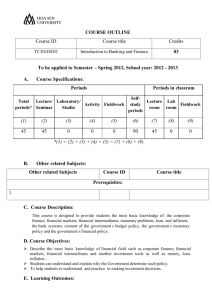

Appendix - Lars E.O. Svensson

advertisement

Appendix Is the price level anchored under a mixed price level/inflation targeting regime? A legitimate question arises on whether the price level would be anchored under simple/optimal rules penalising a mixture of price level and inflation deviations from target, or anything that was not a pure price level target. We would expect the price level to be anchored in any rule with 0 but 1 (i.e. in any rule feeding back on the price level or mixtures of this and the inflation rate, but not in rules feeding back only on the inflation rate). This is because such rules (either simple or optimal) feed back on price level deviations from target, on top of other things (inflation and output deviations from target and potential, respectively). This ensures that, under those rules, the price level will be returned to base after a shock even if over a long time period in the mixed targets case relative to the pure price level target case. As the charts 1b-7b show, the variance of the price level is bounded over a 200periods time period following a shock, both under optimal and simple rules of that ‘mixed’ kind.1 This provides prima facie evidence that the price level is stationary under those rules (a non-stationary process would display infinite variance, and so an estimate of the variance on a 200-period sample would be very large). Below we provide further corroborative evidence on this issue. For this purpose, we computed impulse responses of the price level and inflation after a temporary, positive, 1 % shock to aggregate demand, using variant BH1 of model closed, for the sake of argument, by a simple rule as (2) with k = 8, and p y 0.5 . Charts 10 and 11 show that, while inflation goes back to base no matter what the value of (0, 0.5 or 0), the price level does not for some value of . In fact, pt does not return to base under inflation targeting ( = 1) being permanently shifted 1 This is not the case for Chart 2b, but the large variability of output and the price level found in that case are conceivably not attributable to the fact that the price level is not anchored. 24 below base even if the demand shock was temporary, because the = 1 case permits a unit root in the price level. But it does, even if over different time periods, under both the pure ( =0), and the mixed ( =0.5) price level targeting specifications of the rule. So, in line with our intuition, a mixed price level/inflation targeting rule does anchor the price level. 25 References Ball, L, (1994), ‘Credible Disinflation with Staggered Price-Setting’, American Economic Review, 84, no. 1, pp 282-289 Batini, N and Haldane A G, (1999), ‘Forward looking rules for monetary policy’ in J B Taylor (ed) Monetary Policy Rules, NBER, University of Chicago Press, Chicago. Batini, N and Nelson, E, (1999), ‘Optimal horizons for inflation targeting’, Bank of England, mimeo, July. Berg, C and Jonung, L, (1998), ‘Pioneering price level targeting: the Swedish experience 1931-1937’, Sveriges Riksbank Working Paper 63, June. Bernanke, B R, Mishkin, T, Laubach and A Posen, (1999), Inflation Targeting: Lessons From The International Experience, Princeton University Press, Princeton. Black, R Macklem, T and D Rose, (1997), ‘On Policy Rules for Price Stability’. In Price Stability, Inflation Targets and Monetary Policy, Bank of Canada. Blake, A and Westaway, P, (1993), ‘Credibility and the effectiveness of inflation targeting regimes’, Manchester School, 64:28-50. de Brouwer, J and O’Regan, J, (1997), “Evaluating Simple Monetary-Policy Rules for Australia”, in P. Lowe (ed.), Monetary Policy and Inflation Targeting, Reserve Bank of Australia. Bryant, R C, Hooper P and C Mann, (1993), Evaluating policy regimes, Washington DC, Brookings Institution. Buiter, W and Jewitt, I (1981), ‘Staggered wage setting with real wage relativities: variations on a theme by Taylor’, The Manchester School, 1981,49, 211-228. Clarida, R., Gali, J, M Gertler, (1997), ‘Monetary Policy Rules and Macroeconomic Stability: Evidence and Some Theory”, mimeo, New York. Currie, D and P Levine, (1993), ‘The Design of Feedback Rules in Linear Stochastic Rational Expectations Models’, in Rules, reputation and macroeconomic policy coordination, Cambridge; New York and Melbourne: Cambridge University Press, pp 95-121. Previously published: [1987]. Fillion, J F and Tetlow, R (1993), ‘Zero inflation or price-level targeting? Some answers from stochastic simulations on a small open-economy macro model’, in Economic Behaviour and Policy Choice under Price Stability, 129-66, Bank of Canada. Fisher, I, (1922), The purchasing power of money, MacMillan. 