ds international finance

advertisement

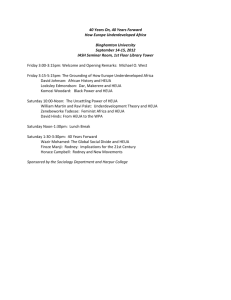

Castro 1 D.S. INTERNATIONAL FINANCE BFIN 4303 Summer 2005 Juan Castro, Ph.D. Instructor: Dr. Juan R. Castro Office: LH 102 Phone: (903) 233-3396 E-mail: JuanCastro@letu.edu CHECK the Class BLACKBOARD: http://online.letu.edu for updated information about the class. Web Site: www.letu.edu/people/juancastro REQUIRED MATERIALS Title: INTERNATIONAL FINANCIAL MANAGEMENT, 7TH Edition Authors: Jeff Madura Publisher: THOMSON/South-Western ISBN Number: 0-324-16551-X Suggested Readings: Businessweek, Economist, Wall Street Journal, and Financial Times. COURSE DESCRIPTION This class will be beneficial to those students who are interested in learning how global markets work. Those students who may want to work in international markets, international businesses, want to travel abroad, or that are interested in learning how emerging markets operate may want to take this class. This class will have a global orientation covering several topics in the international field. In general, international finance has become very relevant for any business student that wants to understand how markets of different countries interchange. The class will cover free-trade agreements, trade deficits, foreign exchange rates, interest parity, purchasing power parity, international fisher effect, capital controls, currency boards, target zones, international banking, international derivatives, hedging, and future markets. This course also provides a strong background for performing in jobs created by international investment, banking, and multinational business activity. Understanding the implications of international financial news as reported, for instance, in financial times will be emphasized. We will basically study international financial problems in a global environment. OBJECTIVES Understand the theoretical concepts of international finance Develop an appreciation of how firms and consumers operate in a global market Expose the student with different fiscal and monetary international policies Create a global perspective and attraction of the modern international financial economics Guide the student to correlate international finance, with Christian Principles Castro 2 A. Evaluation criteria DETERMINING THE FINAL GRADE Unless the class is told differently by the faculty member, the final grade will be based upon the following: Assigned Weekly Homework Problems 20% Weekly exams 20% Final Exam 30% Final Paper 30% Total 100% B. Weekly Assignments Due Week One – May 23- May 29 Read Chapters 1-3 Complete the following end-of-chapter questions for each chapter and submit the answers by Midnight on Saturday. Chapter 1: # 4, # 9, #12 Chapter 2: #8, #9, #18 Chapter 3: #3, #7, #14, #17, #21 Take Quiz-1 between Saturday and Sunday Due Week Two – May 30 – June 05 Read Chapters 4-6 Complete the following end-of-chapter questions for each chapter and submit the answers to the Faculty Member by Midnight on Saturday. Chapter 4: #2, #3, #9, #10, #12, #13, #19 Chapter 5: #4, #10, #13, #14 #18, #19 #21 Chapter 6: #3, #5, #7, #21 Take Quiz-2 between Saturday and Sunday Due Week Three – June 06 – June 12 Read Chapters 7-9 Complete the following end-of-chapter questions for each chapter and submit the answers to the Faculty Member by Midnight on Saturday. Chapter 7: #2, #10, #12, #19, #20, #21, #25 Chapter 8: #3, #7, #10, #12, #15, #18, #25, #28 Chapter 9: #11, #12, #15, #18, #26 Take Quiz-3 between Saturday and Sunday Castro 3 Due Week Four - June 13 – June 19 Read Chapters 10-12 Complete the following end-of-chapter questions for each chapter and submit the answers to the Faculty Member by Midnight on Saturday. Chapter 10: #2, #12, #19, #20, # 25, #27 Chapter 11: #1, #3, #9, #16, #26, #28, #29 Chapter 12: #1, #11 Take Quiz-4 between Saturday and Sunday FINAL EXAM TO BE TAKEN BETWEEN: June-17 and June -20 FINAL PAPER DUE ON JUNE 23 C. FINAL PAPER TOPIC The goal of the research paper is to develop your skills in analyzing a country financial and exchange rate conditions with respect to balance of payments, central bank intervention, and J-Curve. You are expected to select three countries (select three of the following countries: Mexico, Morocco, Spain, Brazil, Costa Rica, Chile, or Argentina). Use the selected 3 countries and first analyze individual countries and second compare the three countries. You are expected to get economic and financial data from the countries in which your case is based on. Data such as exchange rate, GDP, exports, imports, trade, interest rate, country risk, loan credits, bank liquidity, hard loans, soft loans, money supply, required bank reserves, banking system, inflation, productivity, foreign direct investments, , balance of payments, , and GDP/capita should be analyzed, when possible, in each written report. Your research report should be professional, including cover page, abstract, introduction, literature review (if any), data collection, answer all the questions, conclusion, references, and appendices. The length of the paper should be between 20 to 35 pages (not including the appendices). Don’t include in your report “full” copies from the Internet. If you want to use Internet information or data, add edited copies in your paper with the proper references. 1. Central Bank Intervention, Balance of Payment, and the J-Curve a. Responsibilities of the Central Bank b. Balance sheets of the Central Bank in the last 5 years (include copies and analyzes) c. Amount of foreign reserves (in USA dollars) hold by the Central Bank in the last 10 years, create table and graphs and explain. Compare foreign reserves with possible exchange rate fluctuations. d. Amount of remittances (money sent by individuals to these countries from USA) in USA dollars. Quantify the percentage of these remittances and the effect on foreign reserves and currency stability. e. Amount and volume of Bonds issued and hold by the Central Bank f. Amounts of domestic and international debt by the central economy and the country g. What does Central Bank Intervention in Foreign Exchange Market mean? Castro 4 h. What kind of exchange rate system the country has, floating, pegged, fixed, dollarization, currency board, etc. i. Performance of the exchange rate with respect to USA dollars in the last 10 years (appreciated/depreciated) show graphs indicating this performance and explain. j. Performance of the short and long interest rates for these countries in the last 10 years k. Inflation and GDP levels of these countries in the last 10 years. l. Indicate the Central Bank Interventions in the last 10 years and their effects? m. What is the rational behind these interventions? n. Credibility of Central Banks on the exchange rate –explain. o. Balance of Payments in the last 7 years p. Analyze trade deficits and surplus for current account and capital account q. Calculate the next export amount (Exports – Imports) and terms of trade r. Include description of the exchange rate monetary systems in the countries, floating, managed floating, pegged, target zones, or fixed exchange rates. s. Analyze periods of local currency depreciations and appreciations t. Analyze any J-Curve effects when the currency depreciates u. Conclusions v. References w. Appendices SOME SOURCES TO FIND DATA FOR THE PAPER 1. International Monetary Fund (IMF) 2. World Bank (WB) 3. InterAmerican Development Bank 4. USA State Department 5. Bank of America World Information Services 6. Business Environment Risk Intelligence (BERI) S.A. 7. Control Risks Information Services 8. Economist Intelligence Unit (EIU) 9. Institutional Investor 10. Standard and Poor’s Rating Group 11. Moody’s Investor Services 12. The Wall Street Journal 13. Central Intelligence Agency (CIA) 14. Central Bank of the selected country 15. Any other agency or institution with international information