rival applications - Limerick Solicitors` Bar Association

advertisement

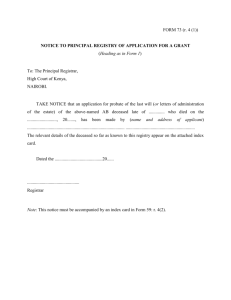

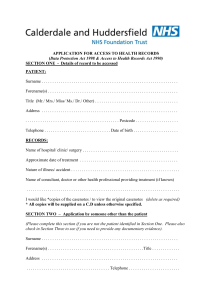

THE QUESTION OF TESTAMENTARY CAPACITY (c) Rita Considine B. L. 2011 The material is the copyright of the above. The paper is intended as a summary of the principal points. While great care has been taken in the production, no responsibility is taken for any errors or omissions and no responsibility is accepted for any loss occasioned to any person acting or refraining from acting in reliance on anything contained in these notes. Professional advice should be sought in all cases. Wills are dealt with under the provisions of Part VII of the Succession Act 1965, [sections 76-100 inclusive]. Section 77 of the Succession Act 1965 deals with the capacity to make a will and states as follows:- ’77. (1) To be valid a will shall be made by a person who- (a) has attained the age of 18 years or is or has been married, and (b) is of sound disposing mind. (2) A person who is entitled to appoint a guardian of an infant may make the appointment by will notwithstanding that he is not a person to whom paragraph (a) of subsection (1) applies.’ The legal test which the Courts apply when determining questions of testamentary capacity is well settled. It is that as set out in the case of Banks-vGoodfellow (1870) LR 5 QB. The test is a threefold test, all elements of which must be present namely:- 1 (a) The testator must understand that he is executing a will, a document which will dispose of his estate on death; (b) The testator must know the nature and extent of his estate; (c) The testator must be able to call to mind the persons who might be expected to benefit from his estate and decide whether or not to benefit them. While the test is a legal test and not a medical test, medical records, opinions and evidence arise where a challenge to the validity of a will arises on the basis of capacity of the testator or the soundness of mind of the testator. The Court will hear evidence from not alone the Solicitor who took the instructions for the making of the Will and who attended upon the deceased for the execution of the Will but medical evidence on the issue of testamentary capacity. It is important to keep good and clear attendance notes and to keep a clear note of the instructions given by the client. In the recent decision of Laffoy J In the estate of Brian Rhatigan deceased Scally v Rhatigan unreported High Court 21.12.2009 the applicable law was clearly set out. The Judge stated as follows:- “The Law 4.1 Section 77(1) of the [Succession] Act of 1965 provides that to be valid a will shall be made by a person who "is of sound disposing mind". The test for determining whether a person was "of sound disposing mind" when making or 2 purporting to make a will which has been consistently applied in this jurisdiction (cf . the decision of Kelly J. in O'Donnell v. O'Donnell , the High Court, unreported, 24th March, 1999 and the decision of Feeney J. in Flannery v. Flannery [2009] IEHC 317) is that set out by Cockburn C.J. in Banks v. Goodfellow [1870] LR 5 "It is essential to the exercise of such a power that a testator shall understand the nature of the act and its effects; shall understand the extent of the property of which he is disposing; shall be able to comprehend and appreciate the claims to which he ought to give effect; and, with a view to the latter object, that no disorder of the mind shall poison his affections, pervert his sense of right, or prevent the exercise of his natural faculties - that no insane delusion shall influence his will in disposing of his property and bring about a disposal of it which, if the mind had been sound, would not have been made." [THE BURDEN OF PROOF] In the said judgment Laffoy J went on to state:“Counsel for the defendant raised the issue as to which of the parties bore the burden of proving that the deceased was of sound disposing mind on 19 th May, 2005. The Court was referred to a passage from the judgment of Hamilton P., as he then was, in In re Glynn, deceased [1990] 2 I.R. 326 (at p. 330) in which it was stated: "Normally the legal presumption is in favour of the will of a deceased and in favour of the capacity of a testator to dispose of his property and to rebut this presumption, the clearest and most satisfactory evidence is necessary. However, in cases such as this when a person suffers a stroke which may affect his capacity, the onus shifts and lies on the party propounding the will. Having 3 regard to the nature of the stroke suffered by the deceased and the disability resulting therefrom, there is a heavy onus on the defendant in this case to establish that on the 20th October, 1981, the deceased had the mental capacity to make a testamentary disposition of his property, that he had a sound disposing mind, that he was capable of comprehending the extent of his property, the nature of the claims of his sister, the plaintiff herein, and that he was disposing of his property." On the issue of the burden of proof counsel for the defendant also referred the Court to a recent decision of the High Court of England and Wales, In re Key, decd . [2010] 1 WLR 2020 and, in particular, to the following passage in the judgment of Briggs J. (at para. 97): "The burden of proof in relation to testamentary capacity is subject to the following rules. (i) While the burden starts with the propounder of a will to establish capacity, where the will is duly executed and appears rational on its face, then the court will presume capacity. (ii) In such a case the evidential burden then shifts to the objector to raise a real doubt about capacity. (iii) If a real doubt is raised, the evidential burden shifts back to the propounder to establish capacity nonetheless...." In this case, evidence was adduced by the plaintiff with a view to establishing that the deceased did have testamentary capacity on 19 th May, 2005. Evidence was adduced by the defendant to cast doubt on whether the deceased was of sound disposing mind on that day. I am satisfied that I must decide, on the basis of the entirety of the evidence, whether, on the balance of probabilities, the deceased had testamentary capacity by reference to the Banks v. Goodfellow test on 19th May, 2005. As is pointed out in Williams, Mortimer and Sunnocks on 'Executors Administrators and Probate ' (18th Ed.) at para. 134 19, "when the whole evidence is before the court, the decision must be against the validity of the will, unless it is affirmatively established that the deceased was of sound mind when he executed it". [The Golden Rule] Again the judgment is helpful as it sets out the test applied in England and Laffoy J continued:“By reference to the judgment of Briggs J. In re Key, decd., counsel for the defendant submitted that the Court should have regard to what was referred to as the "Golden Rule" in that case. In his judgment (at para. 7), Briggs J. stated: "The substance of the Golden Rule is that when a solicitor is instructed to prepare a will for an aged testator, or for one who has been seriously ill, he should arrange for a medical practitioner first to satisfy himself as to the capacity and understanding of the testator, and to make a contemporaneous record of his examination and findings ...." However, Briggs J. went on to say (at para 8): "Compliance with the Golden Rule does not, of course, operate as a touchstone of the validity of a will, nor does non-compliance demonstrate its invalidity. Its purpose, as has repeatedly been emphasised, is to assist in the avoidance of disputes, or at least in the minimisation of their scope." 