Collection Litigation in Idaho

Debbie Allen

City of Boise, Idaho

2008

A summary of obtaining and executing on legal judgments in Idaho, particularly as it pertains to past due debt.

Fair Debt Collection Practices Act (“FDCPA”) creates statutory guidelines under which debt collectors may conduct business, defines rights of consumers involved with debt collectors, and prescribes penalties and remedies for violations of the Act. A current copy of the FDCPA can be obtained from the Federal Trade Commission website at www.ftc.gov/bcp/edu/pubs/consumer/credit/cre27.pdf

.

Pre-Litigation Strategies

Before sending a collection to in-house counsel, the collector may consider sending a preliminary warning letter advising the debtor that the account is being referred to an attorney. If the business entity follows the FDCPA, a “Mini-Miranda” warning should be included warning the debtor that the collector is attempting to collect a debt and that any information obtained will be used for that purpose.

If the warning letter is unsuccessful, the debt may be referred to the Legal Department.

In most cases, the Legal Department will prepare and mail a demand letter. Effective demand letters can often lead to collection of an obligation without the necessity of initiating litigation.

The demand letter should be individualized and comprehensive. Attaching a recital (or accounting) of the obligation together with a draft complaint ready to be filed may give the debtor the perception that immediate litigation is at hand, making the debtor more inclined to consider a resolution of the claim.

Litigation Strategies

One must consider several questions to decide whether to file a claim in court. The first two considerations should be the size of the claim and the solvency of the debtor. If you are not aware of any assets that a debtor has which may satisfy a sizeable claim, and are unwilling to expend the time or money required to undertake an asset search, it makes little sense to expand significant fees in pursuit of obtaining a judgment which may simply sit in the file.

An additional consideration is whether to handle the claim in-house or hire a collection agency or attorney to collect on your behalf. Collection agency fees range from 30% to 50% of the amount recovered, plus costs. Arrangements with attorneys range from strict hourly fees to a percentage of the amount recovered, plus fees.

Finally, it is important to consider the status of the debtor. Is the debtor in prison? Is the debtor gainfully employed? Is the debtor deceased? Is the debtor married? Is the debtor in military service? Is the obligation a community obligation or an individual obligation? If the debtor is an organization (corporation, LLC, etc.), what is the status of the entity? The answers to these questions will bear on the decision to pursue collection of the claim in court. But do not allow the answers to these questions to deter you from collecting if you feel comfortable

proceeding. For instance, simply because a debtor is deceased does not mean it is impossible to pursue assets in a probate proceeding. The statute of limitations for claims against an estate is 3 years, unless the estate publishes a notice of filing of claims, in which case the time period is 4 months. If you are interested in collecting your debts, it is worthwhile to pay attention to the legal notices in the local paper.

For any agreement based on an alleged contract, you must consider the impact of the statute of limitations. Oral contracts bear a statute of limitations of 4 years (Idaho Code § 5-217); written contracts bear a statute of limitations of 5 years (Idaho Code § 5-216). Payments on open accounts may extend the statute of limitations (runs from the time of the last item proved on the account on either side) (Idaho Code § 5-222).

The courts in most states have statutory limits on the size of the claim brought before each level of court. In Idaho, the statutory limit for Small Claims Court is $5,000. Any claim between $5,001 and $10,000 would be brought in Magistrate Court, and any claim over $10,000 would be brought in the District Court.

Small Claims Court is an inexpensive avenue to pursue recovery of the smaller debts.

Attorneys are not allowed to practice before Small Claims Court, but you may seek the advice of an attorney to help you prepare your case. Small Claims proceedings do not adhere to the rules of evidence or rules of procedure, and a judge hearing a small claims proceeding will listen to

(but not necessarily accept) almost any evidence a claimant chooses to offer. While adherence to the rules is not required, a magistrate judge is, after all, still an attorney. A presentation conforming mainly to the rules of evidence and normal courtroom procedures will be received more warmly than one which does not.

Small Claims courts in Idaho provide forms which they strongly urge you to use. Packets may be picked up at the courthouse, or you may download the forms from the website.

( http://www.courtselfhelp.idaho.gov/ ). The initial packet to be filled out includes a Summons,

Complaint, Blank Answer, and Instructions. The cost to file the complaint is $35.00.

