Generalized Economics of Exchange Rates and Policy Options

advertisement

Generalized Economics of Exchange Rates and Policy Options:

Empirical Evidence

Hsieh Hsih-chia and Hsieh Pei-gin

Providence University

9,Alley 24, Lane 52

Shih-wey Rd.

Taipei,Taiwan

Fax 886-2-27056893

Case Western Reserve University,

Department of Accountancy,

Cleveland, Ohio 44106,

U.S.A.

pxh29@po.cwru.edu

Abstract

The minmax solution of foreign exchange rates is a consistent efficiency test for

micro and macro efficiency. Deviations from the competitive equilibrium lead to

persistent devaluation and output declines. The optimal fiscal and monetary policy is

estimated with a minimum and shrinking variance of errors. The necessary and

sufficient Lagrange multiplier, nonlinear stability, and convergence probability are

defined. A family of evolution equations yields the minmax solution, which is

equilibrium level of outcomes to be evaluated, when the response coefficient of

strategies alternates in sign around the equilibrium. The larger the conditional

convergence probability is, the steeper the wave curvature of the objective welfare

and asset allocation would be, and the faster the convergence time is. Beyond the

equilibrium, the positive sign of coefficient synergy tends to blow up and becomes

transformed into a negative response. Thus we solve the optimization problem at all

horizons and times. The Lagrange multiplier is a coordinator and indicates the

evolution direction and the convergence probability towards the stable equilibrium.

The generalized solution is found consistent with real data and satisfies the equality

and inequality constraints of resources, when resources are potential rather than

constant.

Keywords: Efficiency test of real exchange rates; Second-order and fourth-order

dimensions. Micro-macro; General equilibrium in a continuous sense; conditional

convergence probability; time-consistent strategy; wave and evolution equations.

JEL Classification F31;D82; E4; E5.

AMS subject classification. primary: 53C25; secondary: 65L06, 65M20

1

1. Introduction

In this paper, we resolve contradictory theories. Devaluation promotes exports

but can either reduce or raise output growth. Similarly, foreign debt is capital but also

may lead to currency crisis(Hausmann, et al. (2003). The Keynesian and monetarists

find a positive correlation between output and price levels (Almonacid, et al. 2003).

We find the competitive equilibrium whereby the output growth and inflation rate turn

from a positive into a negative relationship. In the autoregression of exchange rates

and output, the second-order autoregressive coefficients changes in sign over time

around the equilibrium. Suppose that the cost function is convex-up, and that the

marginal revenue is declining. The price-takers of the firms perform better than its

rivals, when the observations converge toward the maximum equilibrium profits such

that the price equals the marginal costs. The efficiency test implies that the real

exchange rate is equal to the purchasing power parity.

In macroeconomics, when the output growth serves as the dependent variable,

the cross-section data show that education spending has a positive impact upon output

growth, while the time-series data show that education spending has a negative

impact(Yang, 2003). Although an increase in government spending can raise output,

the increase in tax revenue tends to reduce output. The Keynesian counter-cyclical

policy is assumed to have a positive stabilization impact upon output and effective

demand. A large variance of government spending, however, has negative impacts

upon output growth(Fatas, et al. 2003). We find that the optimal policy is the ratio of

government spending to output and denotes the minmax solution, where the

equilibrium is stable and has the minimum and shrinking variance. Thus, output

2

growth and profits are maximized and the variance of disturbances is minimized.

Empirically, international assistance to the developing countries is focused to debt

concessions, food, drugs, and cloths for short periods of survival. Many African

people, however, do not know how to use the movie for mass education and to utilize

the machinery for self subsistance. Lack of education, infrastructure, democratic

voting or referendum leads to persistence of wars and strife. When the volatility of

policy deviates from the maximum equilibrium, it has a negative impact upon output;

and vice versa. We solve a welfare function as the minmax solution, which is

equilibrium level of outcomes to be evaluated, when the response coefficient of

strategies alternates in sign around the equilibrium. The minmax solution serves a

consistent efficiency test for micro and macro efficiency.

Section 2 presents a general model of foreign exchange rate economics.

Section 3 illustrates examples. Section 4 concludes with remarks.