5 Those observations, in my view, reflect the law in this jurisdiction. Irrespective of whether the "Golden Rule" or best practice was followed in a particular case, it is a question of fact, which is to be determined having regard to all of the evidence and by applying the evidential standard of the balance of probabilities, whether a testator was of sound disposing mind when the testamentary document which is being propounded was executed.” The earlier decision of Feeney J In the matter of the estate of Michael Flannery deceased; Flannery v Flannery and Hehir, unreported High Court 17/2/2009 - 2009 21 5205 2009 IEHC 31 when dealing with the question of capacity Feeney J stated:- “Section 77 of the Succession Act 1965, identifies the manner in which a will must be executed so as to be valid. In particular, the will must be signed at the foot or end thereof by the testator … . And such signature shall be made or acknowledged by the testator in the presence of each of two or more witnesses, present at the same time and each witness shall attest by his signature the signature of the testator in the presence of the testator. The evidence before the Court, confirms that these provisions of s. 78 were complied with and that there was a valid execution. The valid execution of the will was proved before the Court and there was no contest or cross-examination in relation to such matters. The Court is satisfied that it has been proved that the will of the 11 th December, 2006 is a duly executed will and therefore carries a presumption of testamentary capacity. The issue which is live before this Court is whether the deceased had sound disposing mind and testamentary capacity on the 11th December, 2006, at the 6 time that he made his will. Intermixed with that question is whether the deceased had the capacity to approve the contents of the will. The onus of proving the formal validity of a will is clearly on the party who propounds the will. However, where there is a challenge to a will based on the state of knowledge or state of health of the testator, the onus is on the person who challenges the will. In this case the plaintiff, as the person who propounds the will, has proved to the satisfaction of the Court the formal validity of the will. The plaintiff has discharged that onus and the onus is therefore on the defendants who challenge the will. It is long established that there is a presumption of due execution and of testamentary capacity where a will is formally validity as the case herein. That was confirmed by the Supreme Court in Re Glynn deceased [1990] 2 I. R. 362 where McCarthy J stated (at p. 340) "A duly attested will carries a presumption of due execution and testamentary capacity." McCarthy J. went on later in the same judgment to state (also at p. 340):"It is a fundamental matter of public policy that a testator's wishes should be carried out however, at times, bizarre, eccentric or whimsical they may appear to be. One man's whimsy is another man's logic… . For my part, is it sufficient to say that there was ample evidence before the President that the testator fully appreciated what was going on and that the terms of the document upon which he placed his mark fully represented what he wanted done with regard to his property." The reason that I bring the recent decisions to your attention is to show that the law has not altered on this issue and the test applied by the Court when determining the issue is well settled. 7 GRANTS OF REPRESENTATION WHERE PERSON ENTITLED IS OF UNSOUND MIND Rita Considine Barrister at Law © The material is the copyright of the above. The paper is intended as a summary of the principal points. While great care has been taken in the production, no responsibility is taken for any errors or omissions and no responsibility is accepted for any loss occasioned to any person acting or refraining from acting in reliance on anything contained in these notes. Professional advice should be sought in all cases. 8 HOW TO OBTAIN A GRANT OF REPRESENTATION ON THE DEATH OF THE WARD Making an application for a Grant of Representation upon the death of a person who was a Ward of Court is not that different from applying for a Grant in any other circumstances. If the Ward made an alleged will, then as previously stated there is a duty upon the person with custody of the Will to deposit it in the Wards of Court Office. On the death of the Ward, the Registrar of Wards of Court transfers the Will to the Probate Office. In order to proceed to apply for a Grant the intended personal representative applies to the Probate office for a copy of the will. The Probate Office cannot release the original will and therefore the attested copy of the unproved will as is obtained from the probate office is used instead of the original for the purpose of the application for the Grant. The oath for Executor/ Administrator with will annexed will require amendment to show that it is the copy of the unproved will and not the original will that is the exhibit to the Oath and it is the copy of the unproved 9 will that is marked by the applicant and the commissioner instead of the original. One of the additional requirements for the application for the Grant will be an affidavit of mental capacity which is required as one of the proofs where the testator died a Ward of Court. In the normal way the affidavit should be sworn by the doctor who attended the Ward of Court in or about the time of the making of the will or if the doctor is dead then the affidavit can be sworn by the Solicitor who drew the will for the Ward. Also the applicant/intended administrator will have to apply to the Accountants Office for a certificate of the balance of the funds held in Court together with accrued interest up to the date of death in order to complete the Inland Revenue Affidavit. Where the Ward died intestate the application for the Grant of Administration Intestate is made in the normal manner with the next of kin of the Ward applying in the normal way. As set out above in the case of estates where the value of the assets of the deceased intestate Ward do not exceed €6,350.00 the application for payment out of the funds in court to the person who would be entitled to apply for a 10 Grant can be made through the Wards of Court office upon the completion of form 18 Appendix K by the relevant person. THE PERSONAL REPRESENTATIVE IS A WARD OF COURT What to do and how to extract the grant where the personal representative is a Ward of Court or where the Personal Representative is the Donee of a Registered E.P.A. In order to extract a grant of representation, the person entitled must be capable of so doing and must not suffer from any legal disability. Order 79 of the Rules of the Superior Courts 1986 sets out the powers of the Probate Officer and rule 26 provides as follows: - “A Grant of Administration may be made to the Committee of a Person of Unsound Mind for such person’s use and benefit”. No difficulty arises if there is more than one person entitled to administer the estate of the deceased and one is under a disability, as the person not under any disability can proceed to extract the grant of representation and administer the estate of the deceased without reference to the other person. 