Be Prepared, Plan Ahead and Survive When Disaster Strikes

by Phil Guerra

We've all heard the adage: "Prepare for the worst, hope for the best." It seems, however that many administrators admittedly rely on the last

half of that adage to see them through potential emergencies.

Others who have lived through disasters can attest that being prepared can make the worst situations more manageable. And the best way to

tackle the formidable obstacles disasters present is with a well-developed emergency manual.

While it's an administrator's job to plan and manage business strategies and activities (concerning personnel, facilities, support systems, and

financial goals) for the law firm, one strategic element is often overlooked: Business operations must continue uninterrupted under any

circumstances for the firm to continue delivering legal services. Ensuring operations continue is the overriding objective of disaster

management and with it comes plans for employee safety, and files and facilities protection.

Long-term business survival, not to mention professional and ethical implications, depends on an emergency plan that clearly maps out a firm's

return to normal operations in the face of predictable or unpredictable calamitous events.

First Steps

How do you start if you don't have a disaster plan? Considering the emergency plan's essential ingredients?

1. What emergencies should be planned for?

2. What needs to be done?

3. Who will do what needs to be done?

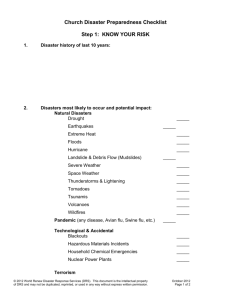

What to Plan For

First thoughts in any discussion of disaster planning turn to major natural calamities: floods, earthquakes, tornadoes, and blizzards. However, it

is the smaller events (power failures, bomb threats, medical emergencies, or computer network failures) that often have a more devastating

effect on firm productivity and viability. While administrators in Salt Lake City Utah, have little need for hurricane plans, they can encounter

some type of Mother Nature's fury. And any firm is susceptible to fire, bomb threats, crime, death, or injury.

Determine your firm's disaster risks: Common sense will help you identify specific types of events (big or small, natural or technological) that

can bring your firm to a halt.

Risk assessment, then, requires, as a first step, the drawing up of the most comprehensive list of emergency events that can conceivably

impact on the firm's ability to carry on business. Everyone in the firm from top management to departmental supervisors - should have a hand in

developing this list to ensure that every possible threat is considered, evaluated, and prioritized.

Include every major and minor emergency event that could possibly interrupt operations. Many items on this list can probably be eliminated

because management already has an alternative resolution: That is, the potential threat already has a planned solution. Those emergency

events with planned solutions, however should be included in the final emergency plan. Examining the potential consequences of the remaining

significant items on the list will focus attention on the alternative corrective actions that, in substance, become the next step in preparing a

comprehensive emergency plan.

What Needs to Be Done

For most potential threats to the interruption of a firm's business, the specific threat will, in all but the most unusual of cases, dictate the specific

preventative and remedial actions required. And, it is in this area (specific guidance related to specific types of emergency situations) where

there is an abundance of reference material and "how-to" guides to use in preparing an emergency plan. Much of this guidance is broken down

into two general categories:

actions that must be taken in managing emergency situations that are related to events that occur with advance warning; and

actions that may be necessary in managing an emergency for which there is no advance warning.

The development of a firm's emergency plan requires that all types of emergencies are considered. Create specific orderly steps to minimize

consequences and return to normal operations as quickly as possible.

Carefully consider how all elements of your firm blend to deliver legal services. Lawyers cannot deliver legal services to clients if the support

function "gears" of the firm are not meshing properly The firm's support functions (staff and systems alike) are extraneous without the focal

point of legal service delivery

What needs to be done with each aspect of the firm's operations (legal and support) must be reviewed in light of the effect its absence would

have in continuing the delivery of services to clients.

Prioritize your emergency response actions to ensure that all aspects of a firms operations can continue in one form or another. Consider what

happens if you need to move to another location to continue work.

Who is Responsible for Performing Emergency Actions

Responsibility for action in emergency situations will become obvious as each scenario is analyzed. However keep the special circumstances of

crisis in mind before conveniently assigning responsibility to the most obvious employee. Consider:

personnel availability;

employees' talents and knowledge; and

employees' ability to act in times of duress and stress. Any emergency plan needs to delineate clear-cut lines of authority and responsibility. It

should lay out who possesses responsibility to make decisions and who will put the plan into action. These decisions can be difficult. An

effective emergency plan will consider these issues carefully, including the potential use of back-up personnel as warranted.

Key Plan Elements

A comprehensive emergency plan includes these identifiable risks that threaten operations. It also will include consideration of certain central

(almost universal) elements that impact every business entity regardless of size or scope.

1. Employee Safety

One thing is paramount when disaster strikes: provisions for the safety of a firm's No. 1 asset its people. Ensure your plan provides for the

safety of employees before or after disaster strikes. The emotional toll that often accompanies a catastrophe can be as debilitating as the initial

event itself. Massive natural disasters can trigger "post-traumatic" syndrome in employees rendering them essentially unavailable for duty. Less

dramatic disasters or threats can pose equally crippling impairment resulting in the inability to take appropriate actions. Anticipating the level of

personal crisis in your action plan is critical to its success.

2. Facilities

Consider what you'll do if your firm's office space are damaged or untenantable. Even if your office is unharmed (or mildly damaged) but stands

in a disaster zone you'll have to find new space until the danger subsides. Pre-arrange commitments to share space or occupy alternative sites.