2. The Model

Following Hsieh(2003), suppose x(t)=F(x(t-1), u(t-1), t) is the welfare function

of exchange rates. x is the state variable or exchange rates; u is the control policy; t is

time. The generalized solution of the law of motion of exchange rate is

Step 1: Estimate the equilibrium x* and the optimal policy u**:

(2.12)

min max

x

n

t 1

v2(t)

p(x)=exp(dx/dt)= 0 + 1 x(t-1)+ 2 x2 (t-1) + 3 u(t-1)+ 4 u2 (t-1)+v(t)

p(x) is the convergence probability and denotes the value of policy options.

x*=max(log Y*(t)-logY(t), 0)

where x* is the value of

optimal policy options and outcomes or competitive

equilibrium. Y(t) is the market output; Y* is the strike price or the exercise price,

3

which is the maximum likelihood estimator and the almost uniformly most powerful

unbiased estimator as well as the minmax solution, when the welfare function F(x,u,t)

is nonsmooth and nondifferentiable . u* is optimal policy or the incentive.

Step 2: The heteroschedascity of errors is reduced into homoschedasticity:

p(x)= exp( x(t))=

t*

t 0

f ( x(t ), u(t ) )dt

= 2 (x(t-1)-x*)2 + 4 (u(t-1)-u**)2 + 5 (x(t-1)-x*)(u(t-1)-u**)2

+ 6 ( x(t-1)) + 7 x(t-2)+v(t)

where 1 , 2 , 3 , 4 , … are parameters and can be trqnsformed into Lagrangian

multipliers of constraints, such as 2 (x(t-1)-x*)2=0. The equilibrium is x*=- 1 /2 2 ;

the optimal policy is u**=- 3 /2 4 . The interactive response 5 may be negatively or

positively switching and stabilize the equilibrium x*. 6 and 7 denote time-delay

responses of the state variable.

3. Examples

Example 1 on convergence probability to the competitive equilibrium at infinite

horizons. From the generalized solution, we detect the distorted magnified impact of

misleading policy upon the welfare and firms’ value, lim F(x(u(n),n))= lim

n

n

n

1

F(x(t), t)exp(xt). Non-uniqueness implies that multiple equilibria comprise the upper

and the lower bound of output and foreign exchange rates.

To maximize the welfare, Hsieh(2003) solves the puzzle of the shadow cost,

which is the unique equilibrium. When the minmax solution for country A is equal to

the maxmin solution for country B. The maximum solution is determined by the

non-Ricardian fiscal budget inequality and by the Ricardian monetary equality of

budget constraints.

4

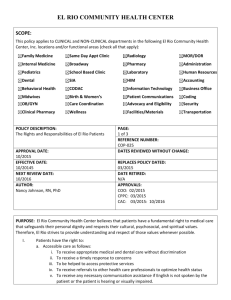

Fig. 1 The maxmin solution in Concave Functions

demand curve

Output Growth

supply curve

x*,q*=1

momentum

contrarian

b1 0

t t*

0

b2 0

t*=t**

t t*

u**

Optimal policy

P/P( t * )

M(t*)/M(t*)

q*=1

price inflation

Growth of money supply or cash flow

real exchange rates

equal the purchasing power parity

In the short-run

In the long-run

As in Figure 1, x is output growth; u is control policies, such as the inflation rate,

fiscal and monetary policy. t is time. When the policy of , say, prices falls below the

equilibrium price, u<u**, the convergence probability also falls below the

Pareto-improving probability, p p * =1 and q*=1. Investors expect the prices to

revert to the equilibrium and buy the stocks and foreign currency; this is the

contrarian strategy for the long run, if the central bank will increase the money supply

and decreases the interest rate towards the optimal rate. During recovery, by use of the

futures contract and momentum strategy, the investors buy the prior winners, sell the

losers, and expect the prices to rise and revert to the equilibrium price. Thus, the

maxmin or minmax solution (x*, u**) is

stabilized by investors and central banks.

Example 2: The foreign exchange rate q*=1 equals the purchasing power parity.

5

This minmax solution is equal to the maxmin solution, when the first-order coefficient

is

1 >0 and the second one is 2 0. The instability is indicated by the

insignificant second-order derivative. Without intervention, the floating real exchange

rate is the competitive equilibrium, and is robust to time-varying parameters.

Suppose q(t)=F(q(t-1), t).

2F/ t q(t-1)= 1 >0. Beyond the equilibrium,

3F/ t q2(t-1)= 2 <0 if q(t-1)>q*=1. Below the equilibrium, 3F/ t q2(t-1)=

2 >0 if q(t-1)<q*=1. q is the real exchange rate of U.K. pound per US dollar, which is

adjusted by the value-added price deflators. The quarterly data of the real exchange

rate over 1978.1 to 1996.4 are used, as reported by International Financial Statistics.