11 The complication arises when the only/sole person entitled to extract a grant of representation to the estate of a deceased person lacks capacity. Lack of capacity does not alter the order of priority to extract the grant. It does however cause a difficulty in that additional procedures are required as a grant cannot issue to a person of unsound mind. If the person who is entitled to administer the estate of a deceased person is the only person entitled to do so and that person is a Ward of Court then the following is the procedure:- (a) Apply to the President of the High Court, through the Wards of Court Office for an order allowing the Committee of the Ward to apply for a Grant in the estate of the named deceased person and to administer the estate of the deceased person for the benefit of the Ward and during his/her incapacity. (b) The application to the President is informal. A letter is sent to the Registrar of Wards of Court enclosing a copy of the death certificate of the deceased person together with a copy of the will (if any) and details of the assets of the deceased including the nature of the asset, the value and where it is situate. If the deceased died intestate or if the Ward is a person other than the executor named in the will, then the letter to the Registrar of Wards of Court should set out clearly how the Ward is the sole 12 person entitled to administer the estate of the named deceased person. (c) If the President of the High Court is satisfied that all matters are dealt with, he will make an Order allowing the committee of the ward to apply for the grant of representation in the estate of the deceased person as the Committee of the Ward for the use and benefit of the Ward and during his/her incapacity. (d) Once the Order is made then the Order forms an additional proof for the Probate Office and must be lodged as part of the application for the Grant of Representation. (e) The fact of the making of the order and the details/terms of the order must be recited in the Oath for Administrator (with or without will annexed). This will form part of the title/clearing off clause in the Oath. (f) The Grant applied for will never be a Grant of Probate, remembering that the Probate can only issue to an Executor. WHERE THE PERSONAL REPRESENTATIVE IS OF UNSOUND MIND BUT NOT A WARD OF COURT 13 Where the sole person entitled to administer the estate of a deceased person is of unsound mind but is not a ward of court, then the procedure is different to that already dealt with. Order 79 rule 27 of the Superior Court Rules 1986 provides as follows: - “ In a case where a Person of Unsound Mind has not a Committee appointed by the Court, a Grant may issue to such person as the Probate Officer may by Order assign, with the consent of the Registrar of the Wards of Court. The application for such Order shall be grounded on an Affidavit of the applicant showing the amount of the assets, the age and residence of the Person of Unsound Mind and his relationship to the applicant, together with an Affidavit of a Medical Practitioner relating to the incapacity of such person”. This Rule permits the Probate Officer to appoint a Committee for the Person of Unsound Mind, limited for the purposes of administering the Estate of the deceased person and during the applicant’s incapacity. The consent of the Registrar of Wards of Court is necessary before the Probate Officer can exercise the power to appoint a Committee under Rule 27. 14 Unlike a Committee of a Ward of Court, the Committee in this situation has no power to deal with the property or the person of the person of unsound mind and is simply appointed to administer the estate of the deceased person in the name and on behalf of the person of unsound mind and during his/her incapacity. The procedure for asking the Probate Officer to appoint a Committee for a person of unsound mind, who is the sole person entitled to represent the estate of the deceased is a two stage procedure. It must also be remembered that this is a pre-grant step, namely the Grant of Administration (with or without will annexed) cannot be applied for until the Committee is first appointed. The procedure is as follows:- (a) An Affidavit is required from a Medical Practitioner of the person of unsound mind. The affidavit of the doctor must confirm the following:- (i) That the doctor has examined the Person who is entitled to apply for the Grant; (ii) In his professional opinion, the Person is of unsound mind and therefore incapable of managing his / her own affairs. 15 (iii) The Person is also therefore incapable of administering the Estate of the deceased person. (iv) It is usual that the Affidavit from the doctor sets out the illness or defect of the mind from which the Person suffers, thereby making that person incapable of managing his or her own affairs and of administering the Estate of the deceased person. (b) The rule says that the consent of the Registrar of Wards of Court is required. To obtain the consent of the Registrar of Wards of Court these facts and when also the consent of the Registrar of the Wards of Court the Solicitor writes to the Registrar of the Wards of Court setting out the relevant information:- (i) Name, address and date of death of deceased; (ii) Enclose copy death certificate; (iii) Value, nature and situation of asset of the deceased; (iv) Enclose draft CA24 if available; (v) How the person of unsound mind is the person entitled to extract the grant to the estate of the deceased person; (vi) Enclose copy will if applicable; (vii) Set out what share of the estate the person of unsound mind is entitled to and the estimated value of that share; (viii) Set out the relationship of the person seeking the consent to the person of unsound mind. 16 (c) Once an Affidavit has been obtained from the doctor setting out the required information this is lodged in the Probate Office, together with the letter of consent from the Registrar of the Wards of Court and an Affidavit sworn by the Applicant and a letter from the Applicant’s Solicitor requesting that the Probate Officer make an order under order 27 of the Superior Court Rules 1986. (d) The Applicant for the Order/proposed Committee swears an Affidavit setting out the matters required to be deposed to as set out in rule 27 namely:- (i) The name, address and occupation of the deceased; (ii) The date and place of death of the deceased; (iii) If the deceased died intestate, then the nearest next of kin of the deceased; (iv) If the deceased died testate, then the provisions of the Will under which the Person of Unsound Mind is the person entitled to apply for the Grant; (v) The relationship of the proposed Committee to the Person of Unsound Mind, or his or her capacity to be appointed Committee under the provisions of the Will of the deceased; 17 (e) Once the above are available then they are lodged in the Probate Office together with a letter from the Solicitor having carriage of the administration of the estate of the deceased requesting the Probate Officer to make an order pursuant to Order 27 of the Superior Court Rules 1986. (f) Once the Order is made and a copy bespoken from the Probate Office then the proposed Applicant/Committee can proceed to swear the necessary documents to lead to the extraction of the Grant. (g) The Order of the Probate Officer must be recited in the Oath for Administrator (with or without the will annexed) and also must be lodged as an additional proof as part of the application for the Grant. WHERE THE PERSON ENTITLED TO A GRANT OF REPRESENTATION IS THE DONEE OF A REGISTERED POWER OF ATTORNEY. While the Enduring Powers of Attorney Act 1996, was a revolutionary piece of legislation in that if, properly planned can allow a person to plan for the future, without the intervention of the Courts, unfortunately the provisions of the Act do not permit the donor of a registered Power of 18 Attorney to administer an estate of a deceased person in the place of or as the Attorney of the donor of the power. The Power of Attorney allows the Attorney to deal with the property and the person of the donor. It does not allow the donee to act in a representative capacity for the donor of the power of attorney. Therefore the same situation arises as where the person is of unsound mind but not a Ward of Court, namely an application must be made pursuant to the provisions of Order 79 rule 27 of the Superior Court Rules 1986 asking the Probate Officer