Draft 2

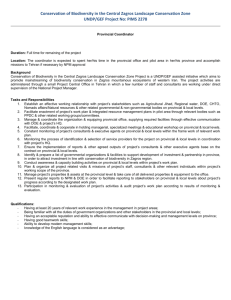

advertisement