DOC - Europa

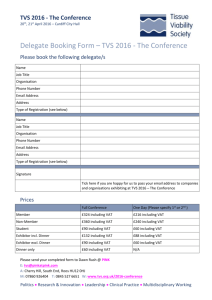

advertisement

MEMO/03/98 Brussels, 6th May 2003 VAT on postal services: frequently asked questions (see also IP/03/633) If VAT is added to postal services, would prices go up? No, there should be no major price increases. First, if traditional national operators are required to charge VAT on their sales they would also have the right to reclaim VAT on their expenses such as equipment, fuel and vehicles. Operating costs would therefore decrease. Increasing use of technology in the postal sector, in particular, means that postal operators currently pay large sums of VAT so the benefit of being able to deduct those costs would be great and they would no longer have to pass them on to consumers as hidden VAT. Second, the proposed Directive would give Member States the option to introduce a reduced VAT rate for the standard postal services used by private consumers. The amount of VAT charged on a postal operator’s sales at a reduced rate would not be significantly different to the amount of VAT at the standard rate reclaimed on his expenses which is currently passed on to consumers. Third, as far as businesses are concerned, most businesses can reclaim VAT paid so they would be better off as a result of the proposal. In principle prices should come down for them because there would be no more hidden VAT. Why would the abolition of the VAT exemption be an advantage for the postal services suppliers that are currently exempt? Because if a sale is VAT exempt, the postal operator cannot reclaim the VAT on its related costs. This non-reclaimable VAT will be an extra cost to the operator. In effect, instead of the customer paying VAT on its sales, the operator pays the VAT on its costs. As a result it has higher costs. This leads to distortions of competition between operators in a sector such as postal services where some can reclaim their VAT (private operators) and some cannot (traditional national operators). Furthermore, operators that have some exempt sales and some taxable sales have to work out how much VAT they can reclaim. Where purchases are used for both purposes this can lead to complex calculations. Why is it an advantage to customers if all businesses can reclaim their VAT under this proposal? Because, at present, since VAT that cannot be reclaimed is an additional cost to a business, businesses that are exempt inevitably pass on the cost to the customer as ‘hidden VAT’. Why do distortions of competition occur if some businesses are allowed to charge VAT while other competing businesses are exempt? Because operators not charging VAT can offer a lower sales price and so will be more attractive to private consumers. At the same time, operators that are charging VAT are more attractive to business customers because these customers can reclaim the VAT, so that the net price will be lower than the prices of an operator not charging VAT. Why not, instead of removing the VAT exemption for national postal operators, include the competitors within the exemption? Because it is not possible to define exactly any business sector. The postal services sector is part of the wider transport sector. The extension of the VAT exemption to all postal operators would still leave freight carriers, for example, on the wrong side of the line. Distortions of competition would thus continue and the problem would merely be moved to a different set of traders. The VAT system is designed to apply broadly to all economic transactions and exemptions have to be very narrowly defined for the system to work effectively. What would be the level of the optional reduced rate of VAT? Reduced rates in Member States currently vary between 5% and 17%. Why not have a reduced rate across the whole postal services sector? Because a reduced rate across the whole sector would mean a significant revenue loss for Member States, which would inevitably have to be recouped elsewhere. The sector includes national and international transport and is very large. The reduced rate is designed as an exception for the small share of postal services used by private consumers. Is the Commission proposal a new idea? No. The Commission set out its plans with regard to VAT and postal services in its Strategy To Improve The Operation Of The VAT System (see IP/00/615), published in June 2000. This strategy includes various measures to modernise, simplify and improve the operation of the current VAT system, including postal services, and improve the functioning of the Internal Market by removing competitive distortions. 2