Product Differentiation

advertisement

INDUSTRIAL ECONOMICS II

Prof. Davide Vannoni

Handout 3

Product Differentiation

Content of lecture and objectives

Part A: preliminaries

Motivation: relevance to (i) real world, (ii) other areas of academic IO

key dimensions and definitions

brief overview of the topic – main issues and development of ideas

Part B: detailed investigation of parts of the theory (a la Tirole)

Spatial competition – lines and circles

Monopolistic competition

Vertical differentiation

Suggested reading

Tirole J (1988) The Theory of Industrial Organization, MIT Press, ch 7, and section 2.1 of chapter 2

Church & Ware (2000) Industrial Organization: a Strategic Approach, McGraw-Hill, ch. 11

Other sources:

Martin S (2001), Advanced Industrial Economics, Blackwell, Oxford, chapter 4

Beath J & Katsoulacos (1991), The Economic Theory of Product Differentiation, Cambridge

University Press

Cabral L (2000), Introduction to Industrial Organization, MIT, chapter 12

1

Part A Preliminaries

I

Motivation – why important?

To introduce greater ‘realism’: in the real world, most products are not

homogeneous, they’re differentiated (variety of brands offered by firms).

Consider: beer, breakfast cereals, PCs, cars, supermarkets, newspapers; but, on

the other hand, sugar, salt, petrol, cement.

Within the academic literature, introducing differentiation into our models:

helps resolve the Bertrand paradox

helps our understanding of the sources of market power: are high prices due to

monopoly power & collusion, or due to very differentiated brands (with

considerable brand loyalty), or both?

provides underpinnings for econometric estimation of demand systems

provides insights for understanding determinants and evolution of market structure

is essential for understanding the likely impact of mergers between firms selling

substitute brands

2

II

Key dimensions and definitions

(i) terminology: for Tirole, the industry or market is the aggregate concept, with

individual firms selling different products. I prefer to refer to individual firms selling

different brands of the same product, e.g. Stella Artois or Guiness are brands of beer

(ii) horizontal or vertical? Think of a product as a bundle of characteristics: physical

attributes, quality, location, time, availability, etc.

In many cases, consumers have different tastes, (value characteristics

differently); if so, no objective way of saying brand A > brand B, they’re just

different. Even if both brands sell at same price, some consumers prefer A,

and some will prefer B (e.g. Brie and Parmesan): horizontal differentiation.

In other cases, all consumers have the same ranking of brands by quality – a

small fast PC is preferred to a large slow PC; a light bulb which lasts for 2

months preferred to one which lasts for 1 month. In these cases, if all brands

sold at the same price, all consumers would buy the same one – quality can be

objectively observed. This is vertical differentiation.

(iii) do brands compete locally or globally?

In a given market, are all brands

substitutes for all others, or do they merely compete with those brands which are

‘close’ to them? Consider beer, cigarettes, newspapers, restaurants, TV

3

III

Overview of the literature

Broadly speaking, there are three types of theoretical approach:

In one-dimensional spatial (address) models, competition is local: Hotelling

(linear); Salop (circular); Gabszewicz/Thisse (vertical). In these models, each

firm competes only with its immediate neighbours.

In global models, deriving from Chamberlin’s Monopolistic Competition

(developed by Spence and Dixit/Stiglitz), all brands compete with each other.

Intermediate models, based on the characteristics approach inspired by

Lancaster, in which brands compete in several different dimensions. As the

number of characteristics increase, so do the number of neighbours, and

competition becomes less local1.

Consumer Preferences: associated with any demand system, there is an underlying

model of consumer preferences. Models differ in assumptions about how many

brands consumers can purchase: tends to be only one in spatial models, giving rise

to the discrete choice approach; in global models, consumers buy more than one,

opening up an important real-world issue – consumer preferences for variety.

It can be argued that the characteristics approach is a generalisation: brands differ vertically in

their provision of any one characteristic, but horizontally in their combination of characteristics.

Consumers vary in weights they attach to different characteristics. So an encompassing approach.

1

4

Part B More detailed discussion, a la Tirole

0.

