Review of load forecast

Annex A: Review of load forecast

Introduction

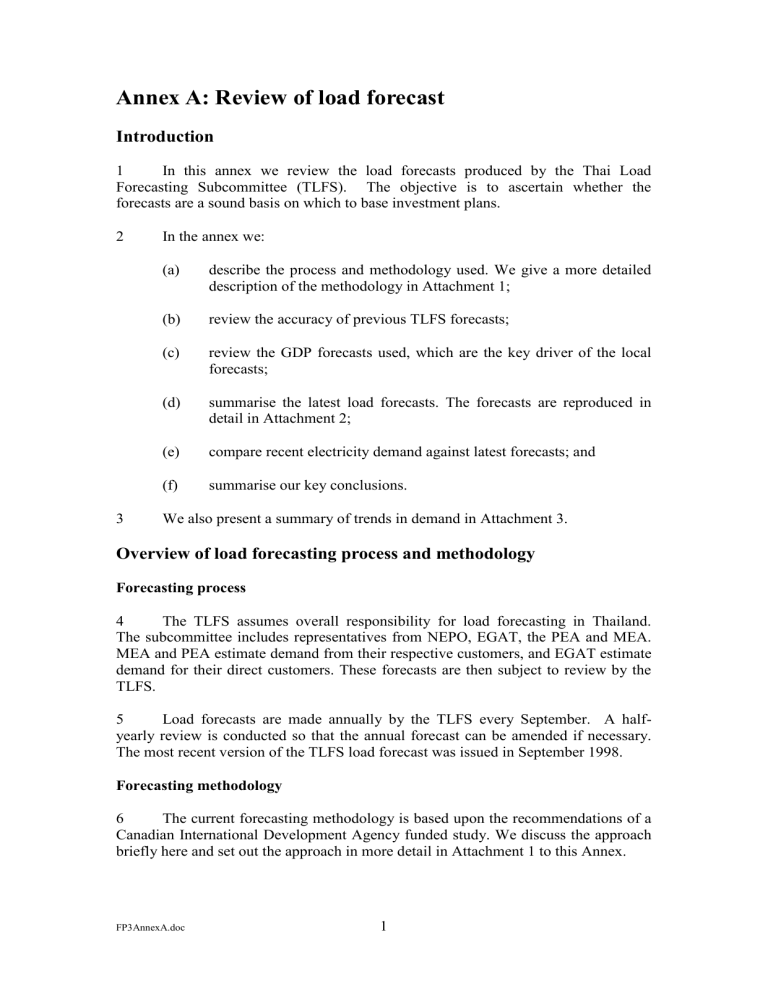

1 In this annex we review the load forecasts produced by the Thai Load

Forecasting Subcommittee (TLFS). The objective is to ascertain whether the forecasts are a sound basis on which to base investment plans.

2 In the annex we:

3

(a) describe the process and methodology used. We give a more detailed description of the methodology in Attachment 1;

(b) review the accuracy of previous TLFS forecasts;

(c) review the GDP forecasts used, which are the key driver of the local forecasts;

(d) summarise the latest load forecasts. The forecasts are reproduced in detail in Attachment 2;

(e) compare recent electricity demand against latest forecasts; and

(f) summarise our key conclusions.

We also present a summary of trends in demand in Attachment 3.

Overview of load forecasting process and methodology

Forecasting process

4 The TLFS assumes overall responsibility for load forecasting in Thailand.

The subcommittee includes representatives from NEPO, EGAT, the PEA and MEA.

MEA and PEA estimate demand from their respective customers, and EGAT estimate demand for their direct customers. These forecasts are then subject to review by the

TLFS.

5 Load forecasts are made annually by the TLFS every September. A halfyearly review is conducted so that the annual forecast can be amended if necessary.

The most recent version of the TLFS load forecast was issued in September 1998.

Forecasting methodology

6 The current forecasting methodology is based upon the recommendations of a

Canadian International Development Agency funded study. We discuss the approach briefly here and set out the approach in more detail in Attachment 1 to this Annex.

