When the Masters of Science of Leadership Program asked me if I

advertisement

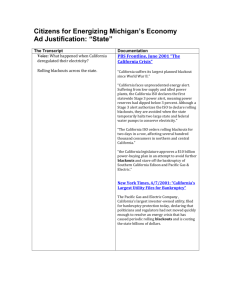

VALUES, ETHICS, AND SPIRITUALITY AMIDST AN EPIDEMIC OF CORPORATE CORRUPTION By Ronald F. White, Ph.D. Professor of Philosophy College of Mount St. Joseph The Masters of Science in Organizational Leadership at the College of Mount St. Joseph is based upon three unifying themes: “values, ethics, and spirituality.” The recent epidemic of illegal and immoral behavior by corporate executives justifies that social mandate. On December 2, 2001 Enron Corporation and its conglomeration of 874 subsidiaries filed for Chapter 11, bankruptcy. This largest bankruptcy in U.S. history, at the time, not only deprived at least 4,500 employees of their livelihood and devastated their 401K retirement funds, but it also led to billions of dollars in losses to its unsuspecting stockholders. Lawyers representing the government, employees, and stockholders claim that the debacle was brought on by an epidemic of illegal and immoral behavior on the part of its top executives, its board of directors, and its accountants. About a year before Enron’s stock values had plummeted, Company Chair Kenneth Lay reportedly cashed in $123 million worth of stock options, and even requested $60 million in severance pay after Enron had already collapsed. At least 600 other executives followed Lay’s lead and collected more than $100 million in bonuses. Lawyers for the shareholders allege that 29 top executives and directors of Enron dumped $1.1 billion in stock during this same period. In addition to the government’s criminal charges, shareholders and employees have at least 47 class action lawsuits pending against Enron, its executives and directors. Allegations of corruption include: using subsidiaries of dubious legality to overstate Enron’s stock value and understate a mountain of debt; and then using those bogus figures to line the pockets of its top executives. At a party, videotaped long before the crash, executives jokingly referred to Enron’s shifty bookkeeping practices as “Hypothetical Future Value Accounting,” or HFV. At first, the “Enron Scandal” exhibited all the symptoms of a “localized infection,” confined to the institutional structure of the Houston-based energy conglomerate. However, as the story gradually unfolded it became apparent that it had spread. Its external auditor, the once prestigious accounting firm of Arthur Andersen, followed Enron into bankruptcy amidst allegations that it had destroyed documents in an effort to cover-up its failure to fulfill its legal responsibilities in auditing Enron’s “HVF” accounting practices. Accounting industry analysts suggested that Andersen’s ability to serve as independent auditor may have been compromised by the fact that it had also collected 27 million dollars in consulting fees from Enron. Of course, much of the malaise could have been thwarted much earlier, if the Security and Exchange Commission, Congress, and other public regulators had done their job. Three years before the Enron collapse, in a speech titled “The Numbers Game,” then SEC chairman Arthur Levitt questioned the validity of corporate financial statements and the growing practice of “earnings management.” However, the congressional response was, no doubt, tempered by laissez faire regulatory policies, industry lobbyists, and Enron’s $5.5 million in campaign contributions. As the story unfolded, it soon became painfully apparent that the localized infection had, indeed, become a full-blown epidemic, and that the symptoms of corporate corruption had spread to other major corporations including: Worldcom, Global Crossing, Tyco, Adelphia, Rite Aide, and even our own locally owned Erpenbeck Corporation. Today, as a direct result of this ongoing epidemic, the public trust in the stock market seems shattered and investors are now reluctant to put their hard earned money into the stock market. As we set out to restore public trust in our financial markets, the moral philosophy of Immanuel Kant, provides an important starting point; most notably, his distinction between what the eighteenth-century philosopher called: a “good citizen” and a “good person.” Legal corporate behavior is simply any behavior in conformity with the “rule of law” as defined, enforced, and interpreted by our legislative, executive, and judicial branches of government. A “good corporate citizen,” is basically a corporation that overtly obeys the law, but does so primarily out of the fear of getting caught and suffering the consequences. Good corporate citizenry, therefore, is proportional to the deterrent effect of the sanctions imposed by government and its ability to detect and prosecute criminal wrongdoing. So if corporate executives are constrained solely on the basis of “good citizenry,” then if they believe that they can lobby Congress to enact favorable legislation; if they believe they can sneak past under-funded governmental regulators; or, if they believe that their army of lawyers can avoid being convicted in a court of law; or, if they believe that violating the law is more profitable then obeying the law, then corporate executives are more likely to indulge in illegal and/or immoral behavior. Therefore, the only way to constrain corporate corruption based on “good citizenry” is to exponentially increase the power of government. But in a liberal democracy, the power of government must be limited to serving the public good. Free market economists argue that the best way to serve the “public good” is to promote competition. Although American corporations are already regulated by a complex maze of legality, many of the laws and regulations do not serve the public good or the free market. Emboldened by lenient campaign finance laws, industry lobbyists tend to encourage the passage of laws and regulations that serve corporate selfinterest. It is important to note that, what seems to be an obvious conflict of interest between Arthur Andersen’s roles as external auditor and internal consultant was perfectly legal. That’s because earlier efforts to ban these conflicts of interest in the accounting industry had been stymied by industry lobbyists. So, when all is said and done, don’t be surprised if the courts decide that many of the shady dealings undertaken by Enron and Andersen were, in fact, perfectly legal. The lesson here is that mere compliance with “legality” does not necessarily translate into “morality.” So while the sphere of “good citizenry” relies upon good laws, and institutional oversight supported by the threat of punishment, the sphere of “good personhood,” according to Kant, implies adherence to universal moral rules, internalized selfregulation, and voluntary compliance. A “good corporate person” simply does what’s “moral,” “ethical,” “right,” “good,” and/or “virtuous;” not out of fear of getting caught, but out of the love and respect for universal morality. Morality therefore must arise in the service of a “good will” and recognition that we all must “act on universal principles,” and “always treat persons as ends and never as means.” But in the real corporate world, doing what’s morally right is not always the most profitable course of action. So as the current wave of corporate corruption worms its way through our judicial system, we cannot ignore the universal immorality of corporate behaviors such as: insider trading, “cooking the books,” bribing public officials, withholding information from conveniently docile regulators and auditors, and lying to and stealing from employees and stockholders. But if Kant is correct, we won’t cure this epidemic of corporate corruption by simply revamping the instruments of “good citizenry;” that is by increasing the woefully inadequate budget of the SEC, vigorously prosecuting corporate wrongdoing with stiffer penalties, and building more plush “white collar prisons.” We must also revitalize the tools of “good corporate personhood” by providing a solid moral foundation for the next generation of corporate executives. That’s exactly what we try to do here at the College of Mount St. Joseph’s Masters of Science in Organizational Leadership Program.