Fixed variety (non- address approach)

It allows to understand easily how differentiation helps resolving the Bertrand

Paradox.

We consider Cournot competition and Bertrand Competition in a duopoly in which

each firm manufactures a variety of a differentiated product.

Direct Demand functions:

q1 = D1(p1, p2)

q2 = D2(p1, p2)

Inverse Demand functions:

p1 = P1(q1, q2)

p2 = P2(q1, q2)

In the case of linear inverse demand functions:

p1= - q1 - q2

and

p2= - q2 - q1

with >0 and 2 > 2: the products are imperfect substitutes

The corresponding direct demand functions are:

q1= a - bp1 + cp2

and

q2= a - bp2 + cp1

with the following relationships between a,b,c and , ,

a = a/(+) ; b = /(2 - 2); c = /(2 - 2)

2 / 2 can be seen as a measure of the degree of differentiation:

High differentiation (low substitutability): 0; 20 (c 0) (independent products)

Low differentiation (high substitutability): 1; 22 (cb) (homog. products)

5

Price decisions (Bertrand)

Direct demand functions: q1= a - bp1 + cp2

and

q2= a - bp2 + cp1

Cost functions:

and

C2 (q2) = k q2

C1 (q1) = k q1

Objective functions:

Max 1= Max (p1– k) q1 ; Max 2=Max (p2– k)q2

p1

p1

p2

p2

Max 1= Max (p1– k) (a - bp1 + cp2)

p1

p1

First order conditions

Firm 1:

(a - bp1 + cp2) – b(p1– k) = 0

Firm 2:

(a - bp2 + cp1) – b(p2– k) = 0

Optimal Response Functions (Reaction functions)

p1=(a + bk + cp2)/2b ; p2=(a + bk + cp1) / 2b

Price is a positive function of the rival’s price. If one firm increases the price, the

rival would react by increasing its price. Prices are thus strategic complements

(Bulow, Geneakoplos, Klemperer, 1985).

a bK cP2

2b

a bK cP1

P2

2b

P1

P1

R2 (P1)

R1 (P2)

P*1

a bK

2b

a bK

2b

P*2

P2

6

p1*= p2* = p * = (a + bk)/(2b-c)

q1*= q2* = q * = [ab - bk(b-c)]/(2b-c)

by using the parameters of the inverse demand function:

p* = k + [( - )( - k)]/(2 - )

p*>k, thus we do not have the Bertrand paradox anymore

Thus i > 0,

with p* = f- () and i =f- ()

If = (homogeneous products) Bertrand paradox and i = 0

If =0 (independent products) p*=k+(-k)/2, as in Monopoly

Quantity Decisions (Cournot)

Inverse demand functions:

p1= - q1 - q2

and

Cost functions:

Ci (qi) = k qi ;

I=1,2

Objective functions:

p2= - q2 - q1

Max(-q1 - q2 )q1– kq1

yi

First order conditions

Firm 1: - 2q1 - q2 – k = 0

Firm 2: - 2q2 - q1 – k = 0

Optimal response functions: q1 = ( -q2 – k)/2 ;

q2 = ( -q1 – k)/2

Quantity is a negative function of the rival’s quantity. If firm 1 increases its quantity,

firm 2 reacts by reducing its output. Quantities are thus strategic substitutes.

The effect is lower with respect to the traditional Cournot model since <:

differentiation reduces rivality

q1*= q2* = q * = (-k) / (2+)

p* = [+k(+)]/(2 + )= k + (-k)/(2+)

= Cournot and =0 Monopoly

7

q1

K

2

Y1C

Y2C

K

2

q2

Issue that has not been addressed: how firm choose the degree of differentiation ?

I.

Horizontal differentiation: the spatial analogy (section 7.12)

Checklist of insights provided:

How the nature of competition differs from homogeneous products

Determinants of ‘market power’, once the Bertrand paradox is avoided

How firms choose to locate (or choice of product)

How many firms

How much variety

I.1

Hotelling’s ‘linear city’

(a) Basic assumptions

(i) The cost to the consumer of buying a particular brand is:

p + tx

2

See also pp. 97-9.