FP3AnnexA.doc

1

7 MEA and PEA forecast energy take for each of their seven customer classes.

Typical load profiles for each customer class are applied to energy take forecasts to calculate peak demand. PEA forecast energy take and demand separately in each of their regions. EGAT then forecast their generation requirement.

8 MEA and PEA use a mixture of econometric equations and energy intensity ratios to forecast energy take. The key driver is Gross Domestic Product (GDP), which determines household income and industrial output and hence electricity demand.

9 The GDP forecasts used are long term forecasts prepared by the Thailand

Development Research Institute (TDRI) specially for load forecasting purposes. The aggregate GDP forecasts are disaggregated by region into Gross Regional Product

(GRP) and by industrial sector, in order to calculate energy take by customer class and by region. There are no comparable forecasts by alternative organisations.

10 Because the outlook for the Thai economy is currently uncertain, the

September 1998 load forecasts are based upon three different predictions for load growth, with different projected rates of economic recovery: the Rapid Economic

Recovery case (RER); the Moderate Economic Recovery case (MER); and the Low

Economic Recovery case (LER).

11 Generally we think that the methodology is sound, but we note that:

(a) the EGAT forecasts of the generation requirement, upon which generation investment plans are based, incorporate EGAT’s own losses /internal consumption, which depends upon the future plant portfolio.

It would be more accurate for planning purposes to prepare the load forecast on a net ‘sent out’ basis and not gross generated values;

(b) the load profiles used are from a 1996 study, but we understand that new research is being undertaken to update this data;

1

(c) the survey data on ownership of household appliances by household income group dates from the early 1990s.

We understand that action is being taken to update it.

1 Using methodology from a recent World Bank funded consultant’s report, MEA will install electronic metering equipment at a sample 1 200 customers (comprising all customer types) to undertake a new

‘end use’ survey of electricity consumption. These meters will be installed by September 1999 and data logging will commence thereafter. We have been told by the TLFS that PEA will carry out a similar ‘end use’ survey in the near future; this survey, however, will be on a very much smaller scale than that of MEA due to limited resources.

FP3AnnexA.doc

2

Accuracy of previous forecasts

12 We understand that load forecasts made before 1995 consistently underestimated actual demand and energy consumption and, as a result, too little new capacity was planned for the system. Since 1995, however, as illustrated in Figure

A.1, ‘Base Case’ forecasts have been higher than actual demand.

In 1996, before the economic downturn, actual demand was consistent with the ‘Low Case’ forecast.

In 1997, the actual demand was consistent with the ‘Very Low Case’ forecast.

Figure A.1 - Comparison of previous load forecasts with actual demand growth

17 000

16 000

15 000

14 000

13 000

12 000

11 000

Actual system maximum demand

1994 'Base case' forecast

1995 'Base case' forecast

1996 'Low case' forecast

1997 'Very low case' forecast

10 000

1994 1995 1996

Year

1997 1998

Review of GDP forecasts used

13 Figure A.2 illustrates the TDRI’s current GDP forecasts, on which the

September 1998 load forecasts are based. Growth is positive in 1999 in all but the

LER, and exceeds 2.0% in 2000 in all scenarios.

FP3AnnexA.doc

3

Figure A.2 - GDP forecast prepared by TDRI for different rates of economic recovery

8.00%

6.00%

4.00%

2.00%

0.00%

-2.00%

-4.00%

Rapid Economic Recovery

Moderate Economic Recovery

Low Economic Recovery

-6.00%

Year

14 In Table A.1, we have compared the TDRI forecasts with other available forecasts, which are all short term.

Table A.1 - Comparison of GDP forecasts

Source of GDP forecast

TDRI (RER)

TDRI (Medium Economic Recovery)

TDRI (LER)

Bank of Thailand (prepared by Economics Research Department)

National Economic and Social Development Board (NESDB)