Outline these plans in your emergency manual.

3. Preservation of Files and Records

A firm's client records and business files are its inventory Your plan needs to address alternatives for duplicating or restoring damaged

paperwork and electronic records. Again, arrangements made in advance (and documented in the emergency plan) to retrieve, duplicate, or

restore files and records (including technologically related files and records) are essential to lessen the risk of loss.

4. Preservation of Systems and Equipment

While losses in some type of disasters that occur without warning (earthquakes, tornadoes, fire, etc.) limit the capacity to preserve technology

systems and equipment, considered assessments of these types of risks will generally dictate appropriate safeguards to minimize the loss of

(most likely) irreplaceable data. Likewise, pre-arranged commitments with systems and equipment vendors to repair damage or replace losses

are essential to immediate business restoration. Include these provisions in your emergency plan.

5. Insurance Coverage

Adequate insurance coverage for a variety of risks is, without question, an essential element to a well-conceived emergency plan. By defining

potential risks, a firm may uncover areas where coverage is either inadequate or non-existent. Consider coordinating with insurance

professionals to assess risk and secure appropriate coverage. Review covered causes of loss, exclusions, and limitations -- this is essential.

Identify critical insurance coverage (including business interruption, extra expense, valuable papers, computer hardware and software, etc.) in

your plan. This information should include contact information for insurance carriers and agents.

6. Client Communications

An emergency plan's principal objective is to keep the firm in business. This means clients have to know what the firm is able to do after a

disaster. Your plan should strive to make the emergency conditions in business operations as transparent as possible to clients. Share your

emergency status constructively and convincingly with clients. Explain how your firm plans to transcend disaster. This will retain client

confidence in the firm's ability to continue operations. Preplanned actions to communicate with clients (by genetic letters, e-mail, fax, or an ad in

the local newspaper) are essential to maintaining client confidence. Communication in general should be coordinated through a designated firm

spokesman to ensure that the same message is being conveyed to everyone (vendors, landlord, the press, etc.) at the same time.

7. Timing Considerations

A well executed emergency plan will "trigger" certain events as specific needs arise. For example, when the threat of a severe storm arises your

action plan should kick in. Keep in mind:

make decisions regarding payroll processing,

contact the firm's bankers to consider additional credit to cover unexpected additional recovery costs, and

re-confirm alternative resources.

Also outline what actions should be taken the "day after" an emergency

assess the firm's capabilities,

identify critical client work, and

secure communications resources.

Completing a Plan

Once specific emergency events have been identified, analyzed, and prioritized they all need to be distilled into a usable document. Distribute

your written plan firmwide so that it can be evaluated for effectiveness by all levels of firm management. Evaluate the plan's strategies for the

safety of people, the safeguarding of property, and the limitation of financial losses.

Make sure your plan adequately provides for emergency information management, recovery and cleanup measures. See that it clearly defines

responsibilities for the resumption of business activities. When your plan passes the initial "management muster," circulate the draft to every

employee. This will help you uncover previously undetected "bugs" that may need correction.

Once your plan is finalized, your job is not over:

Encourage all employees to

Include your plan as part of new employee orientation.

Remind veteran employees to reread it occasionally.

Review and update the plan annually include a review by firm management.

Test your plans with some dry runs. This will help employees learn how to react when the real emergencies hit.

No effective emergency plan is a static work; it is usually a "work-in-progress, "because risks to the firm are constantly changing. Keep thinking

about contingencies and ask your firm-management peers how they plan to handle different situations.

Article Synopsis

Many firm managers find the weak link in their planning ability just when they need all their talents most: during disasters. Learn how to assess

your firms emergency needs and ensure that you'll still be able to serve clients and keep employees safe. This article outlines what a disaster

plan should include and the thought process behind any good plan.

Learn More About It

On the Web

Distaster Recovery Institute (DRI) Canada. This Canadian firm offers training and certification in disaster management, contingency planning,

and business continuity. Visit http://dri.ca/

Off the Shelf

The following resources are available at many bookstores or online at amazon.com

Disaster Recovery Planning: For Computers and Communication Resources (Book and Disk) by Jan William Toigo

Emergency and Disaster Planning Manual by Laura G. Kaplan

Disaster Recovery Plan by Richard Arnold

Contingency Planning and Disaster Recovery: Protecting Your Organizations Resources by Janet G. Butler and Paul Badura

Disaster Planning and Recovery: A Guide for Facility Professionals by Alan M. Levitt

Local Resources

Don't overlook reference material available from local and regional authorities who may have already prepared "localized" checklists and guides

for specific threats. Agencies such as the Red Cross, local police, and fire departments, as well as local utility providers can be reliable sources

of useful information.

From The Missouri Bar

Audiotape of CLE program Preparing for the Worst and Hoping for the Best: Disaster Planning for Small Law Firms, presented at the 2000 Solo

and Small Firm Conference. Cost $12.00.

Reprint permission has been granted by the author, Phil Guerra. Mr. Guerra works at Miami's Adorno & Zeder. He can be reached at

pg@adomo.com Reprinted with permission from Legal Management, Nov/Dec 1998 issue, Vol. 17, No. 6, published by the Association of

Legal Administrators, Vernon Hills, IL (http://www.alanet.org). All rights reserved.