1. The Problem of Seasonal Products

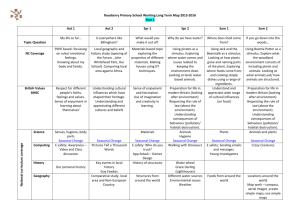

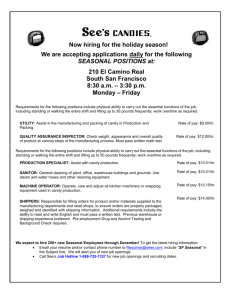

advertisement