Suppose t denotes time or quarters.

Our unique equilibrium of the real

exchange rate, q*=1, is estimated as follows:

q=q(t)-q(t-1)= 0 +( 1 - 1)q(t-1) + 2 q2(t-1)

=-0.17+0.46q(t-1)-0.23q2(t-1)+v3(t)

(0.8) (3.38)

(1.2)

= -0.23(q(t-1) - (0.46)/2(0.23))2+ v3(t)

(4.8)

for q*=1.0

R 2=0.8; D.W.=1.71

where Student t statistics are in the underlying parentheses. It is noteworthy that the

Dickey-Fuller test is applicable for the linear model.

By treating (q(t-1) - 1)2 as

one explanatory variable, we need to reestimate the nonlinear model. The coefficient

of determination is R 2=0.88.

The Dickey Fuller(DF) t test is t=1.92. The

constant intercept is statistically insignificant. Our dynamic quadratic regression,

however, provides the unique stable prediction, q*=1, for the nonstationary difference.

Our solution converges to the equilibrium E(q)=1, which is robust to time-varying

parameters (t), while the chaos model provides multiple solutions, depending on

the initial values and noises.

6

Remark: Andrews(1993, p.153) shows that the half life of an unit shock is

log(1/2)/log( ) and denotes the speed of adjustment of perturbations, where x(t)=

x(t-1)+v(t). Our maximum x*=F(x2) corresponds to Andrews’ (1993) median of the

variable x(t) due to his lack of the optimal-control context.

In the equation of foreign exchange rate, the convergence probability is

R 2=0.8. The convergence rate is =0.93 1+ 1 . t=1/ 1 =1/0.46=2 years is the

half life speed of adjustment of an unit shock.

lim 1 = /2=1/2 0.46,

t t *

where

dq/dt= 0 + 1 q(t-1)+ 2 q2(t-1+v(t).

Suppose q*(0)=q(t)exp(-xt)+O(1/xt2)=1;

where x is the convergence rate. log p=log (1/2)=tlog x. t=log (1/2)/x* is the

half-life time of adjustment by 50 percent towards the purchasing power parity.

p(x*)=exp x(t)= 2 (t- t*)2+ 4 (x(t-1) – x*(t-1))2+v(t)

for 0 t t*=- 1 /2 2 ; x*=- 3 /2 4 .

where t* is the convergence time. 0 t t*<n. n is the sample size.

p(x*)=1= 2 tt*=- 2 t(- 1 /2 2 )= t( 1 /2)

t= (2/ 1 )=2/0.46=4 years, denoting the one life ( or time) of the maximum distance of

q(t) from the purchasing power parity q*(0)=1. In contrast, Murray(2002) shows

three to five years, and others find that about two years is the half-life distance of the

real exchange rate converges to the purchasing power parity.

Example 3: Exchange Rates and Monetary and Fiscal Policy

The foreign exchange rate is determined by the share of real money balances and

that of the government spending in output.

Such monetary and fiscal policies

dominate the effects of output fluctuations, net exports, and capital flows(Hsieh,

2003b). Suppose S is the market nominal exchange rate of pounds per U.S. dollar.

Dynamic quadratic regression is estimated as:

7

S(t)=-1.33+0.64S(t-1)+10.17M(t-1)/P(t-1)Y(t-1) –15.51(M(t-1)/P(t-1)Y(t-1))2

(-1.33) (4.66)

R2=0.89

(1.89)

(-1.57)

R 2=0.88; D.W.=1.60 1st order autocor.=0.17

where the values in the parentheses are t statistic. Below the optimum,

(M/PY)**=-10.17/(2)(-15.51) 30%, an increase in money supply denotes the credit

capital in advance,

tends to increase output, and leads to the appreciation of

domestic currency.

dS(t)/dt=133.23+0.48S(t-1)-19.40(M(t-1)/P(t-1)Y(t-1) –0.30)2

(1.74)

(3.49)

(2.00)

(1.38)

+0.08(G(t-1)/Y(t-1) – 27%)2

(2.72)

R2=0.33

R 2=0.24; D.W.=1.85 1st order autocor.=0.057

where dS(t)/dt=133.23+0.48S(t-1)=0.48(S(t)-2.5), implying that the non-homogenous

solution is the equilibrium exchange rate, S=2.5 pounds per U.S. dollar. 6 =0.08>0

implies that the flexibility and volatility of government spending has a positive impact

upon the appreciation of the U.S. dollar.