8

where x = distance to shop (or departure of the brand’s characteristics from the

consumer’s ideal) and t = transport cost per unit of length (or psychic costs of having

to consumer a brand which is not ideal.)3

If the consumer enjoys a surplus of S when he consumes, then his utility is

S – (p+tx)

(ii) There are two brands on offer: A and B (separate firms).

(iii) They are located at opposite ends of the city.

Define the distance between them as 1, and now think of x as the consumer’s distance

from brand A (and therefore 1-x from B). The consumer buys the brand which

generates the larger utility.

(b) Basic model, with fixed location

Assume that, in equilibrium, all consumers buy, and that both firms sell 4, then there is

a marginal consumer who is indifferent between the two brands. This is shown in

figure 1, from which we can derive:

the demand curves for each brand

the best response functions (from the first order conditions)

the equilibrium

Demand:

marginal consumer, located at x

so pA + tx = pB + t(1-x)

Utility

Figure 1

S-pA

S-pB

therefore x = {(pB - pA)/2t} + 1/2

S-pA-tx

S-pB-t(1-x)

If consumers distributed uniformly with

unit density, then demand curves are:

DA = x and DB = 1 – x

0

3

4

x

1

Tirole, on pp. 279/80 goes straight to quadratic transport costs. Initially, I set the model up with linear transport costs.

But see the diagrams on p.98 for where this is not true.

9

Best responses

A = (pA – cA). DA

A = (pA – cA). {(pB - pA)/2t + ½},

f.o.c =>

pA = (pB +c +t)/2

therefore upward sloping best response functions: the brands are strategic complements.

Equilibrium pA = pB = c +t

This equilibrium yields our first two important insights:

INSIGHT 1

the brands are strategic complements (cf Cournot homogeneous)

INSIGHT 2

prices are higher the larger is t. In this sense, the degree of

differentiation increases ‘market power’

(c) More general location (i.e. not necessarily at the end of the line)

Now assume that transport costs are quadratic, rather than linear. The results are

similar, but this proves to be a more convenient way of modelling location of brands.

(What do quadratic costs imply?)

Suppose that firm A is located at point a, and that firm B is at point (1-b).

Special cases:

if a=b=0, we have maximum differentiation (as before)

if a+b=1, there is minimal differentiation (both firms locate at the same point)

Again, we can proceed to derive the demand curves, best response functions and

equilibrium price:

10

Figure 2

Demand: marginal consumer defined by:

Utility

2

S-pA-t(x-a)2

2

pA + t(x-a) = pB + t(1-b-x)

S-pB-t(1-b-x)2

therefore, solving for x:

S-pA

S-pB

DA = x = {(pB - pA)/2t(1-a-b)} + (1-a-b)/2 +a

Best response:

As before, maximise A , giving:

pA = (pB + c)/2 + t/2(1-a-b).(1+a+b)

Equilibrium

Solve for interesection of best response curves:

a

x

1-b

pA = c + t(1-a-b). {1+(a-b)/3}

Conclusion: the two basic insights still hold: the equilibrium expression confirms that

price increases with t, and the best responses show that pA is positively related to pB.

HINT: Doing Tirole’s exercise 7.1 is a useful test of whether you’ve understood this!

(d) Endogenous location

But now let’s make things even more interesting (realistic), by allowing firms to

choose their locations, so as to optimise.

This now becomes a 2 stage game, in which firms choose location in stage 1 and then

price in stage 2. (Is this sequence reasonable?) It highlights a key point: brand

positioning is often a strategic variable.

Tirole provides the algebra for you to work through (sub-section 7.1.1.2).

Summarizing (new simbols: a and b are x1 and x2, z is x, pA and pB are P1 and P2):

D1 Z a

1a b

P2 P1

2

2t(1 a b)

a

0

D2 1 Z b

1a b

P1 P2

2

2t(1 a b)

1-a-b

X1

Z

11

b

X2

1

Which variety will be chosen by the two firms?

Maximal (x1 = 0; x2 = 1) or Minimum (0 x1 = x2 1) differentiation?