Bangkok Bank plc

Asian Development Bank

Goldman Sachs

ABN-AMRO

Merrill Lynch Phartra

Thai Farmer Bank plc

15 We note that:

Annual GDP growth (%)

1998 1999 2000

-5.0%

-5.0%

2.4%

0.6%

5.4%

3.7%

-5.0%

-8.0%

-7.8%

-0.5%

1.0%

0.9%

2.7%

2.5%

2.5%

-7.8%

0.5%

-1.0%

-2.0%

-2.4%

0.5%

(a) the TDRI forecast of GDP growth of –5% for 1998 is significantly more optimistic than that predicted by the Bank of Thailand and

NESDB, which predict growth of about -8%;

(b) for 1999, the MER GDP assumption is consistent with the forecasts by the public agencies, but significantly higher than forecasts by the private sector international banks.

FP3AnnexA.doc

4

Summary of the September 1998 load forecast

16 The following tables, Tables A.2, A.3 and A.4, summarise the result of the

September 1998 forecasts.

Table A.2 - Summary of TLFS forecast for EGAT generation

Period

1997-2001

2002-2006

2007-2011

Average energy growth rate

(% per annum)

RER

5.34

7.68

7.16

MER

3.83

6.39

6.65

LER

2.69

4.58

6.01

Period

1997-2001

2002-2006

2007-2011

Average peak demand growth rate

(% per annum)

RER

5.37

7.62

7.13

MER

4.02

6.46

6.65

LER

2.96

4.80

5.92

Table A.3 - Summary of TLFS load forecast for MEA

Period

1997-2001

2002-2006

2007-2011

Average energy growth rate

(% per annum)

RER MER LER

3.59

6.12

5.30

2.18

4.68

4.36

1.35

3.47

3.49

Period

1997-2001

2002-2006

2007-2011

Average peak demand growth rate

(% per annum)

RER MER LER

3.46

6.07

5.31

2.01

4.58

4.34

1.17

3.37

3.48

Table A.4 - Summary of TLFS load forecast for PEA

Period

1997-2001

2002-2006

2007-2011

Average energy growth rate

(% per annum)

RER

7.11

8.82

8.50

MER

5.49

7.57

8.20

LER

4.18

5.37

7.76

Period

1997-2001

2002-2006

2007-2011

Average peak demand growth rate

(% per annum)

RER

6.45

8.73

8.24

MER

5.20

7.74

7.99

LER

4.00

5.80

7.38

17 The MER load forecast (on which all investment plans are based) for total

EGAT generation is illustrated in Figure A.3.

FP3AnnexA.doc

5

Figure A.3 - Forecast of EGAT generation

35 000

30 000

25 000

20 000

15 000

10 000

5 000

Maximum demand (MW)

Energy (GWh)

350 000

300 000

250 000

200 000

150 000

100 000

50 000

0

1985 1990 1995 2000

Year

2005 2010 2015

0

18

The TLFS forecasts that PEA’s generation requirement will continue to grow at a faster rate than that of MEA due to decentralisation of industry away from

Bangkok. This is clearly illustrated in Figure A.4, which shows a predicted

7% increase in PEA’s share of total EGAT generation between the years 2001 and

2011.

Figure A.4 -Breakdown of forecast for EGAT generation

2001 2011

MEA

35%

Direct sales

2%

MEA

29%

Direct sales

1%

Ow n use

/Lossses

6%

Ow n use

/Lossses

6%

PEA

57%

PEA

64%

19 A summary of the annual MER load forecast for EGAT, MEA and PEA for

1999-2011 is given in Attachment 2.

FP3AnnexA.doc

6

Recent electricity demand

20 We have been told by MEA and the TLFS that demand for the first three months of this fiscal year was lower than had originally been forecast. This may have been due, in part, to the unusually cool weather experienced during this time but MEA told us that they were seeing patterns of demand more similar to the LER forecast than to the MER forecast. However, insufficient data is yet available to make a reasonable comparison.

