JLARC and Budget Mandate

advertisement

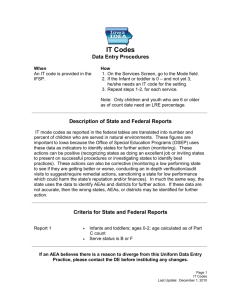

Recommendations to the Governor and Legislature re: Special Education Excess Cost Accounting Excess Cost Accounting Ad Hoc Committee Mary Alice Heuschel (Renton) Kris Lenke (Puyallup) Fred Row (Renton) Dennis Mathews (ESD 112) Trip Goodall (Deer Park) Doug Matson (W. Valley, Spokane) Carol Gray (Vancouver) Brian Aiken (Fife) Sue Curtis (Anacortes) John Molohon (ESD 113) Christie Perkins (Coalition) Mike Merlino (Evergreen, Clark) Michelle Corker-Curry (Seattle) Neil Sullivan (Spokane) OSPI Staff Jennifer Priddy, Doug Gill, Calvin Brodie, Mary Ellen Parrish, John Bresko, Michelle Sabin, Kim Thompson Mandate of Committee The following operating budget language governs the mandate of committee to review and recommend a Special Education Excess Cost Accounting method: “…conduct further evaluation of issues raised in the recently completed joint legislative audit and review committee report on the accounting of special education excess costs. Within the amounts provided in the subsection, the office of the superintendent of public instruction will convene a work group to evaluate modifying or replacing the current 1077 methodology. This work group will deliver a report to the appropriate committees of the legislature, including the joint legislative audit and review committee, and the office of financial management, by January 1, 2007. The work group will take into consideration recommendations of the Washington learns steering committee.” As background, the related JLARC recommendations follow: JLARC Report Recommendation # 2 The Superintendent of Public Instruction, with the assistance of interested stakeholders, should examine whether the current excess cost methodology might be improved through various modifications to the 1077 Special Education Excess Cost Worksheet. JLARC Report Recommendation # 3 The Office of Superintendent of Public Instruction should provide clear guidance and instruction, and periodic training on how to accurately and appropriately: A. Complete the 1077 Least Restrictive Environment child counts through: 1. Better identification, in the individualized education programs, of the location where minutes of specially designed instruction are provided; and 2. A consistent base of minutes of weekly instruction used for calculating percentage of time students spend in the regular classroom. B. Allocate costs of contracted services between basic education and special education programs. 1 of 7 2/18/2016 Recommendations to the Governor and Legislature re: Special Education Excess Cost Accounting JLARC Report Recommendation # 4 The Office of Superintendent of Public Instruction should require school districts to report the full costs of serving their special education students (i.e., both basic education and special education programs separately). Committee Process The committee met four times during November through January, reviewing the: JLARC report, Washington Learns K-12 Advisory Committee recommendations, Background information on the current 1077 process, and Strengths and weaknesses of the current 1077 method. Further, the committee discussed new methods, the exact calculations of such methods, and the advantages and pitfalls of such methods. In mid-December the committee reached consensus on a proposed new excess cost accounting method. This method and related background detail is described below. Superintendent Bergeson accepted the committee’s recommendation in full. Standards for an Improved Method The committee identified several standards and requirements by which to evaluate a recommended method: Transparency and Ease of Understanding Accuracy Equitable and Fair Incentive Neutral In addition, the committee put a very high premium on an accounting method that would reinforce the current state priority to treat every student as a basic education student first. To this end, the committee focused on developing a method that easily identified the amount of basic education revenue that was being expended on students’ specially designed education or instruction. COMMITTEE RECOMMENDED STATE SPECIAL EDUCATION EXCESS COST ACCOUNTING METHOD Description of Method The proposed method has two objectives. First, to ensure that special education eligible students, as a class, receive their full share of general apportionment (basic education) funding before accessing the state excess cost funding. Second, to simplify and consistently apply the cost accounting necessary to achieve the first objective by 2 of 7 2/18/2016 Recommendations to the Governor and Legislature re: Special Education Excess Cost Accounting shifting the majority of the cost accounting function from the local school district to the state apportionment office. The proposed accounting method will: a) Shift a portion of basic education revenue to the special education program based on students’ full-time equivalency (FTE) in the special education setting; and b) Require all costs for the special education program (e.g., the full cost of special education teachers and program) be captured within a single program rather than splitting program costs between basic and special education. The basic education revenue shifted to the special education program, revenue 3121, is intended to establish a minimum amount of spending of state program 21 before the school district accesses the excess revenues, revenue 4121, generated by the excess cost formula (.9309 of general apportionment revenue). The method is referred to as the Washington State Excess Cost Accounting Method (WSECM). Specifically: 1. Districts would continue to use the 10771 to generate student FTEs served in the special education setting. The number will be specific/unique for each school district. (Currently of the approximate113,000 school-age students eligible for specially designed instruction and generating general apportionment revenue, ~70% of full-time equivalent students are served in the regular education setting; ~30% of FTE students are served in the special education setting.) 2. Based on the split of FTE described above, OSPI would split general apportionment funds associated with these students eligible for special education into three categories: a. General apportionment for the regular education classroom (current account code 3100); b. General apportionment for the special education setting (new account code 3121); c. Indirect support for utilities, administration, district-wide services, etc. 3. Districts will code their staff and appropriate expenses related to providing specially designed instruction to the special education program. 