Once the complaint is filed, a copy of the complaint, blank answer and instructions will need to be served upon the debtor. There are 3 options for service. The rules provide that you may request the court serve by certified mail, return receipt. If you choose this option, an additional $7 charge will be assessed by the clerk. The second option is to have the U.S.

Marshal serve the paperwork. The cost for this service is $25. The final option is to hire a process server. The process server’s charge ranges between $25 and $100, depending on how many times they have to drive to the service address to effect service.

The debtor has 20 days to answer the complaint after service. If the debtor files an answer, the Small Claims Court will set the case for mediation/trial. Mediation is mandatory in

Small Claims Court. The Court views this as preferable to going to trial. However, if the parties are unable to come to an agreement at the morning mediation, the trial is held that afternoon, so it would be well to be prepared to proceed to trial regardless of your outcome at mediation.

On the other hand, should the debtor fail to file an answer, the Small Claims Court will set the matter for a default hearing. At the hearing, the judge will ask to see proof of the debt, so be prepared with your business records. If the judge deems your proof sufficient, he will issue the judgment at the hearing.

If the debtor has real property worth executing against, record the judgment with the

Recorder’s Office. There is a per page cost for recording. This attaches an automatic lien against all real property in the name of the debtor at the time of the judgment, as well as any property purchased after the date of the judgment. To file liens against personal property, you need to file a UCC Statement with the Secretary of State

( http://www.sos.idaho.gov/online/ucc/uccSession.jsp?new=y ). The cost for filing the lien is

$3.00 plus the online transaction fee of $1.00.

Magistrate and District Courts

If a claim is more than $5,000 and less than $10,000, you may wish to file in Magistrate

Court. Anything over $10,000 would be filed in District Court. The proceedings in Magistrate and District Court are more formal. Rules of civil procedure and evidence apply, and attorneys may appear and represent clients. Consulting an attorney may be advisable if the collector feels at all uncomfortable with the expectations in Magistrate and/or District Court.

Should the collector wish to collect attorney fees in addition to the costs of suit, a demand letter should be sent 10 days before a complaint is filed in either of these courts. The Magistrate

Court has limited the amount of attorney fees requested, depending on the amount of the initial claim ( ID-City-Judgment_AttyFeeSched.pdf

). Attorney fees in District Court vary between a flat fee, one-third of the amount recovered, or hourly.

The initial process is similar to Small Claims, i.e. filing a complaint, and having it served on the debtor. The forms, however, are more lengthy and detailed ( ID-City-

Judgment_Summons.doc

and ID-City-Judgment_Complaint.doc

).

Once the complaint is filed with the Court, the collector is responsible for having it served upon the debtor. The options provided in Small Claims Court do not exist in Magistrate or District Court. A private process server may be hired, or a county sheriff may serve civil documents. The cost for a sheriff to serve process in Idaho is $20 plus mileage. form).

The debtor has 20 days to answer the Complaint after it has been served (see Summons

A

NSWER FILED

If the debtor files an Answer within the 20 days stated in the Summons, the case will proceed to trial. If you did not consult with an attorney previously, it would be advisable to consult an attorney at this juncture. The more formal rules in Magistrate and District Court can include discovery (interrogatories, admissions and document production), as well as depositions.

At trial, witnesses may be called and sworn in. Depending on the complexity of the case, an attorney’s expertise may be invaluable.

N O A NSWER FILED

If the debtor does not file an Answer, the collector may ask the Court for a default judgment. The default documents are prepared and filed with the Clerk (Exhibit D). No hearing is held on defaults – the judge simply reviews the paperwork and if deemed appropriate, will sign the default judgment.

It is important that once you receive the signed Default Judgment that it be recorded with the County Recorder’s Office. This places an automatic lien on the real property of the debtor.

If the debtor has personal property of value you may wish to file a general U.C.C. Statement with the Secretary of State ( http://www.sos.idaho.gov/online/ucc/uccSession.jsp?new=y ). The cost for filing the lien is $3.00 plus the online transaction fee of $1.00.

Execution

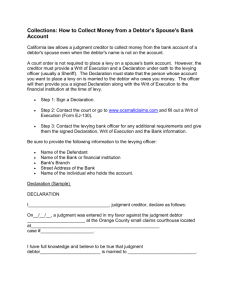

Once a collector has obtained a judgment, the first effort to collect the debt is to obtain a

Writ of Execution.

