Results

ETHANOL AND PRE-SALT OIL IN BRAZIL: COMPETITION OR COMPLEMENT? A

Prospective analysis for the Brazilian Market

Henrique M. M. Santos GradEI, University of Aberdeen, +44 (0) 7853103982, h.santos.08@aberdeen.ac.uk

Dr. Afonso Henriques M. Santos, IAEE member, Federal University of Itajuba, +55 (35) 91066094, afonsohms@gmail.com

Evgeniya Mezentseva GradEI, University of Aberdeen, +44 (0) 7853978189, evegeniya.mezentseva.08@aberdeen.ac.uk

Overview

The present Brazilian situation in the oil and gas scenario may look very comfortable with all the new discoveries. However the world crises show itself as a barrier to the development of many new prospects. And the Brazilian situation is not different.

In the other hand there is the Brazilian ethanol, from sugar cane, the most efficient of the bio-fuels which have been the subject of many international discussions, and reason for different president to visit the country looking for technologies and agreements.

This paper looks to make a contrast and an analysis of these two different new energetic Brazilian resources, as the limitations of the production of each one of them and how it will compete in an internal market situation as in the international market. It is exhibit the production costs for both Ethanol and pre-salt prospects. In the Santos bay, the probable reserves are estimated around 50.000 mmBOE. Although it is estimated a production cost of US$12 per barrel in the pre-salt fields it is located near the most developed area in the country, which is also the biggest consumer. This situation can change the picture of the competition between ethanol and oil, as the oil will be very accessible. It will be compared with the different production costs and perspectives for the ethanol associated to its final selling price. The paper suggests later an optimum oil price which would attract investors either for the oil and ethanol production as it will generate a line where the ethanol will be very interesting for the internal and some external consumption as mainly a vehicular fuel and the oil will be released to exportation.

The different scenarios of competition or complementation, as the boundaries, limitation and advantages of the different resources are discussed in this paper which looks to elucidate first view about this new energy potential found in this south-

American country while energy uncertain is demonstrated.

Methods

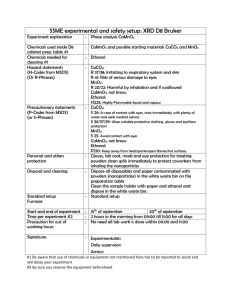

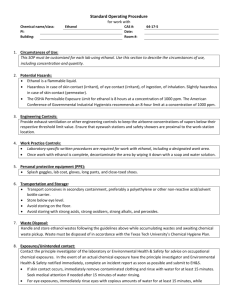

Firstly will be demonstrated the general characteristics of oil production in the Santos bay. Where the prospects are and which are the volumes expected. It will be analysed the oil production cost and the impact and influence of the oil price in the production.

Further, the Ethanol will be analysed following the same criteria. Production costs, main production localization, infrastructure and all the perspectives considering the final selling price.

As the main scenario, the Brazilian market will be exposed such as oil, gas and ethanol consumption for vehicle purposes and what are the perspectives.

For the international market projection are taken into consideration for international oil and gas price tendencies forecasts. And it will be compared with the Brazilian internal situation.

Finally, different scenarios will be elaborated for short, medium and long term for oil combining it with the Brazilian market alternatives as the consumption of ethanol purely or as an additive, vehicular natural gas, diesel and gasoline. Resulting on what is the excess to be exported, if there will be market for that and at what price.

Results

The results of this dissertation were simulated utilizing the Monte Carlo random method for ten different cases of oil price combined to oil exploration and production oil cost probability distribution. This simulation concludes that investments the investments are safe for a risk level of 20%. The expected value of pre-salt production has been calculated based on the same different oil price scenarios. The ethanol production potential has been calculated as well, considering a probability distribution of its production cost. After analyzing the internal market based on three scenario assumptions there is resulting excess allowing ethanol exportation. Assuming a reliability range of 80% for the results is understood that the internal market is totally able to absorb the ethanol production, what lets this sector independent of other countries political or logistical conditions. In the other hand there is oil which has an assured market. The stronger discrepancy of the Brazilian Market, in relation the other countries, is the huge car fleet ran by flexible fuel engines, allowing to change the fuel option according to the price.

Conclusions

After our simulations, comparisons and developments we arrived on the following conclusions:

1The Brazilian Ethanol has its assured market independent of the world demand as the Brazilian internal market is more than enough to absorb it.

2The ethanol consumption increase, combined to the vehicle natural gas fleet increase will allow the oil exportation.

3The oil market is more easily negotiable than ethanol or even natural gas due the great volume and as there is several types and form of negotiations and contracts.

4The installation of the two first regaseification plants in Brazil, replace the country in a condition to choose between different markets especially in a short term. It can be transferred to the internal market choosing to use the gas in the industry, power generation or in vehicles.

5For the ethanol there is the possibility of utilization as an additive to the regular gasoline, as it is already done in

Brazil. Due to environmental reasons it can be spread to other countries generating a significant international market for this biofuel.

References

Augusto, L. A. “ Bioethanol - Sugar cane based bioethanol ”. BNDES Ed. Rio de Janeiro 2008.

Empresa de Pesquisa Energetica – http://www.epe.gov.br/PNE/Forms/Empreendimento.aspx

EPE . Acces in March 2009,

International Energy Agency –IEA, Acces on March 2009, http://www.iea.org/

BP. “ Statistical Review of World Energy 2008 ”. Acces on February and March 2009. http://www.bp.com/productlanding.do?categoryId=6929&contentId=7044622

3 Intelligent Well Technology: Status and Opportunities for Developing Marginal Reserves SPE