TRUST-BASED MICROPAYMENT AUTHENTICATION SYSTEM

advertisement

JOURNAL OF INFORMATION, KNOWLEDGE AND RESEARCH COMPUTER

SCIENCE AND APPLICATIONS

TRUST-BASED MICROPAYMENT

AUTHENTICATION SYSTEM IN MOBILE DATA

NETWORK

1 PROF.

HEMANT APPA TIRMARE, 2 PROF. SANJAY SHAMRAO PAWAR,

3 PROF. GITANJALI BHIMRAO YADAV

1 Assistant

Professor, I. T. Department, Bharati Vidyapeeth College of Engg. Kolhapur

Professor, E&TC. Department, Bharati Vidyapeeth College of Engg. Kolhapur

3 Assistant Professor, C.S.E. Department, Bharati Vidyapeeth College of Engg. Kolhapur

2 Assistant

tirmarehemant@rediffmail.com,pawarsanjay2@rediffmail.com,gitanjalistar@gmail.com

ABSTRACT: In this paper we develop trust based Anonymous Micro payment Authentication System for micro

payments in mobile data network. This system is innovative and practical authentication system designed for

micro payments in mobile data network. Through AMA the customer and merchant can authenticate each other

indirectly, at the same time the merchant does not know the customers real identity. A customer can get

Micropayments not only from his local domain but also from a fast remote domain without increasing any

burden on his mobile phone. The system maintains customer’s privacy, confidentiality and integrity without

increasing any burdens on mobile phone. Evaluation of proposed AMA is carried out based on security,

feasibility and scalability. All the work is carried out using WAP toolkit simulator and Nokia Mobile Browser

emulator.

Keywords: Anonymous Micro payments, Authentication, RSA, Cryptography

1. INTRODUCTION

In the recent year data communication networks has

led to enormous development in electronic

commerce. Internet banking and trading are the two

important applications that execute financial

transaction from anywhere in the world. This enables

banks and trading are two important applications that

execute financial transaction from anywhere in the

world. This enables banks and merchants to simplify

their financial transaction process as well as to

provide customer friendly service twenty four hours a

day. Electronic micro payment is one of the most

important research topics in electronics commerce,

practically, low cost online payment scenarios and

offline payments in rural areas. Micropayments refer

to low value financial transaction ranging from

several pennies to a few dollars [1].Large portion of

electronics commerce occurs in mobile data network

belongs to the category of Micropayments. The

amount of each single transaction in micro payment

is small, the number of users and transaction in micro

payment is small and the number of users and

transaction is large. Due to insecure transaction small

percentage of loss increases fraud. So measure issue

is to secure micro payment. The common security

scheme called pretty good privacy was designed to

provide privacy, integration, authentication and no

repudiation.

Presently security is based on cryptography which is

classified as to script based, macro payment based

hash chain based categories. These methods works

well for internet network and not suitable for mobile

data network. Mobile environment has some

limitations for mobile payment, such as limited

bandwidth of mobile data network, limited

computational capability and memory resources of

mobile phone. So it is necessary to propose a new

secure mechanism for mobile Micropayments. The

paper is organized as follows. Section 2 describes

AMA model. Section 3 focuses protocols designed.

Section 4 shows Implementation of RSA algorithm.

The experimental results are given in Section 5.

Finally Section 6 ends up with conclusion.

2.

ANONYMOUS

MICROPAYMENT

AUTHENTICATION (AMA) MODEL

In virtual world for authentication username

password, symmetric signature, asymmetric signature

and biometry methods are used. There are many

protocols and mechanisms are based on this

mechanism. In micro payment system symmetric and

asymmetric signature are chosen for authentication.

Username and password is not enough safe for

mobile commerce and biometry is not feasible and

asymmetric signature is used only for cross

authentication symmetric is used to authenticate the

customer and merchant in home domain The

combined authentication method is enough safe for

mobile micro payment. Selected model is similar to

Kerberos protocol [8][9].

ISSN: 0975 – 6728| NOV 10 TO OCT 11 | VOLUME – 01, ISSUE - 02

Page 26

JOURNAL OF INFORMATION, KNOWLEDGE AND RESEARCH COMPUTER

SCIENCE AND APPLICATIONS

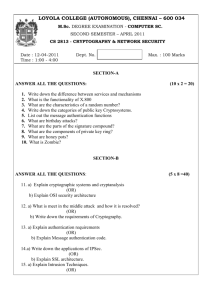

3

CS

CC

4

2

5

1

C

M

6

Fig.1. Trusted AMA Model

The interaction paths with the customer as shown in

Fig.1 are

1) Customer sends request to Merchant for goods

through order form.

