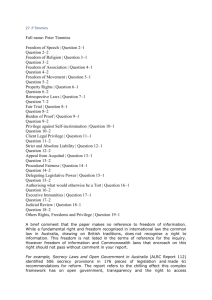

The attorney client privilege and the corporate Internal Investigation

advertisement