Summary of key findings

21 The key conclusions from our review of the September 1998 load forecast are that:

(a) the forecasting methodology is generally sound; and

(b) the Medium Economic Recovery forecast which underlies the present investment plans provides:

(i) a sensible basis for long term planning, in the absence of evidence to the contrary; but

(ii)

– may constitute an optimistic view of short term demand since outturn demands for the first six months of FY1999 are lower than forecast, although this may be explained, at least in part, by unusually cool weather;

– TDRI GDP forecasts for 1998 were more optimistic than those produced by the Bank of Thailand and

NESDB; and

–

TDRI GDP forecasts for 1999 exceed those of the private sector international banks.

22 However, we believe the current demand forecast represents a reasonable basis on which to undertake the current tariff review.

FP3AnnexA.doc

7

Attachment 1- Review of forecasting methodology

23 The methodologies employed by MEA and PEA to forecast load are largely based upon the results of a Canadian International Development Agency funded consortium. The methodology recommended by that study is published in a volume entitled “Load Forecast Methodology, Basic Data, and Load Forecast Results by sector by Utility”, printed in 1993. The methodologies used are described below.

Residential

24

MEA adopt an ‘end use’ model to forecast residential loads. This model considers the level of market saturation and diversity of use for eight different household appliances (accounting for about 85 % of all domestic electricity consumption) in certain stocks of dwelling by income and by dwelling type. We were told by the TLFS that PEA has, from 1998, adopted a similar approach to forecasting residential loads. The structure of the ‘Residential End Use Model’ is illustrated in

Figure A.5.

Figure A.5 - Residential End Use Model

Model Structure

Number of

Dwellings

Source of Data

Household Registration,

Population, Population per

Household

Dwelling by

Income

Surveys,

GRP

Appliance, Saturation

Dwelling by

Types

Social Economic

Survey

Appliance Stock by Dwelling by Income by Dwelling Types

Capacity, Hours of Use

Efficiency Factors

Survey

DSM

Energy

MEA, PEA

Residential Rate Class

FP3AnnexA.doc

8

Commercial

25 MEA and PEA adopt different methodologies for short term and long term forecasting of commercial loads:

For short term load forecasting, MEA use a regression model based on the stock of commercial floor space by type of building and energy-use per floor area to derive a forecast of total energy consumption.

Both MEA and PEA disaggregate total commercial load by business type, and use econometric equations, or energy intensity ratios, to develop medium to long term forecasts. The MEA and PEA both estimate load disaggregated by business type with different specifications of the equations for different types of business. MEA have a greater tendency to use economic equations.

The TDRI is commissioned to prepare GDP forecasts by region and business type which are used in conjunction with the aforementioned energy intensity elasticities to estimate total energy consumption.

26 The structure of the ‘Commercial Model’ is illustrated in Figure A.6.

FP3AnnexA.doc

9

Figure A.6 - Commercial Model

Model Structure

Stock of

Floorspace by

Type of Building

Floorspace by

Type of Building

New Construction by Type Building

Demolition

/Deferral

Take-Up Rate

Energy Use per

Floor Area

Efficiency

Factor

Short Run

Energy Use

(MEA) Energy Intensity

Source of Data

Consultant Studies,

Surveys

BMA and MEA

Applications

MEA and Consultant

Estimate

Consultant Studies

Consultant Studies and Survey

DSM

GRP Estimate

Long Run

Energy Use

(MEA /PEA)

TOTAL

FORECAST

Short Run

Energy Use

(PEA)

Industrial

27 EGAT, MEA and PEA all use the above energy intensity methodology for long term forecasting of industrial loads. However, for short term forecasts both

MEA and PEA survey their major customers directly to establish the extent to which their future electrical loads might change. The structure of the ‘Industrial Model’ is illustrated in Figure A.7

FP3AnnexA.doc

10

Figure A.7 - Industrial Model

Model Structure

Short Run

Sources of Data

BOI

Expected Future

Energy Consumption by Type of Industry

MEA /PEA

Survey

MEA, PEA

Applications

Others

Long Run

Energy Intensity

Ratio

Efficiency Factor

Long Run Energy

Consumption by Sector

GRP and

MEA/PEA

Estimate

DSM ?