2) Merchant forwards this request with nickname and

account information to CC for verification through

price form.

3) After verification in CC sends billing form with

account information to CS for account settlement.

4) After account settlement of C and M CS sends

acknowledgement to CC.

5) CC forwards acknowledgement to M.

6) M forwards acknowledgement to C

So for secure transaction between customer and

merchant trusted third party introduces the process is

credential center(CC) along with clearing and

settlement center (CS) registers in CC. CS

administrates accounts for C and M, debits C’s

accounts and credits M’s account. It also provides

account closer, balance inquires, account statements.

AMA uses RSA algorithm for authentication. For

transaction submission of order form, price form,

billing form, the price negotiation protocol and micro

payment protocol are implemented. AMA allows

mutual authentication between M and C. AMA

maintains confidentiality of transaction data and

privacy of customer. The security and performance is

important issue. Computational efforts are shifted

from user side to network side and allowing customer

to get micro payment.

2.1 Principals and Notations

All the parties involved in the micro payment

systems are called principals. All principals

communicate through wireless and wired network.

Basic principals in micro payment systems are

merchant, customer credential center, clearing and

settlement center. The symbols C, M, CC and CS are

used to denote the names of the principals. The

following symbols are used to represent other

messages and protocols.

KCpb: Principal C’s public key

KCpr: Principal C’s private key

KAc-m: Authentication key shared between principal

C and Principal M

KSc-m: session key shared between C &M

H(x): One way hash function of message x

EK(x): Message x encrypted with key K

x,y: Msg x concatenated with Msg y

IDc: C’s identity

TIDc: Nickname, Temporary identity

Iz: Item z

Pz: Price of Item z offered by the merchant

V: Micro payment value

TSc: Timestamp Generated by C

ETIz: Expiration Time of offered price for item z

C M: x C sending message x to M

R: Random numbers generated by respective

principal

Authentication and session keys KAc-m and KSc-m

are generated as follows:

A secret key between principal c and principal M is

created when they know each other at the first time.

An authentication key KAc-m is created for C and M

to communicate over insecure network. The main

goals of Authentication key KAc-m are:

a) Mutual authentication between C and M

b) Confidentiality of data

From hash of secret key and random number the

KAc-m is generated .It is dynamic for random

number in every communication. It is very difficult

for any attacker to get information related to the

secret key. Thus key guessing attacks can be

prevented. The session key KSc-m is generated with

random number.

3. PROTOCOLS DESIGNED

3.1 Price Negotiation Protocol

Before transaction begins the customer queries the

merchant about the price of specific goods. It is not

necessary for both of them to establish the secure

channel for the price information. Sometimes it is

important to prevent a merchant from knowing the

identity of his customers. TIDc a nickname instead of

his customer real identity is used. A customer can

have many nicknames when customer registers in

CC. Several nicknames are assigned to customer and

those nicknames are knows only to the customer and

the CC. So the merchant does not know the real

identity of the customer. The customer privacy is

protected. To avoid replaying attacks timestamp is

used in protocol.

Steps:

1] C M: TIDc, Iz, Pz

2] M C: IDm, Iz, Pz, TSm, ETz

Step By Step Explanation:

1] Customer c queries merchant M about the price Pz

of the item Iz.

2] M responds to c with the price Pz of the item Iz,

M’s identity IDm, M’s time stamp TSm and Pz’s

expiration time ETz.

3.2 Authentication and Micro payment Protocol

During transaction, Customer c sends order including

payment authorization to merchant M.M forwards

order to CC. At the same time m sends elated

information of item Iz and its identity information to

ISSN: 0975 – 6728| NOV 10 TO OCT 11 | VOLUME – 01, ISSUE - 02

Page 27

JOURNAL OF INFORMATION, KNOWLEDGE AND RESEARCH COMPUTER

SCIENCE AND APPLICATIONS

CC.CC checks the validity of C’s payment

authorization, authenticates c and M. sends billing

information to CS. After receiving acknowledgement

from cc M provides goods or service to C.

