. > Each player’s conjectured beliefs about the strategies of the other players are consistent with equilibrium strategies adopted by those players. Consistent beliefs are, in some of the literature, called rational expectations. > Each player’s strategy is sequentially rational (in the case of sequential move models). > Each player updates beliefs in a Bayesian fashion (in the case in which information enters into the models). To illustrate the application of these concepts, we consider a couple of simple models of imperfect competition. Illustration 1 Consider a game in which two firms, 1 and 2, that produce the same product. The sequence of the game is as follows. Each firm simultaneously chooses a quantity to put up for sale that maximizes its expected profits. Let q1 denote the quantity produced by firm 1 and q2 denote the quantity produced by firm 2. The cost per unit for each firm is denoted c. After the products are offered up for sale, the market opens and the market-clearing price (i.e., the price at which the supply, q1 + q2, equals the total demand) is p = k – (q1 + q2), where k > c and > 0. a) Derive the optimal quantity produced by firm 1 given a conjectured quantity, q^2, for firm 2. b) Derive the optimal quantity produced by firm 2 given a conjectured quantity, q^1. for firm 1. c) Use your answers to part a and b, coupled with the requirement of consistent beliefs, to determine a pair of equilibrium quantity choices for the two firms. Equilibrium Notes – page 1 of 2 Illustration 2 Note that the modeling in Illustration 1 did not employ the last two equilibrium requirements, sequential rationality and Bayesian updating. To add the dimension of sequential rationality, consider the following extension of Illustration 1. Assume the same as in illustration 1 with the exception that firm 1 moves first and firm 2 observes firm 1’s quantity choice prior to making its choice. Derive an equilibrium in this sequential move game. Note that we will employ backward induction to get to a sequential equilibrium. a) Derive the optimal quantity produced by firm 2 given an observed quantity, q1, for firm 1. b) Derive the optimal quantity produced by firm 1 given the sequentially rational quantity response, ^q2(q1), for firm 2. c) Use your answers to part a and b to determine a pair of equilibrium quantity choices for the two firms. d) Which firm earns higher profits in your equilibrium? Why do you think this is true? Illustration 3 In Illustration 3, we add the dimension of Bayesian updating to Illustration 1. Assume the same as in ~ Illustration 1 with the additional information assumption that k is the realization of a random variable, k , that takes on one of two values, kh >kl >c. The probability for each outcome is .5. Prior to making quantity ~ choices each firm observes the same information about the realized value for k . This information takes the ~ , that takes on one of two values, g or b. The probability of g form of a realization of a random variable, conditional on kh being realized is > .5 and the probability of b conditional on kl being realized is also . Assume that each firm is risk neutral so each maximizes expected profits. a) Derive the optimal quantity produced by firm 1 given a conjectured quantity, q^2, for firm 2 given realization . Use the Bayesian updating requirement here. b) Derive the optimal quantity produced by firm 2 given a conjectured quantity, q^1. for firm 1 given realization . Use the Bayesian updating requirement here. c) Use your answers to part a and b, coupled with the requirement of consistent beliefs, to determine a pair of equilibrium quantity choices for the two firms. ~ d) Does information about k have value to the firms? Equilibrium Notes – page 2 of 2