FP3AnnexA.doc

11

Attachment 2 - Review of trends in generation and consumption

EGAT

28 In the 1998 financial year (FY1998), EGAT generated 92 134 GWh, which was 0.64% less than the previous year. This reduction contrasts with past growth and can be attributed to the downturn in the Thai economy which started in July 1997. In the period FY1988 to FY1997, EGAT’s energy generation increased from

31 997 GWh to 92 725 GWh, an average annual growth rate of 12.5%.

29

EGAT’s peak generation in FY1998, 14 180 MW, was 2.25 % lower than in the previous year. This reduction can again be attributed to the downturn in the Thai economy, but is proportionately greater than the reduction in energy generation.

Consequently, the overall system load factor increased from 72.97 % in 1997 to

74.17 % in FY1998. Figure A.8 illustrates EGAT’s annual energy and peak power generation over the period 1961 to 1998.

Figure A.8 - EGAT’s annual energy and peak power generation (1961-1998)

16 000

14 000

12 000

10 000

Peak pow er generated (MW)

Energy generated (GWh)

160 000

140 000

120 000

100 000

8 000

6 000

4 000

80 000

60 000

40 000

2 000 20 000

0

1960 1965 1970 1975 1980

Year

1985 1990 1995

0

2000

30 In the past 10 years EGAT’s sales to PEA have grown faster than sales to

MEA. In FY1988, sales to PEA accounted for 43 % of all EGAT’s generation, in

FY1998 this value rose to 56 %, as illustrated in Figure A.9.

FP3AnnexA.doc

12

Figure A.9 - Breakdown of EGAT’s total generation for FY1988 and FY1998

1988 1998

MEA

45%

Direct sales

4%

MEA

35%

Direct sales

2%

8 000

6 000

4 000

2 000

0

16 000

14 000

12 000

10 000

Ow n use

/Lossses

8%

PEA

43%

Ow n use

/Lossses

7%

PEA

56%

31 In FY1998, MEA, PEA and direct customers accounted for 41%, 56% and 2% of EGAT peak generation respectively. A further 4% was consumed within EGATs power plants. Data for prior years is not available.

32 Figure A.10 illustrates the load profiles for MEA, PEA and direct customers, and EGATs generation requirement for the peak day in FY1998.

Figure A.10 - Load profile for day of system maximum demand in FY1998

(28/04/98)

EGAT generation requirement

EGAT total sales

PEA

MEA

Direct customers

Tim e of day

FP3AnnexA.doc

13

MEA

33

For the period FY1988 to FY1997, MEA’s energy purchases from EGAT increased from 14 564 GWh to 33 708 GWh showing an average growth rate of 9.8 % per annum. In FY1998, however, MEA purchased only 32 341 GWh, a reduction of

4.05 % over the previous year. This reduction was significantly greater than the national average decrease of 0.64 % and illustrates the fact, that from a national point of view, energy consumption in the metropolitan area has been most affected by the downturn in the Thai economy. Figure A.11 illustrates MEA’s power and energy purchases from EGAT for the period FY1988-FY1998.

Figure A.11 - MEA’s energy and power purchases from EGAT

7 000

6 000

5 000

4 000

3 000

2 000

1 000

Peak pow er

Energy purchases

0

1988 1989 1990 1991 1992 1993

Year

1994 1995 1996 1997

0

1998

34 Pie charts showing the distribution of sales to each tariff category are shown in

Figure A.12. The categories are residential, small general service, medium general service, large general service, specific business, government and non-profit organisations (NPOs) and street lighting. The pie charts also show that MEA’s own use/losses account for about 3.8 % of total purchases from EGAT.