to appoint a committee of the purpose of the extraction of the Grant and the administration of the estate. Rita Considine July 2011 19 Example 1: OATH FOR ADMINISTRATOR THE HIGH COURT PROBATE The Probate Office Phoenix House, Smithfield, Dublin 7 In the Goods of … late of [insert name address and occupation of deceased] I, [insert name address and occupation of committee] of… in the County of … aged eighteen years and upwards, Make Oath and say, that [insert name address and occupation of deceased] …late of … Deceased died Intestate [insert clearing off clause] leaving him surviving one lawful and only brother a ward of court and I am the committee lawfully appointed of the said ward and entitled to administer the estate of the deceased by Order of the President of the High Court dated the … day of … 2006 limited for the use and benefit of the Ward and during his incapacity that I am the lawful [insert relationship of committee to deceased if any] of said Deceased and that I will well and faithfully administer the Estate of the said Deceased by paying all just debts, and distributing the Residue of said Estate according to law, and that I will exhibit a true Inventory of the said Estate and render a true account thereof, whenever required by law so to do; that the said Deceased died at …[insert place of death] on the … day of … 2006 and and that the whole of the Personal Estate of the said Deceased amounts in value to the sum of € [insert gross personal estate] and that the whole of the real estate of the said Deceased which devolves on and vests in his legal personal representatives is of the market value of € [insert current value of real estate] and no more to the best of my knowledge, information and belief Sworn etc. Filed this … day of … 2006 by [insert name and address of firm] 20 21 EXAMPLE 2: Oath for Administrator with the Will THE HIGH COURT PROBATE In the Goods of [insert name of deceased] late of [insert address and occupation of deceased] in the County of … I [insert name address and occupation of committee] aged Eighteen years and upwards, make Oath and say, that I believe the paper writing hereunto annexed, and marked by me to contain the true and original last Will of [insert name address and occupation of deceased] late of … in the County of … and that same was made by the said … [insert name of deceased] after attaining the full age of Eighteen years, and that he did not intermarry with any person after the making of same and that the Executor therein named, [insert name ] is a Ward of Court and that I am the of said [insert name of deceased] ,and the Committee lawfully appointed of the said [insert name of executor] and authorised to extract the grant by Order of the President of the High Court dated the … day of … 2006 [insert date of order] limited for the use a benefit of the Ward of Court and during his/her incapacity, and that I will well and faithfully administer the estate of the said deceased, by paying his/her just debts and the legacies contained in his/her said Will and distributing the residue of his/her Estate according to law — and that I will exhibit a true and perfect Inventory of the said Estate, and render a true account thereof whenever required by law so to do; and the Testator died at … [insert place and date of death] on the … day of …2006 and that the whole of the Personal Estate amounts in value to the sum of € … [insert amount], and that the whole of the Real Estate of deceased which devolves to and vests in his/her Legal Personal Representative is of the marked value of € … [insert amount] and no more to the best of my knowledge, information and belief. SWORN etc. Filed this … day of … 2006 by [insert name and address of firm] 22 DISPUTES RELATING TO THE EXTRACTION OF A GRANT OF REPRESENTATION TO THE ESTATE OF A DECEASED PERSON Rita Considine Barrister at Law © The material is the copyright of the above. The paper is intended as a summary of the principal points. While great care has been taken in the production, no responsibility is taken for any errors or omissions and no responsibility is accepted for any loss occasioned to any person acting or refraining from acting in reliance on anything contained in these notes. Professional advice should be sought in all cases. INTRODUCTION: This paper is intended to be a practical guide to dealing with disputes relating to the entitlement to extract a grant of representation and other matters relating to a third party causing an obstruction to the extraction of the grant. I intend to deal with certain pre-grant matters. It will cover the relevant rules of Order 79 of the Superior Court Rules 1986 (as amended). As you will note that Order sets out the rules applicable to the practice and procedure in the Probate Office, High Court, including the rules to determine the entitlement to apply for a Grant of Representation, matters to deal with disputes or conflicts arising in relation to that order of entitlement or conflicting claims and what to do when the person entitled will not proceed to extract the grant. The Order itself is much more extensive than that but I have only set out briefly the matters that will arise in this paper. As well as dealing with some of the 23 provisions of Order 79, I will also be dealing with certain of the statutory provisions as set out in the Succession Act 1965 (as amended), relating to Caveats and Grants of Representation. I hope to give you an insight into rival applications and how to deal with them, the use of Caveats proper and improper and the consequences and how to progress matters where the person entitled to apply for the grant either delays or refuses to act or renounce. I hope to deal with the role of the Probate Officer and the Court in such matters. DISPUTES RELATING TO OBTAINING A GRANT OF REPRESENTATION/RIVAL APPLICATIONS Order 79 Rule 5 of the Superior Court Rules 1986 sets out the rules applicable to the determination of the person or persons entitled to extract a Grant of Administration intestate and with the will annexed and also the person entitled, where the deceased died domiciled outside of the Republic of Ireland. It is to be noted that the rules apply to deaths on or after the 1st day of January 1967, the date the Succession Act became law. It is to be noted that only one grant of administration can issue and be valid at any given time. Further the grant is only of use for so long as the Personal Representative is capable of performing his or her duties. Therefore if more than one member of a class of persons is entitled to seek to represent the estate of a deceased person, the application must be made by them jointly in order that a Grant can issue to the applicants and it is to be noted that Order 79 rule 5 (14) provides for this but with a limitation. The sub-rule states:- “No grant of administration shall be made jointly to more than three persons unless the Probate Officer otherwise directs.” 24 Also it is to be noted that section 20 of the Succession Act 1965 makes it clear that all personal representatives are to act jointly and section 20 provides as follows:- “20. (1) Where probate is granted to one or some of two or more persons named as executors, whether or not power is reserved to the other or others to prove, all the powers which are by this Act or otherwise by law conferred on the personal representative may be exercised by the proving executor or executors or the survivor or survivors of them and shall be as effective as if all the persons named as executor had concurred therein. (2) This section applies whether the testator died before or after the commencement of this Act.” It happens in good times and in bad that more than one person entitled to apply to extract a grant of representation may do so at the same time. This gives rise to what are referred to or known as “rival applications”. RIVAL APPLICATIONS (Order 79 rule 5 (3)) “Where there are conflicting claims for a Grant amongst members of a class entitled to administration, the Grant shall be made to such of the claimants as the Probate Officer shall select, having given not less than twenty-one days’ notice to the rival claimants, or on objection made in writing within the said period, to such person as the Court shall select”. 