Forecasting economic time series involves constructing a model

advertisement

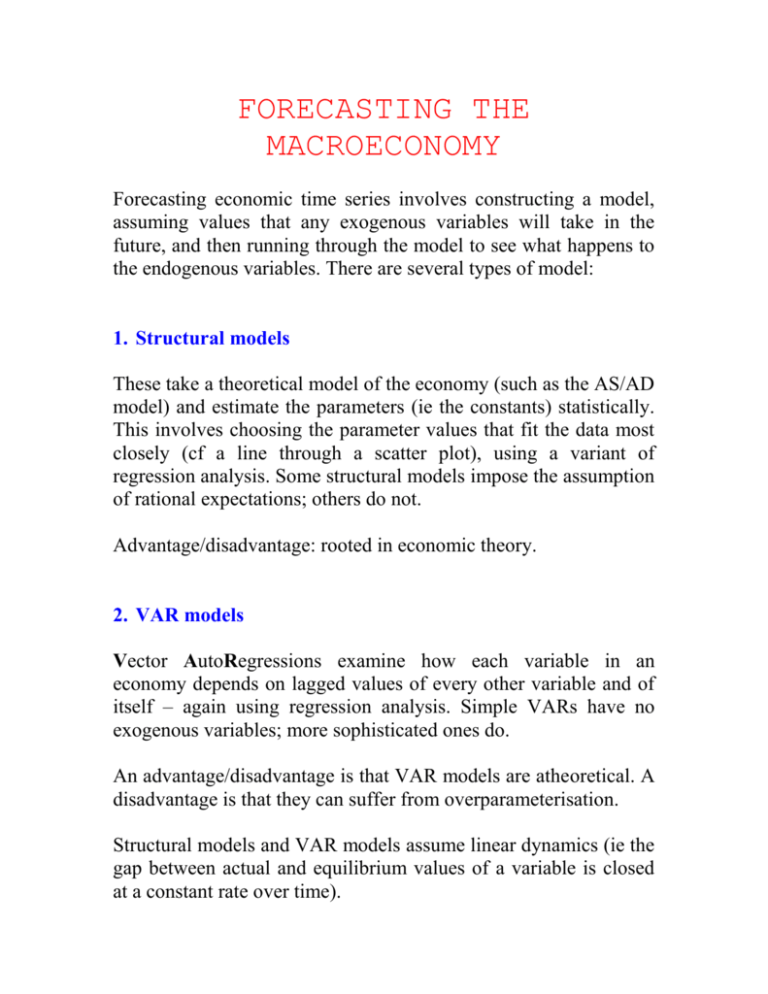

FORECASTING THE MACROECONOMY Forecasting economic time series involves constructing a model, assuming values that any exogenous variables will take in the future, and then running through the model to see what happens to the endogenous variables. There are several types of model: 1. Structural models These take a theoretical model of the economy (such as the AS/AD model) and estimate the parameters (ie the constants) statistically. This involves choosing the parameter values that fit the data most closely (cf a line through a scatter plot), using a variant of regression analysis. Some structural models impose the assumption of rational expectations; others do not. Advantage/disadvantage: rooted in economic theory. 2. VAR models Vector AutoRegressions examine how each variable in an economy depends on lagged values of every other variable and of itself – again using regression analysis. Simple VARs have no exogenous variables; more sophisticated ones do. An advantage/disadvantage is that VAR models are atheoretical. A disadvantage is that they can suffer from overparameterisation. Structural models and VAR models assume linear dynamics (ie the gap between actual and equilibrium values of a variable is closed at a constant rate over time). 3. Neural networks Based on the structure of, and learning processes in the brain. Often used in pattern recognition (eg how computers read handwriting), now also used in forecasting. Information enters each neurode (black dot in diagram) from inputs or from other neurodes. A weighted average of this information is taken (weights estimated statistically), and then ‘squashed’ (ie adjusted in a nonlinear way). The output is therefore an aggregate of many highly nonlinear processes. INPUT HIDDEN OUTPUT LAYER LAYER LAYER Figure 2: A single hidden layer feedforward neural network Squasher may be y = 1/(1+e-x). Advantage: neural networks can approximate arbitrarily closely any nonlinear process, even chaos. Disadvantages: need a lot of data; danger of overparameterisation; no basis in theory. The future: a mix of approaches. You can get an online interactive version of the Treasury model, and much other information about macroeconomic forecasting, from http://www.bized.ac.uk/virtual/economy/ You can get a compendium of current forecasts for the UK from http://www.hm-treasury.gov.uk/pub/html/forc/comp/main.html Latest Treasury model forecasts are: GDP growth (per cent) RPIX inflation (per cent, Q4) 1997 3½ 42¾ 1998 1999 2¾ 1 to 1½ 2½ 2½ Forecast 2000 2¼ to 2¾ 2½ 2001 2¾ to 3¼ 2½ An important use of forecasting is to predict the effects of alternative policy measures – the above forecasts made a particular set of assumptions, but what happens if those assumptions are changed? Following results are from the Treasury model. ‘Before’ refers to base forecasts, ‘after’ refers to forecasts following a reform (reducing the basic rate of income tax to 20% from 1999 on): Economic forecasts may be subject to the Lucas critique – if a discrete policy change alters the parameters of the model (eg via expectations), the model cannot forecast well. eg the outcome of the early 1980s Thatcher experiment (where the government sought directly to reduce expectations of inflation by adopting an aggressive counter-inflation policy) could not be forecast. Information needed: national income consumer expenditure investment government spending and tax income prices unemployment trade Economic forecasting is difficult, imprecise, and subjective; it is potentially useful to business and policymakers, and it is fun.