Remark: In simulations we test the alternative money supply, either M/PY=40% or

24%. These alternative performances become statistically insignificant,

have a

lower convergence probability, and cannot shift the trend of the U.S. dollar

depreciation. In 1965-2001, the Japanese Yen currency has a long-term and large

swing. The U.S. dollar has a long-term trend of depreciation. The market exchange

rate of British pounds per dollar continues to appreciate from 2.80 pounds in 1965 to

1.15 pounds per U.S. dollar in 2001.

Table 1: The crowding-out effect and turning points in the United States

____________________________________________________________________

The dependent variable

Investment rate I/Y:

8

(I/Y)/ (G/Y)<0 if G/Y>10%;

(I/Y)/ (T/Y)<0 if T/Y>24%;

Consumption ratio C/Y:

(C/Y)/ (T/Y)<0 if T/Y>37%;

Government spending share G/Y:

(G/Y)/ (M/PY)<0 if G/Y>37%;

_________________________________________________________________

Notations: I is investment; Y is output; G is government spending; T is tax revenues;

M is money supply; P is the GDP price deflator.

Note:In the steady state, if the government spending share exceeds 24%, the

consumption share is maximized but the investment share is crowded out. The

consumption share is C/Y=1-(I/Y)-(G/Y)=100%-1%-23%=76%, if G/Y=23% and

I/Y=1%. The optimum income tax rate is around T/Y=17% i.e., ((37%+10%)/2),

while government spending switches between 10%<G/Y<37%.

Example 4: Output, Inflation Rate, and Monetary Policy

Contractionary monetary policy leads to declines in output growth and

depreciation within two years in 2001-2002 in Taiwan and in 1929-1932 in the United

States.

In the equation of monetary growth upon output growth in Taiwan,

x(t)=19.5+0.63 x(t-1)-0.413 x(t-2)-0.089( M/M(t))- 8%)2

(2.98) (5.73)

(-4.03)

(-3.02)

+1.07(x(t)-9%)( P/P(t))-3%)2+0.013(x(t)-9%)( M/M(t))-8%)2

(5.20)

(3.10)

2 =0.71;

=0.69;

n=76; D.W.=2.20;

(3.2)

1st order autocorrelation =-0.10.

where, below the optimum inflation P/P(t)=3%, as the growth rate of money

supply M/M(t) decreases, output growth x(t) declines. Money growth, inflation,

and output growth are positively related.

The convergence probability is 2 =0.71. The speed of adjustment to

perturbations is =0.63 and 1+ 1 does not always hold for output growth

x(t), while 1 =10.30, where it is assumed that x(t)/ x(t-1)= and

x(t)= 1 x(t).

Suppose x(t)/ x(t-1)= =1/2 denotes a half-life convergence probability

9

of fifty percent after perturbations and suppose that x(t)/ x(t-1)= .

t

life probability implies

The half

0< lim 1 = /2 <1

t t *

The cumulative convergence probability is p= (x(t)/ x(t-1))= 1, as

t

t . We estimate the convergence probability, p=exp(dx/dt), and the convergence

rate, x. The convergence time is

t={log(Y(t)/Y(0))}/x

for x*=- 1 /2 2 and Y(t)=Y(0)exp(xt).

p=exp(dx/dt)= 2 (t-t*)2= 2 t(- 1 /2 2 )= t(- 1 /2)

for 0 t t* x(t*)

where t=p(-2/ 1 )=(1/2)( -2/ 1 )=1/ 1 is an approximate half life, p=1/2, of a unit

shock when the state variable x(t) converges to the equilibrium x*, time t also

converges to t* but has no independent explanatory power.

For the half-life speed of adjustment, t =log(1/2)/ log(1/2)/log(1+ 1 )

= -0.69 /0.63 1 year. The monetary impact is lim 1 = /2=2.00/2 1; and t=

t t *

1/ 1 =1 year is half life of an unit shock after monetary perturbations in the sense of

x dlogY/dt dlogM/dt, denoting the incentive-compatible equivalence. Our

convergence acceleration implies that

x(t)/x(t-1)= 1 =10.30 and that delay time

is t=1/ 1 =1/10.30=0.1 a year and denotes a half life cycle of adjustment speed. Thus,

when the inflation falls below the optimal inflation, the monetary contraction is a

significant cause for depression with various delay times between one month and one

year.