25 “Members of a class” means a group of persons who have an equal entitlement to extract a Grant of Representation. The significance of this Rule arises where there is more than one application for a Grant of Administration to the Estate of a deceased Intestate. Where two or more persons being members of a class entitled to administration make individual applications for a Grant, they do so as against each other and not jointly. Unless the matter can be resolved between the parties then in order to remove the rival application and thereby allow the Grant to issue, one of the parties must apply to the Probate Officer by Affidavit, asking the Probate Officer to issue a statutory twenty-one day Notice to the rival claimant. The application to the Probate Officer is by Affidavit sworn by the Applicant and the Affidavit must set out the entitlement of the Deponent to extract the Grant of Administration to the Estate of the deceased Intestate. The Affidavit must also set out fully the details of the rival claimant, including: - (i) The name and address of the rival applicant; (ii) The rival applicant’s relationship to the deceased intestate; (iii) The date of the application by the rival applicant; (iv) The details of the Solicitor acting on behalf of the rival applicant (if any) The Affidavit should also contain a prayer to the Probate Officer, requesting the Probate Officer to issue a twenty-one day Notice to the rival applicant. Once the twenty-one day statutory notice is prepared by the Probate Officer and served by the party seeking to have the application set aside, an Affidavit of Service of the Notice should be sworn and filed in the Probate Office. If the rival claimant has not lodged an objection in writing in the Probate Office within the twenty-one day period, then the party seeking to extract the Grant 26 will request that the Probate Officer make an Order allowing the applicant to proceed with his or her application. If the Affidavit of Service of the twentyone day Notice is in order and is filed in the Probate Office and no objection has been filed in writing, the Probate Officer will make the Order. If the rival claimant for the Grant files an objection in writing in the Probate Office within the twenty-one day period, then the Probate Officer has no jurisdiction to adjudicate between the rival claimants for the Grant. Either claimant will then have to make an application to the Probate Judge for the Probate Judge to select between the rival claimants for the Grant of Administration. Such applications are made to the High Court by means of an originating notice of motion grounded upon an affidavit of the person seeking the Order, namely the applicant. The relief sought on the notice of motion is an Order pursuant to Order 79 rule 5 (3) of the Superior Court Rules 1986, permitting the applicant to extract the grant instead of the rival claimant and setting aside the application of the rival claimant together with costs. The rival claimant for the Grant must be on notice of the application and must be served with the documents which have been lodged for court and the court will require an affidavit of service to ensure that service has been properly effected on the notice party (the rival claimant). On the return date, if there is no appearance by the rival claimant for the Grant and if service can be proved, the Court will normally grant the relief sought and deal with the question of costs. 27 If, however, the notice party (rival claimant) attends in Court and opposes the application the Judge will either adjudicate between the parties or else the Judge will adjourn the motion to permit the rival claimant to set out his or her objections in an affidavit to be served on the applicant. The Judge will adjudicate between the parties on the adjourned hearing date. It is to be noted that the Probate Judge takes a practical approach to such applications and if it appears that one is bona fides and the other is a nuisance type application, in those circumstances the person properly making the claim will more than likely be permitted to extract the Grant. It is to be noted, that in appropriate cases, the court will not select between the rival claimants but will appoint some independent person to administer the estate, where it appears to be in the best interests of the beneficiaries to do so in order to prevent further disputes and allow the estate of the deceased to be properly administered. BLOCKING THE ISSUE OF A GRANT – THE PROPER AND IMPROPER USE OF CAVEATS Section 38 of the Succession Act 1965 is the statutory basis for the lodgement of a Caveat. The section states as follows:- ’38. (1) A caveat against a grant may be entered in the Probate Office or in any district probate registry. (2) On a caveat being entered in a district probate registry, the district probate registry shall immediately send a copy thereof to the Probate Office to be entered among the caveats in that Office.’ 28 A caveat is a formal warning lodged in the Probate Office or any one of the District Probate Registries that nothing is to happen in relation to the issue of a grant of representation to the estate of the deceased person named on the caveat, without notice to the Caveator- the person who lodged the caveat. The provisions dealing with caveats as set out in Order 79 of the Superior Court Rules 1986 (as amended), are to be found at rules 41 – 51 which deal with caveats, warnings and appearance to caveat. The rules state as follows:‘XIX. Caveats. 41. Any person intending to oppose the issuing of a grant of probate or letters of administration shall either personally or by his solicitor, lodge a caveat in the Probate Office, or in a District Registry. 42. A caveat shall bear date of the day it is lodged, and shall remain in force for the space of six months only, and then expire and be of no effect; but caveats may be renewed from time to time. 43. Every caveat shall state the name and address of the person on whose behalf the same is lodged, and the registered place of business of the solicitor lodging the same, or if there be no solicitor, an address for service (within the jurisdiction) at which the caveat can be warned, and where the case is so, the caveat shall state that it is lodged only with a view to seeing that the security is sufficient. 29 44. Any person who shall knowingly lodge, or cause to be lodged in the Probate Office, a caveat in the name of a fictitious person, or with a false address of the person on whose behalf it purports to be lodged, shall be deemed guilty of a contempt of Court. 45. The Probate Officer shall, immediately upon a caveat being lodged, send notice thereof to the District Registrar of the district in which it is alleged the deceased resided at the time of his death, or in which he is known to have had a fixed place of abode at the time of his death. 46. No caveat shall affect any grant made on the day on which the caveat has been lodged, or on the day on which notice is received of a caveat having been lodged in a District Registry. 47. All caveats shall be warned from the Probate Office. The warning shall be served by delivery of a copy thereof at the place mentioned in the caveat as the registered place of business of the solicitor, or address for service of the person who lodged the caveat, as the case may be, within 14 days of the date thereof; and otherwise shall be deemed inoperative unless the Court or the Probate Officer shall make a special order on the subject. 