Before preparing the Writ, it would be advisable to calculate the amount due. An electronic spreadsheet which calculates interest, tracks costs and payments makes this exercise easy ( ID-City-Judgment_JudgmntSpreadsheet.xls

).

There are several avenues to be taken to execute.

1.

Personal property: to execute against personal property takes special handling. The sheriff requires the collector to pay a deposit toward the anticipated costs of seizing, hauling, and storing items of personal property. It would be wise to talk to the sheriff’s office to determine these costs before a Writ is issued.

2.

Real property: also takes special handling and is quite complicated. Again, it would be advisable to talk to the sheriff’s office before taking this step.

3.

Wages: a collector may request the court to allow continuous garnishment of wages if the debtor’s employer is known. Once the Writ is delivered to the sheriff and service accomplished, a percentage of the debtor’s wages are held back to be paid towards the outstanding debt. Because it is a continuous execution, a collector need only sit back and wait for the sheriff to disburse the money, approximately 60 days after the sheriff receives the writ.

4.

Bank Account: a collector may empty a debtor’s bank account. The banks require a

$5.00 processing fee, which must be sent with the remaining execution paperwork to the sheriff’s office.

5.

Tax Refund Garnishment: finally, a collector may execute against a debtor’s tax refund. A processing fee of $10 is required by the State Controller’s Office, which must be sent with the remaining paperwork to the sheriff’s office.

Depending on the type of execution, several documents will need to be prepared. Once a

Writ of Execution is prepared, it is taken to the county clerk of court for issuance. After issuance, the packet is forwarded to the sheriff’s office for service, along with any required fees (around

$55) plus the special fees for bank or tax refund garnishments. ( ID-City-

Judgment_TaxRefundExecution.doc and ID-City-Judgment_WageGarnishment.doc and ID-City-

Judgment_BankAcctExecution.doc

)

When the sheriff receives the forms, he must serve the execution within 60 days.

Whether a bank account, wages, or tax refund, the third party (called a “Garnishee”) must fill out a questionnaire as to whether the debtor has assets (money) that the Garnishee is holding on the debtor’s behalf. If the Garnishee chooses not to answer the questionnaire, the collector may require the Garnishee to appear in court and explain to the judge why the Garnishee did not answer ( ID-City-Judgment_EmployerExam.doc

). If the Garnishee fails to appear before the court and explain, the Garnishee is at risk of the collector obtaining a judgment against the

Garnishee ( ID-City-Judgment_JudgmntAgainstEmplyr.doc

). The collector need not compel the employer to appear. By statute, a collector may simply request the court enter default judgment against the employer. This process essentially begins a lawsuit within a lawsuit. The delays associated with this action should be considered carefully as part of the execution process.

Not all assets of a debtor are subject to a judgment. Certain assets should not be taken.

A good list of these types of assets is set forth in the notice that the sheriff has to provide the debtor. (See Notice of Exemption in Writ packet.)

If a collector is unable to determine the assets of a debtor, and if an execution is returned by the sheriff unsatisfied, the collector may require the debtor to appear in court and answer questions ( ID-City-Judgment_DebtorsExamQuestions.doc

). This is called a Debtor’s Exam. In

Idaho, a debtor is not required to attend such an exam if he does not reside in the county where the suit is filed.

When a debtor’s exam is held, the debtor is sworn in by the presiding judge. At that point, the judge leaves the room (or asks you to use a conference room outside the courtroom) to ask the questions. If either party (collector or debtor) feels the other is being untruthful or uncooperative, they may ask the judge to step in. Because the exam is not held in open court, the collector may consider using a recording device to record the exam, as long as that is allowed by the law of your state.

If a debtor fails to appear at the debtor’s exam, you may move the court to hold the debtor in contempt. The court will order a second hearing (which order must be served upon the debtor) for the debtor to appear and explain the reason for not appearing. Should the debtor fail to appear at the second hearing, the court will issue a Writ of Attachment for the debtor's arrest.

The bond amount is typically set at the amount then owing on the judgment. Once the debtor is arrested, if a cash bond is posted, the collector may at the hearing request that cash bond be handed over as payment of the judgment. ( ID-City-Judgment_OrderReleasingFunds.doc

)

Once the debt is paid, the collector files a Satisfaction of Judgment with the court ( ID-

City-Judgment_SatisfactionofJudgment.doc

). A certified copy of the Satisfaction is recorded, at which time the collector can close the file.