Second stage: choice of location

Firm 1’s profits

1a b

P2 P1

MAX P1 a

P1

2

2t(1 a b)

Firm 2’s profit

1a b

P1 P2

MAX P2 b

P2

2

2t(1 a b)

From the first order conditions (first derivatives w.r.t prices), one can get the best

response functions:

t 1 a b 1 a b

P1

2

t 1 b a 1 a b

P2

2

P2

2

P1

2

Solution of the system:

ba

P* 2 t 1 a b 1

3

ab

P *1 t 1 a b 1

3

Intuition:

Firms try to locate at the extremes so as to reduce price competition.

First stage: choice of the variety (locations a, b)

*

*

Firm 1: MAX P*1 a 1 a b P 2 P 1

a

Firm 2:

2

2t(1 a b)

1a b

P*1 P*2

MAX P*2 b

b

2

2t(1 a b)

1

t

ab

1

1 3a b 0

a

6

3

2

t

ba

1

1 3b a 0

b

6

3

12

Maximal differentiation

a

b

x1

x2

I want to emphasise the distinction between the demand effect and the strategic

effect. This comes about because where the firm chooses to locate (i.e. the value of a

chosen by firm 1) has two effects on its profits:

A direct (demand) effect – the closer you are to your rival, the more of his

demand you can steal.

A strategic effect: the closer you get, the tougher is price competition between

the two firms.

Algebraically, this is:

d1/da = (p1* - c) { D1/a + D1/pB*. pB*/a }

direct

strategic effect

effect (+)

(-)

So there’s a trade-off: the former effect makes firm 1 want to move closer to the

centre (this minimises the costs to consumers). But this will increase competition

with firm 2, and provoke a price reduction by firm 2, which thereby reduces demand

for firm 1. To avoid this latter (strategic) effect, firm 1 will want to move to the left.

Since it can be shown that the strategic effect dominates, we have:

INSIGHT 3

The two firms will locate at opposite ends of the line: MAXIMUM

DIFFERENTIATION

But is this optimal from society’s point of view?

13

INSIGHT 4

NO: optimal (in terms of minimising consumers’ transport costs)

if the firms locate at (0.25, 0.75): Therefore, the market

equilibrium involves TOO MUCH DIFFERENTIATION

P.S. Maximal or minimal differentiation?

How robust is the prediction of maximal differentiation? In reality, demand is not

uniformly distributed (shops and restaurants in historical town centres), there may

be agglomeration cost-saving effects (industrial districts, department stores), and

there may not be price competition (collusion and/or administered prices). Where

these variations occur, there may be forces moving brands to the centre.

Example: horizontal differentiation with exogenous prices (P1 = P2)

i)

Firms choose the same variety in order to maximize the demand

a

1-b

0

x1

z

x2

1

a

1-b

0

x1

z

x2

1

ii)

Which variety?

a

b

0

x1 = x2

0,5

1

If: a = 1 – b < 0,5

BOTH FIRMS TEND TO MOVE TO THE RIGHT.

14

In fact, for > 0 small enough

a

b

0

x2

x1

Firm 1 demand is:

0,5

1

b 1 a b 1

2

2

In the same vein, if a = 1 – b > 0,5 both firms have an incentive to move leftwards.

Thus, in equilibrium:

a

b

0

x1 = x2 = 0,5

1

Without price competition, firms offer ‘average’ varieties: political elections, TV

programs, and so on.

I.2

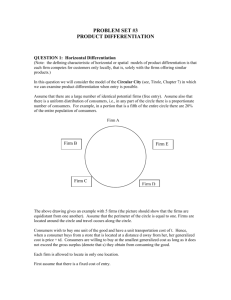

Salop’s circular model (section 7.1.2)

This allows us to analyse the possibility of entry and n>2. For this purpose, a circle is

better than a straight line5.

5

Because product space is now homogeneous – no location is a priori better than any other.