48. In addition to the service of the warning the Probate Officer shall, on the same day on which the warning is signed by him, send by post a copy of it to the solicitor or person who lodged the caveat at the registered place of business or address for service therein mentioned and on the same day a memorandum of such posting shall be entered in the book to be kept for that purpose. 49. The warning to a caveat shall state the name and interest of the party on 30 whose behalf the same is issued; and if such person claims under a will, it shall state the date, if any, of such will, and in any event state the registered place of business of the solicitor lodging the same, or if there be no solicitor, an address for service within the jurisdiction. 50. An appearance to a warning shall be entered in the Probate Office within 14 days of the service thereof, provided that the time for appearance may be considered to be extended until action on default has been taken under rule 51. 51. In order to clear off a caveat, when no appearance has been entered to a warning duly served, an affidavit of the service of the warning in manner required by rule 47 and a certificate of non-appearance shall be filed.’ The rules relating to caveats, warnings and appearances thereto are in my opinion very comprehensive and they set out clearly the requirements and the procedures to be followed. Order 80 of the Superior Court Rules 1986 (as amended) and which deals with the non-contentious practice in the District Probate Registries sets out the rules dealing with the lodgement of caveats in the District Probate Registries. However, only the Probate Office is authorised to deal with any warnings and appearances to caveats. Rule 54 and 55 of Order 80 provide as follows:“Rule 54. Caveats shall be warned from the Probate office only. Rule 55. After a caveat has been lodged, a District Probate Registrar shall not proceed with the grant of probate or administration to which it relates until 31 it has expired or been subducted or until he has received notice from the Probate Office that the caveat has been warned and no appearance entered or that the contentious proceedings consequent on the caveat have been terminated.” Again, as can be seen the rules relating to caveats are very comprehensive and set out in detail the requirements and the procedure for the lodgement of the Caveat and the lodgement of the Warning and Appearance thereto. In short the rules provide that the Probate Office has statutory authority to set aside a caveat if a warning to the caveat has been filed and served and the person who lodged the caveat does not appear to the warning and set out in writing that his or her caveat should not be set aside. It is to be noted that the requirement is simply to enter an appearance but the appearance does not have to set out the reason why the Caveator says his or her caveat should not be set aside. The main points to note in relation to caveats are the following:- A caveat can be lodged personally or by the solicitor of the Caveator; A caveat can be lodged in the Probate Office or the appropriate District Probate Registry; The form of caveat is set out in appendix Q form no 20 of the Superior Court Rules 1986 (as amended). The caveat must contain the following information:- (a) The date it was lodged; 32 (b) The name and address of the person on whose behalf the caveat is lodged; (c) The business address of the solicitor who lodged the caveat; or (d) An address for service within the jurisdiction at which the caveat can be warned; A caveat remains in force for 6 months from the date of lodgement unless it is warned and an appearance entered; A caveat can be renewed by the lodgement of another caveat; If the caveat is warned and an appearance entered to the warning then the caveat can only be removed by order of the Probate Officer on the consent of the parties or order of the court. A caveat will not affect the issue of a grant made on the same day that the caveat is lodged; All caveats are warned from the Probate Office. The District Probate Registries have no jurisdiction to deal with warnings and appearances; The warning must be served by the person seeking to remove the caveat, within 14 days of being signed by the Probate Officer; The Probate Officer is required to send a copy of the warning, on the day it is signed, to the solicitor for the Caveator or the Caveator if acting in person; 33 The form of warning to caveat is to be found in Appendix Q form no 21 of the Superior Court Rules 1986 (as amended). The warning to caveat must include the following information:- (a) The name of the person seeking to warn the caveat; (b) That person’s legal interest in the estate; (c) If the legal claim is under a will the date of the will; (d) The address for service within the state or the registered place of business of the solicitor acting for that person. The Caveator has a period of 14 days from the date of service of the warning in which to enter an Appearance to the warning, in the Probate Office; If no Appearance is entered to the warning, then the person who warned the caveat must file an affidavit of service of the warning in the Probate Office with a certificate that no appearance has been filed and a request (in writing) that the Probate Officer make an Order clearing off the caveat, (side bar order). A caveat can be disposed of as follows:- 1. By lapse of time- 6 months- if not warned; 34 2. By the Caveator voluntarily withdrawing the caveat; 3. By Order of the Court setting aside the Caveat either in non-contentious proceedings before the Probate Judge or in contentious proceedings proving the will in solemn form of law; 4. By order of the Probate Officer if all of the parties consent in writing to the removal of the Caveat; 5. By non appearance to a warning and then obtaining a side bar order from the Probate Officer setting aside the Caveat. A caveat should be lodged if there is a dispute in relation to the validity of a testamentary document to prevent the will from being proved until the validity of the will /testamentary document can be determined by a court in a probate action. A caveat should only be lodged by or on behalf of a person having an interest in the estate of the deceased, namely an executor or beneficiary under an earlier will or a person entitled in the event of the deceased person being deemed to have died intestate. While the section of the Succession Act 1965 does not limit the lodgement of a caveat to prevent the issue of a grant of probate or administration with the will annexed, there is a view that it is only appropriate to lodge a caveat where there is a dispute over the validity of a will. In my opinion, caveats can be lodged against testate and intestate estates as provided for under statute and in the rules 35 of court. It is however only appropriate to lodge a caveat if there is a dispute in relation to the validity of a testamentary document or the entitlement of a person to obtain administration. It is not appropriate to lodge a caveat if the Caveator is a child intending to issue proceedings pursuant to section 117 of the Succession Act 1965 as it is necessary that the will is proved before such a claim can progress. It is also not appropriate to lodge a caveat on behalf of some person who wishes to sue the estate of the deceased to recover a debt or damages or to enforce a contract or promise. Caveats are sometimes lodged in order to give the Caveator warning that the grant is about to issue. This arises because when the grant is prevented from issuing because of the lodgement of a caveat the Probate Office then notifies the person who has made the application for the grant of the lodgement of the caveat. Before the caveat is warned it is normal practice for the solicitor acting on behalf of the applicant for the grant to write to the Caveator or his or her solicitor to call for the removal of the caveat, before a warning is issued and served. This then gives the Caveator an opportunity to remove the caveat lodged by him or her before any expense is incurred and the person is therefore on notice of the issue of the Grant. Caveats are sometimes lodged to preserve the status quo until a party having an interest in the estate of a deceased person has an opportunity to make inquiries or investigate matters of concern before a grant is issued. Again when called upon to remove the caveat the same should be done before incurring unnecessary expense. 