70 000

60 000

50 000

40 000

30 000

20 000

10 000

FP3AnnexA.doc

14

Figure A.12 Comparison of MEA sales by customer type for FY1996 and

FY1998

Government

& NPO

4.1%

Small general service

13.5%

1996

Specif ic business

4.0%

Government

& NPO

4.3%

1998

Small general service

13.9%

Specif ic business

4.3%

M edium general service

27.6%

M edium general service

22.8%

Resident ial

18.4%

Resident ial

21.6%

Own Use

/ Losses

3.8%

* Ot her

0.4%

Own Use

/ Losses

3.8%

* Ot her

0.4%

Large general service

28.1%

Large general service

29.0%

35 Whilst the overall level of sales in 1996 and 1998 were similar, there was a rearrangement of sales between customer groups: sales to medium general service’ customers declined by about 9.2 % over this two-year period, whereas sales to most other customer groups experienced modest increases.

PEA

36

For the period FY1988 to FY1997, PEA’s energy purchases from EGAT increased from 13 737 GWh to 50 192 GWh showing an average growth rate of

15.5 % per annum. In FY1998, however, PEA’s purchase increased by only 2.41 % to 51 403 GWh. This decline can be attributed to the downturn in the economy.

Figure A.13 illustrates PEA’s peak power demand and energy purchases from EGAT for the period FY1988-FY1998.

37 Prior to FY1998, PEA did not determine the coincident peak demand for its four regions in total, (i.e., north, north east, central and south), and simply calculated the sum of the separate maximum demands in each region. This fact underlies the significant “reduction” of PEA’s peak power demand in FY1998.

FP3AnnexA.doc

15

Figure A.13 - PEA’s energy and power purchase from EGAT

10 000

9 000

8 000

7 000

6 000

5 000

4 000

3 000

2 000

Peak pow er

Energy purchases

100 000

90 000

80 000

70 000

Non-coincident peak before 1998 60 000

50 000

40 000

30 000

20 000

1 000

0

1988 1989 1990 1991 1992 1993

Year

1994 1995 1996 1997

10 000

0

1998

38 Pie charts showing the distribution of PEA’s sales are shown in Figure A.7.

Figure A.14 - Comparison of PEA sales by customer type for FY1996 and

FY1998

1998

Government

& NPO

4.0%

Small general service

8.6%

1996

Specif ic business

2.6%

M edium general service

26.8%

Government

& NPO

3.4%

Small general service

8.1%

Specif ic business

2.5%

M edium general service

17.8%

* Ot her

2.4%

Resident ial

21.3%

Resident ial

23.1%

* Ot her

2.4%

Own Use

/ Losses

5.1%

Large general service

29.2%

Own Use

/ Losses

5.8%

Large general service

36.9%

39 Between 1996 and 1998, PEA’s largest growth in sales was to ‘large general service’ customers, from 13 141 GWh to 18 952 GWh, equivalent to an average increase of 20 % per annum. PEA sales to ‘medium general service’ customers fell by an average of 13 % per annum over the same period from 12 055 GWh to

9 139 GWh. These two customer categories represent the most significant changes to

PEA’s market.

FP3AnnexA.doc

16

Attachment 3 - Current load forecasts

40 The Moderate Economic Recovery scenario forecasts for EGAT’s Generation requirements, and MEA’s and PEA’s demand and energy take are shown in Tables

A.5, A.6 and A.7 respectively.

Table A.5 - EGAT’s generation requirements forecast, Sept. 1998 - (Moderate

Economic Recovery Case)

