Executive Summary for Business Money Source

advertisement

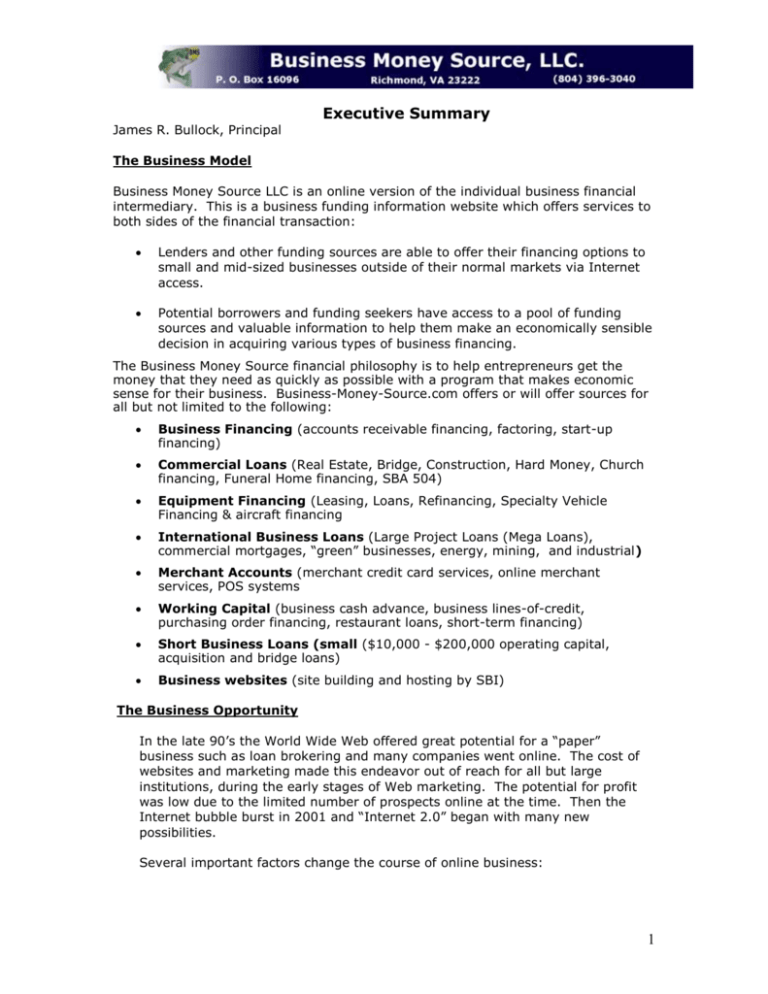

Executive Summary James R. Bullock, Principal The Business Model Business Money Source LLC is an online version of the individual business financial intermediary. This is a business funding information website which offers services to both sides of the financial transaction: Lenders and other funding sources are able to offer their financing options to small and mid-sized businesses outside of their normal markets via Internet access. Potential borrowers and funding seekers have access to a pool of funding sources and valuable information to help them make an economically sensible decision in acquiring various types of business financing. The Business Money Source financial philosophy is to help entrepreneurs get the money that they need as quickly as possible with a program that makes economic sense for their business. Business-Money-Source.com offers or will offer sources for all but not limited to the following: Business Financing (accounts receivable financing, factoring, start-up financing) Commercial Loans (Real Estate, Bridge, Construction, Hard Money, Church financing, Funeral Home financing, SBA 504) Equipment Financing (Leasing, Loans, Refinancing, Specialty Vehicle Financing & aircraft financing International Business Loans (Large Project Loans (Mega Loans), commercial mortgages, “green” businesses, energy, mining, and industrial) Merchant Accounts (merchant credit card services, online merchant services, POS systems Working Capital (business cash advance, business lines-of-credit, purchasing order financing, restaurant loans, short-term financing) Short Business Loans (small ($10,000 - $200,000 operating capital, acquisition and bridge loans) Business websites (site building and hosting by SBI) The Business Opportunity In the late 90’s the World Wide Web offered great potential for a “paper” business such as loan brokering and many companies went online. The cost of websites and marketing made this endeavor out of reach for all but large institutions, during the early stages of Web marketing. The potential for profit was low due to the limited number of prospects online at the time. Then the Internet bubble burst in 2001 and “Internet 2.0” began with many new possibilities. Several important factors change the course of online business: 1 Many who failed during the early Internet years had developed a marketing methodology by now. The number of Internet users grew exponentially each year, now 1.9 billion users are online worldwide and 344 million users in the U.S. The number of people who used the Internet as an information and communications source, rather than for amusement, greatly increased. Amazon.com offered “mini-stores” to “affiliates” who were paid a commission for each item sold. This was the beginning of Affiliate Internet Marketing. The percentages were so small and so much traffic was required to make any real income that this idea was dismissed for almost a decade. The initial Internet Marketing endeavor required a product or service to focus on. The chosen product had to have a constant demand and would provide more than pennies/sale. The choice of financial products for sale to businesses was a logical but not an original one. Thus, Business Money Source.com was created to marry the concepts of financial intermediary to affiliate Internet marketing. “Once a mind is stretched by an idea, it never returns to its’ original size”. The business legal structure for the www.business-money-source.com website is a Limited Liability Company: Business Money Source LLC. Registered with the State Corporation Commission of the state of Virginia. Who Is James (Jim) R. Bullock? Jim Bullock is an engineering technologist who has also worked as a part-time commercial loan broker for several years. During that time he learned the importance of working with direct lenders in order to insure excellent service to clients. He also learned the importance to qualify potential clients for a specific financial product. Jim Bullock has almost 30 years of computer operations experience and has been online since the Internet became available to the public. These experiences, along with many other transferable skills, such as written and oral communications, data analysis, and project management will help make Business Money Source, LLC a successful venture. Why Now? A Federal report states that there are 24,653,098 small businesses in the U.S. alone. Each one of those businesses will require some type of funding during the natural life cycle of start-up, growth, operation, expansion and liquidation. The downturn in economy, over the past 3 years, has created more demand for alternative financing due to addition restrictions placed on lending institutions by the Federal government, and the slow economic recovery. Business owners still need to be able to acquire financing despite shortages in money supply. Business Money Source.com will be an alternative funding source for the near and distant future. 2