36 If a caveat is not removed under the statutory procedure set out in Order 79 and if it appears that the Caveator had either:- (a) No interest in the estate of the deceased; or (b) The caveat has been improperly lodged, then an application can be made to the Probate Judge on notice to the Caveator asking the court to set aside the caveat. Again the application is made by originating notice of motion grounded upon an affidavit sworn by the person seeking the issue of the grant, setting out all of the relevant facts and why the caveat should be set aside. The person seeking the issue of grant will be the applicant on the motion and the Caveator will be the notice party to the motion. If the Judge is satisfied that the lodgement of the caveat was without cause, frivolous and/or vexatious or inappropriate or improper then the Judge will order that the caveat is set aside and that the Caveator discharge the costs of the court application. The Probate Judge will not set aside a caveat if it appears that the caveat was properly lodged and that it is for the parties to litigate the dispute as a contentious action to determine the validity of a will. In those cases the Probate Judge will normally reserve the costs of the application to be determined at the trial of the action relating to the will of the deceased person. The Probate Judge is very clear in his rulings on improperly lodged caveats and will make costs orders against the Caveator in such cases. 37 STATUTORY REQUIREMENTS OF THE LODGEMENT OF A CAVEAT A caveat is required as a preliminary step before seeking the issue of a citation requiring a person to accept or to refuse probate or administration or to deposit a Will. The filing of a caveat is required before the issue of a Testamentary Civil Bill and is provided for under the provisions of the Circuit Court Rules 2001. Order 50 of the Circuit Court Rules 2001 was amended by S. I. 312/2007 and the lodgement of a caveat is no longer required when lodging a Succession Law Civil Bill. In the High Court, Order 5 rule 11 provides that where a summons is issued in probate proceedings... “The Plaintiff shall if he has not already so done, lodge a caveat in the Probate Office entitled in the estate of the deceased person”. CITATIONS Section 16 of the Succession Act 1965 provides as follows:“16. The High Court shall have power to summon any person named as executor in a will to prove or renounce probate”. An executor must either accept the office as such executor and proceed to prove the Will of the deceased or alternatively he can renounce his/her office. If the executor fails to do either then the court can compel the executor to prove the will or renounce his rights to do so, by means of the citation procedure. 38 Order 79 of the Superior Court Rules 1986 (as amended), deals with the citation procedure and rules 52 - 58 set out the requirements and the procedure to be followed for the issue of a citation from the Probate Office. Again the District Probate Registrars have no jurisdiction to issue citations. The relevant rules 52-58 are set out hereunder. ‘XX. Citations. 52. A citation shall not issue under the seal of the Court until an affidavit, in verification of the averments it contains, has been filed in the Probate Office. All citations shall issue from the Probate Office. 53. (1) When the person to be served with a citation is within the jurisdiction or being abroad is a citizen of Ireland, the citation itself shall be served on him. (2) When the person to be served, being abroad, is not a citizen of Ireland, notice only of the citation shall be served on him. (3) The affidavit to lead to a citation shall in all cases in which any person to be served is outside the jurisdiction show whether such person is or is not a citizen of Ireland. (4) A citation, or notice of a citation, shall be served personally when that can be done. 39 (5) Where personal service is intended to be affected, no order of the Court shall be necessary for the issue of the citation. (6) Where personal service cannot be affected the party desiring to serve the citation shall apply to the Court for directions as to the mode of service. 54. A citation shall not be signed by the Probate Officer unless and until a caveat shall have been entered against any grant being made in respect of the estate of the deceased to which such citation relates, and notice thereof shall be sent to the District Registrar of the district in which the deceased appears to have had a residence at the time of his death. 55. A citation shall be written, typed or printed, and the party extracting the same, or his solicitor, shall take it together with a copy thereof to the Probate Office and there deposit the copy, and get the citation signed and sealed. The citation shall contain a statement of the registered place of business of the solicitor extracting the same, or if extracted by a party in person, an address for service within the jurisdiction. 56. An appearance to a citation shall be entered in the Probate Office within 14 days of the service thereof, provided that the time for appearance may be considered to be extended until action on default has been taken under rule 57. 57. If the party cited to accept or refuse probate or administration having been served with a citation, shall not appear within the time limited 40 by the citation, or if the time for appearing shall be extended by the Court, or the Probate Officer, and such party shall not appear within such extended time, his non-appearance shall be deemed and taken as and for a renunciation of his right to probate or administration, as the case may be, and the party citing shall be entitled to obtain from the Probate Officer a side-bar order in the estate of the deceased to the following effect: "On reading citation and affidavit of it is ordered that the nonappearance of C.D. (naming the party cited) be taken as and for a renunciation of his right to probate (or administration)". 58. A party cited to accept or refuse probate or administration and desiring to accept, shall so state on entering his appearance, and thereupon the party citing shall be entitled to obtain from the Probate Officer a side-bar order in the estate of the deceased to the following effect: "On reading the citation, and (party cited) having in his appearance stated his desire to accept probate (or administration) let him extract same within fourteen days from the date of service of this order upon him and in case he shall not do so within that time, or within such further time (if any) as the Court or the Probate Officer shall allow for that purpose, let his not doing so be deemed and taken as and for a renunciation of his right to probate (or administration)". A copy of such side-bar order shall be served forthwith on the party appearing.’ So in relation to citations the following are points of importance:41 Citations issue from the Probate Office only, District Probate Officers having no jurisdiction; A caveat must be entered as a preliminary step to the issue of a citation; The issue of a citation is preceded by the filing of an affidavit which is sworn by the person seeking the issue of the citation. The affidavit must verify the averments contained and set out in the citation and must set out:- (a) The circumstances giving rise to the application for the issue of a citation; (b) The interest of the person seeking the issue of the citation; (c) Details of the person against whom the citation is sought and that person’s interest in the estate; (d) The address of the person against whom the citation is sought; (e) If the person resides outside of the jurisdiction whether that person is an Irish citizen. The citation must be in writing and lodged in duplicate in the Probate Office; 42 The citation must set out the registered place of business of the solicitor seeking to extract the same or an address for service within the jurisdiction if lodged in person; Once satisfied that all matters are in order and that it is appropriate to issue the citation, the Probate Officer will sign and seal an original citation; The citation must be served personally on the person sought to be cited; If the person cited is not an Irish Citizen then notice only of the citation and not the original is served; If personal service of the citation cannot be effected, then an application to court for directions as to the service of the citation will be required; An application for directions in relation to service of a citation where personal service is not possible is made to the Probate Judge again by means of an originating motion paper and verifying/grounding affidavit. The person cited to accept/refuse probate has a period of 14 days from the date of service in which to enter an Appearance to the Citation in the Probate Office; If an appearance is entered the party cited must state if he/she intends to accept probate/administration; 43 The party cited can then obtain an order from the Probate Officer in the terms set out in rule 58; If the person cited does not enter an appearance within the time permitted, then an affidavit of service of the citation should be filed in the Probate Office with a request for an Order from the Probate Officer deeming the person cited to have renounced his/her rights to the grant as provided for in rule 57. The citation procedure is very useful in circumstances where the person entitled to administer the estate is simply not doing anything. The procedure allows a person having an interest in the matter to take steps to progress the administration of the estate of the deceased. In essence if a person with a prior entitlement to represent the estate of a deceased fails to do so, the citation procedure allows the person with a lesser entitlement to have the person with the prior entitlement cleared off by an order of the Probate Officer. Further where a statutory procedure is available that procedure should be exhausted before any application is made to court for the appointment of a person to represent the estate of a deceased pursuant to the provisions of section 27 (4) of the Succession Act 1965. The Probate Judge may refuse to allow a party costs if that party has not exhausted the statutory procedure before seeking the intervention of the court. 44 NON-CONTENTIOUS PROBATE MOTIONS Most of you may be aware that the High Court has exclusive jurisdiction to determine non-contentious probate motions which are motions dealing with pre grant issues and relating in the most part to the extraction of the grant of representation. The Circuit Court does not have a similar jurisdiction. Again Order 79 deals with the form of the Originating Notice of Motion and rules 87 and 88 of deal with and set out the form of the documents and what they must deal with. “87. On ex-parte applications in probate causes and matters, a motion paper shall be lodged with the Probate Officer two clear days before the day on which such motion or application shall be moved or made, with an affidavit or affidavits of any facts to be brought under the notice of the Court in support of the same. The motion paper shall contain a short statement of the principal facts upon which the motion or application is grounded, and conclude with the terms in which the motion is to be made. This statement shall comprise no facts which are not supported by affidavit or official documents, and any rule made by the Probate Officer on the subject of the motion or application shall be mentioned in the motion paper. 88. Motion papers in probate causes and matters shall set forth the style and object of, and the names and descriptions of the parties to, the cause or proceeding before the Court, the proceedings already had in the cause, and the dates of the same, the prayer of the party on whose behalf the motion is made and briefly the circumstances on which it is founded. If the motion paper tendered is deficient in any of the above particulars, it shall not be received without the permission of the Probate Officer. On depositing the motion paper in the Probate Office, the affidavits in support of the motion and a copy of any testamentary paper writing therein referred to and, if required by the Probate Officer, any original documents referred to in such affidavits or to be referred to on the hearing of the motion shall also be left in the Probate Office; or in case such affidavits or documents have been already filed or deposited the same 45 shall be searched for, looked up, and deposited with the proper officer, to be sent with the motion paper to the Court. 89. (1) An appearance in matters to which this Order relates shall be entered in the Probate Office. (2) Every order of the Court in such matters shall be issued out of the Probate Office.” The rules also provide that the Motion Paper/Notice of Motion is to be lodged in the Probate Office and grounded upon affidavit(s) setting out the facts to be brought to the attention of the Court. Rule 89 of Order 79 provides for the entry of an appearance to the motion in the Probate Office and that the Order of the Court shall issue from the Probate Office. The Notice of Motion or Motion Paper is grounded upon an affidavit sworn by the person making the application to court. The grounding affidavit deposes to the accuracy of the facts set out in the recitals to the probate motion. The grounding affidavit will also exhibit all of the necessary evidence for the court such as death certificates, copy wills, medical records, the Inland Revenue affidavit and relevant correspondence. Probate motions and grounding affidavits are lodged in the Probate Office where the affidavits are filed and the motion issues and receives a return date when it will appear listed in the Probate List. The Probate Judge sits each Monday during term at 10.30 am and hears and determines non –contentious probate motions. Following the issue of the motion and the filing of the affidavit and exhibits the solicitor having carriage of the motion must serve the same upon the notice party (if any). An affidavit of service should thereafter be prepared and filed in the Probate Office. 46 The Probate Judge tends to have read the motion papers in advance of the Monday morning list and therefore the list progresses in a very efficient manner. CONCLUSION I hope that the paper has put some matters in context to make dealing with Caveats and rival applications more clear. While it is not possible to deal with every aspect of the complexities which arise in such matters, it was intended to set out the basic procedure both in the Probate Office and before the Probate Judge in the non-contentious probate list when dealing with these pre-grant issues. Rita Considine June 2011 47