26 Friedman, M, (1959), ‘A program for monetary stability’, Fordham University Press, New York. Fuhrer J C and G R Moore, (1995), ‘Inflation persistence’, Quarterly Journal of Economics, 111, no. 1, February, pp 127-159. Fuhrer, J C, (1997),‘The (un)importance of forward looking behaviour in price specifications’ Journal of Money, Credit and Banking, 29, 338-350. Haldane, A G, (1995), (ed) Inflation targeting, Bank of England. Haldane, A G and Salmon, C K, (1995), ‘Three issues on inflation targets’, in Haldane AG (ed), op cit. Hall, R E, and N G Mankiw, (1994), ‘Nominal Income Targeting’, in N G Mankiw (ed.) Monetary Policy, Studies in Business Cycles, vol. 29, Chicago and London: University of Chicago Press, pp 71-93. Henderson, D and W McKibbin, (1993), ‘An assessment of some basic monetary policy regime pairs’, in Evaluating policy regimes: new research in macroeconomics (ed) R Bryant et al, op cit., Washington DC, Brookings Institution. Jonung, L, (1979), ‘Knut Wicksell's Norm of Price Stabilization and Swedish Monetary Policy in the 1930’s’, Journal of Monetary Economics, 5(4), pp 459-96. Julius, D, M Fry, L Mahadeva, S Roger and G Sterne (1999), ‘Monetary Policy Frameworks in a Global Context’, paper prepared for the Central Bank Governors’ Symposium, 4th June. Kiley, M T, (1998), ‘Monetary Policy Under Neoclassical and New-Keynesian Phillips Curves With An Application To Price Level and Inflation Targeting’, Board of Governors of the Federal Reserve System, mimeo? King, M A, (1999), ‘Challenges for monetary policy: new and old’, paper for the symposium on ‘New challenges for monetary policy’, sponsored by the Federal Reserve Bank of Kansas City at Jackson Hole, Wyoming, 27 August 1999. Levin, A, Wieland V and J C Williams, (1999), ‘Robustness of Simple Monetary Rules under Model Uncertainty’, in J B Taylor (ed) op cit. McCallum, B T, (1988), ‘Robustness properties of a rule for monetary policy’, Carnegie-Rochester Conference Series on Public Policy, vol 29, pages 53-84. McCallum, B T, (1990), Could a Monetary Base Rule Have Prevented the Great Depression?’, Journal-of-Monetary-Economics, 26(1), pp 3-26. McCallum, B T, (1993), ‘ Specification and Analysis of a Monetary Policy Rule for Japan’, in Bank of Japan Monetary and Economics Studies, 11, pp 1-45. 27 McCallum, B T, (1994), ‘Monetary Policy Rules and Financial Stability’, National Bureau of Economic Research Working Paper: 4692, pp 33. McCallum, B T and Nelson, E, (1999), Nominal Income Targeting in an OpenEconomy Optimising Model, Journal of Monetary Economics, 43 (1999), pp 553-578. Nelson, E (1999), ‘UK Monetary Policy 1972-1997: A Guide Using Taylor Rules’, Bank of England, mimeo, August. Smets, F, (1999), ‘What horizon for price stability?’, European Central Bank, mimeo, August. Svensson, L E O, (1997a), ‘Inflation Forecast Targeting: Implementing and Monitoring Inflation Targets’, European Economic Review, 41, pp 1111-1146. Svensson, L E O, (1997b), ‘Inflation Targeting: Some Extensions’, mimeo, IIES, Stockholm University. Svensson, L E O, (1999a), ‘Price Level Targeting Versus Inflation Targeting: A. Free Lunch?’, Journal of Monetary Economics, forthcoming. Svensson, L E O, (1999b), ‘Inflation Targeting as a Monetary Policy Rule’, Journal of Monetary Economics, forthcoming. Taylor, J B, (1980), ‘Aggregate dynamics and staggered contracts’, Journal of Political Economy, 88, pp 1-24. Taylor, J B, (1993a), ‘Discretion versus policy rules in practice’, Carnegie Rochester Conference series on public policy, 39, pp 195-214. Taylor, J B, (1993b), Macroeconomic Policy in a World Economy. New York: W.W. Norton. Taylor, J B, (1996), ‘Policy Rules as a Means to a More Effective Monetary Policy’ Bank of Japan Monetary and Economic Studies, 14(1), July 1996, pp 28-39. Taylor, J B, (1999), [ed] Monetary Policy Rules, National Bureau of Economic Research, University of Chicago Press, Chicago. Vestin D, (1999), ‘Price Level Targeting versus Inflation targeting in a ForwardLooking Model’, IIES, Stocholm Universtity, mimeo, Stockholm. Wicksell, K, (1935), Lectures on Political Economy, Routledge, London. Williams, J, (1999), ‘Simple Rules For Monetary Policy’, Board of Governors of the Federal Reserve System, Finance and Economics Discussion Papers Series. Wolman, AL (1997), ‘Zero inflation and the Friedman rule: a welfare comparison’, Federal Reserve Bank of Richmond Economic Quarterly, 83/4 Fall. 28 Woodford, M, (1999), ‘Inflation stabilisation and welfare’, mimeo, Princeton University, June. 29