15

Assumptions

Mostly similar to the linear city (in terms of transport costs, distribution of consumers

etc). Crucially, however, we now assume that:

1. there are fixed costs (of say product development and marketing)

2. ‘free entry’ – as many firms are allowed into the market as are profitable

3. zero profits in equilibrium

Two stage game

Stage I

potential entrants simultaneously choose whether or not to enter (they

will be arranged equidistantly around the circle)

Stage II

actual entrants select price, given their location

Solution

Because firms are located symmetrically, we can look for an equilibrium where they

all charge the same price p.

n firms decide to enter, but each firm has only two competitors. If we define the

circumference of the circle as 1, then firms will be arrayed at intervals of 1/n.

Define the marginal consumer for firm i as located at distance x away. If he is to be

indifferent between firm i’s brand and the brand of its immediate competitor, it

follows that: pi + tx = p + t{(1/n)-x}

1/(2N)

P1

1/(2N)

X1

pN = p

p2 = p

1/N

XN

X2

X2

16

As before, this enables us to derive the demand curve for i: since demand for i’s

brand is 2x, solving for x from the above gives:

Di = 2x = {p + (t/n) – pi}/t

Inserting this, in turn, into i’s profit function gives:

Пi = (pi – c){p + (t/n) – pi}/t - F

Maximising with respect to price gives:

p = c + t/n

Notice the similarity with the linear model, except that:

INSIGHT 5:

Price is lower the larger is n: price is positively related to

concentration.

However, this is only an intermediate conclusion, in that n is, itself, endogenous.

Since this is a free entry equilibrium, firms will continue to enter until profits are

driven down to zero. Noting that each firm sells quantity 1/n, zero profits implies:

Π = (p-c) (1/n) – F = 0

and using the above expression for price:

i.e. t/n2 – F = 0

Thus n = (t/F)1/2 and p = c + (tF)1/2

INSIGHT 6

The number of firms (i.e. brands) will be higher the larger is t, and

the smaller are fixed costs

INSIGHT 7

Price will be higher the larger is t (as before), and the larger are

fixed costs. Discuss?

17

Is there too much variety?

From society’s point of view, there is

a benefit from more variety: it benefits consumers by reducing their transport

costs, or each consumer is better able to buy a brand which suits his taste, but

a cost from more variety: increasing the total fixed costs incurred in serving the

market.

It turns out (p. 284) that the socially optimal number of firms would be smaller than

this – there are too many firms (i.e. brands) in the market solution. This is because of

the trade diversion effect – with the entry of each extra firm, business is taken away

from rivals, but this externality is not reflected in the entry decision of each firm.

Extensions

See Tirole (p.285) on location choice, sequential entry, brand proliferation.

Or

Church & Ware on brand proliferation and brand specification.

Brand Proliferation (Schmalensee, 1978)

Entry deterrence strategy: incumbent produce different varieties in order to avoid to

leave market niches that could be profitably exploited by entrants (see lecture on

entry barriers).

The incumbent deters entry with a credible threat of continuing to sell the product

after the rival enters the market. Result: a few number of firms can divide the market,

by producing many different varieties, and avoid entry of new firms.

Examples:

Ready-to-Eat Cereals. Low economies of scale, low technology, entry should be easy

but from 1950 to 1980, four dominant firms (Kellogg, General Mills, Post, Quaker

Oats) and virtually no entry. In the 90’s, in USA: 200 different varieties of “Corn

Flakes”.

18

Office products. Supermarket chain Staples (USA) in the ’90 was trying to build a

critical mass of stores in the Northeast to shut out competitors…

“By Building these networks of stores in the big markets like New York and Boston

we have kept competitors out for a very, very long time”, Staples’ CEO, 1996.

Banking sector: The main banks open too many branches.

Restaurants: Too many fast foods in town centres.

Model: Incumbent moves first and potential entrant afterwards. There is no price

competition (only choice of location). There are fixed (and sunk) costs equal to F.

A) If the incumbent manufactures one variety only it locates at the centre, to leave

to entrant the lowest possible market share (50%):

B)

|______________|_____________|

0

½

1

If the incumbent manufactures two varieties he chooses the following locations:

|_________|__________________|_________|

0

¼

¾

1

to leave the potential entrant with the lowest market share: ¼.