Steps:

1] CM: Order form, TIDc, IDcc, Rc

Order form=EKAc-cc(IDc,IDm,Iz,Pz,TSc, ETz, H

(Iz,Pz,TSc,ETz))

2] MCC: Price form, Order form, TIDc, IDm,

IDcc, Rc, Rm

Price form= EKAm-cc (TIDc,IDm,IDcc,IDz, Pz,

TSm, ETz, H(Iz,Pz,TSm,ETz))

3] CC CS: Billing form, Rcc

Billing

form=

EKAcc-cs

(Serial

no,IDc,IDm,Iz,TScc,V,H(Iz,TScc,V))

4] CSCC: Acknowledgement

5] CCM : confirm To M ,Conform To C

Conform

To

M=

EKAm-cc(Serial

No.,TIDc,IDm,Iz,TScc,KSc-m,

V,H(Iz,TScc,KScm,V))

Conform To C= EKAc-cc (TIDc, IDm, Iz, TScc,

KSc-m, V, H (Iz, TScc, KSc-m, V))

6] M C: EKSc-m (content (Iz)), Conform To C

Step By Step Explanation:

1] C creates order including C’s and M’s identities,

item Iz and associated price Pz, Timestamp TSc read

from the C’s clock, Pz’s expiration time ETz. Some

important fields, such as Iz, Pz, TSc, and ETz are

hashed to check if they are modified or replaced with

others while transit. Then the order is encrypted by

the authentication key known only to C and CC Time

stamp is used to avoid reply attacks. C sends order

form to M with C’s nickname, CC’s identity and

random number is generated by C.

2] M forwards order form to CC. M creates a price

form including C’s nickname M’s and CC’s identity,

item Iz and associated price Pz, timestamp TSm, Pz’s

expiration time ETz. The price form with some

encrypted important field used to authenticate M’s

identity to CC and M sends price form to CC with

C’s nick name, Rc, Rm. Then Cc decrypts order form

and price form and authenticates C’s and M’s

identity. CC checks fields in order form and price

form.

3] CC creates a billing record including serial number

of transaction generated by CC and C’s and M’s

identities, timestamp TScc, Micro payment value V.

The billing record with some encrypted important

field used for authentication of CC and CS. Then CC

sends billing form to CS with Rcc.

4] CS decrypts billing form and checks C has enough

funds in the account. If funds is enough then CS

completes transaction otherwise adds billing record

and send acknowledge back to CC.

5] CC generates session key KSc-m for

communication between C and M and acknowledges

with Confirmtoc and Confirmtom. Conformtoc has

got from encryption of C’s and M’s identities, item z,

transaction value V, time stamp of CC, session key

KSc-m. Conformtom has got from encryption of C’s

nickname, M’s identities, item z, transaction value V,

time stamp of CC, session key KSc-m. CC sends

Conformtoc and conformtom to M.

6] M forwards Confirmtoc and sends encrypted

contents of item z with session key KSc-m generated

by CC. M adds this transaction record in to database.

C decrypts confirmtoc and gets the session key KScm. Then C decrypts contents of item Iz and session

key KSc-m.

3.3 Clearing and Settlement Protocol

Regularly M sends to CS amount of money spend by

C after the M authenticates CC and CS checks

amount are consistent before settles account.

Steps:

1] M CC: EKAm-cc (IDm, clearingreq), IDm, Rm

2] CC M: EkAm-cc (IDm, TScc, KSm-cs),

EKAcc-cs (IDm, TScc, KSm-cs)

3] MCS: KKAm-cs (serial nos, amount, period,

EKAcc-cs (IDm, Tscc, KSm-cs)

4] CS M: Acknowledge

Step By Step Explanation:

1] M sends clearing request to CC which is encrypted

with key KAm-cc.

2] CC checks M’s identity and refuges request if

authentication failed. Otherwise CC generates session

key KSm-cs for subsequent communication and

encrypts session key KSm-cs and timestamp of CC

with authentication key KAm-cc and sends

encryption to M then M forwards to CS.

3] M gets session key KSm-cs and decrypts message

sent by CC. then M encrypts amount of money spent

by C during the period with session key KSm-cs and

sends to CS.

4] CS checks if the amounts are consistent and sends

acknowledgement to M.

4. RSA ALGORITHM

RSA is public key algorithm with two different keys

used to encrypt and decrypt the data. RSA is used for

many application like RSA secured ID, Digital

Certificates, Smart cards etc. This algorithm is based

on exponentiation takes O ((log n) 3) operation. RSA

uses large integers. RSA is basically based on

mathematics. First it finds prime numbers and

generates a key pair using these two prime numbers.

