The Market for TDRs in New York City

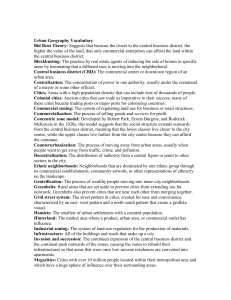

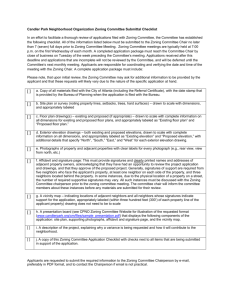

advertisement