Profits

In case a) i = ½ p - F and

e = ½ p – F

In case b) i = ¾ p - 2F and

e = ¼ p – F

Entrant does not enter if: (¼ p – F) < 0, that is if F > ¼ p

Is that worth to introduce two varieties in order to prevent entry?

If there is no entry: i (two varieties) = p - 2F

i (two varieties = p-2F > ½p – F = i (one variety)

The incumbent deters entry by selling two varieties if ¼ p < F < ½ p

1)

Without the entry menace, the incumbent would not introduce 2 varieties:

p – F > p-2F

19

2)

Without the presence of sunk costs, the incumbent would not credibly

threathen to impede entry (Judd, 1985)

i (one variety) = ½ p-F > i (two varieties) = ¾ p – 2F if ¼ p < F F > ¼ p

Exercise.

Market of size M=1; Price is exogenous and equal to 1; Fixed cost F=3/8

Two stage game: in the first stage the incumbent chooses how many and which

variety to introduce; in the second stage the entrant observes the incumbents’

decisions and decides to enter or not.

1)

If the incumbent produces one variety, the entrant enters:

yi =ye = ½ and i = e = ½ p – F = ½ - 3/8 = 1/8

2) If the incumbent produces two varieties, the entrant does not enter:

yi = ¾ ; ye = ¼

e = ¼ p – F = ¼ - 3/8 = - 1/8 and i = p – 2F = 1 - 2(3/8) = ¼

3) If fixed costs are not sunk, the menace is not credible and the incumbent should

not introduce a second variety:

i (one variety) = ½ -3/8 = 1/8 > i (two varieties) = ¾ – 2(3/8) = 0

e (1) = ½ -3/8 = 1/8

II

Horizontal differentiation: Monopolistic competition

Chamberlin – each firm faces a downward sloping demand curve (as in monopoly),

but there is free entry (as in perfect competition). No strategic effects, in that a price

change by any one firm has equal (negligible) effects on the demands for all other

firms. (Global competition, as opposed to the above local competition)

SEE APPENDIX FOR QUICK RESUME OF BASIC MODEL

Tirole’s main-text comments (p.288) are addressed almost exclusively to questioning

the famous excess capacity result. This leads on to the question of whether or not the

20

market generates socially too few or too many firms (brands). In principle, there are

two opposing effects:

Non-appropriability of social surplus – because each firm faces a downward

sloping demand curve, it sets p>MC and so the sum of consumer and producer

surplus is not maximised. In turn, this implies that some brands will not be

produced (because the firm can’t cover its fixed cost) even although it ‘should

be’ (because consumers would have received sufficient surplus to more than

offset that fixed cost, i.e. they could pay the firm to produce and still receive a

net surplus.)

Business stealing effects: each new brand steals custom away from existing

brands – this loss of income for rivals is not taken into account by the entrant,

so the social cost > private cost.

In general, we can’t say which effect will dominate.

But see C&W p. 374:

insufficient diversity when product differentiation ‘strong’.

See also Tirole’s

Appendix, (in which he develops the analysis, using the Spence/Dixit-Stiglitz

formalisation of monopolistic competition.)

This generates a prediction for price: price is higher, the less substitutable are the

brands. The model can also be used to derive firm numbers (variety). This allows

comparisons with what would be socially optimal, using the Utility function (see pp.

299-300).

III

Vertical differentiation (pp. 96/7 and section 7.5.1, or C&W, section 11.6)

Model 1 (Based on Gabsewicz & Thisse)

For the individual consumer, if he consumes 1 unit,

U = s – p

where s measures ‘quality’ of brand and reflects consumer’s taste for quality.

21

With only 1 brand on offer, the consumer buys if :

s > p that is > p/s

In the market as a whole, suppose that is uniformly distributed across consumers6

with density 1. It has upper and lower limits as follows:

U > > L, where U = L +1 and L > 0

Competition between brands

Now suppose 2 different brands (firms), where brand B has higher quality, i.e.

sB > sA

Suppose all consumers buy 1 unit of one of the brands. The marginal consumer is

defined by:

*sA - pA = *sB - pB, i.e. * = (pA -pB)/(sA - sB)

Then demand for brand A is given by:

DA = * - L = {(pB-pA)/} - L

DB = U - * = -{(pB-pA)/} + U

where = sB - sA , the quality differential. (High consumers buy B)

and something similar for B.