Then encryption and decryption has been done using

key pair.

4.1 RSA Key Generation

1. Select two prime numbers p and q.

2. Compute n= p*q.

3. Calculate f (n) = (p-1)*(q-1)

4. Select integer e; gcd(f(n),e)=1 where 1<e<f(n).

5. Calculate d; d= e-1modf (n).

6. Public key Kb = {e, n}

7. Private key Kp= {d, n}

We have the private key d and public keys e and n .If

we encrypt text we need to first represent it in some

numeric form and then simply apply the formula

c=me(mod n) where M is plain text and c is cipher

ISSN: 0975 – 6728| NOV 10 TO OCT 11 | VOLUME – 01, ISSUE - 02

Page 28

JOURNAL OF INFORMATION, KNOWLEDGE AND RESEARCH COMPUTER

SCIENCE AND APPLICATIONS

text. If we decrypt cipher text c then apply formula

p=cd mod n

4.2 Timing Attacks

RSA exploit timing attacks and the inter operand size

based on time taken. RSA exploits time taken in

exponentiation. The countermeasures are, use

constant exponentiation time, add random delay and

blind values used in calculations. Once the system is

designed the next step is to convert it in to actual

code to satisfy user’s requirements as expected. The

approved is error free has been implemented. The

main aim of the system was to identify

malfunctioning of system. Implementation includes

proper training to end users.

4.3 Encryption

Encryption is done using the public key component e

and the modulus n. We encrypt message with their

public key (e, n). Encryption is done by taking an

exponentiation of the message m with public key e

and then taking a modulus of it. Following steps are

done in encryption.

1. Obtain recipient’s public key (n, e).

2 .Represent the plain text message as a positive

integer m<n.

3. Compute cipher text c=me mod n.

4. Send cipher text to recipient.

4.4 Decryption

Decryption is done using private key. Decryption is

similar to the encryption except that the keys used are

different. Following steps are done in decryption.

1. Recipient uses his private key (n, d) to compute

m=cd mod n

2. Extract plain text from the integer representative

m.

5. EXPERIMENTAL RESULTS

The C and M authenticate with CC indirectly. The

time stamp is used in two ways from order form and

price form, one is used to protect this transaction

from replying attacks and other one is to check

whether the price offer is still in effect because price

of item is often changed. C authentication with

trusted third party CC the registration is as shown in

Fig.2.

The Merchant M authentication with trusted third

party CC the registration is as shown in Fig.3

Fig.3.Merchant registrations with third party CC.

Both C and M trusts CC .CC authenticates C by

decrypting order form encrypted with authentication

key known only to C and CC.CC authenticates M by

decrypting price form encrypted with authentication

key known only to M and CC.

Anonymity is important to prevent a merchant from

real identity of customer. The customer’s real identity

is protected. Instead of customer’s real identity the

nick names TIDc are used for communication with

merchant. The nickname is known only to C and CC.

The login with nickname and password as shown in

fig.4 and The list of options for C are as shown in

fig.5.

Fig.4. C Login with Nickname and Password.

Fig.2.Customer registration and after registration

login form with nickname and password.

Fig.5. The list of options for customer

ISSN: 0975 – 6728| NOV 10 TO OCT 11 | VOLUME – 01, ISSUE - 02

Page 29

JOURNAL OF INFORMATION, KNOWLEDGE AND RESEARCH COMPUTER

SCIENCE AND APPLICATIONS

Instead of M’s real identity the nick names TIDm are

used for communication with merchant. The

nickname is known only to M and CC. The login

with nickname and password is as shown in fig.3.

Fig.6.After registration M login with CC.

Confidentiality is to encrypt important data per

transaction while in transit. After logged in through

nickname and password the list of goods displayed

for negotiation as shown in Fig.7. So order is

generated after requesting current rate of goods as

shown in fig.8.and the order form is generated and

encrypted with session key generated by CC. Any

other principal could not get the correct content of

these goods because he does not know this session

key.

Fig 7. After logged in through nickname and

password the list of goods displayed for negotiation.

Fig.8. order is generated after requesting current rate

of goods.

After placing the purchase order the validation and

after validation the account settlement of CS for the

customer and merchant as shown in Fig.9.