4. Districts will first expend the general apportionment funding associated with revenue code 3121 and then expend excess cost funding attributed to revenue code 4121. The 1077 Form collects the school districts’ information of implementation of Least Restrictive Environment (LRE) on December 1st each school year. Districts report the percentage of time that special education students spend in the basic education classroom; it is a federal reporting requirement under IDEA part B. 1 3 of 7 2/18/2016 Recommendations to the Governor and Legislature re: Special Education Excess Cost Accounting Proposed Method measured against Standards for Improved Method Transparency and Ease of WSECM is easier to understand because OSPI will Understanding display and account for all revenues that districts are allocated in general apportionment and special education. Because districts will not split code staff, expenditures for special education are contained in one set of codes and easily identifiable on current OSPI reports. Accuracy Revenue splits are calculated by OSPI for each school district using current apportionment formulas and reported student data. Equitable and Fair All students in specially designed services will be included in revenue calculations (tables 1-8 of 1077) to the extent they generate general apportionment funding. WSECM is responsive to districts’ unique mix of students and continuum of service delivery settings. WSECM is consistently applied for all districts by the OSPI. Special education students, as a class, receive a full share of general apportionment revenues in addition to excess cost revenues. Districts will first expend general apportionment funding attributed to revenue code 3121. Incentive Neutral Method reflects, but does not influence, a district’s LRE decisions. No additional revenue is generated by a district based upon students’ placement on the 1077. Revenue split between programs is based on prior year 1077 tables, removing any incentive related to student placement in the special education setting. Use of the prior year’s 1077 data presents a stable and consistent basic for district to use in budgeting and accounting for the school year. Other WSECM is consistent with the federal excess cost threshold requirements that will govern how much districts must spend in total resources before accessing federal IDEA funds. OSPI will develop future guidelines consistent with the federal excess costs. 4 of 7 2/18/2016 Recommendations to the Governor and Legislature re: Special Education Excess Cost Accounting JLARC Recommendations and Findings: Committee Response JLARC Committee Response Recommendation 1: The Legislature should decide whether the current or alternative approach should be used. We recommend that the legislature adopt the WSECM. Recommendation 2: If the current method is maintained, the OSPI should examine modifications to improve the accuracy of the current 1077 worksheet. Agree: Improving the 1077 accuracy remains relevant to the new WSECM. Recommendation 3: If the current method is maintained, the OSPI should provide clear guidance and instruction on how to a) complete the 1077 Least Restrictive Environment child counts; and b) assign costs of contracted services and non-employee related costs between basic education and special education programs. Agree: Recommendation 4: The OSPI should require school districts to report the full cost of serving their special education students. Agree; WSECM will enable such reporting. JLARC Finding: Some districts have not implemented the current excess cost accounting method. Upon adoption, WSECM will be consistently calculated by OSPI for each district using data already reported to the state. JLARC Finding: Some districts split code staff incorrectly. WSECM provides for full cost special education accounting. Accordingly spilt coding of staff is no longer appropriate. a) JLARC 1077 recommendation is relevant to WSECM also. b) Under the WSECM, concerns about split coding of contracted services and nonemployee related costs are no longer relevant. 5 of 7 2/18/2016 Recommendations to the Governor and Legislature re: Special Education Excess Cost Accounting JLARC Committee Response JLARC Finding: Some districts make mistakes in Training by OSPI and ESDs identifying and reporting Least Restrictive Environment will address identifying and because: reporting Least Restrictive Environment. a. IEPs do not clearly state where services are provided. b. Number of minutes in a location is not defined on IEP. c. Process for determining the number of minutes on which to base table placement is unclear to some districts. Items a through c result in possible incentives and disincentives for student placement. JLARC Finding: Current method does not address assignment of key costs: a. NERCs. b. Contracts. Upon adoption of the new WSECM, these costs would be included in full. Concerns about assignment of contracted services and nonemployee related costs are no longer relevant. JLARC Finding: Total cost of serving special education Upon adoption of the eligible students is not reported; total revenue is not WSECM, OSPI will revise the accounted for. School District Accounting Manual, and budget and expenditure reports to track total cost of serving and the total revenue generated by special education-eligible students. Use of the 1077 Form in the Proposed Method The committee has carefully considered the findings and concerns that JLARC expressed about the 1077 form report. However, the committee concluded that the LRE was the best available statewide data for use in an excess cost accounting method. 6 of 7 2/18/2016 Recommendations to the Governor and Legislature re: Special Education Excess Cost Accounting Additional Work Products Required by OSPI to Implement Method 1. Revise apportionment reports for new revenue coding (1220 report and others). 2. Define adjustments to the K-4 calculation to mitigate unintended consequences of implementing a new method. 3. Modify the carryover and expenditure rules related to special education excess cost revenues for the WSECM. 4. Develop a training module to ensure districts appropriately place students on 1077 tables. Address including students in LRE tables 4-8 in the WSECM method. 5. Review the School District Accounting Manual requirements for the special education programs, consulting the OSPI School District Accounting Advisory Committee and the Special Education Advisory Committee. 6. Revise the current special education safety net process to accommodate the WSECM. 7. Reconvene its Excess Costs Accounting Ad Hoc Committee during school years 2007-08 and 2008-09 to review and evaluate school district implementation of the WSECM and report to the legislature any potential changes or modifications to the method. 7 of 7 2/18/2016