Best responses

Substitute this expression for demand into the profit function and maximise to give:

pA = (pB+c- L)/2

pB = (pA+c+ U)/2

where c denotes the constant marginal cost

22

Solving for the equilibrium,

pA = c + {(U - 2L)/3}.

and

pB = c + {(2U - L)/3}.

A = (U - 2L)2/9

and

B = (2U - L)2/9

It can be seen (or easily shown) that:

the brands are strategic complements

high quality firm (B) charges higher price and earns higher profits

price cost margins disappear as the extent of differentiation () declines

(compare with horizontal)

Brand choice/location

Now suppose that firms can choose quality. This sets up a two stage game, in which

firms first choose quality, then price.

Obviously, they will want to differentiate (not choose the same s). Initially, assume

that quality is costless for the firm. Here, they will choose the most extreme values

consistent with the market being covered.

Again therefore, we have maximum

differentiation, for the same reasons as before (to soften competition.)

In a simultaneous move game, it’s arbitrary which firm is high quality. In a

sequential game, the first mover would be high quality. But what if there is a race to

be first…? There have been a number of interesting developments to these models,

including various important insights into how market structure evolves over time in

markets where firms compete (via R&D and advertising) to increase consumers’

willingness to pay.

6

Alternatively, we can assume that consumers are distributed by income.

23

Model 2 (Based on Shaked & Sutton)

There exist n firms each with a product of quality uk (labelled so that u1>u2>…>un)

and a price pk

There exists a continuum of consumers with identical tastes but different incomes t. t

is uniformly distributed with density S (S=size of the market) on a support [a,b], with

a>0.

Consumers buy one unit of the good (the market is covered), and have utility

U(t,k)=uk (t-pk)

The game

1. Firms decide on entry (fixed cost >0)

2. They decide on quality of the good

3. They decide prices and sell (zero marginal costs)

Proposition: If b<2a, only one firm will enter the industry at equilibrium (whatever S)

(As income becomes less concentrated, more firms can enter; e.g., if 2a<b<4a, two

firms will enter at equilibrium. Generally, the number of firms which coexist

at equilibrium is finite even as S goes to infinity)

Proof of the proposition

We show that two firms cannot co-exist at equilibrium. Firms’ demand is derived by

finding the consumer indifferent between the two qualities:

From: u1 (t-p1) ≥ u2 (t-p2), we obtain:

t t12 ( p1 , p2 , u1 , u 2 )

u1 p1 u 2 p2

u1 u 2

All consumers with income t ≥t12 will buy 1, all others will buy 2. Therefore:

q1 = b-t12 ; q2 = t12-a

Profits can be written as:

u p u 2 p2

p1

1 b 1 1

u

u

1

2

u p u 2 p2

2 1 1

a p2

u1 u2

By setting dΠi/dpi=0 we obtain the best reply functions:

24

R1 : p1

b(u1 u 2 ) u 2 p2

2u1

R2 : p1

a(u1 u 2 ) 2u 2 p2

u1

Equilibrium prices are given by:

p1

(2b a)(u1 u 2 )

3u1

p2

(b 2a )(u1 u 2 )

3u 2

Therefore, if b<2a there exists no equilibrium with positive p2, and firm 2 will not

enter the industry.

Equilibrium, when b>2a

25

Generalisation

The finiteness property holds if the cost of producing a higher quality does not fall

upon variable costs. It holds across a number of different specifications (see e.g.,

Shaked-Sutton, 1987)

Sutton (1991): Endogenous Sunk costs and market structure: Advertising

Sutton (1991) puts the result to an empirical test. It shows that in advertisingintensive industries as S increases the industry does not become fragmented.

