Curriculum Vitae (CV)

advertisement

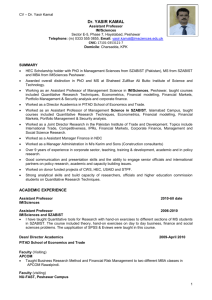

CV – Dr. Yasir Kamal Dr. YASIR KAMAL Assistant Professor IM/Sciences Sector E-5, Phase 7, Hayatabad, Peshawar Telephone: (m) 0333 555 0855, Email: yasir.kamal@imsciences.edu.pk Domicile: Charsadda, KPK SUMMARY HEC Scholarship holder with PhD in Management Sciences from SZABIST (Pakistan), MS from SZABIST and MBA from IMSciences Peshawar. Awarded overall distinction in PhD and MS at Shaheed Zulfikar Ali Butto Institute of Science and Technology. Working as an Assistant Professor of Management Science in IM/Sciences, Peshawar, taught courses included Quantitative Research Techniques, Econometrics, Financial modelling, Financial Markets, Portfolio Management & Security analysis and corporate finance. Worked as a Director Academics in PITAD School of Economics and Trade. Worked as an Assistant Professor of Management Science in SZABIST, Islamabad Campus, taught courses included Quantitative Research Techniques, Econometrics, Financial modelling, Financial Markets, Portfolio Management & Security analysis. Worked as a Joint Director Research in the Pakistan Institute of Trade and Development. Topics include International Trade, Competitiveness, IPRs, Financial Markets, Corporate Finance, Management and Social Science Research. Worked as a Assistant Manager Finance in NDC Worked as a Manager Administration in M/s Karim and Sons (Construction consultants) Over 9 years of experience in corporate sector, teaching, training & development, academic and in policy research. Good communication and presentation skills and the ability to engage senior officials and international partners on policy research, academic and capacity building issues. Worked on donor funded projects of CWS, HEC, USAID and STPF. Strong analytical skills and build capacity of researchers, officials and higher education commission students on Quantitative Research Techniques. Published and Accepted Research Papers/Projects: 1. Asif, A. Rasool, W & Kamal, Y (2011) Impact of leverage on Dividend Policy, African Journal of Business Management, Volume 5 (4), pp (1312-1324) 2. Kamal, Y. Mughal, H & Ghani, U. (2011), Modelling exchange rate volatility: A case of Pak Rupees against US Dollar. African Journal of Business Management, Volume (), pp () 3. Ghani, U & Kamal, Y (2010),The impact of in-store stimuli on the impulse purchase behaviour of consumers in Pakistan, The Interdisciplinary Journal of Contemporary Research in Business, volume 2, no 8, pp. 155-162 4. Ashraf .M. F & Kamal, Y.(2010), Acceptance of Mobile Marketing Among University Students, Mustang Journal of Business and Ethics, volume: 1, pp 9-30, 5. Kamal, Y & Ghani, U (2011), Day of the week effect: a case of KSE, African Journal of Business Management ,(Accepted in 2010) 1 CV – Dr. Yasir Kamal 6. Kamal, Y & Rehman, K. (2006), Random Walk of Securities Prices in Pakistani Stock Markets: Evidence from LSE, ISE, and KSE, Journal of Independent Studies and Research,Volume 4(1), pp.17-23 Working Papers: 1. Efficient market hypothesis: A case of KSE (WPS, SSRN) 2. Pay & Job Satisfaction: A comparative Analysis of Different Pakistani Banks (WPS, SSRN) Conference Presentation: RESEARCH CONFERENCES/SEMINARS SESSIONS CHAIR a) Chaired session of 2nd Iqra conference on IT and Business Jan. 2010 b) Chaired session in 10th National Research Conference SZABIST Jan. 2010 c) Chaired session in 9th National Research Conference SZABIST July. 2009 PAPER PRESENTATION: a) 1st Iqra conference on IT and Business b) 7th SZABIST NRC Apr. 2008 Jan, 2007 Paper presented: Forecasting stock return volatility evidence from KSE 100 index a) 5th SZABIST NRC Sep. 2006 Paper presented: The impact of Selected Sectors on Karachi Stock Market Returns a case of Oil & Gas Exploration, Fertilizer, Commercial Banks and Cement Sectors of Pakistani Economy b) 4th SZABIST NRC May. 2006 Paper presented: 1. Daily anomalies in stock return evidence from emerging Asian countries 2. What Determines student satisfaction at MS/PhD level A Case of Islamabad based institutions and universities of higher education c) 3rd SZABIST NRC Jan. 2006 Papers Presented: Random Walk of Securities Prices: Evidence from Pakistani Stock Markets d) 2nd SZABIST NRC Sep. 2005 Papers Presented: Weak Form of Market Efficiency evidence from KSE 100 index Day of the week effect on Stock Returns evidence from KSE 100 index 2