Fig.9.Account settlement of CS for the C and M with

previous and current balance.

After account settlement CS sends the feed back CC

then CC to M and then M to C. Integrity while in

transit is the data is protected from being modified

and replaced with others. The message digest

algorithms are used and hash values of some

important information is padded in to order form,

price form. Immune from key guessing attack is

prevented. The authentication key is created

dynamically using one way hash function and it is

known only to the respective principal and third party

CC. So It is very difficult for any attacker to get

information related to secret key by analyzing

intercepted data for the dynamic authentication key.

Scalability is when AMA can support mobile

commerce with RSA .So capability of mobile phone

is improved and CC is upgraded to CA. AMA

functions as authentication protocol to authenticate.

6. CONCLUSION

Using proper mechanism of Protocols and algorithms

the mobile micro payment transactions are secured.

For this security we have used micro payment

negotiation, authentication protocols and RSA

algorithm. The AMA model provides security to all

principals by generating various respective keys.

Customer and merchant authenticate indirectly with

each other and communicate with their nickname

which is known to respective principal and trusted

third party The customer gets goods or services from

the merchants in any domain without disclosing

privacy and without increasing communication

overheads in the air. Most computational effort is

moved to wired network side to reduce computational

overheads on the mobile phone with limited

computational capability and storage. We have

explored alternative for tamper resistant system.

7. REFERANCES

[1]Zhi-YuanHu, Yao-Wei Liu,Anonymous Micro

payment Authentication (AMA) system in mobile

data network, IEEE INFOCOM20040-7803-83567/04/$20.00 ©2004 IEEE.

ISSN: 0975 – 6728| NOV 10 TO OCT 11 | VOLUME – 01, ISSUE - 02

Page 30

JOURNAL OF INFORMATION, KNOWLEDGE AND RESEARCH COMPUTER

SCIENCE AND APPLICATIONS

[2]A. Mitchell C.Trinity Coll,Algorithms For

Software Implementations Of RSA, Cambridge as

appears computers and digital Techniques,IEEE May

1989(Vol, 136,No:3-pp66-170)

[3] Amir Hertzberg, Payment Technology for

ECommerce, Micro payments PP.245-280,in Editor

Prof.Weidong Kou, springer-Verlag, ISBN 3-54044007-0, 2003.

[4] New Orleans, Louisiana Sung-Ming Yen, SangJae, RSA speedup with Chinese Remainder Theorem

Immune against Hardware Fault Cryptanalysis,

December 11-15, 2000.

[5] T. Pedersen, Electronic Payments of small

amounts, In Fourth Cambridge Workshop on Security

Protocols. Springer Verlag, Lecture Notes in

Computer Science, April 1996.

[4] P.M. Hallam-baker. Micro Payment Transfer

Protocol (MPTP) Version 0.1, November 1995.

[6] G. Horn and B.Preneel, Authentication and

Payment in Future Mobile System, ‘Computer

security-ESORICS’98, Lecture Notes in computer

Science 14851998, pp.277-293.

[7] R.Hauser, M.Stenier and M.Waidner, Micro

payments based on ikp, 14th Worldwide Congress on

computer and communications and security

protection, Paris, 1996, pp.67-82.

[8] John Kohl and B. Clifford Neumann. The

Kerberos

Network

Authentication

service

(Ver.5).IETFRFC1510.Sept.1993.

[9] J. Kohl and B. Neumon and T. Ts’o, The

Evolution of the Kerberos Authentication Service, In

Brazier. And Johansen, D.Distributed Open Systems.

Los Alamitos, CS: IEEE Computer Society Press,

1994.

[10] Mihir Bellaire and Phillip Rogaway Entity

Authentication and Key Distribution, Extended

abstract in Advances in Cryptology- CRYPTO 93,

Lecture Notes in Computer science Vol.773, D.

Stinson ed, and springer-Verlag.1994.

[11] M. Bellaire. Garay, R. Hauser, A.Herzberg, etal,

iKP- A Family of secure electronic Payment

Protocols, In First USENIX Workshop on Electronic

Commerce, New York, 1995.

[12] Ronald L. Rivest and Adi Shamir, pay Word and

MicoMint,Two

simple

Micro

paymentSchemes,CryptoBytes,1996:2(1):pp.7-11.

ISSN: 0975 – 6728| NOV 10 TO OCT 11 | VOLUME – 01, ISSUE - 02

Page 31