Advertising is an endogenous sunk cost:

- endogenous because, differently from set-up costs, is a variable that can

be chosen by the firm

- sunk, because, after having undertaken the investment, it cannot be

recovered

1/N

1/N

(i)

(ii)

(iii)

size

Endogenous sunk costs

size

Exogenous sunk costs

(i) high exogenous sunk costs w.r.t endogenous sunk cost

(ii) intermediate exogenous sunk costs w.r.t endogenous sunk cost

(iii) low exogenous sunk costs w.r.t endogenous sunk cost

While in free-entry models with homogenous or horizontally differentiated

products but with exogenous sunk costs concentration (1/N) has a lower bound

26

that goes down to zero as market size increases, in models with vertically

differentiated products and with endogenous sunk costs concentration has a

lower bound that does not go to zero as size increases

Intuition: there is a competitive escalation in advertising such that, if the size of

the market is sufficiently large, firms that invest aggressively gain increasing

market shares

The logic of the bound approach, that is the existence of a limit to concentration

(which can go to zero or not) as size increases clashes with the view of those who

maintain that “anything can happen in oligopoly”. We must look for some robust

results that do not depend on the specific assumptions of a model (price versus

quantity competition, homogeneous versus differentiated goods, simultaneous

versus sequential games, and so on).

Sutton (1998): Technology and market structure

Why in some high R&D industries concentration is high while in other

concentration remains low?

Entrant spend an amount K to obtain a profit equal to a Y, where Y is the amount

of sales in the previous period.

α= a/K is the escalation parameter

high α: by investing K the entrant can obtain high profits

low α: by investing K the entrant cannot obtain high profits

In high- α industries there is high R&D investment and concentration increases,

while in low- α industries concentration does not increase.

27

Examples of high- α industries: where there is high substitutability (camera tapes

after technological change, telecommunication equipment after opening to the

global market, aircraft industry)

Examples of low- α industries: low substitutability and products fill different niche

positions (flowmeters and measurement instruments, pharmaceutical industry)

Sutton (1991) puts the result to an empirical test. It shows that in advertising-

Appendix on Monopolistic Competition

Review of monopoly & perfect competition

Monopoly

Perfect competition

one seller

many sellers

many buyers

many buyers

homogeneous product (no substitutes)

homogeneous product

price setter

price takers

no entry

free entry

Outcome

Price is higher, and quantity is lower under monopoly than under perfect competition

£

Figure 1 monopoly and perfect competition revisited

MC

monopoly

perfect

competition

MR

Demand

Quantity

28

Monopolistic competition Chamberlin & Robinson pre-war.

Main assumptions

In common with monopoly, each firm produces its own differentiated product. Other firms’

products are similar, but not identical. The individual firm therefore has its own downward

sloping demand curve.

In common with perfect competition, there are a large number of firms in the market as a

whole. There is also free exit and entry.

Outcomes:

The individual firm sets MR = MC (as in monopoly). In the short-run, this may imply

P>AC, in which case the firm makes a profit (as in monopoly).

However, this profit signal will attract the entry of new firms into the market. This

will impact negatively on the firm’s demand curve (the entrants will capture some of

the firm’s existing customers.) Diagrammatically, this shifts the demand curve (&

MR) inwards until the profits are dissipated. At that point, no further entry occurs 7.

The long-run zero profit outcome has been attained (as in perfect competition).

One big difference from perfect competition is that, in long-run equilibrium, firms are

not operating at the bottom of their AC curves. They are producing sub-optimally.

The famous excess capacity result.

In terms of welfare, there is a trade-off. Since P>MC, there is allocative inefficiency consumers pay more than the social costs of production. On the other hand, this

market structure provides the variety which is lacking under perfect competition.

Modern research in this area has looked at whether monopolistic competition provides

too much or too little product variety (compared to what would be provided by a

social planner who takes into account the utility that consumers derive from variety

per se.)

7.

How does this match with real world industries in which products are differentiated?

The reverse is true if firms are making a loss in the short-run.

29

Figure 2 monopolistic competition: short-run

£

MC

AC

profits

(short-run)

MR

Demand

Quantity

Figure 3 monopolistic competition: long-run

£

MC

AC

demand

curve

shifted inwards by

new entry. Squeezes

profits out

MR

Quantity

30