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

Fiscal

Year MW

Peak Generation

Increase

MW %

4 734

5 444

6 233

7 094

8 045

8 877

9 730

10 709

12 268

13 311

14 506

14 180

14 499

15 254

16 214

17 308

18 399

19 611

20 818

22 168

23 728

25 450

27 232

28 912

30 587

1 559

1 043

1 195

-

553

710

789

861

951

832

853

979

326

319

755

960

1 094

1 091

1 212

1 207

1 350

1 560

1 722

1 782

1 680

1 675

GWh

Energy Generation

Increase

GWh

Actual

13.23%

15.00%

14.49%

13.81%

13.41%

10.34%

9.61%

10.06%

28 194

31 998

36 458

43 190

49 226

56 007

62 181

69 651

14.56%

8.50%

78 880

85 924

8.98%

-2.25%

92 728

92 134

Forecast

3 414

3 804

4 460

6 732

6 036

6 781

6 173

7 470

9 229

7 044

6 804

- 593

2.25%

5.21%

93 178

97 858

6.29% 103 685

6.75% 110 436

6.30% 117 341

6.59% 124 532

6.15% 132 228

6.48% 141 300

7.04% 151 322

7.26% 162 438

7.00% 173 532

6.17% 184 213

5.79% 194 930

1 044

4 680

5 827

6 751

6 905

7 191

7 696

9 072

10 022

11 116

11 094

10 681

10 717

%

13.78%

13.49%

13.94%

18.46%

13.98%

13.78%

11.02%

12.01%

13.25%

8.93%

7.92%

-0.64%

1.13%

5.02%

5.95%

6.51%

6.25%

6.13%

6.18%

6.86%

7.09%

7.35%

6.83%

6.16%

5.82%

Load

Factor

%

67.99%

67.10%

66.77%

69.50%

69.85%

72.02%

72.95%

74.25%

73.40%

73.69%

72.97%

74.17%

73.36%

73.23%

73.00%

72.84%

72.80%

72.49%

72.51%

72.76%

72.80%

72.86%

72.74%

72.73%

72.75%

FP3AnnexA.doc

17

Table A.6 - MEA’s forecast of demand and energy, TLFS Sept. 1998

(Moderate Economic Recovery Case)

Fiscal

Year

Energy demand by consumer category (GWh) Total

Sales

(GWh)

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

5 962

6 494

6 986

4 375

4 645

4 480

7 449

7 872

8 292

8 787

9 280

9 763

10 253

10 767

11 333

11 919

12 531

13 151

13 750

4 474

4 641

4 859

5 119

5 390

5 655

5 924

6 205

6 516

6 837

7 172

7 512

7 860

8 941

8 735

7 376

7 240

7 441

7 727

8 078

8 440

8 799

9 156

9 531

9 929

10 349

10 813

11 273

11 737

Actual

9 099

9 591

9 368

Forecast

9 521

9 848

10 273

10 782

11 299

11 806

12 304

12 858

13 358

13 908

14 484

15 051

15 602

1 290

1 338

1 386

1 337

1 443

1 391

122

127

134

31 126

32 373

31 121

1 431

1 493

1 567

1 626

1 686

1 738

1 788

1 841

1 897

1 965

2 027

2 089

2 164

1 431

1 491

1 562

1 640

1 692

1 765

1 826

1 892

1 968

2 035

2 093

2 151

2 207

137

143

148

153

160

168

175

180

185

189

193

197

200

31 683

32 929

34 428

36 185

37 947

39 694

41 426

43 274

45 186

47 202

49 313

51 424

53 520

Fiscal

Year

1996

1997

1998

Total

Sales

(GWh)

