poison exemption

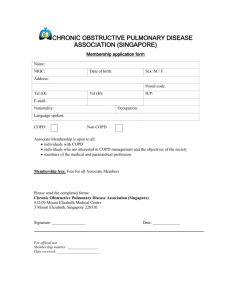

advertisement