5. Concluding Remarks

The contribution of this paper is an efficiency test of real exchange rate regimes

10

through the second-order Lagrangian multiplier, nonlinear stability of sign, and

convergence probability. We test the stability of the general competitive equilibrium

in a continuous sense, when the equilibrium is

optimal policy

incentive-compatible with the

in according with the conditional convergence probability. The

first-order solution, positive, or negative, may be misleading, when inequality

constraints imply that resources are underutilized or potential and can be

Pareto-improving. The control variable also indicates the location. The minmax

solution is the equilibrium, where the (individual) firms minimize the welfare loss,

and when the (aggregate) central bank maximizes the social welfare. The positive ( or

negative) sign of the first-order coefficient of the welfare function is not instable but

denotes the maxmin or minmax solution.

When Lagrange uses the first-order negative coefficient to obtain the negative

solution, the Lagrangian multiplier is a show cost. We transform the Lagrange

multiplier into an equilibrium price, which comprise the first-order and the

second-order coefficients. We compare the equilibrium levels, which is attained by

various strategies under evaluation, when there do not coexist the positive and

negative impacts and the supply and demand curves. Beyond (or below) the

equilibrium, the central banks may contract (or expand) the money supply, when

output growth declined due to high or low inflation. The macro policy is

incentive-compatible with micro investment strategies, which otherwise may fail to

revert to the positive equilibrium or the fair value. In the concave domain, beyond (or

below) the equilibrium, the uncertainty of expansionary policy has a negative (or

positive) coefficient impact upon output. The performance is measured through

convergence probability, is indicated by the coefficient of determination and estimated

by

dynamic quadratic regression. An example illustrates the coexistence of the

(Ricardian) identity, which becomes the (non-Ricardian) inequality at disequilibrium

11

of budget constraints.

Note:Consider the position vector of spiral waves which is a nonlinear equation:

x=F(x,u)={cos (i,t)x+sin (i,t)u}{-sin (i,t)x+cos (i,t)u}

where 0< <90o denotes the tangent angle of the position vector F(x,u). x is

a

tangent vector; u is a normal vector. In linear models, the Hessian matrix H(x) implies

that when the second-order derivative

maximum, x*= min max F(x,u),

du

x

cofficient is negative, the solution x* is

if 2 2F(x(t),u(t))/ x2<0. In our nonlinear

models, the solution is a minmax one when there is the same sign for the first-order

coefficient of state variable and that third order coefficient of the policy. The solution

may be maximal or minimal; depending upon the second-order coefficient,

2F(x(t),u(t))/ u2<0 or 2F(x(t),u(t))/ x u>0. The same maximum is attained

according to the envelope theorem, when the time first-order derivative is positive,

F(x(t),u(t))/ t >0, and 2F(x(t),u(t))/ t logY= F(x(t),u(t))/ x>0

if

dlogY/dt x(t). Thus a common optimal policy holds for the output growth and for

output levels.

References

Almonacid, R., (2003):”The determinants of nominal income, output and the price

level: A synthesis of the Keynesian and neo-classical views,” Journal of

International Money and Finance, 22, 747-772.

Andrews,

D.W.,

(1993):”Exactly-unbaised

estimation

of

first-order

autoregressive/unit root models,” Econometrica, 61(1), 139-165.

Andrews D. W. K., (2003) ”End-of-sample instability tests,” Econometrica, 71(6),

1661-1694.

12

Fatas, A., and I. Mihov, (2003):”The Case for Restricting Fiscal

Policy

Discretion,” Quarterly Journal of Economics, November, 1419-1445.

Hausmann R. and U. Panizza, (2003):”On the determinants of Original Sin: an

empirical investigation,” Journal of International Money and Finance, 22,

957-990.

Hsih-chia Hsieh, (2003):”Unemployment rates and optimal money supply”

Asia-Pacific Management Review, 8(4), December, 433-459.

Hsih-chia Hsieh, (2003):”The Uniformly Consistent Most Powerful Unbiased Test”

Constructing and Applying Objective Functions, 2001, University of Hagen,

Germany, Berlin, Heidelberg, Volume 510, p.460-469. ISBN 30540-42669-8.

Spring Verlag Publisher.

Hsih-chia Hsieh, (2003) ”Equilibrium, Optimal Policy and Convergence Probability:

Dynamic Quadratic Regression,” Unpublished Book, The Econometric Society,

2003.

Yang H. L.,(2003):”Government education spending, labor supply, fertility, and

economic growth,” Proceeding of The conference on open economy and

macroeconometrics,

October 23-24, 2003, Academia Sinica.

13