31 126

32 373

31 121

1999

2000

2001

2002

2003

2004

2005

31 683

32 929

34 428

36 185

37 947

39 694

41 426

2006

2007

2008

2009

43 274

45 186

47 202

49 313

2010 51 424

2011 53 520

* Other - street lighting

MW

Peak demand met by EGAT

Increase

5 636

5 938

5 657

5 716

5 935

6 225

6 598

6 892

7 147

7 457

7 788

8 166

8 567

8 872

9 250

9 631

MW

-

195

302

281

59

219

290

373

294

255

310

331

378

401

305

378

381

Energy received from EGAT

Increase

% GWh GWh

Actual

9.86%

5.36%

-4.73%

Forecast

1.04%

3.83%

4.89%

5.99%

4.46%

3.70%

4.34%

4.44%

4.85%

4.91%

3.56%

4.26%

4.12%

32 366

33 708

32 341

1 539

1 342

- 1 367

33 038

34 408

36 050

37 890

39 736

41 564

43 378

45 311

47 343

49 427

51 636

53 847

56 077

697

1 370

1 642

1 840

1 846

1 828

1 814

1 933

2 032

2 084

2 209

2 211

2 230

%

13.51%

4.15%

-4.06%

2.16%

4.15%

4.77%

5.10%

4.87%

4.60%

4.36%

4.46%

4.48%

4.40%

4.47%

4.28%

4.14%

Load

Factor

%

65.56%

64.80%

65.26%

65.98%

66.18%

66.11%

65.56%

65.82%

66.39%

66.41%

66.42%

66.18%

65.86%

66.44%

66.45%

66.47%

FP3AnnexA.doc

18

Table A.7 - PEA’s forecast of demand and energy, TLFS Sept. 1998

(Moderate Economic Recovery Case)

Fiscal

Year

Energy demand by consumer category (GWh) Total

Sales

(GWh)

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

9 569

10 635

11 879

3 853

4 119

4 154

13 245

14 589

15 999

17 444

18 940

20 498

22 124

238 330

25 622

27 511

29 505

31 613

33 844

4 226

4 391

4 621

4 898

5 210

5 562

5 958

6 405

6 872

7 360

7 872

8 410

8 976

12 055

10 208

9 139

8 817

9 164

9 649

10 233

10 891

11 633

12 470

13 415

14 413

15 467

16 583

17 764

19 015

Actual

13 141

17 920

18 952

Forecast

18 234

19 054

20 165

21 477

22 950

24 603

26 458

29 255

32 793

36 986

40 974

44 175

47 132

1 183

1 239

1 278

1 812

2 141

1 769

1 075

1 279

1 253

42 688

47 541

48 424

1 388

1 487

1 595

1 714

1 848

1 987

2 133

2 286

2 446

2 615

2 793

2 981

3 180

1 778

1 823

1 887

1 973

2 083

2 217

2 373

2 557

2 751

2 959

3 179

3 415

3 666

1 381

1 487

1 600

1 728

1 877

2 029

2 184

2 347

2 517

2 694

2 882

3 079

3 291

49 069

51 995

55 516

59 467

63 799

68 529

73 700

294 595

87 414

95 592

103 788

111 437

119 104

Fiscal

Year

Total

Sales

Peak demand met by EGAT

Increase

Energy received from EGAT

(GWh) MW MW % GWh

Actual

1996

1997

1998

42 688

47 541

48 424

44 981

50 192

51 403 7 736 n/a n/a

Forecast

1999

2000

2001

2002

2003

2004

2005

49 069

51 995

55 516

59 467

63 799

68 529

73 700

8 010

8 560

9 188

9 878

10 627

11 433

12 305

274

550

628

690

749

806

872

3.54%

6.87%

7.34%

7.51%

7.58%

7.58%

7.63%

51 975

55 064

58 762

62 921

67 493

72 481

77 940

2006

2007

2008

2009

294 595

87 414

95 592

103 788

13 339

14 500

15 782

17 081

1 034

1 161

1 282

1 299

8.40%

8.70%

84 648

92 305

8.84% 100 838

8.23% 109 406

2010 111 437 18 326 1 245 7.29% 117 443

2011 119 104 19 591 1 265 6.90% 125 514

* Other - agricultural pumping, temporary, free of charge

GWh

4 818

5 211

1 211

Increase

572

3 089

3 698

4 159

4 572

4 988

5 459

6 708

7 657

8 533

8 568

8 037

8 071

%

12.00%

11.58%

2.41%

1.11%

5.94%

6.72%

7.08%

7.27%

7.39%

7.53%

8.61%

9.05%

9.24%

8.50%

7.35%

6.87%

Load

Factor

%

75.85%

74.07%

73.43%

73.01%

72.71%

72.50%

72.37%

72.31%

72.44%

72.67%

72.94%

73.12%

73.16%

73.14%

FP3AnnexA.doc

19