Logistics, market size and the scale of the firm in 1900

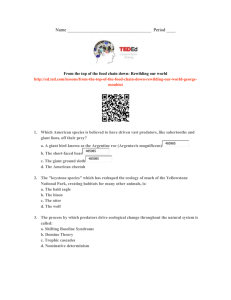

advertisement