Summaries of International Accounting Standards

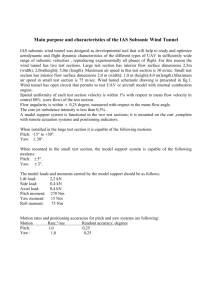

advertisement